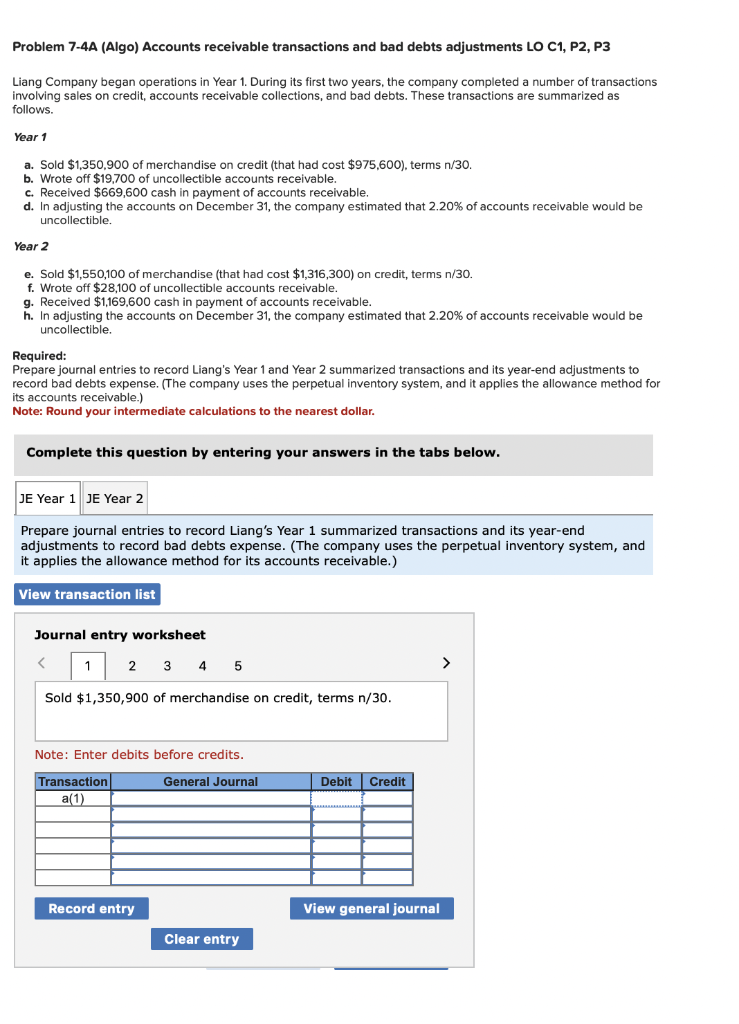

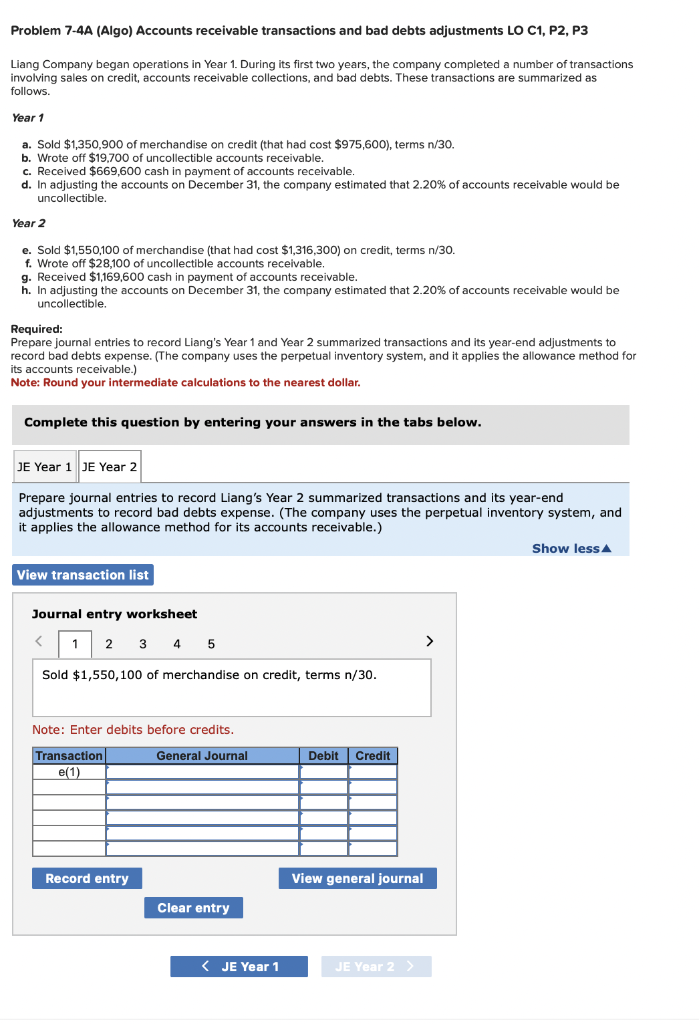

Problem 7-4A (Algo) Accounts receivable transactions and bad debts adjustments LO C1, P2, P3 Liang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $1,350,900 of merchandise on credit (that had cost $975,600 ), terms n/30. b. Wrote off $19,700 of uncollectible accounts receivable. c. Received $669,600 cash in payment of accounts receivable. d. In adjusting the accounts on December 31 , the company estimated that 2.20% of accounts receivable would be uncollectible. Year 2 e. Sold $1,550,100 of merchandise (that had cost $1,316,300 ) on credit, terms n/30. f. Wrote off $28,100 of uncollectible accounts receivable. g. Received $1,169,600 cash in payment of accounts receivable. h. In adjusting the accounts on December 31 , the company estimated that 2.20% of accounts receivable would be uncollectible. Required: Prepare journal entries to record Liang's Year 1 and Year 2 summarized transactions and its year-end adjustments to record bad debts expense. (The company uses the perpetual inventory system, and it applies the allowance method for its accounts receivable.) Note: Round your intermediate calculations to the nearest dollar. Complete this question by entering your answers in the tabs below. Prepare journal entries to record Liang's Year 1 summarized transactions and its year-end adjustments to record bad debts expense. (The company uses the perpetual inventory system, and it applies the allowance method for its accounts receivable.) Journal entry worksheet 34> Sold $1,350,900 of merchandise on credit, terms n/30. Note: Enter debits before credits. Problem 7-4A (Algo) Accounts receivable transactions and bad debts adjustments LO C1, P2, P3 Liang Company began operations in Year 1. During its first two years, the company completed a number of transactions involving sales on credit, accounts receivable collections, and bad debts. These transactions are summarized as follows. Year 1 a. Sold $1,350,900 of merchandise on credit (that had cost $975,600 ), terms n/30. b. Wrote off $19,700 of uncollectible accounts receivable. c. Received $669,600 cash in payment of accounts receivable. d. In adjusting the accounts on December 31 , the company estimated that 2.20% of accounts receivable would be uncollectible. Year 2 e. Sold $1,550,100 of merchandise (that had cost $1,316,300 ) on credit, terms n/30. f. Wrote off $28,100 of uncollectible accounts receivable. g. Received $1,169,600 cash in payment of accounts receivable. h. In adjusting the accounts on December 31 , the company estimated that 2.20% of accounts receivable would be uncollectible. Required: Prepare journal entries to record Liang's Year 1 and Year 2 summarized transactions and its year-end adjustments to record bad debts expense. (The company uses the perpetual inventory system, and it applies the allowance method for its accounts receivable.) Note: Round your intermediate calculations to the nearest dollar. Complete this question by entering your answers in the tabs below. Prepare journal entries to record Liang's Year 2 summarized transactions and its year-end adjustments to record bad debts expense. (The company uses the perpetual inventory system, and it applies the allowance method for its accounts receivable.) Journal entry worksheet 45 Sold $1,550,100 of merchandise on credit, terms n/30. Note: Enter debits before credits