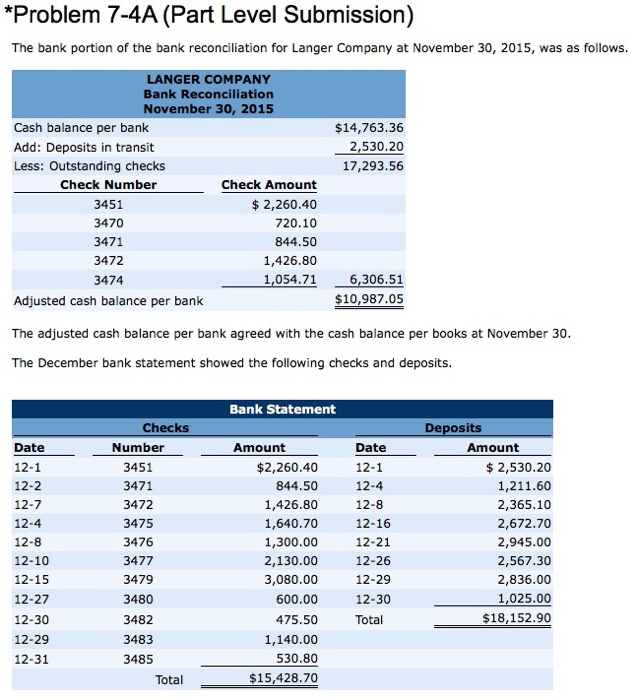

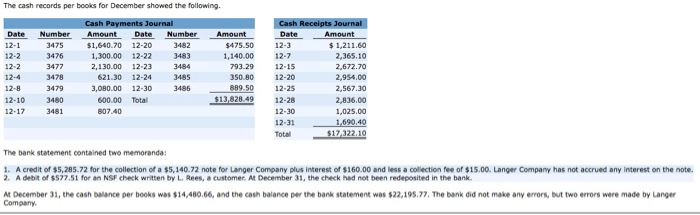

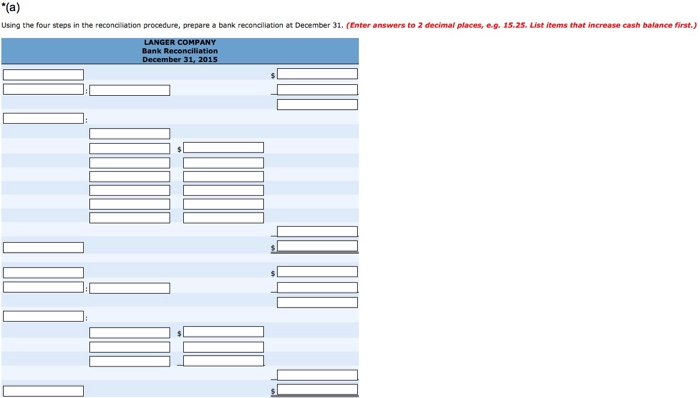

Problem 7-4A (Part Level Submission) The bank portion of the bank reconciliation for Langer Company at November 30, 2015, was as follows. ANGER COMPANY Bank Reconciliation November 30, 2015 Cash balance per bank Add: Deposits in transit Less: Outstanding checks $14,763.36 2,530.20 17,293.56 Check Number 3451 3470 3471 3472 3474 Adjusted cash balance per bank Check Amount $2,260.40 720.10 844.50 1,426.80 1,054.71 6,306.51 $10,987.05 The adjusted cash balance per bank agreed with the cash balance per books at November 30 The December bank statement showed the following checks and deposits Bank Statement Checks Deposits Date 12-1 12-4 12-8 12-16 12-21 12-26 12-29 12-30 Total Date 12-1 12-2 12-7 12-4 12-8 12-10 12-15 12-27 12-30 12-29 12-31 Number 3451 3471 3472 3475 3476 3477 3479 3480 3482 3483 3485 Amount Amount $ 2,530.20 1,211.60 2,365.10 2,672.70 2,945.00 2,567.30 2,836.00 1,025.00 $18,152.90 $2,260.40 844.50 1,426.80 1,640.70 1,300.00 2,130.00 3,080.00 600.00 475.50 1,140.00 530.80 $15,428.70 Total 2 The cash records per boolks for December showed the following. Date Number Amount Date Number Date 3475 $1,640.70 12-20 1,300.00 12-22 2,130.00 12-23 621.30 12-24 $475.50 1,140.0012-7 1,211.60 2,365.10 2,672.70 2,954.00 2,567.30 2,836.00 1,025.00 12-31,690.40 12-3 12-2 12-2 12-4 12-8 12-10 12-17 3483 3477 3478 3479 3480 3481 793.29 2-15 12-20 ,080.00 12-303486889.50 12-25 13,828.49 12-28 12-30 350.80 600.00 Total 807.40 Total The bank statement contained two memoranda: 1. A credit of $5,285.72 for the collection of a S5, 140.72 note for Langer Company plus interest of S 160.00 and less a collection fee of $15.00. Langer Company has not accrued any interest on the note. A debit of $577.51 for an NSF check written by L. Rees,a customer. At December 31, the check had not been redeposited in the bank M December 31, the cash balance per books was $14,480.66, and the cash balance per the bank statement was $22,195.77, The bank did not make any errors, but two errors were made by Langer Company Using the four steps in the reconoliation procedure, prepare a bank reconciliation at December 31. (Enter answers to 2 decimal places, e-g. 15.25. List items that increase cash balance first.) ciliation