Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 7-5 (Bad Debt Reporting) The following information relates to the Accounts Receivable accounts of G Corporation during 2019: 1. An aging schedule of

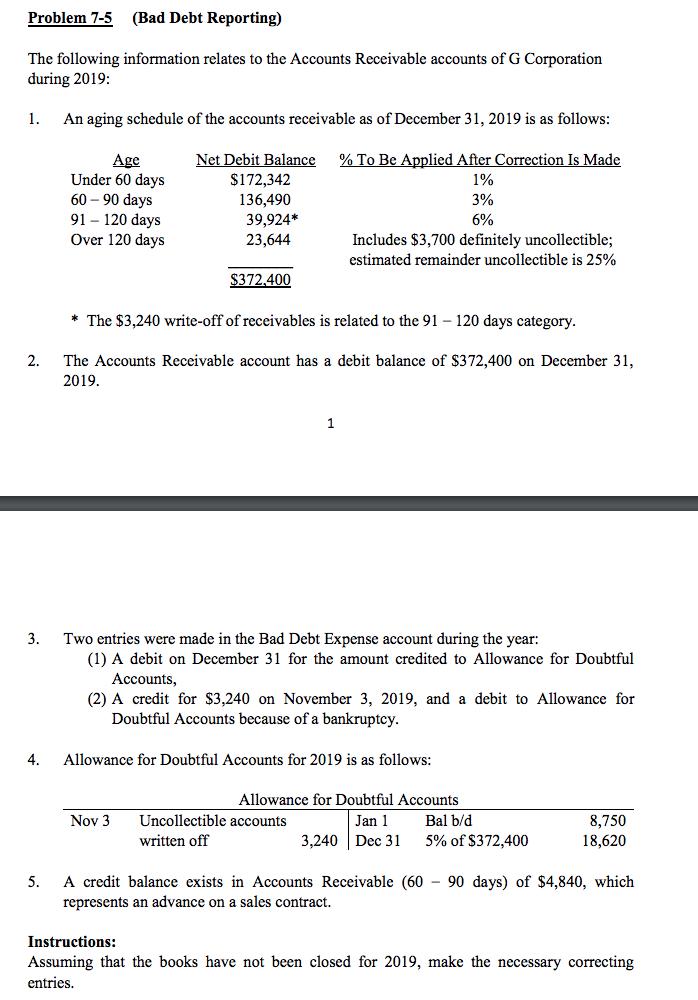

Problem 7-5 (Bad Debt Reporting) The following information relates to the Accounts Receivable accounts of G Corporation during 2019: 1. An aging schedule of the accounts receivable as of December 31, 2019 is as follows: Net Debit Balance % To Be Applied After Correction Is Made Age Under 60 days 60 90 days 91 120 days Over 120 days $172,342 136,490 39,924* 1% 3% 6% 23,644 Includes $3,700 definitely uncollectible; estimated remainder uncollectible is 25% $372.400 * The $3,240 write-off of receivables is related to the 91 - 120 days category. 2. The Accounts Receivable account has a debit balance of $372,400 on December 31, 2019. 1 Two entries were made in the Bad Debt Expense account during the year: (1) A debit on December 31 for the amount credited to Allowance for Doubtful 3. Accounts, (2) A credit for $3,240 on November 3, 2019, and a debit to Allowance for Doubtful Accounts because of a bankruptcy. 4. Allowance for Doubtful Accounts for 2019 is as follows: Allowance for Doubtful Accounts Nov 3 Uncollectible accounts Jan 1 Bal b/d 8,750 written off 3,240 Dec 31 5% of $372,400 18,620 5. A credit balance exists in Accounts Receivable (60 - 90 days) of $4,840, which represents an advance on a sales contract. Instructions: Assuming that the books have not been closed for 2019, make the necessary correcting entries.

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started