Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 7.5A (Static) Accounting for Marketable Securities (LO7-1 ,LO7-4) At December 31, year 1, Charter Holding Company purchased the following marketable securities in the capital

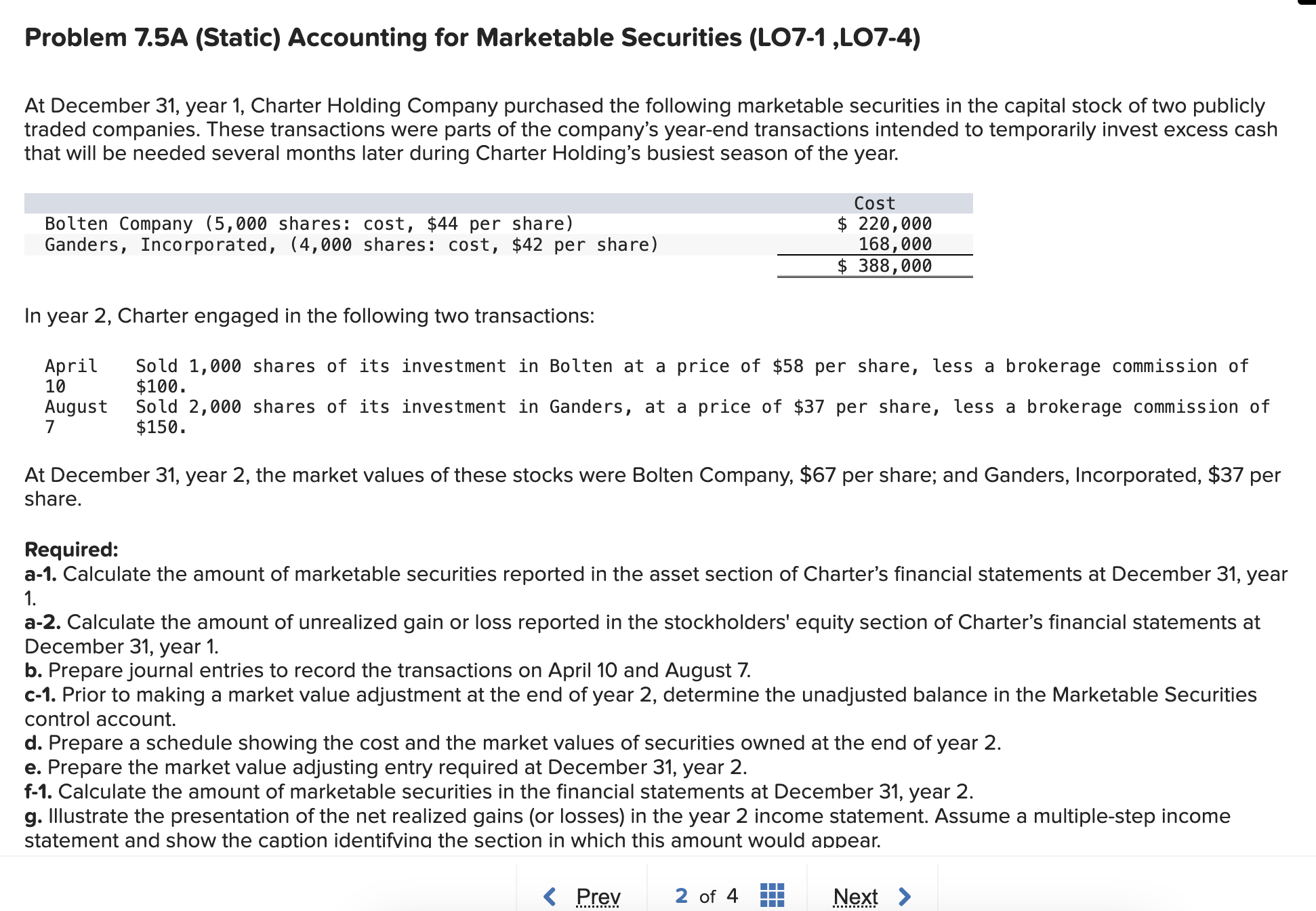

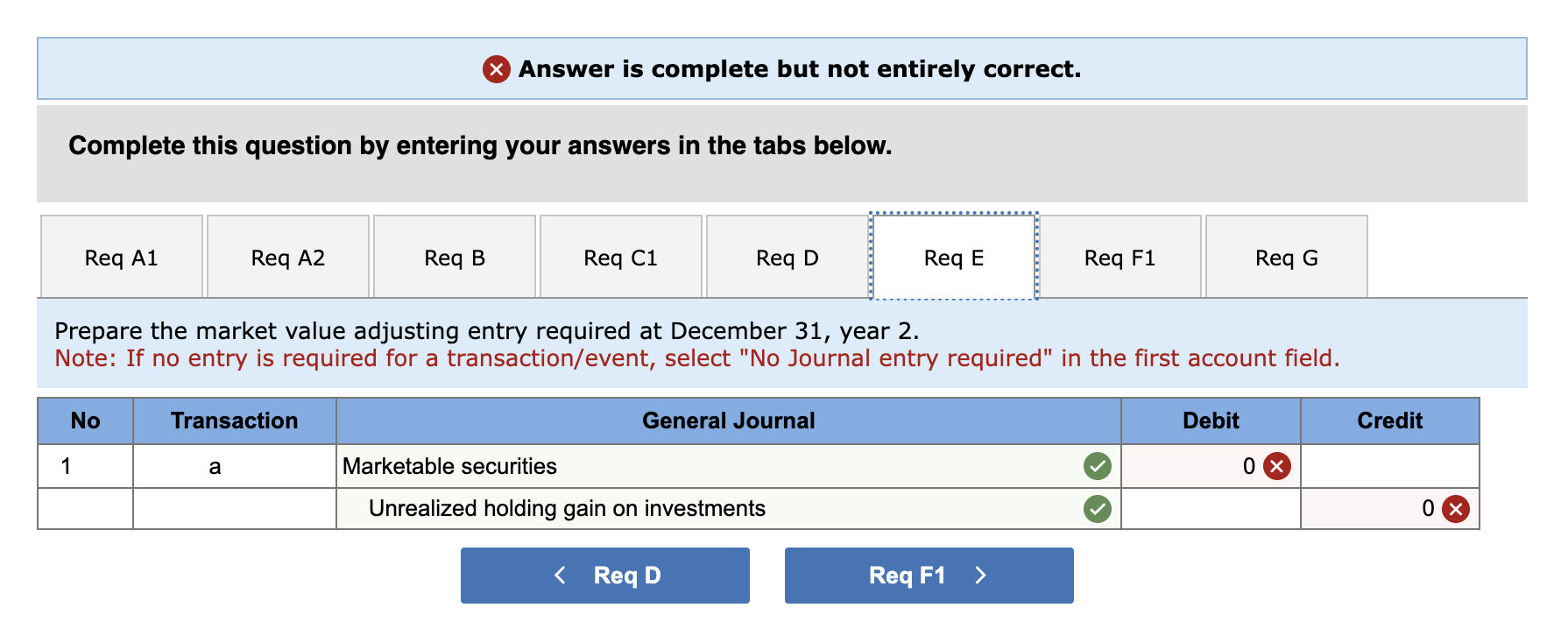

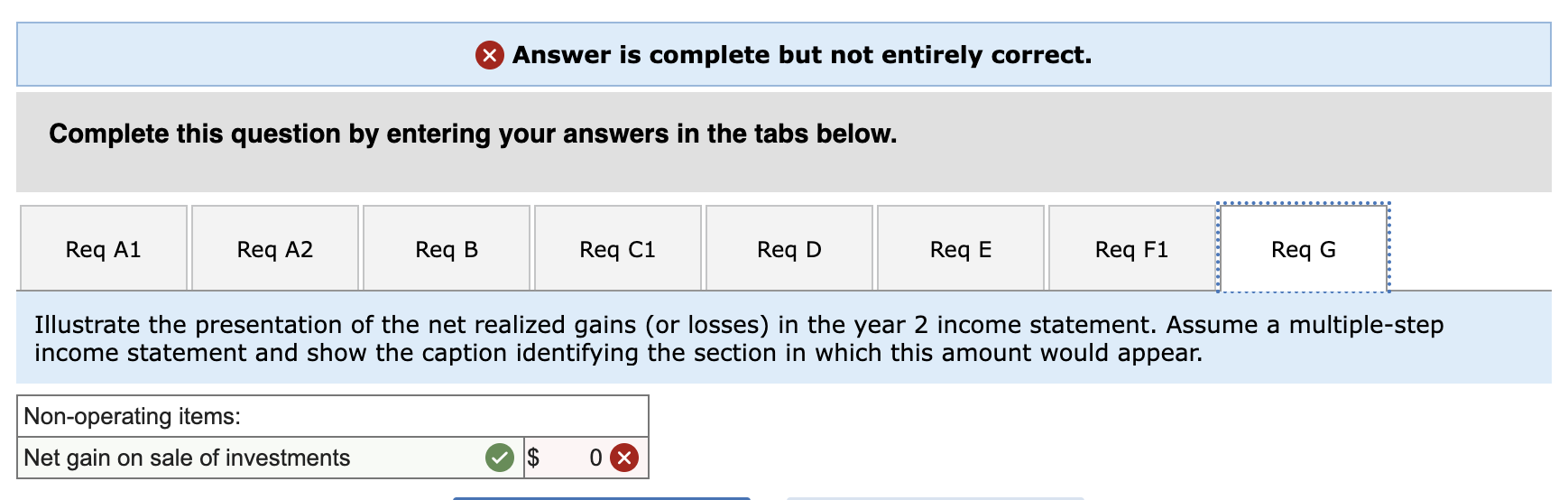

Problem 7.5A (Static) Accounting for Marketable Securities (LO7-1 ,LO7-4) At December 31, year 1, Charter Holding Company purchased the following marketable securities in the capital stock of two publicly traded companies. These transactions were parts of the company's year-end transactions intended to temporarily invest excess cash that will be needed several months later during Charter Holding's busiest season of the year. In year 2, Charter engaged in the following two transactions: April10August7Sold1,000sharesofitsinvestmentinBoltenatapriceof$58pershare,lessabrokeragecommissionof$100.Sold2,000sharesofitsinvestmentinGanders,atapriceof$37pershare,lessabrokeragecommissionof$150. At December 31, year 2, the market values of these stocks were Bolten Company, \$67 per share; and Ganders, Incorporated, \$37 per share. Required: a-1. Calculate the amount of marketable securities reported in the asset section of Charter's financial statements at December 31, year 1. a-2. Calculate the amount of unrealized gain or loss reported in the stockholders' equity section of Charter's financial statements at December 31, year 1. b. Prepare journal entries to record the transactions on April 10 and August 7. c-1. Prior to making a market value adjustment at the end of year 2, determine the unadjusted balance in the Marketable Securities control account. d. Prepare a schedule showing the cost and the market values of securities owned at the end of year 2. e. Prepare the market value adjusting entry required at December 31 , year 2. f-1. Calculate the amount of marketable securities in the financial statements at December 31, year 2. g. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifvina the section in which this amount would appear. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare the market value adjusting entry required at December 31, year 2 . Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifying the section in which this amount would appear. Problem 7.5A (Static) Accounting for Marketable Securities (LO7-1 ,LO7-4) At December 31, year 1, Charter Holding Company purchased the following marketable securities in the capital stock of two publicly traded companies. These transactions were parts of the company's year-end transactions intended to temporarily invest excess cash that will be needed several months later during Charter Holding's busiest season of the year. In year 2, Charter engaged in the following two transactions: April10August7Sold1,000sharesofitsinvestmentinBoltenatapriceof$58pershare,lessabrokeragecommissionof$100.Sold2,000sharesofitsinvestmentinGanders,atapriceof$37pershare,lessabrokeragecommissionof$150. At December 31, year 2, the market values of these stocks were Bolten Company, \$67 per share; and Ganders, Incorporated, \$37 per share. Required: a-1. Calculate the amount of marketable securities reported in the asset section of Charter's financial statements at December 31, year 1. a-2. Calculate the amount of unrealized gain or loss reported in the stockholders' equity section of Charter's financial statements at December 31, year 1. b. Prepare journal entries to record the transactions on April 10 and August 7. c-1. Prior to making a market value adjustment at the end of year 2, determine the unadjusted balance in the Marketable Securities control account. d. Prepare a schedule showing the cost and the market values of securities owned at the end of year 2. e. Prepare the market value adjusting entry required at December 31 , year 2. f-1. Calculate the amount of marketable securities in the financial statements at December 31, year 2. g. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifvina the section in which this amount would appear. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare the market value adjusting entry required at December 31, year 2 . Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifying the section in which this amount would appear

Problem 7.5A (Static) Accounting for Marketable Securities (LO7-1 ,LO7-4) At December 31, year 1, Charter Holding Company purchased the following marketable securities in the capital stock of two publicly traded companies. These transactions were parts of the company's year-end transactions intended to temporarily invest excess cash that will be needed several months later during Charter Holding's busiest season of the year. In year 2, Charter engaged in the following two transactions: April10August7Sold1,000sharesofitsinvestmentinBoltenatapriceof$58pershare,lessabrokeragecommissionof$100.Sold2,000sharesofitsinvestmentinGanders,atapriceof$37pershare,lessabrokeragecommissionof$150. At December 31, year 2, the market values of these stocks were Bolten Company, \$67 per share; and Ganders, Incorporated, \$37 per share. Required: a-1. Calculate the amount of marketable securities reported in the asset section of Charter's financial statements at December 31, year 1. a-2. Calculate the amount of unrealized gain or loss reported in the stockholders' equity section of Charter's financial statements at December 31, year 1. b. Prepare journal entries to record the transactions on April 10 and August 7. c-1. Prior to making a market value adjustment at the end of year 2, determine the unadjusted balance in the Marketable Securities control account. d. Prepare a schedule showing the cost and the market values of securities owned at the end of year 2. e. Prepare the market value adjusting entry required at December 31 , year 2. f-1. Calculate the amount of marketable securities in the financial statements at December 31, year 2. g. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifvina the section in which this amount would appear. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare the market value adjusting entry required at December 31, year 2 . Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifying the section in which this amount would appear. Problem 7.5A (Static) Accounting for Marketable Securities (LO7-1 ,LO7-4) At December 31, year 1, Charter Holding Company purchased the following marketable securities in the capital stock of two publicly traded companies. These transactions were parts of the company's year-end transactions intended to temporarily invest excess cash that will be needed several months later during Charter Holding's busiest season of the year. In year 2, Charter engaged in the following two transactions: April10August7Sold1,000sharesofitsinvestmentinBoltenatapriceof$58pershare,lessabrokeragecommissionof$100.Sold2,000sharesofitsinvestmentinGanders,atapriceof$37pershare,lessabrokeragecommissionof$150. At December 31, year 2, the market values of these stocks were Bolten Company, \$67 per share; and Ganders, Incorporated, \$37 per share. Required: a-1. Calculate the amount of marketable securities reported in the asset section of Charter's financial statements at December 31, year 1. a-2. Calculate the amount of unrealized gain or loss reported in the stockholders' equity section of Charter's financial statements at December 31, year 1. b. Prepare journal entries to record the transactions on April 10 and August 7. c-1. Prior to making a market value adjustment at the end of year 2, determine the unadjusted balance in the Marketable Securities control account. d. Prepare a schedule showing the cost and the market values of securities owned at the end of year 2. e. Prepare the market value adjusting entry required at December 31 , year 2. f-1. Calculate the amount of marketable securities in the financial statements at December 31, year 2. g. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifvina the section in which this amount would appear. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Prepare the market value adjusting entry required at December 31, year 2 . Note: If no entry is required for a transaction/event, select "No Journal entry required" in the first account field. Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifying the section in which this amount would appear Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started