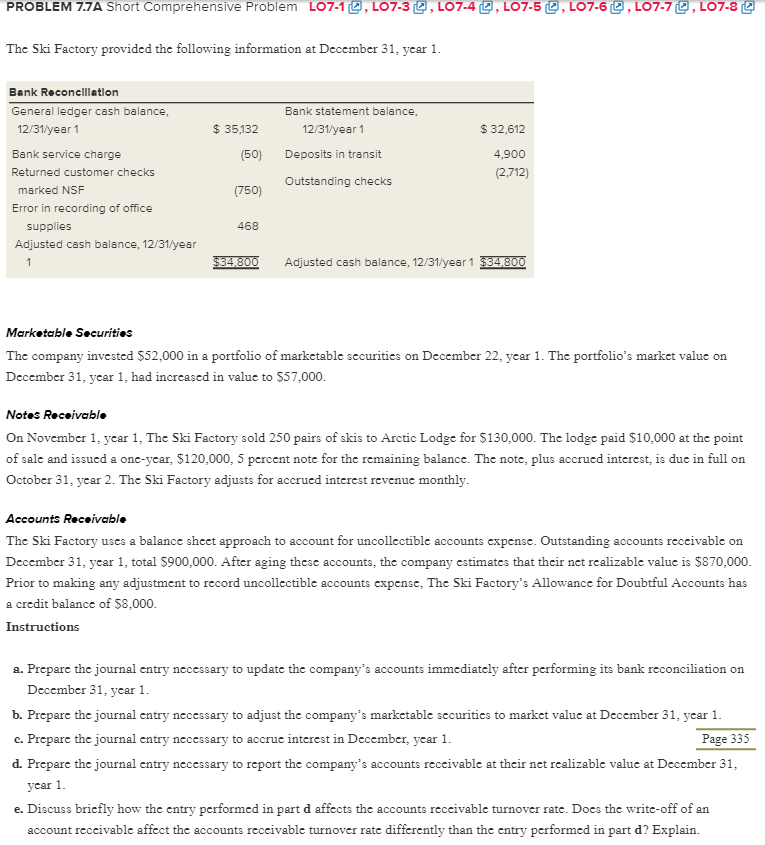

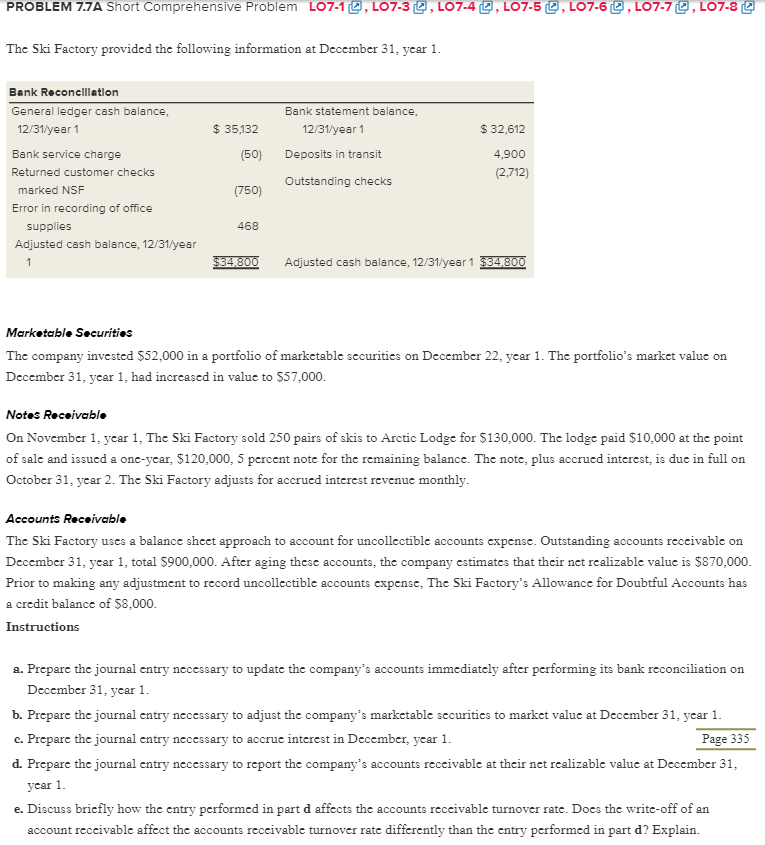

PROBLEM 77A Short Comprehensive Problem L 7-1 O, LO7.30, L 7-4 , L 7-5 g, LO7-60, LO7-70, LO7-8@ The Ski Factory provided the following information at December 31, year 1 B nk Reconciliatlon General ledger cash balance Bank statement balance 12/31/year1 Deposits in transit Outstanding checks $ 35,132 S 32,612 4,900 (2,712) 12/31/year 1 Bank service charge Returned customer checks (50) marked NSF Error in recording of office (750) supplies 468 Adjusted cash balance, 12/31/year 00 Adjusted cash balance, 12/31/year 1 $34800 Marketable Securities The company invested $52,000 in a portfolio of marketable securities on December 22, ycar 1. The portfolio's market value on December 31, ycar 1, had incrcased in valuc to $57,000 Notes Receivable On November 1, year 1, The Ski Factory sold 250 pairs of skis to Arctic Lodge for $130,000. The lodge paid $10,000 at the point of sale and issued a one-year, $120,000, 5 percent note for the remaining balance. The note, plus accrued interest, is due in full on October 31, ycar 2. The Ski Factory adjusts for accrued interest revenue monthly Accounts Receivable The Ski Factory uses a balance sheet approach to account for uncollectible accounts expense. Outstanding accounts receivable on December 31, year 1, total $900,000. After aging these accounts, the company estimates that their net realizable value is $870,000 Prior to making any adjustment to record uncollectible accounts expense, The Ski Factory's Allowance for Doubtful Accounts has a credit balance of $8,000 Instructions a. Prepare the journal entry necessary to update the company's accounts immediately after performing its bank reconciliation on December 31, year 1 b. Prepare the journal entry necessary to adjust the company's marketable securities to market value at December 31, ycar 1 c. Prepare the journal entry necessary to accrue interest in December, year 1 d. Prepare the journal entry nccessary to report the company's accounts reccivable at their net rcalizable valuc at December 31 Page 335 ycar e. Discuss briefly how the entry performed in part d affects the accounts receivable turnover rate. Does the write-off of an account receivable affect the accounts receivable turnover rate differently than the entry performed in part d? Explain