Answered step by step

Verified Expert Solution

Question

1 Approved Answer

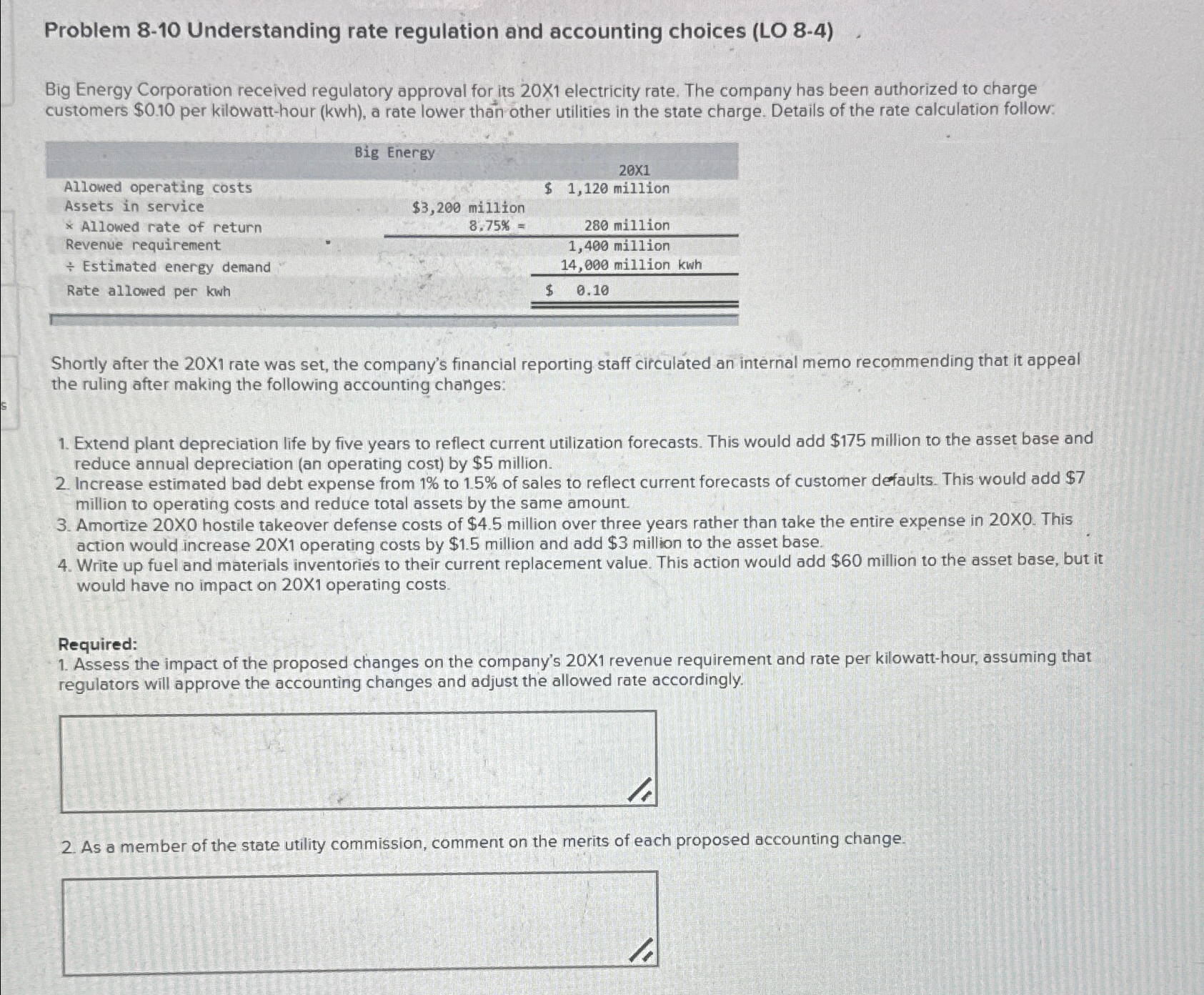

Problem 8 - 1 0 Understanding rate regulation and accounting choices ( LO 8 - 4 ) Big Energy Corporation received regulatory approval for its

Problem Understanding rate regulation and accounting choices LO

Big Energy Corporation received regulatory approval for its electricity rate. The company has been authorized to charge customers $ per kilowatthour kwh a rate lower than other utilities in the state charge. Details of the rate calculation follow:

Shortly after the rate was set, the company's financial reporting staff circulated an internal memo recommending that it appeal the ruling after making the following accounting changes:

Extend plant depreciation life by five years to reflect current utilization forecasts. This would add $ million to the asset base and reduce annual depreciation an operating cost by $ million.

Increase estimated bad debt expense from to of sales to reflect current forecasts of customer defaults. This would add $ million to operating costs and reduce total assets by the same amount.

Amortize hostile takeover defense costs of $ million over three years rather than take the entire expense in This action would increase operating costs by $ million and add $ million to the asset base.

Write up fuel and materials inventories to their current replacement value. This action would add $ million to the asset base, but it would have no impact on operating costs.

Required:

Assess the impact of the proposed changes on the company's revenue requirement and rate per kilowatthour, assuming that regulators will approve the accounting changes and adjust the allowed rate accordingly.

As a member of the state utility commission, comment on the merits of each proposed accounting change.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started