Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 8 - 9 Accounting in regulated industries ( LO 8 - 4 ) Duke Energy Corporation's 2 0 1 8 annual report to shareholders

Problem Accounting in regulated industries LO

Duke Energy Corporation's annual report to shareholders contains the following note disclosure edited for brevity:

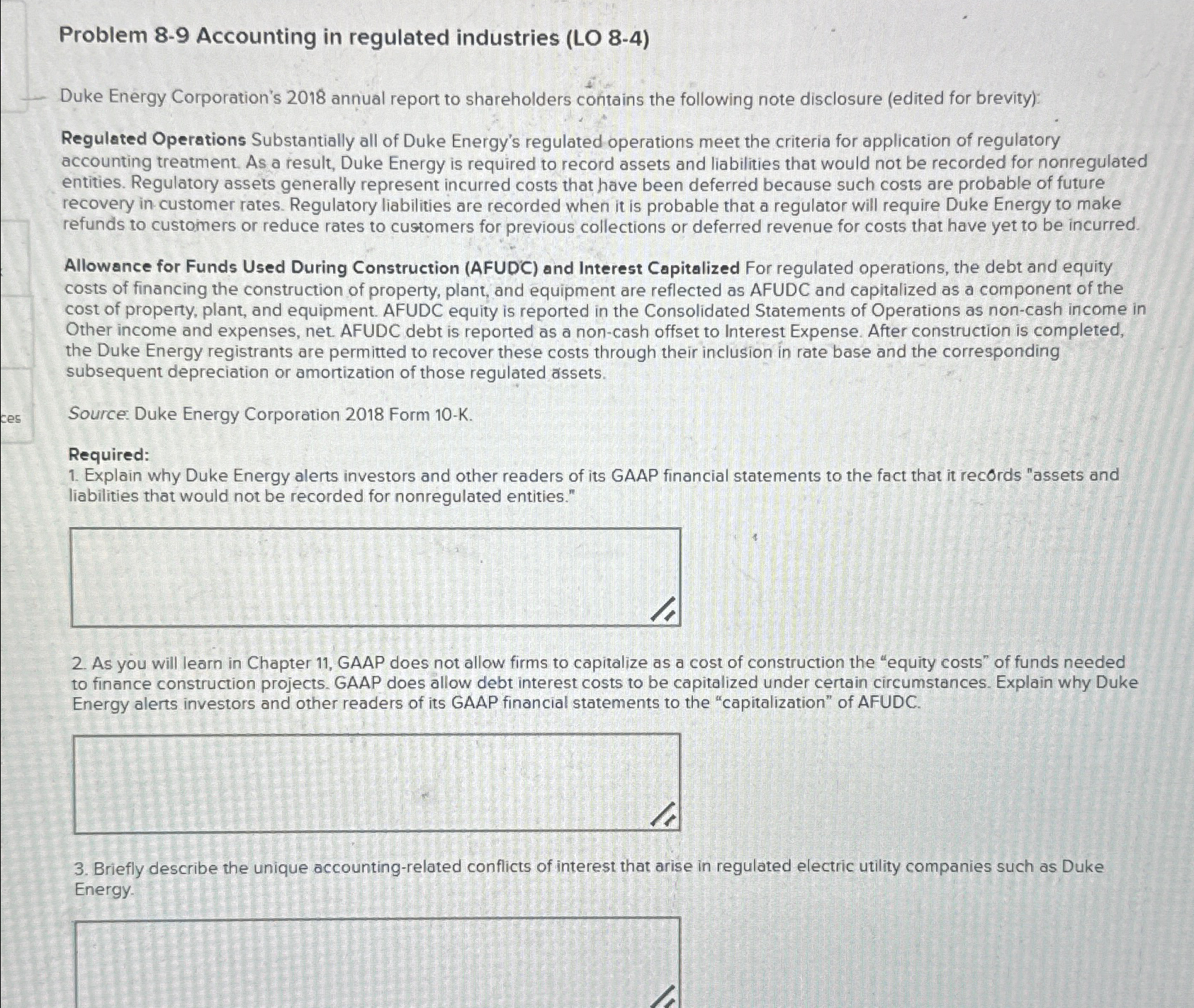

Regulated Operations Substantially all of Duke Energy's regulated operations meet the criteria for application of regulatory accounting treatment. As a result, Duke Energy is required to record assets and liabilities that would not be recorded for nonregulated entities. Regulatory assets generally represent incurred costs that have been deferred because such costs are probable of future recovery in customer rates. Regulatory liabilities are recorded when it is probable that a regulator will require Duke Energy to make refunds to customers or reduce rates to customers for previous collections or deferred revenue for costs that have yet to be incurred.

Allowance for Funds Used During Construction AFUDC and Interest Capitalized For regulated operations, the debt and equity costs of financing the construction of property, plant, and equipment are reflected as AFUDC and capitalized as a component of the cost of property, plant, and equipment. AFUDC equity is reported in the Consolidated Statements of Operations as noncash income in Other income and expenses, net. AFUDC debt is reported as a noncash offset to Interest Expense. After construction is completed, the Duke Energy registrants are permitted to recover these costs through their inclusion in rate base and the corresponding subsequent depreciation or amortization of those regulated assets.

Source: Duke Energy Corporation Form K

Required:

Explain why Duke Energy alerts investors and other readers of its GAAP financial statements to the fact that it records "assets and liabilities that would not be recorded for nonregulated entities."

As you will learn in Chapter GAAP does not allow firms to capitalize as a cost of construction the "equity costs" of funds needed to finance construction projects. GAAP does allow debt interest costs to be capitalized under certain circumstances. Explain why Duke Energy alerts investors and other readers of its GAAP financial statements to the "capitalization" of AFUDC.

Briefly describe the unique accountingrelated conflicts of interest that arise in regulated electric utility companies such as Duke Energy.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started