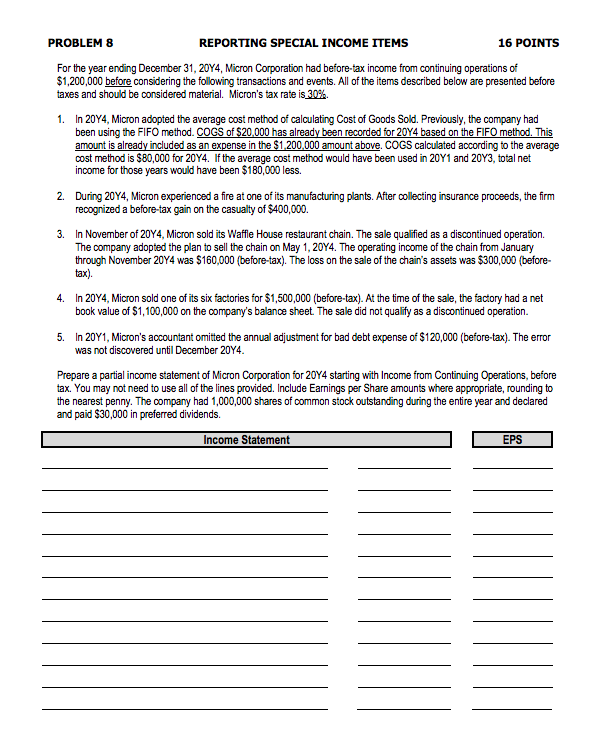

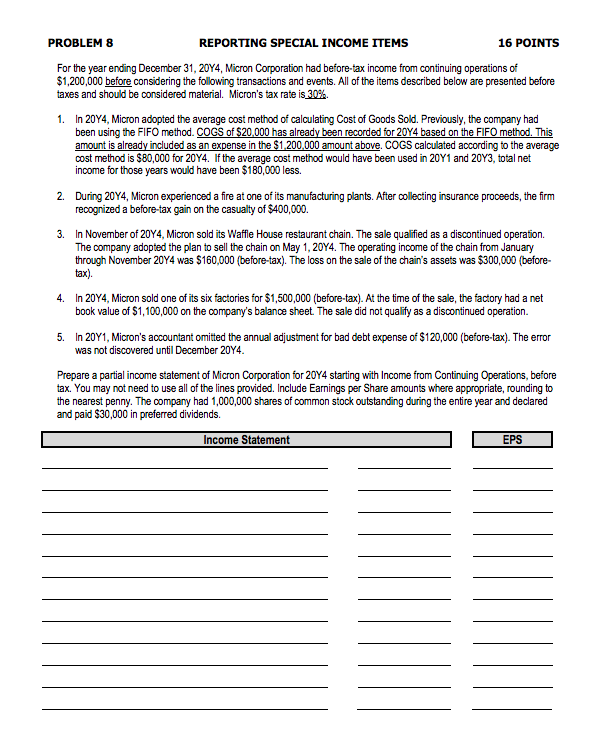

PROBLEM 8 REPORTING SPECIAL INCOME ITEMS 16 POINTS For the year ending December 31, 20Y4, Micron Corporation had before-tax income from continuing operations of $1,200,000 before considering the following transactions and events. All of the items described below are presented before taxes and should be considered material. Micron's tax rate is30 1. In 20Y4, Micron adopted the average cost method of calculating Cost of Goods Sold. Previously, the company had been using the FIFO method. COGS of $20,000 has already been recorded for 20Y4 based on the FIFO method, This included as an ex 000 amount above, COGS calculated according to the average cost method is $80,000 for 20Y4. income for those years would have been $180,000 less. If the average cost method would have been used in 20Y1 and 20Y3, total net 2. During 20Y4, Micron experienced a fire at one of its manufacturing plants. After colecting insurance proceeds, the firm recognized a before-tax gain on the casualty of $400,000. 3. In November of 20Y4, Micron sold its Waffie House restaurant chain. The sale qualified as a discontinued operation. The company adopted the plan to sell the chain on May 1, 20Y4. The operating income of the chain from January through November 20Y4 was $160,000 (before-tax). The loss on the sale of the chain's assets was $300,000 (before- tax) In 20Y4, Micron sold one of its six factories for $1,500,000 (before-tax). At the time of the sale, the factory had a net book value of $1,100,000 on the company's balance sheet. The sale did not qualify as a discontinued operation. 4. 5. In 20Y1, Micron's accountant omitted the annual adjustment for bad debt expense of $120,000 (before-tax). The error was not discovered until December 20Y4 Prepare a partial income statement of Micron Corporation for 20Y4 starting with Income from Continuing Operations, before tax. You may not need to use all of the lines provided. Include Earnings per Share amounts where appropriate, rounding to the nearest penny. The company had 1,000,000 shares of common stock outstanding during the entire year and declared and paid $30,000 in preferred dividends. Income Statement EPS PROBLEM 8 REPORTING SPECIAL INCOME ITEMS 16 POINTS For the year ending December 31, 20Y4, Micron Corporation had before-tax income from continuing operations of $1,200,000 before considering the following transactions and events. All of the items described below are presented before taxes and should be considered material. Micron's tax rate is30 1. In 20Y4, Micron adopted the average cost method of calculating Cost of Goods Sold. Previously, the company had been using the FIFO method. COGS of $20,000 has already been recorded for 20Y4 based on the FIFO method, This included as an ex 000 amount above, COGS calculated according to the average cost method is $80,000 for 20Y4. income for those years would have been $180,000 less. If the average cost method would have been used in 20Y1 and 20Y3, total net 2. During 20Y4, Micron experienced a fire at one of its manufacturing plants. After colecting insurance proceeds, the firm recognized a before-tax gain on the casualty of $400,000. 3. In November of 20Y4, Micron sold its Waffie House restaurant chain. The sale qualified as a discontinued operation. The company adopted the plan to sell the chain on May 1, 20Y4. The operating income of the chain from January through November 20Y4 was $160,000 (before-tax). The loss on the sale of the chain's assets was $300,000 (before- tax) In 20Y4, Micron sold one of its six factories for $1,500,000 (before-tax). At the time of the sale, the factory had a net book value of $1,100,000 on the company's balance sheet. The sale did not qualify as a discontinued operation. 4. 5. In 20Y1, Micron's accountant omitted the annual adjustment for bad debt expense of $120,000 (before-tax). The error was not discovered until December 20Y4 Prepare a partial income statement of Micron Corporation for 20Y4 starting with Income from Continuing Operations, before tax. You may not need to use all of the lines provided. Include Earnings per Share amounts where appropriate, rounding to the nearest penny. The company had 1,000,000 shares of common stock outstanding during the entire year and declared and paid $30,000 in preferred dividends. Income Statement EPS