Answered step by step

Verified Expert Solution

Question

1 Approved Answer

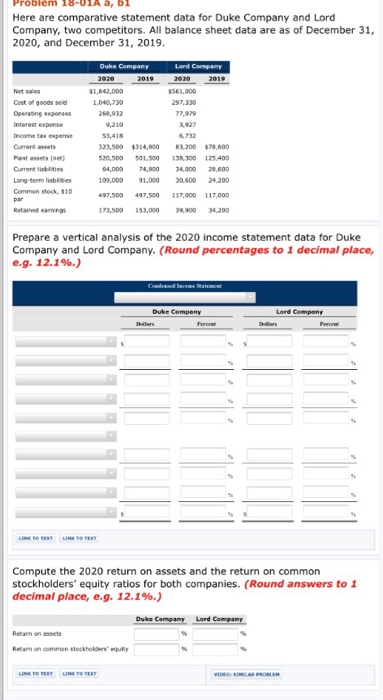

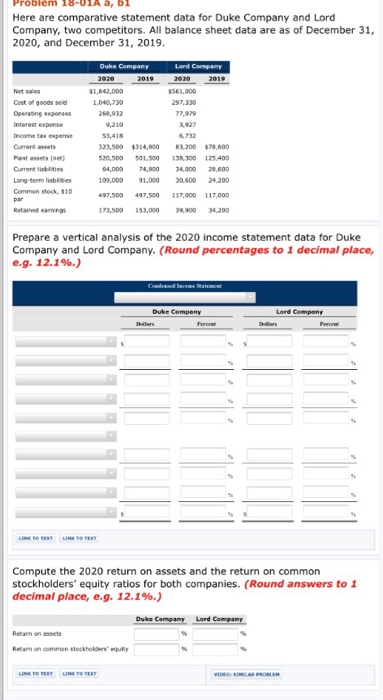

problem 8-0 A a, bi Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of

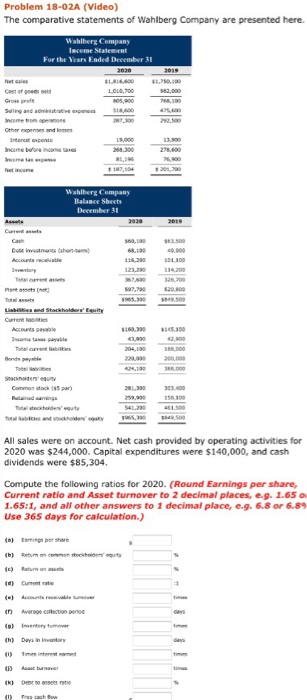

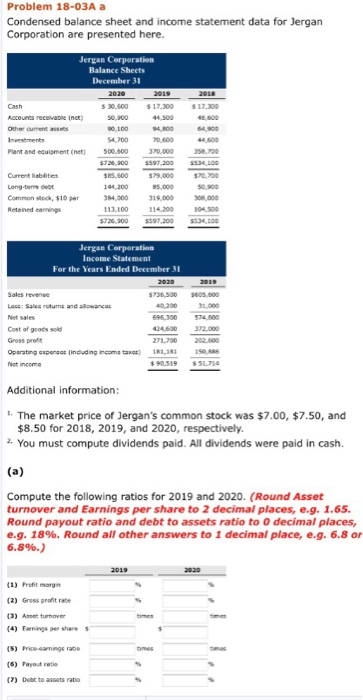

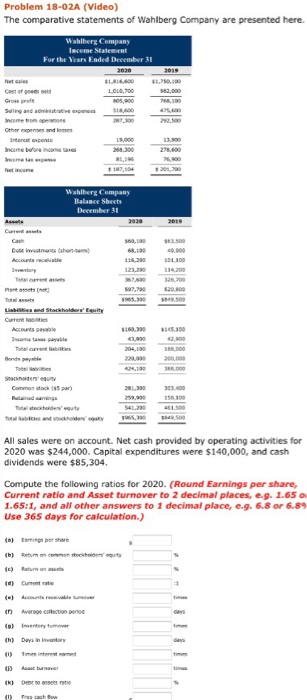

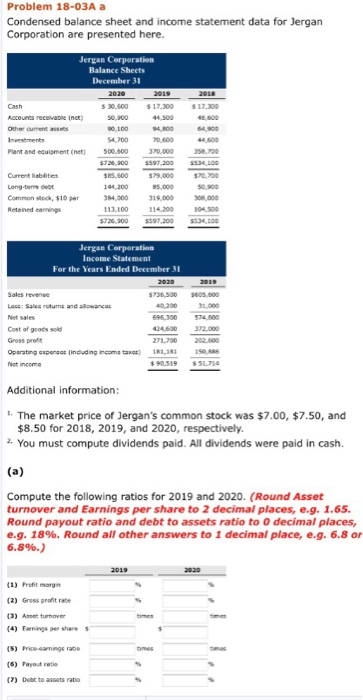

problem 8-0 A a, bi Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31 2020, and December 31, 2019 Cost of goods seld Operating expenses 1,842,000 1,040,730 268,932 297,330 7,979 ,210 53,418 323,500 $314,800 3,200 78,600 0,500 501,500 138 300 125.400 4,00 74,800 4,000 28,600 09,000 91,000 0 600 24.200 97,500 173,500 153,000 39900 320 eax expenme 6,732 Plent assets (n Current lisbiities Long-term lisbines Common stock, 10 17,000 11 Retaived earnings Prepare a vertical analysis of the 2020 income statement data for Duke Company and Lord Company. (Round percentages to 1 decimal place, e.g. 12.1%.) Compute the 2020 return on assets and the return on common stockholders' equity ratios for both companies. (Round answers to 1 decimal place, eg. 12.1%.) Retarn on Return on common stockholdersequty Problem 18-02A (Video) The comparative statements of Wahlberg Company are presented here. Wahlberg Company 1816800 Wahlberg Company Balance Sheets 345 300 Sacniters All sales were on account. Net cash provided by operating activities for 2020 was $244,000. Capital expenditures were $140,000, and cash dividends were $85,304 Compute the following ratios for 2020. (Round Earnings per share, Current ratio and Asset turnover to 2 decimal places, e.g. 1.65 o 1.65:I, and all other answers to 1 decimal place, e.g. 6.8 or 6.89 Use 365 days for calculation.) () Eming pr shore (g) Inventery tumover Problem 18-03A a Condensed balance sheet and income statement data for Jergan Corporation are presented here Jergan Cerperation Balance Shects 30,500 17.300 $ 17.300 Other current 0,100 4,700 500,800 Piant and equipment (net 0,000 728,30 97,200534,100 385.500$79.000 Current hablites Leng-term det Common stock, $10 per Retained eanings 79,000 0,0 0,900 84,000 19,000 104.500 726,300 597,200534,00 1300 14.20010 Jergan Corporation Income Statement For the Years Ended December 31 736,300 805 800 Cost of geods sold Gross pro Oparating expenacs (nduding incoms taxa) 181,385e Not income Additional information: 1. The market price of Jergan's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 2 You must compute dividends paid. All dividends were paid in cash. Compute the following ratios for 2019 and 2020. (Round Asset turnover and Earnings per share to 2 decimal places, e.g. 1.65. Round payout ratio and debt to assets ratio to 0 decimal places, e.g. 18%. Round all other answers to 1 decimal place, e.g. 6.8 or 6.8%.) 1) Profit margn (2) Gress prot rt Aturnove (4) Eanings per share (S) Price-eaningsa (6) Payout retio 7) Db to aseuts rabo

problem 8-0 A a, bi Here are comparative statement data for Duke Company and Lord Company, two competitors. All balance sheet data are as of December 31 2020, and December 31, 2019 Cost of goods seld Operating expenses 1,842,000 1,040,730 268,932 297,330 7,979 ,210 53,418 323,500 $314,800 3,200 78,600 0,500 501,500 138 300 125.400 4,00 74,800 4,000 28,600 09,000 91,000 0 600 24.200 97,500 173,500 153,000 39900 320 eax expenme 6,732 Plent assets (n Current lisbiities Long-term lisbines Common stock, 10 17,000 11 Retaived earnings Prepare a vertical analysis of the 2020 income statement data for Duke Company and Lord Company. (Round percentages to 1 decimal place, e.g. 12.1%.) Compute the 2020 return on assets and the return on common stockholders' equity ratios for both companies. (Round answers to 1 decimal place, eg. 12.1%.) Retarn on Return on common stockholdersequty Problem 18-02A (Video) The comparative statements of Wahlberg Company are presented here. Wahlberg Company 1816800 Wahlberg Company Balance Sheets 345 300 Sacniters All sales were on account. Net cash provided by operating activities for 2020 was $244,000. Capital expenditures were $140,000, and cash dividends were $85,304 Compute the following ratios for 2020. (Round Earnings per share, Current ratio and Asset turnover to 2 decimal places, e.g. 1.65 o 1.65:I, and all other answers to 1 decimal place, e.g. 6.8 or 6.89 Use 365 days for calculation.) () Eming pr shore (g) Inventery tumover Problem 18-03A a Condensed balance sheet and income statement data for Jergan Corporation are presented here Jergan Cerperation Balance Shects 30,500 17.300 $ 17.300 Other current 0,100 4,700 500,800 Piant and equipment (net 0,000 728,30 97,200534,100 385.500$79.000 Current hablites Leng-term det Common stock, $10 per Retained eanings 79,000 0,0 0,900 84,000 19,000 104.500 726,300 597,200534,00 1300 14.20010 Jergan Corporation Income Statement For the Years Ended December 31 736,300 805 800 Cost of geods sold Gross pro Oparating expenacs (nduding incoms taxa) 181,385e Not income Additional information: 1. The market price of Jergan's common stock was $7.00, $7.50, and $8.50 for 2018, 2019, and 2020, respectively. 2 You must compute dividends paid. All dividends were paid in cash. Compute the following ratios for 2019 and 2020. (Round Asset turnover and Earnings per share to 2 decimal places, e.g. 1.65. Round payout ratio and debt to assets ratio to 0 decimal places, e.g. 18%. Round all other answers to 1 decimal place, e.g. 6.8 or 6.8%.) 1) Profit margn (2) Gress prot rt Aturnove (4) Eanings per share (S) Price-eaningsa (6) Payout retio 7) Db to aseuts rabo

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started