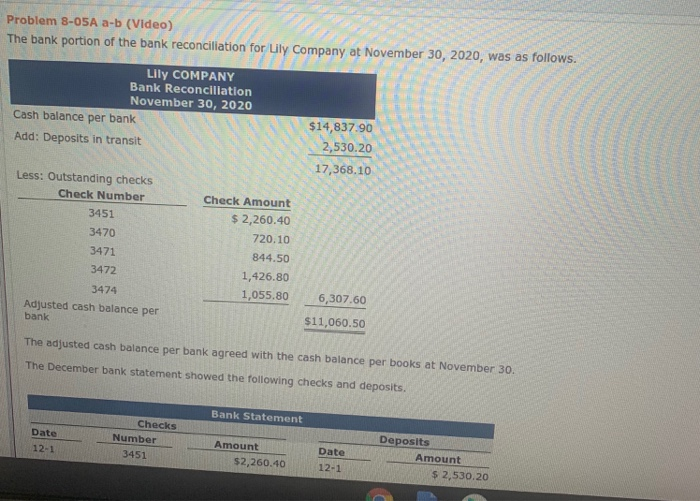

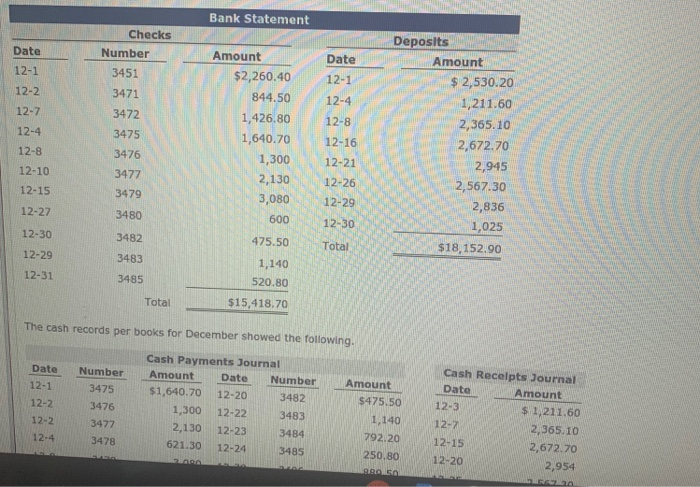

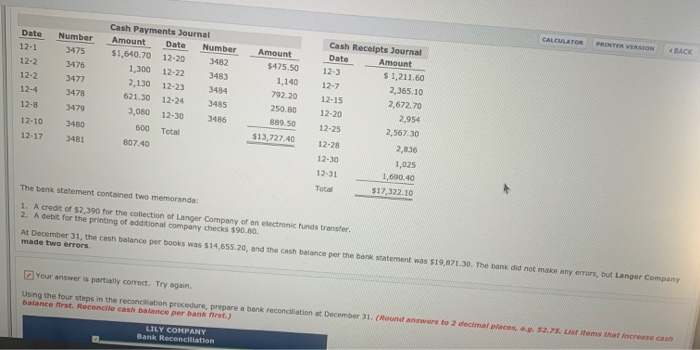

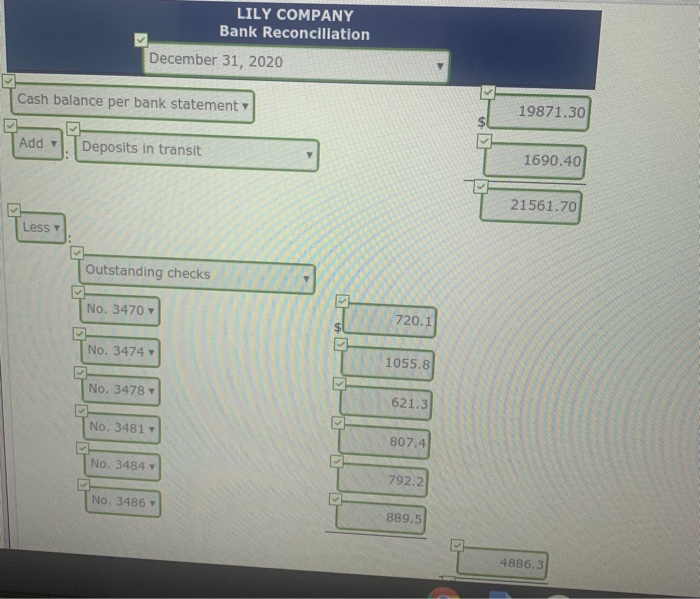

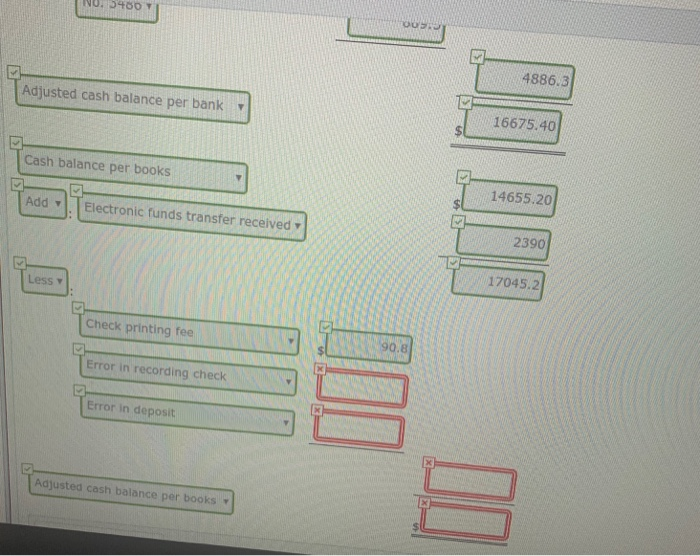

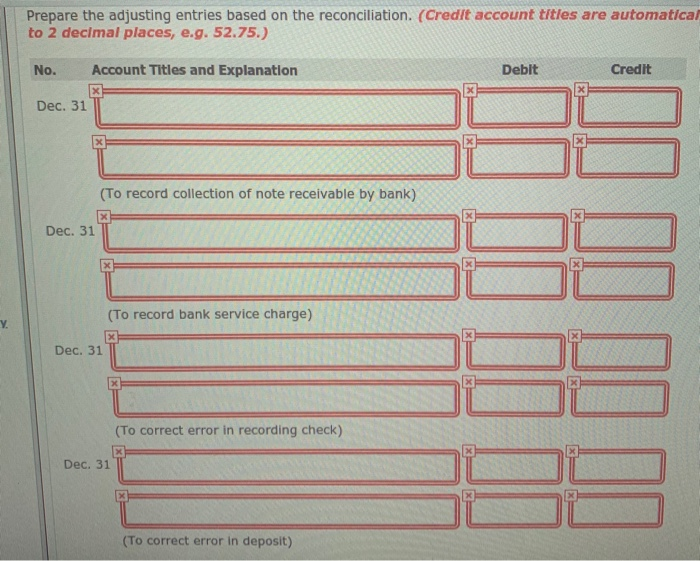

Problem 8-05A a-b (Video) The bank portion of the bank reconciliation for Lily Company at November 30, 2020, was as follows. Lily COMPANY Bank Reconciliation November 30, 2020 Cash balance per bank Add: Deposits in transit $14,837.90 2,530.20 17,368.10 Less: Outstanding checks Check Number 3451 3470 3471 Check Amount $ 2,260.40 720.10 844.50 1,426.80 1,055.80 3472 3474 Adjusted cash balance per bank 6,307.60 $11,060.50 The adjusted cash balance per bank agreed with the cash balance per books at November 30. The December bank statement showed the following checks and deposits. Bank Statement Date 12-1 Checks Number 3451 Amount $2,260.40 Date 12-1 Deposits Amount $ 2,530,20 Bank Statement Checks Number Date Date 12-1 3451 12-1 12-2 3471 12-4 12-7 3472 12-8 12-4 3475 Amount $2,260.40 844.50 1,426.80 1,640.70 1,300 2,130 3,080 600 12-16 12-8 Deposits Amount $ 2,530.20 1,211.60 2,365.10 2,672.70 2,945 2,567.30 2,836 1,025 $18,152.90 3476 12-21 12-10 3477 12-26 12-15 3479 12-29 12-27 3480 12-30 3482 12-30 12-29 475.50 Total 3483 12-31 3485 1,140 520.80 $15,418.70 Total The cash records per books for December showed the following. Date 12-1 12-2 Number 3475 3476 Cash Payments Journal Amount Date Number $1,640.70 12-20 3482 1,300 12-22 3483 2,130 12-23 3484 621.30 12-24 3485 12-2 Cash Receipts Journal Date Amount 12-3 $ 1,211.60 12-2 2,365.10 12-15 2,672.70 12-20 2,954 Amount $475.50 1,140 792.20 250.80 3477 3478 12-4 CALCULATOR PRINTER VERSION BACK Date 12-1 12-2 12-2 12-4 12-8 12-10 12-17 Number 3475 3476 3477 3478 Cash Payments Journal Amount Date Number $1,640.70 12-20 3482 1,300 12-22 3483 2,130 12-23 3484 621.30 12-24 3,080 12-30 3486 600 Total 807.40 Amount 5475.50 1.140 792.20 250.30 889.50 $13,727.40 3485 3479 Cash Receipts Journal Date Amount 12-3 $1,211.60 12-7 2,365.10 12-15 2.672.70 12-20 2,954 12-25 2,567.30 12-28 2,036 12-30 1,025 12-31 1.690.40 $17,322.10 3480 3481 Total The bank statement contained two memoranda: 1. A credit of $2.390 for the collection of Langer Company of an electronic funds transfer. 2. A debit for the printing of additional company checks 590.80. At December 31, the cash balance per books was $14,655.20, and the cash balance per the bank statement was $19,871.30. The bank did not make any errors, but Langer Company made two errors Your answer is partially correct. Try again. Using the four steps in the reconciliation procedure, prepare a bank reconciliation at December 31. Cound answers to 2 decimal places. 52.75. Listems that increase cash balance first. Reconcile cash balance per bank st.) LILY COMPANY Bank Reconciliation LILY COMPANY Bank Reconciliation December 31, 2020 Cash balance per bank statement 19871.30 Add Deposits in transit 1690.40 21561.70 Less Outstanding checks No. 3470 720.1 No. 3474 1055.8 No. 3478 621.3 > No. 3481 807.4 No. 3484 792.2 No. 3486 889.5 4886,3 0.5400 DOS 4886.3 Adjusted cash balance per bank 16675.40 Cash balance per books Add 14655.20 Electronic funds transfer received 2390 Less 17045.2 Check printing fee 90.8 Error in recording check Error in deposit Adjusted cash balance per books UD Prepare the adjusting entries based on the reconciliation. (Credit account titles are automatical to 2 decimal places, e.g. 52.75.) No. Account Titles and Explanation Debit Credit X Dec. 31 x (To record collection of note receivable by bank) Dec. 31 (To record bank service charge) Y. ]. III X Dec. 31 X (To correct error in recording check) Dec. 31 (To correct error in deposit)