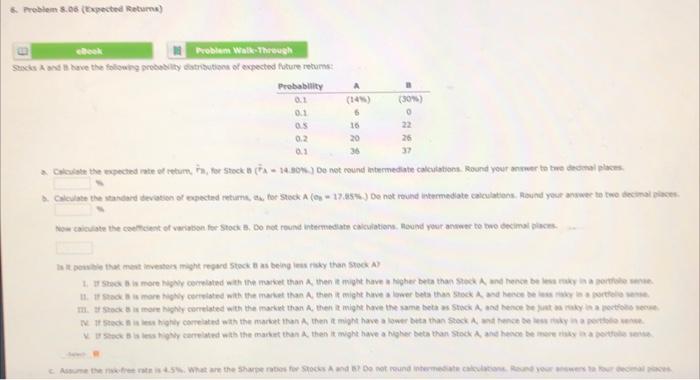

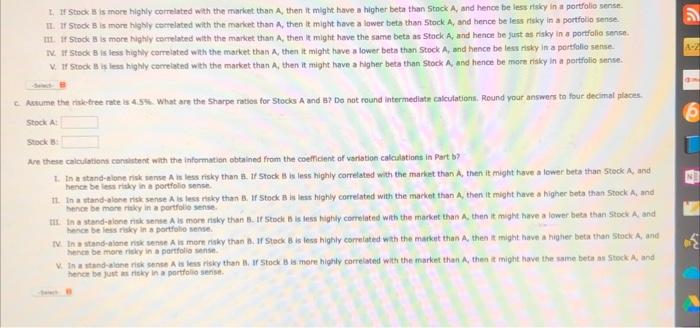

Problem 8.08 (txpected Returns A 6 steek Problem Walkthrough Socks and beve the flowing pretty crina of expected Mature rebume: Probability 0.1 0.1 05 0.2 2.1 Cate the expected to retum, To for Stock A-14.30) Do not round intermediate calculations. Round your newer to the domain Calculate the standard deviation of expected returns tor Stock A ( 17454.) De not round intermediate calculations. Round your answer to two decimal How calculate the coeficent of variation for Stock 8, Do not round intermediate calculations, round your awer to two decimal places (304) 0 22 26 32 20 36 stvoritoard Stocks being than to A) 1:17 more correlated with the more than then it might have her that Anne 1 Scored with the market than the might have betha Stock Stockmore created with the market than the might have the same stuck Aandeer Stecked with mar than then it might have a lower than Stock Aceh is less carried with the methan A then it might have a higher beathan Stock and hence Demek A 5. What are the share to St And Detround me L I Stock is more highly correlated with the market than A then it might have a higher beta than Stock A, and hence be less risky in a portfolio sense IL I Stock is more highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense II I Stock is more highly correlated with the market than then it might have the same beta as Stock A, and hence be just as risky in a portfolio sos 1. I Stock is less highly correlated with the market than then it might have a lower beta than Stock A, and hence be less risky in a portfolio sense V. If Stock is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. AZ Anume the motre rett 14.54. What are the Sharpe ration for Stocks A and 8? Do not round intermediate calculations. Round your answers to four decimal nice A Stock A Stock An these calculations consistent with the information obtained from the coefficient of variation calculations in Part b? In a stand-alone risk sense is less risky than 8.1 Stock is highly correlated with the market than A, then it might have a lower beta than Stock A, and henge besky in a portfolio sense 12 na stand-alone is sense is less risky than 3. If Stock is less highly correlated with the market than A then it might have a higher beta than Stock A, and hen be more my in a portfolio sense In a stand-alonen Als more risky than 8. Ir stock is less highly correlated with the market than A, then it might have a lower beta than Stock A and herbes sky in a portfolio sense IV. the standalone risk Als mor risky than 3. If Stock 8 is des highly correlated with the market than then it might have a higher bets than Stock A, and not be more in a portfolio in standalone sense As les risky than I Stock B is more highly correlated with the market than then it might have the same beton Stock and hence bet ky in a portfolio sense or