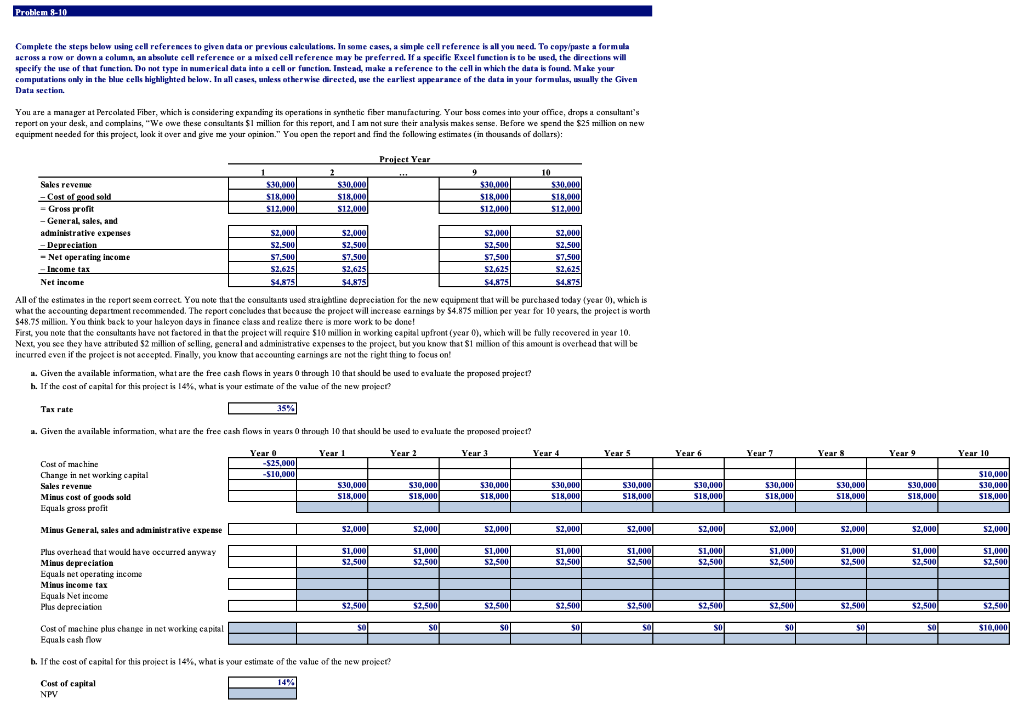

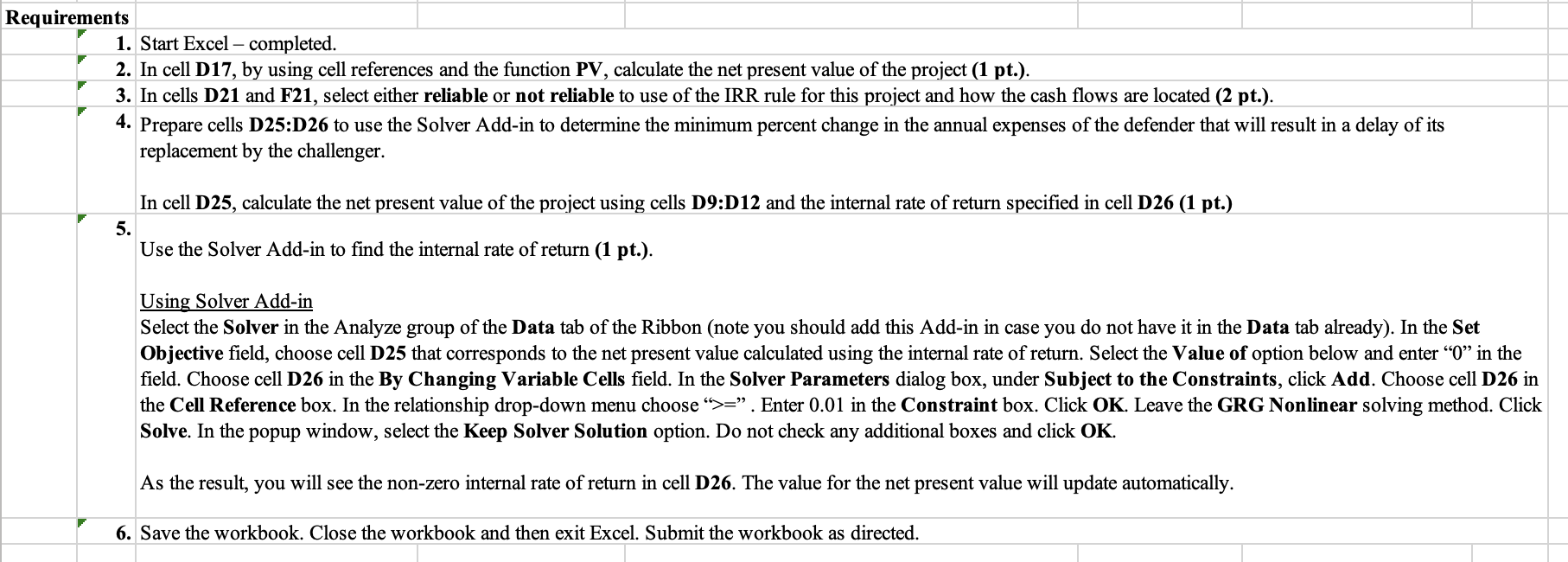

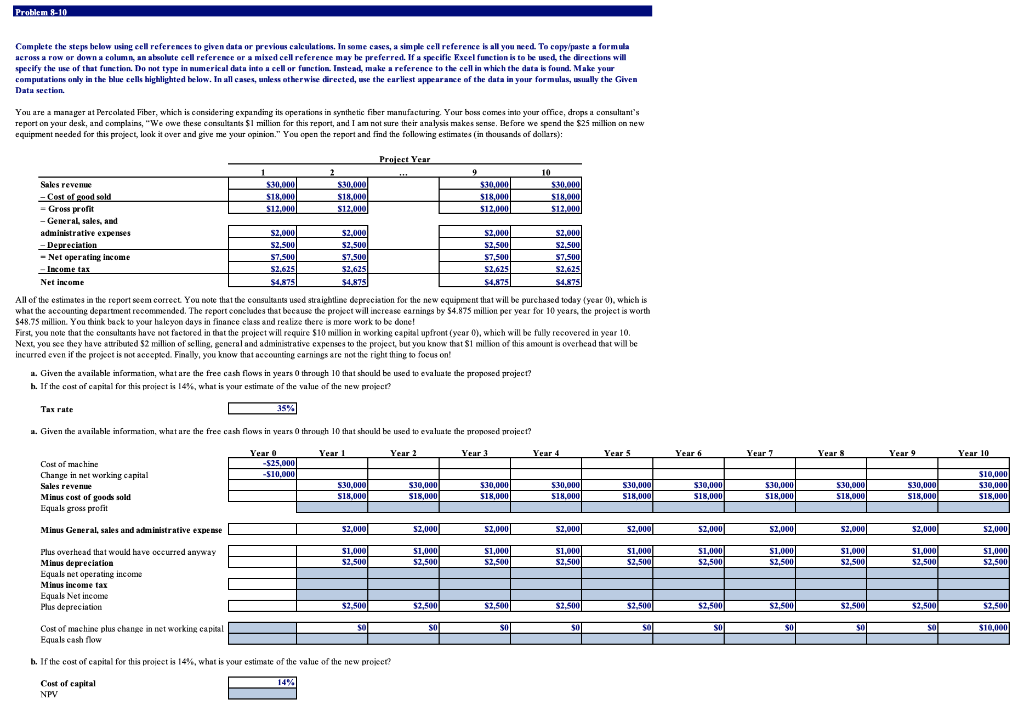

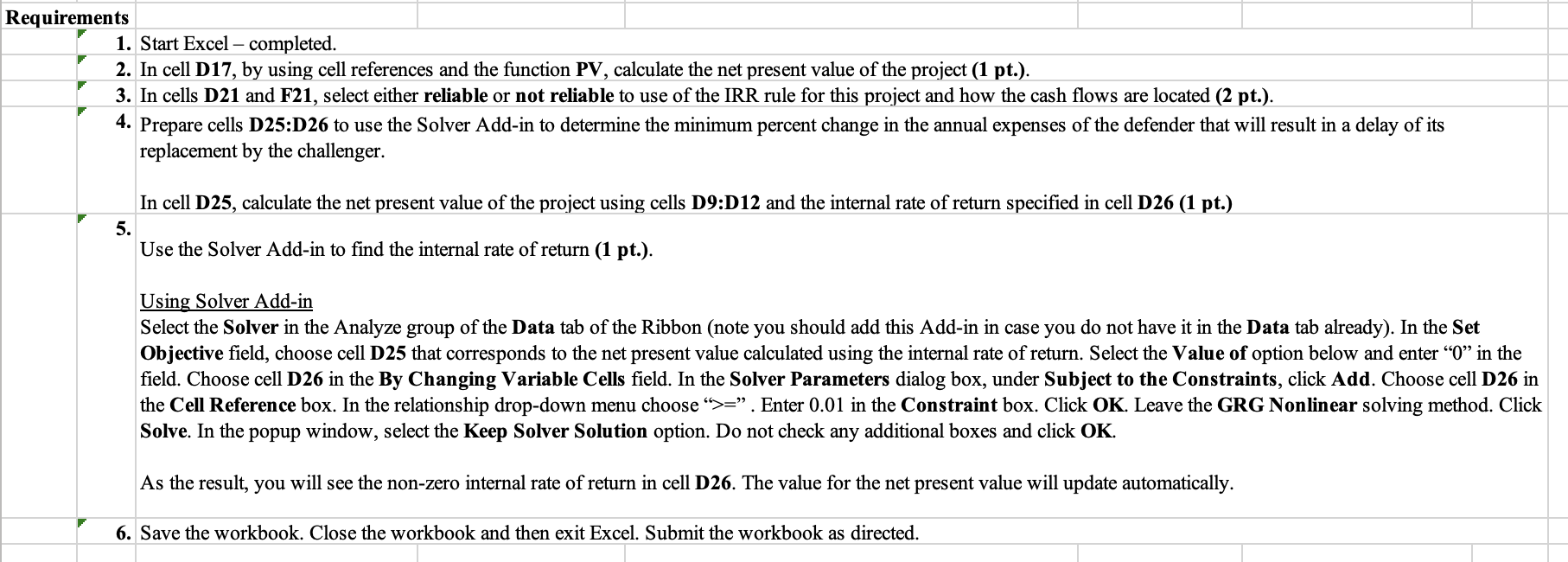

Problem 8-10 Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may he preferred. If a specific Excel function is to be used the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulus, suully the Given Data section. You are a manager at Percalated Fiber, which is considering expanding its operations in synthetic fiber manufacturing Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in thousands of dollars): Project Year 2 9 10 Sales revenue $30,000 $30.000 $30,000 $20,000 $ - Cost of good sold $18,000 $18.000 $18,000 $18.000 = Gross pront $12.000 $12.000 $12.000 $12,000 - General, sales, and administrative expenses $2.0001 $2.000 $2,000 $2.000 - Depreciation $2.500 $2.500 S2,500 $2.500 -Net operating income $7,5001 $7.500 S7,500 S7.500 - Income tax S2.625 $2,6251 $2,625 S2.625 Net income $4.8751 $4,878 $4,875 $4.875 All of the estimates in the report seem correct. You note that the consultants used straightline depreciation for the new equipment that will be purchased today (year 0), which is $48.75 million You think back to your halcyon days in finance class and realize throne will increase earnings by $4.875 million per year for 10 years, the project is worth . work to be done! First, you note that the consultants have not factored in that the project will require $10 million in working capital upfront (year o), which will be fully recovered in year 10 Next, you see they have attributed 52 million of selling, general and administrative expenses to the project, but you know that $1 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting carnings are not the right thing to focus on! 1. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? h. If the cost of capital for this project is 14%, what is your estimate of the value of the new project? Tax rate 35% u. Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed project? Year 1 Year 2 Year 3 Year 4 Years Year 6 Yeur 7 Year & Year 9 Year 10 Year O -$25.000 -$ -$10.000 Cost of machine Change in net working capital Sales revenue Minus cost of goods sold Equals gross profit $30,000 530,000 $18,000 $30,000 $18,000 $30,000 $18,000 $30,000 S18,000 $30,000 $18,000 $30,000 $18,000 530.000 S18.000 $30,000 $18,0001 $10,000 $30,000 $18,000 $18.000 Minus General, sales and administrative expense $2.000 52,000 S2,000 S2.000 52.0001 $2,000 $2.0001 S2.000 S2,000 $2,000 $ $1,000 $2,500 $1,000 $2,500 $1,000 $2.500 $1.0001 $2.500 $1,000 $2,500 $1,000 $2,500 $1,000 $2,500 $1.000 $2,500 $1,000 $2,500 $1,000 $2,500 Plus overhead that would have occurred anyway Minus depreciation Equals net operating income Minus Income tax Equals Net income Plus depreciation Cost of machine plus change in net working capital Equals cash flow $2,500 $2,5001 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 SO SO $0 $0 SO SO $0 $0 SO $10,000 h. If the cost of capital for this project is 14%, what is your estimate of the value of the new project? 14% Cost of capital NPV Requirements 1. Start Excel - completed. 2. In cell D17, by using cell references and the function PV, calculate the net present value of the project (1 pt.). 3. In cells D21 and F21, select either reliable or not reliable to use of the IRR rule for this project and how the cash flows are located (2 pt.). 4. Prepare cells D25:D26 to use the Solver Add-in to determine the minimum percent change in the annual expenses of the defender that will result in a delay of its replacement by the challenger. In cell D25, calculate the net present value of the project using cells D9:D12 and the internal rate of return specified in cell D26 (1 pt.) 5. Use the Solver Add-in to find the internal rate of return (1 pt.). Using Solver Add-in Select the Solver in the Analyze group of the Data tab of the Ribbon (note you should add this Add-in in case you do not have it in the Data tab already). In the Set Objective field, choose cell D25 that corresponds to the net present value calculated using the internal rate of return. Select the Value of option below and enter O in the field. Choose cell D26 in the By Changing Variable Cells field. In the Solver Parameters dialog box, under Subject to the Constraints, click Add. Choose cell D26 in the Cell Reference box. In the relationship drop-down menu choose >=. Enter 0.01 in the Constraint box. Click OK. Leave the GRG Nonlinear solving method. Click Solve. In the popup window, select the Keep Solver Solution option. Do not check any additional boxes and click OK. As the result, you will see the non-zero internal rate of return in cell D26. The value for the net present value will update automatically. 6. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed. Problem 8-10 Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copy/paste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may he preferred. If a specific Excel function is to be used the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulus, suully the Given Data section. You are a manager at Percalated Fiber, which is considering expanding its operations in synthetic fiber manufacturing Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1 million for this report, and I am not sure their analysis makes sense. Before we spend the $25 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in thousands of dollars): Project Year 2 9 10 Sales revenue $30,000 $30.000 $30,000 $20,000 $ - Cost of good sold $18,000 $18.000 $18,000 $18.000 = Gross pront $12.000 $12.000 $12.000 $12,000 - General, sales, and administrative expenses $2.0001 $2.000 $2,000 $2.000 - Depreciation $2.500 $2.500 S2,500 $2.500 -Net operating income $7,5001 $7.500 S7,500 S7.500 - Income tax S2.625 $2,6251 $2,625 S2.625 Net income $4.8751 $4,878 $4,875 $4.875 All of the estimates in the report seem correct. You note that the consultants used straightline depreciation for the new equipment that will be purchased today (year 0), which is $48.75 million You think back to your halcyon days in finance class and realize throne will increase earnings by $4.875 million per year for 10 years, the project is worth . work to be done! First, you note that the consultants have not factored in that the project will require $10 million in working capital upfront (year o), which will be fully recovered in year 10 Next, you see they have attributed 52 million of selling, general and administrative expenses to the project, but you know that $1 million of this amount is overhead that will be incurred even if the project is not accepted. Finally, you know that accounting carnings are not the right thing to focus on! 1. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? h. If the cost of capital for this project is 14%, what is your estimate of the value of the new project? Tax rate 35% u. Given the available information, what are the free cash flows in years through 10 that should be used to evaluate the proposed project? Year 1 Year 2 Year 3 Year 4 Years Year 6 Yeur 7 Year & Year 9 Year 10 Year O -$25.000 -$ -$10.000 Cost of machine Change in net working capital Sales revenue Minus cost of goods sold Equals gross profit $30,000 530,000 $18,000 $30,000 $18,000 $30,000 $18,000 $30,000 S18,000 $30,000 $18,000 $30,000 $18,000 530.000 S18.000 $30,000 $18,0001 $10,000 $30,000 $18,000 $18.000 Minus General, sales and administrative expense $2.000 52,000 S2,000 S2.000 52.0001 $2,000 $2.0001 S2.000 S2,000 $2,000 $ $1,000 $2,500 $1,000 $2,500 $1,000 $2.500 $1.0001 $2.500 $1,000 $2,500 $1,000 $2,500 $1,000 $2,500 $1.000 $2,500 $1,000 $2,500 $1,000 $2,500 Plus overhead that would have occurred anyway Minus depreciation Equals net operating income Minus Income tax Equals Net income Plus depreciation Cost of machine plus change in net working capital Equals cash flow $2,500 $2,5001 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 SO SO $0 $0 SO SO $0 $0 SO $10,000 h. If the cost of capital for this project is 14%, what is your estimate of the value of the new project? 14% Cost of capital NPV Requirements 1. Start Excel - completed. 2. In cell D17, by using cell references and the function PV, calculate the net present value of the project (1 pt.). 3. In cells D21 and F21, select either reliable or not reliable to use of the IRR rule for this project and how the cash flows are located (2 pt.). 4. Prepare cells D25:D26 to use the Solver Add-in to determine the minimum percent change in the annual expenses of the defender that will result in a delay of its replacement by the challenger. In cell D25, calculate the net present value of the project using cells D9:D12 and the internal rate of return specified in cell D26 (1 pt.) 5. Use the Solver Add-in to find the internal rate of return (1 pt.). Using Solver Add-in Select the Solver in the Analyze group of the Data tab of the Ribbon (note you should add this Add-in in case you do not have it in the Data tab already). In the Set Objective field, choose cell D25 that corresponds to the net present value calculated using the internal rate of return. Select the Value of option below and enter O in the field. Choose cell D26 in the By Changing Variable Cells field. In the Solver Parameters dialog box, under Subject to the Constraints, click Add. Choose cell D26 in the Cell Reference box. In the relationship drop-down menu choose >=. Enter 0.01 in the Constraint box. Click OK. Leave the GRG Nonlinear solving method. Click Solve. In the popup window, select the Keep Solver Solution option. Do not check any additional boxes and click OK. As the result, you will see the non-zero internal rate of return in cell D26. The value for the net present value will update automatically. 6. Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed