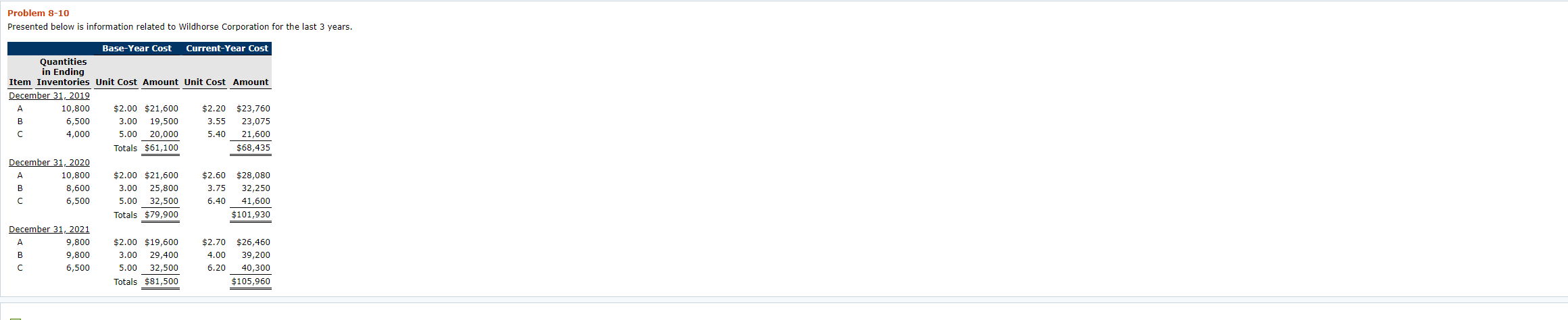

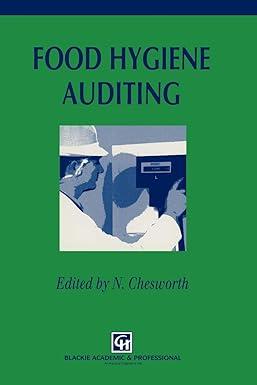

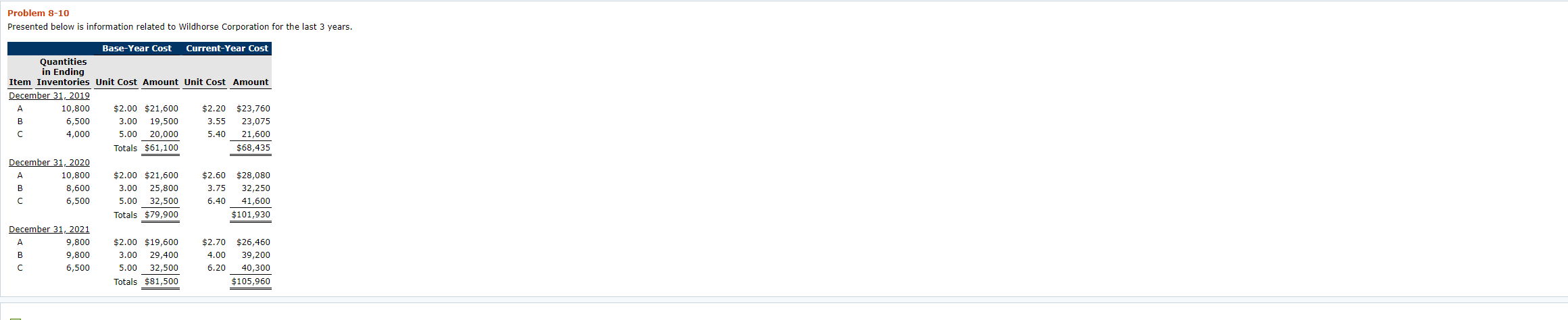

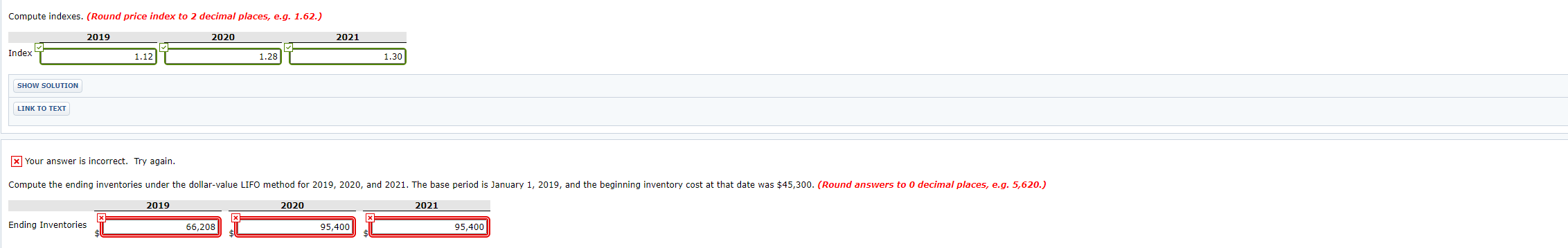

Problem 8-10 Presented below is information related to Wildhorse Corporation for the last 3 years. Base-Year Cost Current-Year Cost Quantities in Ending Item Inventories Unit Cost Amount Unit Cost Amount December 31, 2019 A 10,800 $2.00 $21,600 $2.20 $23,760 B 6,500 3.00 19,500 3.55 23,075 4,000 5.00 20,000 5.40 21,600 Totals $61,100 $68,435 December 31, 2020 A 10,800 $2.00 $21,600 $2.60 $28,080 B 8,600 3.00 25,800 3.75 32,250 6,500 5.00 32,500 6.40 41,600 Totals $79,900 $101,930 December 31, 2021 A 9,800 $2.00 $19,600 $2.70 $26,460 B 9,800 3.00 29,400 4.00 39,200 6,500 5.00 32,500 6.20 40,300 Totals $81,500 $105,960 Compute indexes. (Round price index to 2 decimal places, e.g. 1.62.) 2019 2020 2021 Index 1.12 1.28 1.30 SHOW SOLUTION LINK TO TEXT x Your answer is incorrect. Try again. Compute the ending inventories under the dollar-value LIFO method for 2019, 2020, and 2021. The base period is January 1, 2019, and the beginning inventory cost at that date was $45,300. (Round answers to 0 decimal places, e.g. 5,620.) 2019 2020 2021 Ending Inventories 66,208 95,400 95,400 Problem 8-10 Presented below is information related to Wildhorse Corporation for the last 3 years. Base-Year Cost Current-Year Cost Quantities in Ending Item Inventories Unit Cost Amount Unit Cost Amount December 31, 2019 A 10,800 $2.00 $21,600 $2.20 $23,760 B 6,500 3.00 19,500 3.55 23,075 4,000 5.00 20,000 5.40 21,600 Totals $61,100 $68,435 December 31, 2020 A 10,800 $2.00 $21,600 $2.60 $28,080 B 8,600 3.00 25,800 3.75 32,250 6,500 5.00 32,500 6.40 41,600 Totals $79,900 $101,930 December 31, 2021 A 9,800 $2.00 $19,600 $2.70 $26,460 B 9,800 3.00 29,400 4.00 39,200 6,500 5.00 32,500 6.20 40,300 Totals $81,500 $105,960 Compute indexes. (Round price index to 2 decimal places, e.g. 1.62.) 2019 2020 2021 Index 1.12 1.28 1.30 SHOW SOLUTION LINK TO TEXT x Your answer is incorrect. Try again. Compute the ending inventories under the dollar-value LIFO method for 2019, 2020, and 2021. The base period is January 1, 2019, and the beginning inventory cost at that date was $45,300. (Round answers to 0 decimal places, e.g. 5,620.) 2019 2020 2021 Ending Inventories 66,208 95,400 95,400