Problem 8-18 Cash Budget; Income Statement; Balance Sheet; Changing Assumptions [LO8-2, LO8-4, LO8-8, LO8-9, LO8-10]

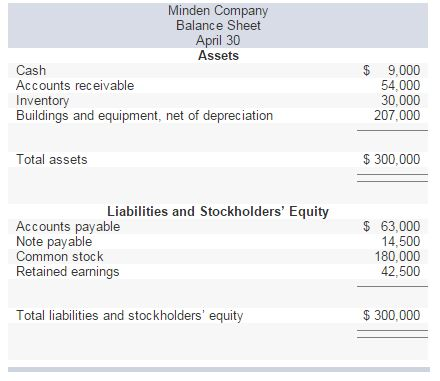

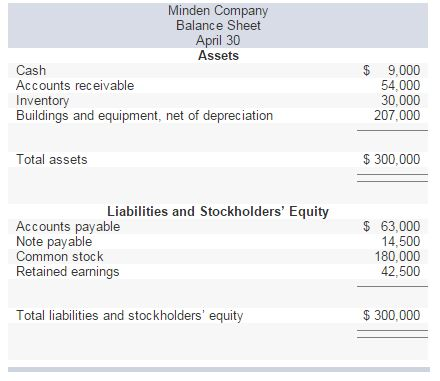

| Minden Company is a wholesale distributor of premium European chocolates. The companys balance sheet as of April 30 is given below:

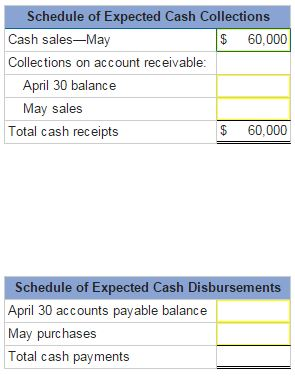

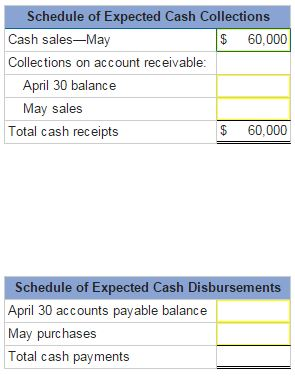

| The company is in the process of preparing a budget for May and has assembled the following data: | | a. | Sales are budgeted at $220,000 for May. Of these sales, $60,000 will be for cash; the remainder will be credit sales. Each months credit sales are collected 60% in the month of sale and 40% in the month following the sale. All of the April 30 accounts receivable will be collected in May. | | b. | Purchases of inventory are expected to total $120,000 during May. These purchases will all be on account. The company pays for 50% of its merchandise purchases in the month of the purchase and the remaining 50% in the month following the purchase. All of the April 30 accounts payable to suppliers will be paid during May. | | c. | The May 31 inventory balance is budgeted at $40,000. | | d. | Selling and administrative expenses for May are budgeted at $72,000, exclusive of depreciation. These expenses will be paid in cash. Depreciation is budgeted at $2,000 for the month. | | e. | The note payable on the April 30 balance sheet will be paid during May, with $100 in interest. (All of the interest relates to May.) | | f. | New refrigerating equipment costing $6,500 will be purchased for cash during May. | | g. | During May, the company will borrow $20,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year. | | Required: | | 1-a. | Prepare a schedule of expected cash collections from sales and a schedule of expected cash disbursements for merchandise purchases..

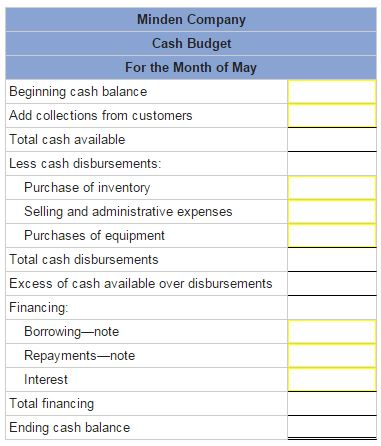

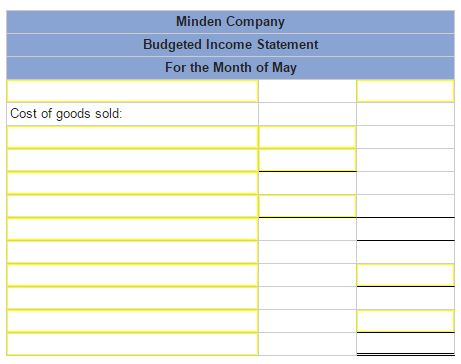

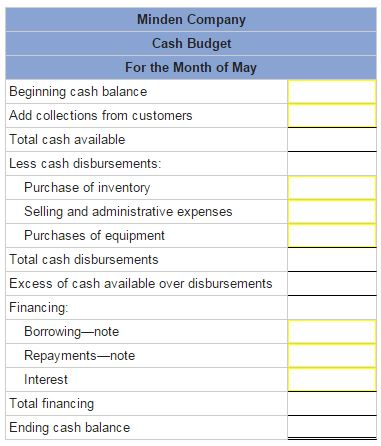

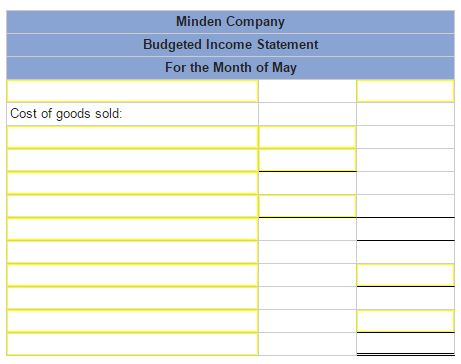

| 1-b. | Prepare a cash budget for May. (Cash deficiency, repayments and interest should be indicated by a minus sign.)  | 2. | Prepare a budgeted income statement for May.

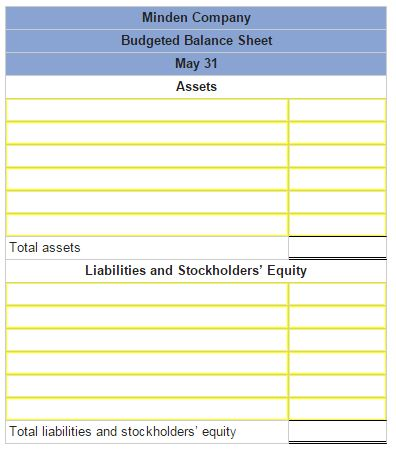

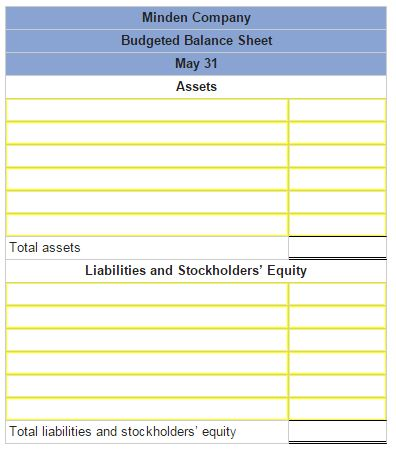

| 3. | Prepare a budgeted balance sheet as of May 31.

| | | | |

Minden Company Balance Sheet April 30 Assets Cash Accounts receivable Inventory Buildings and equipment, net of depreciation $ 9,000 54.000 30,000 207,000 Total assets $ 300,000 Liabilities and Stockholders' Equity Accounts payable Note payable Common stock Retained earnings 63,000 14,500 180,000 42,500 Total liabilities and stockholders' equity $300,000