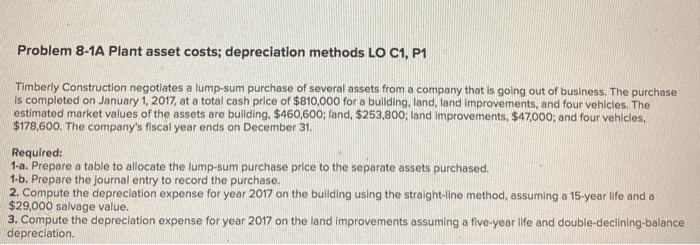

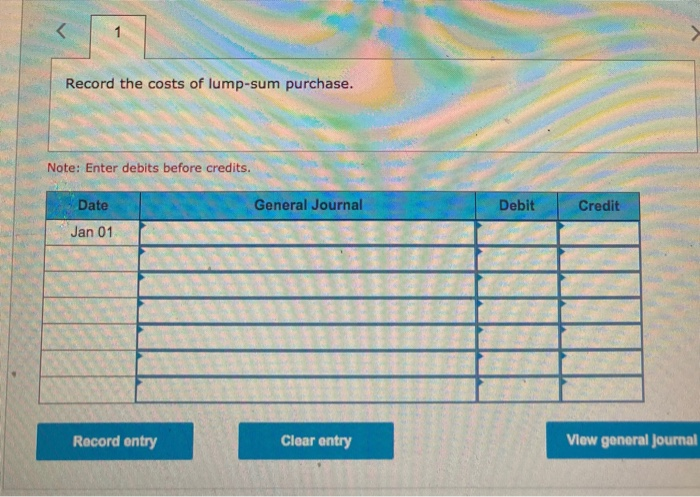

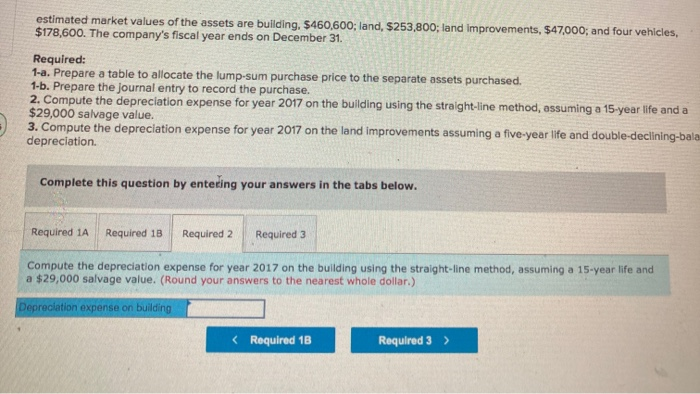

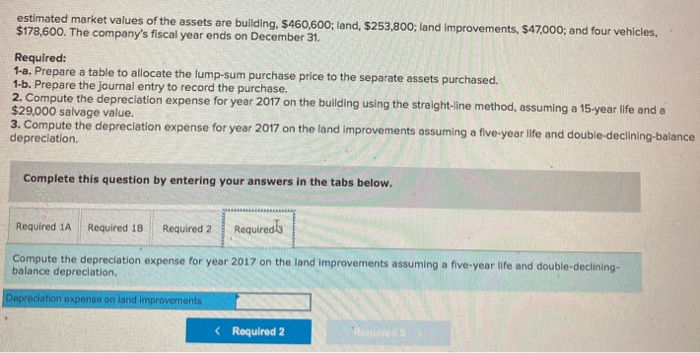

Problem 8-1A Plant asset costs; depreciation methods LO C1, P1 Timberly Construction negotiates a lump-sum purchase of several assets from a company that is going out of business. The purchase is completed on January 1, 2017, at a total cash price of $810,000 for a building, land, land improvements, and four vehicles. The estimated market values of the assets are building, $460,600; land, $253,800; land improvements, $47.000, and four vehicles, $178,600. The company's fiscal year ends on December 31 Required: 1-a. Prepare a table to allocate the lump-sum purchase price to the separate assets purchased 1-b. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2017 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. 3. Compute the depreciation expense for year 2017 on the land improvements assuming a five-year life and double-declining-balance depreciation. Record the costs of lump-sum purchase. Note: Enter debits before credits. Date General Journal Debit Credit Jan 01 Record entry Clear entry View general Journal estimated market values of the assets are building. $460,600; land, $253,800; land improvements, $47,000; and four vehicles, $178,600. The company's fiscal year ends on December 31. Required: 1-a. Prepare a table to allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2017 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. 3. Compute the depreciation expense for year 2017 on the land improvements assuming a five-year life and double-declining-bala depreciation. Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required 3 Compute the depreciation expense for year 2017 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. (Round your answers to the nearest whole dollar) Depreciation expense on building estimated market values of the assets are building, $460,600; land, $253,800; land improvements, 547,000; and four vehicles, $178,600. The company's fiscal year ends on December 31. Required: 1-a. Prepare a table to allocate the lump-sum purchase price to the separate assets purchased. 1-b. Prepare the journal entry to record the purchase. 2. Compute the depreciation expense for year 2017 on the building using the straight-line method, assuming a 15-year life and a $29,000 salvage value. 3. Compute the depreciation expense for year 2017 on the land improvements assuming a five-year life and double-declining-balance depreciation Complete this question by entering your answers in the tabs below. Required 1A Required 18 Required 2 Required Compute the depreciation expense for year 2017 on the land improvements assuming a five-year life and double-declining- balance depreciation. Depreciation oxpenso on land improvements