Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 8-27A effect of straight line versus double declining balance depreciation, on the recognition of expense and gains or losses Becker office service purchase a

PROBLEM 8-27A

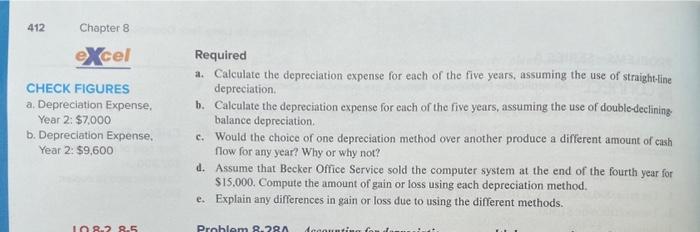

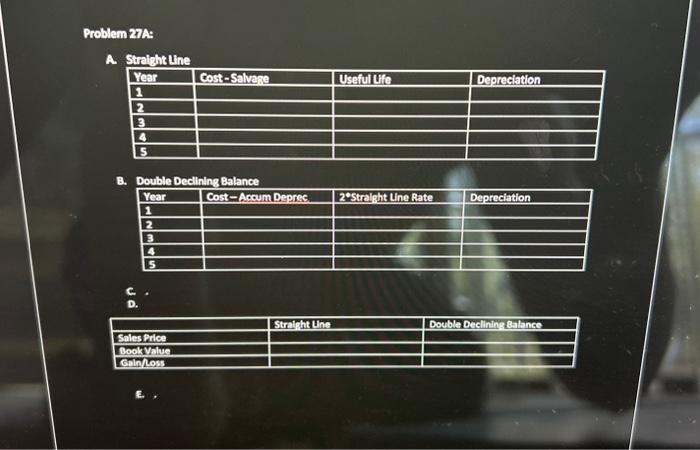

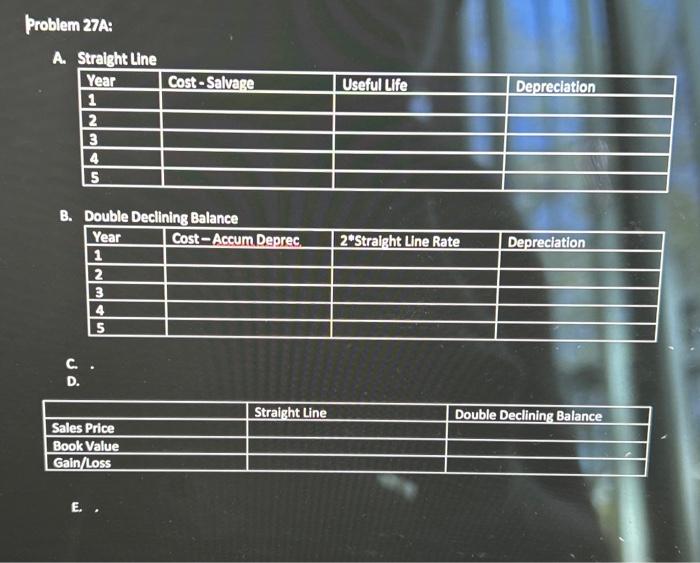

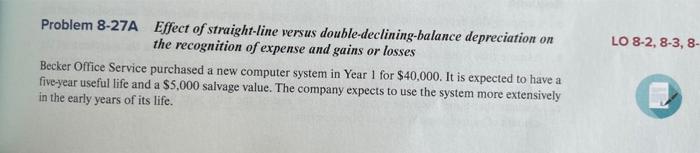

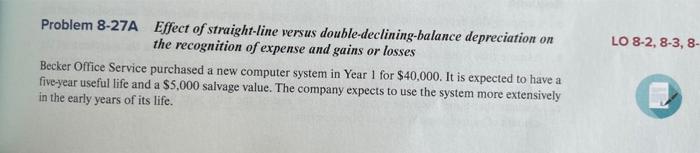

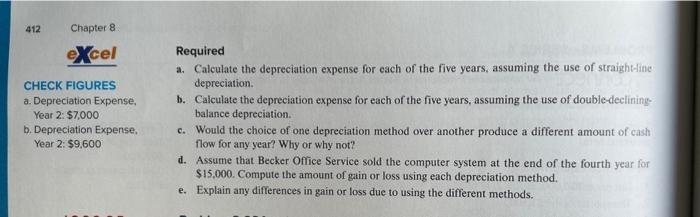

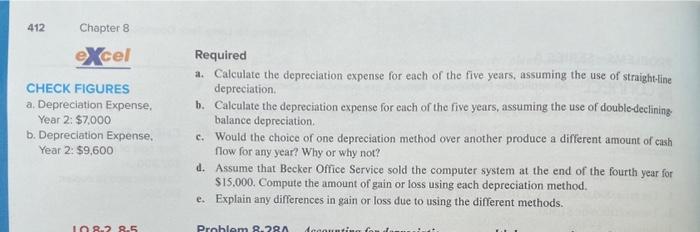

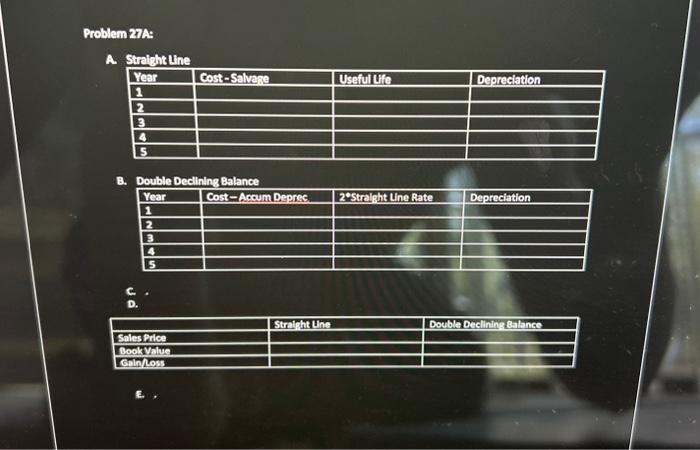

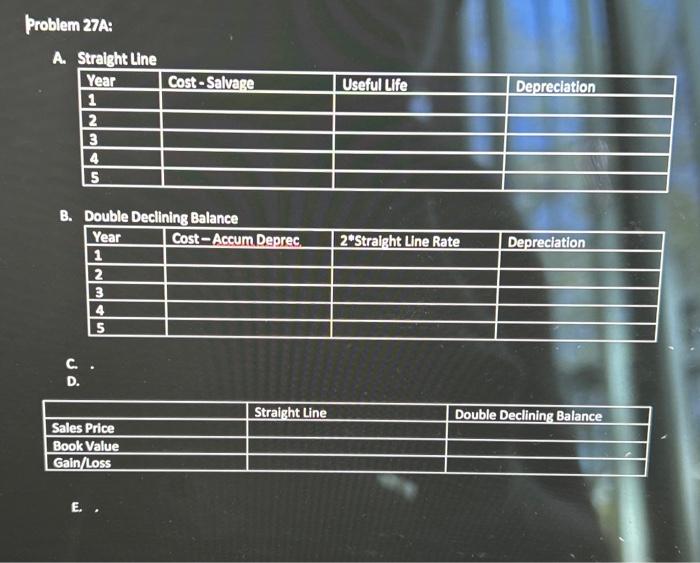

Problem 8-27A Effect of straight-line versus double-declining-balance depreciation on the recognition of expense and gains or losses Becker Office Service purchased a new computer system in Year 1 for $40,000. It is expected to have a five-year useful life and a $5,000 salvage value. The company expects to use the system more extensively in the early years of its life. Required a. Calculate the depreciation expense for each of the five years, assuming the use of straight-line depreciation. b. Calculate the depreciation expense for each of the five years, assuming the use of double-decliningbalance depreciation. c. Would the choice of one depreciation method over another produce a different amount of cash flow for any year? Why or why not? d. Assume that Becker Office Service sold the computer system at the end of the fourth year for $15,000. Compute the amount of gain or loss using each depreciation method. e. Explain any differences in gain or loss due to using the different methods. el Required a. Calculate the depreciation expense for each of the five years, assuming the use of straight-line depreciation. HECK FIGURES b. Calculate the depreciation expense for each of the five years, assuming the use of doubledeclining- Depreciation Expense, balance depreciation. Year 2: $7.000 c. Would the choice of one depreciation method over another produce a different amount of cash Depreciation Expense, flow for any year? Why or why not? Year 2:$9,600 d. Assume that Becker Office Service sold the computer system at the end of the fourth year for $15,000. Compute the amount of gain or loss using each depreciation method. e. Explain any differences in gain or loss due to using the different methods. 412 Chapter 8 ezcel Required CHECK FIGURES a. Calculate the depreciation expense for each of the five years, assuming the use of straight-ine depreciation. a. Depreciation Expense. b. Calculate the depreciation expense for each of the five years, assuming the use of double-decliningYear 2: $7,000 balance depreciation. b. Depreciation Expense, c. Would the choice of one depreciation method over another produce a different amount of cash Year 2: $9,600 flow for any year? Why or why not? d. Assume that Becker Office Service sold the computer system at the end of the fourth year for $15,000. Compute the amount of gain or loss using each depreciation method. e. Explain any differences in gain or loss due to using the different methods. Q. Cel Required CHECK FIGURES a. Calculate the depreciation expense for each of the five years, assuming the use of straightline depreciation. a. Depreciation Expense. b. Caleulate the depreciation expense for each of the five years, assuming the use of double-declining Year 2: $7,000 balance depreciation. b. Depreciation Expense. c. Would the choice of one depreciation method over another produce a different amount of cash Year 2: $9,600 flow for any year? Why or why not? d. Assume that Becker Office Service sold the computer system at the end of the fourth year for $15,000. Compute the amount of gain or loss using each depreciation method. e. Explain any differences in gain or loss due to using the different methods. Problem 27A: A. Stralght Line \begin{tabular}{|l|l|l|l|} \hline Year & Cost-Salvase & Usafululie & Derreciation \\ \hline 1 & & & \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline 5 & & & \\ \hline \end{tabular} B. Double Declining Balance \begin{tabular}{|l|l|l|l|} \hline Year & Cost-Accum Deprec & 2 Stralght Line Rate & Depreciation \\ \hline 1 & & & \\ \hline 2 & & & \\ \hline 3 & & & \\ \hline 4 & & & \\ \hline 5 & & & \\ \hline \end{tabular} C. . D. \begin{tabular}{|l|l|l|} \hline & Straight Line & Double Declining Balance \\ \hline Sales Price & & \\ \hline Book Value & & \\ \hline Galn/Loss & & \\ \hline \end{tabular} E effect of straight line versus double declining balance depreciation, on the recognition of expense and gains or losses

Becker office service purchase a new computer system near one for $40,000. It is expected to have a five-year useful life and a $5000 salvage value. The company expects to use the system more extensively in the early years of its life.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started