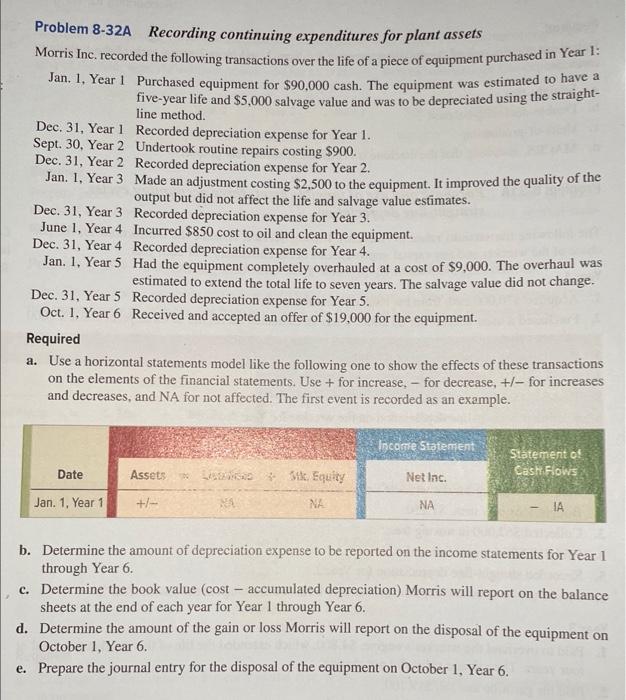

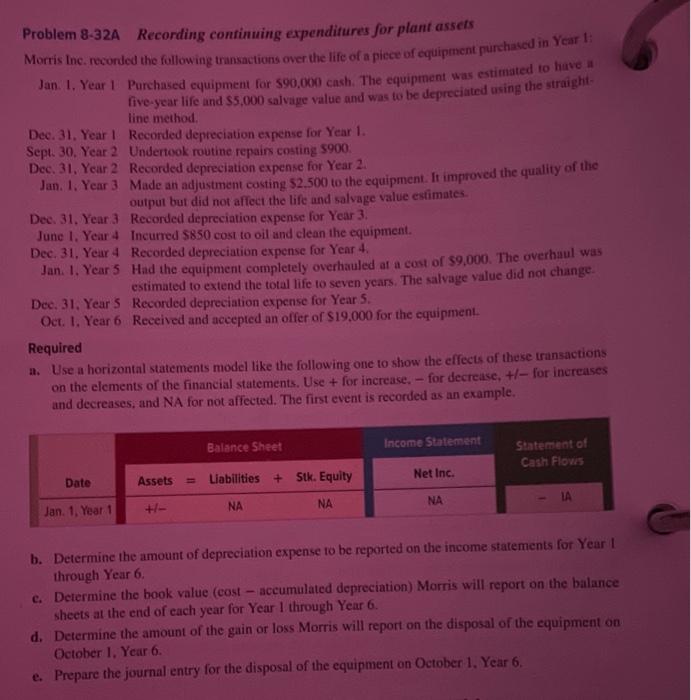

Problem 8-32A Recording continuing expenditures for plant assets Morris Inc. recorded the following transactions over the life of a piece of equipment purchased in Year 1: Jan. 1, Year 1 Purchased equipment for $90,000 cash. The equipment was estimated to have a five-year life and $5,000 salvage value and was to be depreciated using the straightline method. Dec. 31, Year 1 Recorded depreciation expense for Year 1. Sept. 30, Year 2 Undertook routine repairs costing $900. Dec. 31, Year 2 Recorded depreciation expense for Year 2. Jan. 1, Year 3 Made an adjustment costing $2,500 to the equipment. It improved the quality of the output but did not affect the life and salvage value estimates. Dec. 31, Year 3 Recorded depreciation expense for Year 3. June 1, Year 4 Incurred $850 cost to oil and clean the equipment. Dec. 31, Year 4 Recorded depreciation expense for Year 4. Jan. 1, Year 5 Had the equipment completely overhauled at a cost of $9,000. The overhaul was estimated to extend the total life to seven years. The salvage value did not change. Dec. 31 , Year 5 Recorded depreciation expense for Year 5. Oct. 1, Year 6 Received and accepted an offer of $19,000 for the equipment. Required a. Use a horizontal statements model like the following one to show the effects of these transactions on the elements of the financial statements. Use + for increase, - for decrease, +/-for increases and decreases, and NA for not affected. The first event is recorded as an example. b. Determine the amount of depreciation expense to be reported on the income statements for Year 1 through Year 6. c. Determine the book value (cost - accumulated depreciation) Morris will report on the balance sheets at the end of each year for Year 1 through Year 6. d. Determine the amount of the gain or loss Morris will report on the disposal of the equipment on October 1, Year 6. e. Prepare the journal entry for the disposal of the equipment on October 1 , Year 6 . Problem 8-32A Recording continuing expenditures for plant assets Morris ine. reconded the following transactions over the life of a piece of equipment purchased in Year 1: Jan. 1, Year 1 Purchased equipment for $90,000 cash. The equipment was estimated to have a five-year life and $5,000 salvage value and was to be depreciated wsing the straightline method. Dec. 31, Year I Recorded depreciation expense for Year 1. Sept. 30, Year 2 Undentook routine repairs costing 5900. Jan. 1. Year 3 Made an adjustment costing $2.500 to the equipment. It improved the quality of the Dec. 31, Year 2 Recorded depreciation expense for Year 2 . output but did not affect the life and salvage value estimates. Dee. 31. Year 3 Recorded depreciation expense for Year 3. June 1. Year 4 Incurred $850 cost to oil and clean the equipment. Dec. 31, Year 4 Recorded depreciation expense for Year 4. Jan. 1. Year 5 Had the equipment completely overhauled at a cost of 59,000 . The overhaul was estimated to extend the total life to seven years. The salvage value did not change. Dee, 31. Year 5 Recorded depreciation expense for Year 5 . Oct. 1. Year 6 Received and accepted an offer of $19,000 for the equipment. Required a. Use a horizontal statements model like the following one to show the effects of these transactions on the elements of the financial statements. Use + for increase, - for decrease, +1 for increases and decreases, and NA for not affected. The first event is recorded as an example. b. Determine the amount of depreciation expense to be reported on the income statements for Year I through Year 6. c. Determine the book value (cost - accumulated depreciation) Morris will report on the balance sheets at the end of each year for Year 1 through Year 6. d. Determine the amount of the gain or loss Morris will report on the disposal of the equipment on October 1, Year 6 . e. Prepare the journal entry for the disposal of the equipment on October 1, Year 6