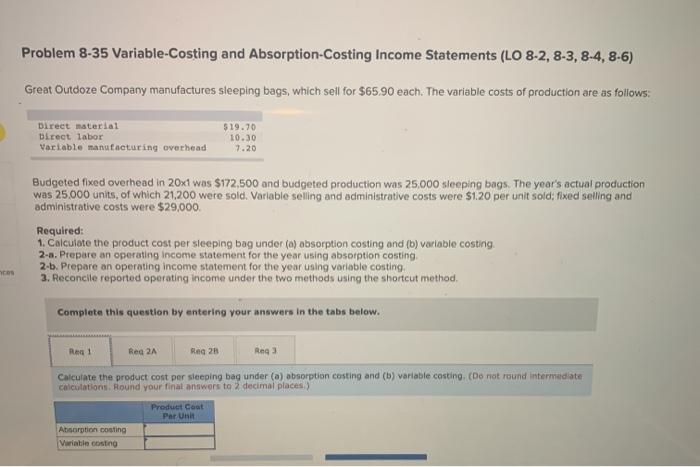

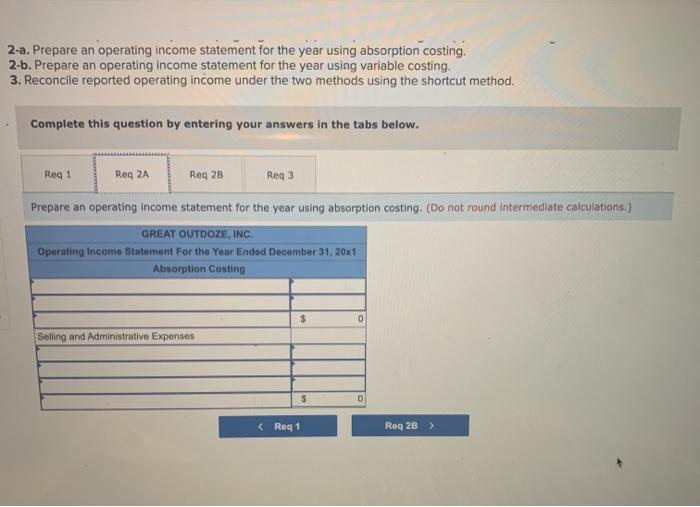

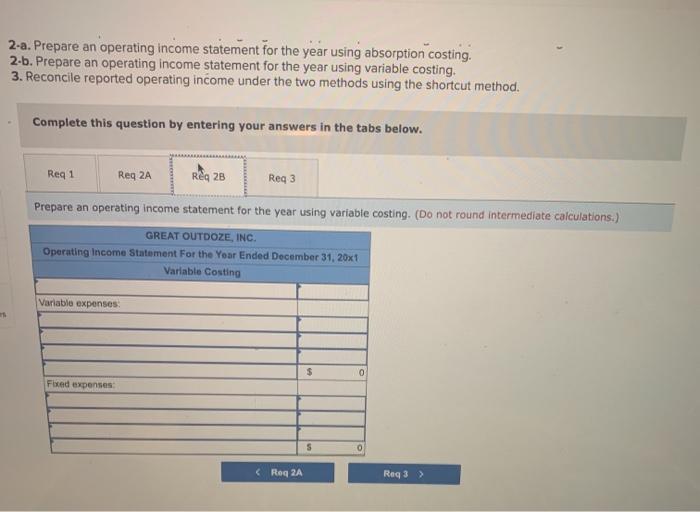

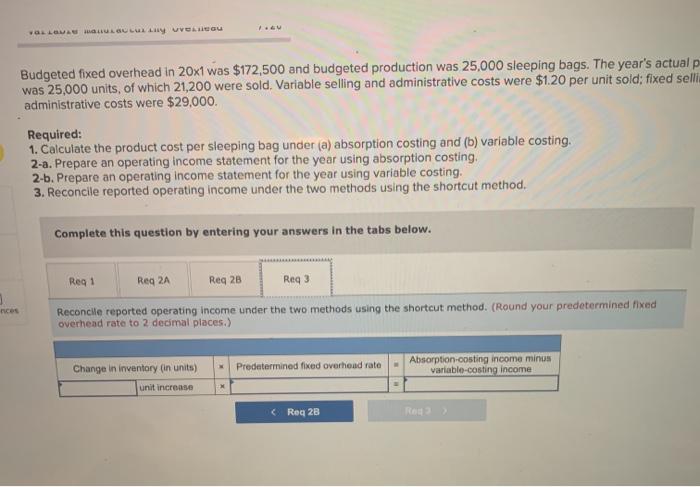

Problem 8-35 Variable-Costing and Absorption-Costing Income Statements (LO 8-2, 8-3, 8-4, 8-6) Great Outdoze Company manufactures sleeping bags, which sell for $65.90 each. The variable costs of production are as follows: Direct material Direct labor Variable manufacturing overhead $19.70 10.30 7.20 Budgeted fixed overhead in 20x1 was $172,500 and budgeted production was 25.000 sleeping bags. The year's actual production was 25.000 units, of which 21,200 were sold. Variable selling and administrative costs were $1.20 per unit sold; fixed selling and administrative costs were $29,000 Required: 1. Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing 2-a. Prepare an operating income statement for the year using absorption costing 2-b. Prepare an operating income statement for the year using variable costing, 2. Reconcile reported operating income under the two methods using the shortcut method Complete this question by entering your answers in the tabs below. Rea 1 Reg 2A Reg 28 Reg 3 Calculate the product cost per sleeping bag under () absorption costing and (b) variable casting Do not found intermediate calculations. Round your final answers to 2 decimal places) Product Coat Par Unit Absorption costing Variable costing 2-a. Prepare an operating income statement for the year using absorption costing. 2-b. Prepare an operating income statement for the year using variable costing. 3. Reconcile reported operating income under the two methods using the shortcut method. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3 Prepare an operating Income statement for the year using absorption costing. (Do not round Intermediate calculations.) GREAT OUTDOZE, INC Operating Income Statement For the Year Ended December 31, 20x1 Absorption Costing $ 0 Selling and Administrative Expenses $ 0 2-a. Prepare an operating income statement for the year using absorption costing. 2.b. Prepare an operating income statement for the year using variable costing. 3. Reconcile reported operating income under the two methods using the shortcut method. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Req3 Prepare an operating income statement for the year using variable costing. (Do not round intermediate calculations.) GREAT OUTDOZE, INC. Operating Income Statement For the Year Ended December 31, 20x1 Variable Costing Variable expenses $ 0 Forced expenses s 0 Reg 2A Req3 > wa LOA LULU GU Budgeted fixed overhead in 20x1 was $172,500 and budgeted production was 25,000 sleeping bags. The year's actual p was 25,000 units, of which 21,200 were sold. Variable selling and administrative costs were $1.20 per unit sold: fixed selli administrative costs were $29,000. Required: 1. Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing. 2-a. Prepare an operating income statement for the year using absorption costing 2-b. Prepare an operating income statement for the year using variable costing. 3. Reconcile reported operating income under the two methods using the shortcut method. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2A Reg 28 Reg 3 Reconcile reported operating income under the two methods using the shortcut method. (Round your predetermined fixed overhead rate to 2 decimal places.) nces Predetermined fixed overhead rate Change in inventory (in units) unit increase Absorption costing income minus variable-costing income Reg 28