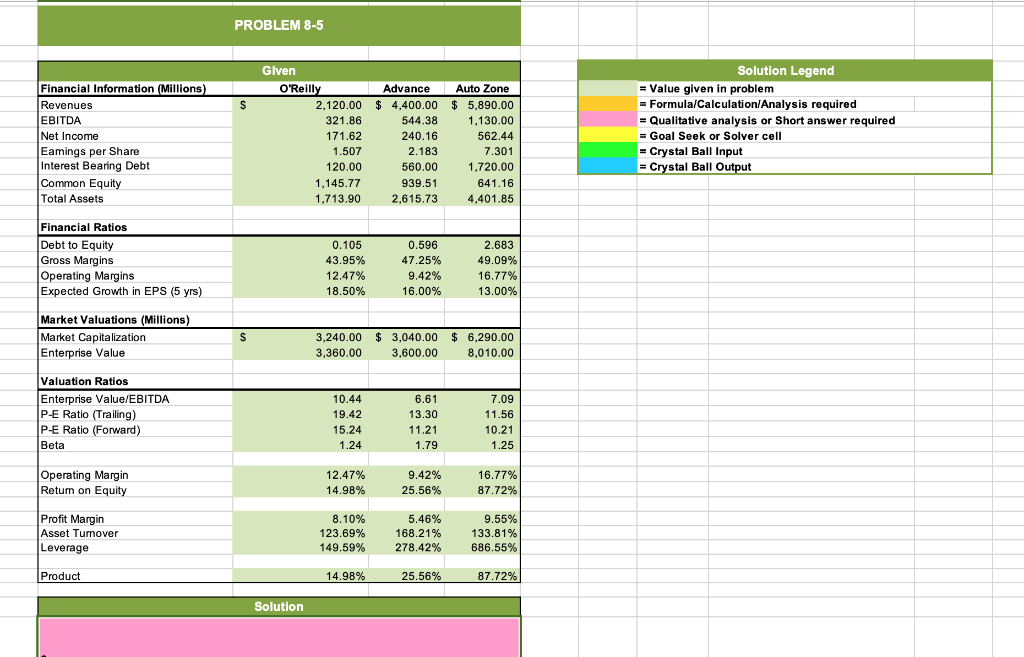

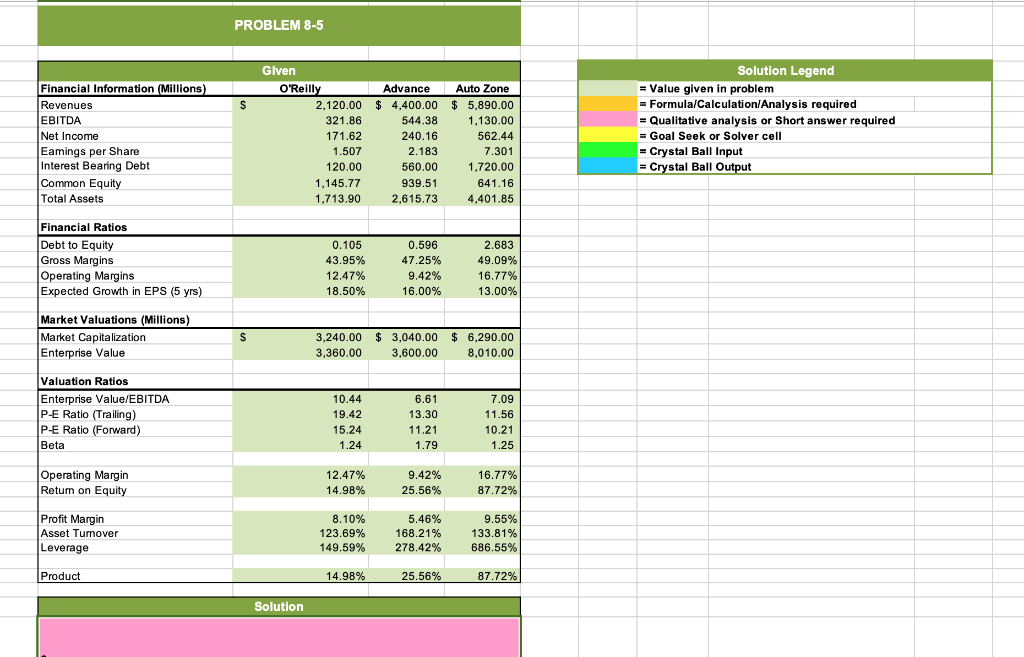

PROBLEM 8-5 Given Solution Legend Financial Information (Millions Revenues EBITDA Net Income Eamings per Share Interest Bearing Debt Common Equity Total Assets O'Reill Advance Auto Zone 2,120.00 $ 4,400.00 $5,890.00 1,130.00 562.44 7.301 1,720.00 641.16 4,401.85 321.86 171.62 1.507 120.00 1,145.77 1,713.90 544.38 240.16 2.183 560.00 939.51 2,615.73 Value given in problem Formula/Calculation/Analysis required Qualitative analysis or Short answer required Goal Seek or Solver cell Crystal Ball Input Crystal Ball O Financial Ratios Debt to Equity Gross Margins Operating Margins Expected Growth in EPS (5 yrs) 0.105 43.95% 12.47% 18.50% 0.596 47.25% 9.42% 16.00% 2.683 49.09% 16.77% 13.00% Market Valuations (Millions) Market Capitalization Enterprise Value 3,240.00 3,040.00 $ 6,290.00 3,360.00 3,600.00 8,010.00 Valuation Ratios Enterprise Value/EBITDA P-E Ratio (Trailing) P-E Ratio (Forward) 10.44 19.42 15.24 1.24 6.61 13.30 7.09 11.56 10.21 1.25 Operating Margin Retum on Equity 12.47% 14.98% 9.42% 25.56% 16.77% 87.72% Profit Margin Asset Tumover Leverage 8.10% 123.69% 149.59% 5.46% 168.21% 278.42% 9.55% 133.81% 686.55% Product 14.98 25.56% 87 72% Solution a. How would you use this information to evaluate a potential offer to acquire Carquest's equity? b. What do you think is driving the rather dramatic differences in the valuation ratios of the three firms? PROBLEM 8-5 Given Solution Legend Financial Information (Millions Revenues EBITDA Net Income Eamings per Share Interest Bearing Debt Common Equity Total Assets O'Reill Advance Auto Zone 2,120.00 $ 4,400.00 $5,890.00 1,130.00 562.44 7.301 1,720.00 641.16 4,401.85 321.86 171.62 1.507 120.00 1,145.77 1,713.90 544.38 240.16 2.183 560.00 939.51 2,615.73 Value given in problem Formula/Calculation/Analysis required Qualitative analysis or Short answer required Goal Seek or Solver cell Crystal Ball Input Crystal Ball O Financial Ratios Debt to Equity Gross Margins Operating Margins Expected Growth in EPS (5 yrs) 0.105 43.95% 12.47% 18.50% 0.596 47.25% 9.42% 16.00% 2.683 49.09% 16.77% 13.00% Market Valuations (Millions) Market Capitalization Enterprise Value 3,240.00 3,040.00 $ 6,290.00 3,360.00 3,600.00 8,010.00 Valuation Ratios Enterprise Value/EBITDA P-E Ratio (Trailing) P-E Ratio (Forward) 10.44 19.42 15.24 1.24 6.61 13.30 7.09 11.56 10.21 1.25 Operating Margin Retum on Equity 12.47% 14.98% 9.42% 25.56% 16.77% 87.72% Profit Margin Asset Tumover Leverage 8.10% 123.69% 149.59% 5.46% 168.21% 278.42% 9.55% 133.81% 686.55% Product 14.98 25.56% 87 72% Solution a. How would you use this information to evaluate a potential offer to acquire Carquest's equity? b. What do you think is driving the rather dramatic differences in the valuation ratios of the three firms