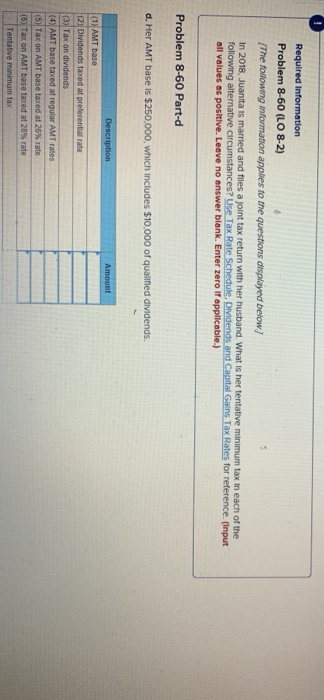

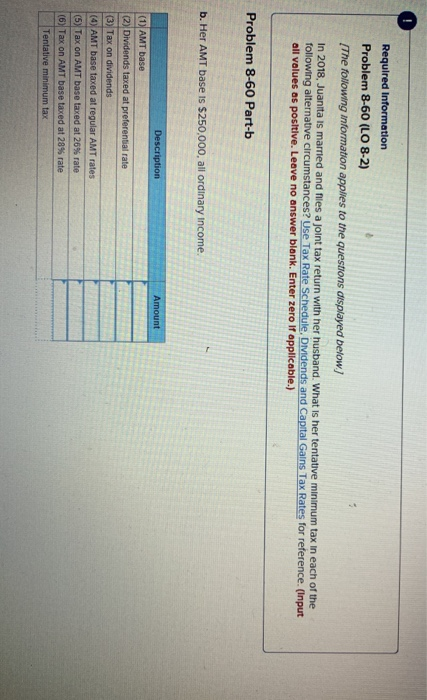

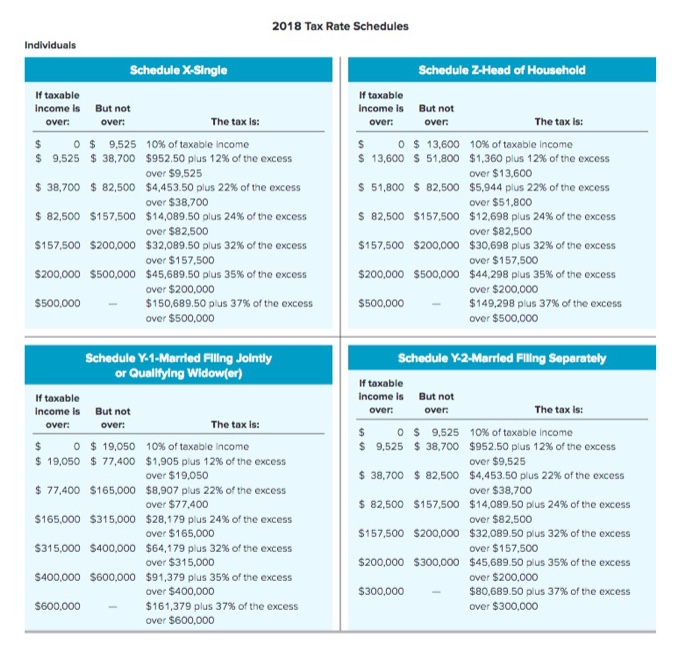

Problem 8-60 (LO 8-2) (The following information applies to the questions displayed below Problem 8-60 Part-d d. Her AMT base Is $250,000, which includes $10,000 of qualified dividends Tax on dividends Required Information Problem 8-60 (LO 8-2) The following information applies to the questions aisplayed below In 2018, Juanita is married and nies a joint tax return with her husband. What Is her tentative minimum tax in each of the following alternative circu all values as posltive. Leave no answer blank. Enter zero If applicable.) mstances? Use Tax Rate Schedule, Dvidends and Capital Gains Tax Rates for reference. (Input Problem 8-60 Part-b b. Her AMT base is $250,000, all ordinary income. Description Dividends taxed at pr rate (3) Tax on dividends (5) Tax on AMT base taxed at 26% rate 2018 Tax Rate Schedules Schedule Z-Head of Household If taxable Income is income is But not But not 0 $ 9,525 10% of taxable income $952.50 plus 12% of the excess over $9,525 $4,453.50 plus 22%of the excess over $38,700 $14,089.50 plus 24% ofthe excess 0 $ 13,600 $ 9,525 $ 38,700 $82,500 $157,500 $200,000 $ 38,700 $ 82,500 $157,500 $200,000 $500,000 $ 13,600 $ 51,800 $ 51,800 $ 82,500 $ 82,500 $157,500 $157,500 $200,000 $200,000 $500,000 $500,000- 10% of taxable income $1,360 plus 12% of the excess over $13,600 $5,944 plus 22% of the excess over $51,800 $ 12,698 plus 24% of the excess over $82,500 $30,698 plus 32% of the excess over $157.500 $44,298 plus 35% of the excess over $200,000 $149,298 plus 37% of the excess over $500,000 $32,089.50 plus 32% of the excess over $157.500 $45,689.50 plus 35% of the excess 500,000- $150,689.50 plus 37% of the excess over $500,000 Schedule Y-1-Married Filling Jolntly or Qualifylng Widow(er) If taxable Income is But not income is But not The tax Is: 0 $ 9,525 10% of taxable income $952.50 plus 12% of the excess O $. 19,050 10% of taxable income $ 19,050 $. 77,400 $ 77,400 $165,000 $165,000 $31 5,000 $31 5,000 $400,000 $400,000 $600,000 S600.000- $ 9,525 $ 38,700 $ 38,700 $ 82.500 $ 82,500 $157,500 $157,500 S200.000 $200,000 s300,000 $300.000- $1,905 plus 12% of the excess $4,453.50 plus 22% of the excess over $38,700 $14,089. 50plus 24% of the excess over $82,500 $32.089 50 pius 32% of the excess over $157.500 $45,689.50 plus 35% of the excess over $200,000 $80,689.50 plus 37% of the excess over $300,000 $8,907 plus 22% of the excess over $77,400 $28,1 79 plus 24% of the excess $64,179 plus 32% of the excess $91,379 plus 35% of the excess $161,379 plus 37% of the excess