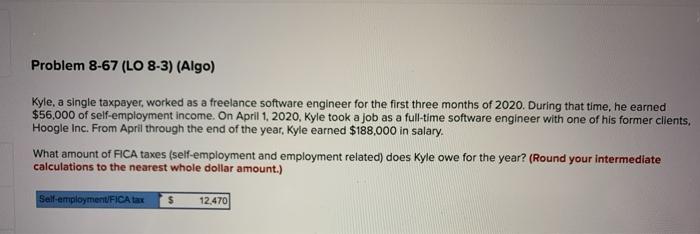

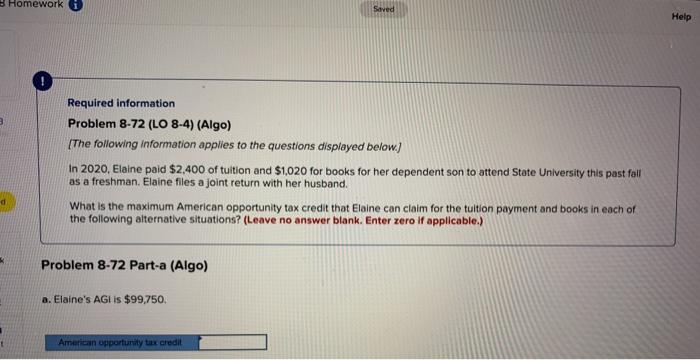

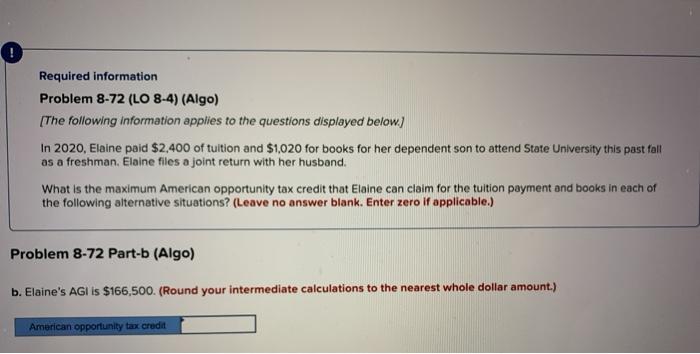

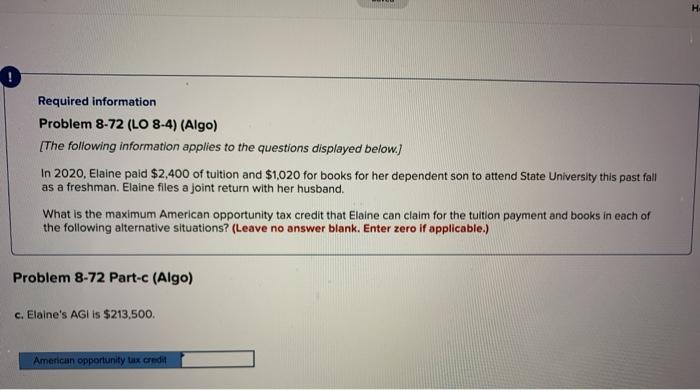

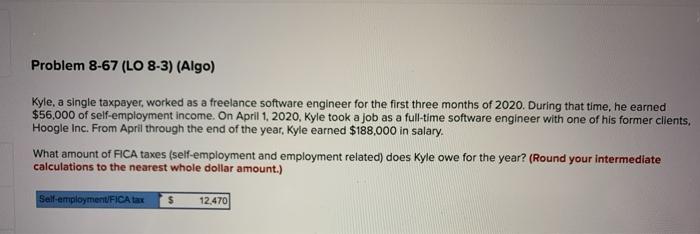

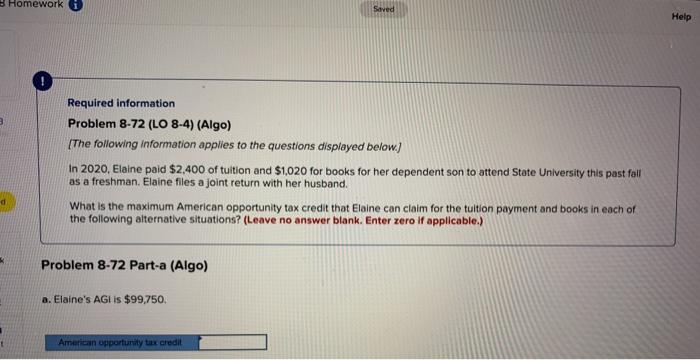

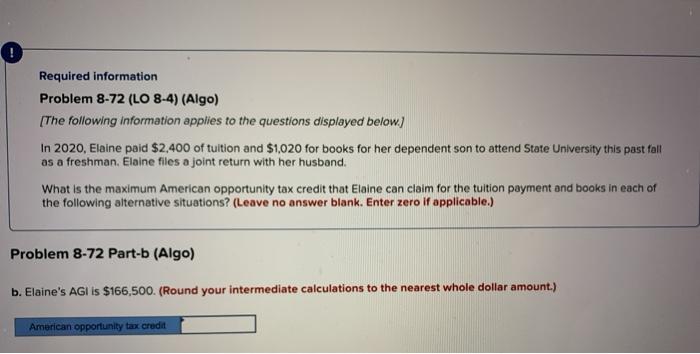

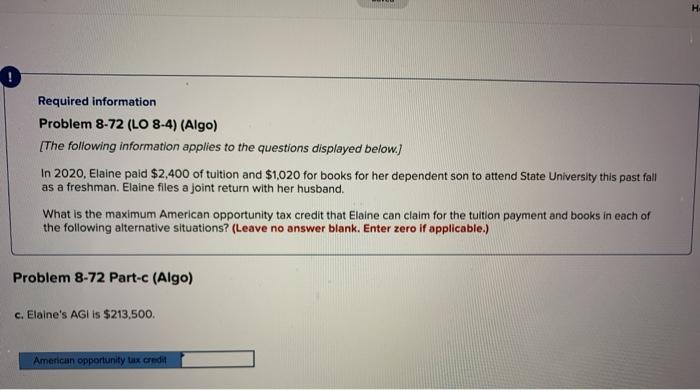

Problem 8-67 (LO 8-3) (Algo) Kyle, a single taxpayer worked as a freelance software engineer for the first three months of 2020. During that time, he earned $56,000 of self-employment income. On April 1, 2020, Kyle took a job as a full-time software engineer with one of his former clients. Hoogle Inc. From April through the end of the year, Kyle earned $188,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? (Round your intermediate calculations to the nearest whole dollar amount.) Self-employmentFICA tax $ 12.470 Homework i Saved Help Required information Problem 8-72 (LO 8-4) (Algo) (The following information applies to the questions displayed below.) In 2020, Elaine paid $2,400 of tuition and $1,020 for books for her dependent son to attend State University this past foil as a freshman. Elaine files a joint return with her husband. What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations? (Leave no answer blank. Enter zero If applicable.) Problem 8-72 Part-a (Algo) a. Elaine's AG is $99,750. American opportunity tax credit Required information Problem 8-72 (LO 8-4) (Algo) (The following information applies to the questions displayed below) In 2020, Elaine paid $2,400 of tuition and $1.020 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband. What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations? (Leave no answer blank. Enter zero If applicable.) Problem 8-72 Part-b (Algo) b. Elaine's AGI is $166,500. (Round your intermediate calculations to the nearest whole dollar amount.) American opportunity tax credit ! Required information Problem 8-72 (LO 8-4) (Algo) (The following information applies to the questions displayed below.) In 2020, Elaine paid $2,400 of tuition and $1,020 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband. What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books in each of the following alternative situations? (Leave no answer blank. Enter zero if applicable.) Problem 8-72 Part-c (Algo) c. Elaine's AGI is $213,500. American opportunity tax credit