Answered step by step

Verified Expert Solution

Question

1 Approved Answer

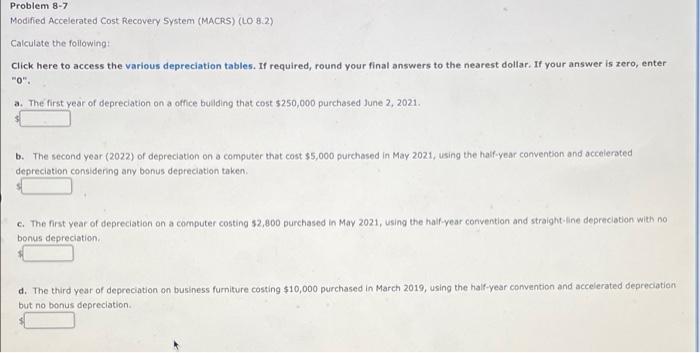

Problem 8-7 Modified Accelerated Cost Recovery System (MACRS) (LO 8.2) Calculate the following: Click here to access the various depreciation tables. If required, round

Problem 8-7 Modified Accelerated Cost Recovery System (MACRS) (LO 8.2) Calculate the following: Click here to access the various depreciation tables. If required, round your final answers to the nearest dollar. If your answer is zero, enter "0". a. The first year of depreciation on a office building that cost $250,000 purchased June 2, 2021. b. The second year (2022) of depreciation on a computer that cost $5,000 purchased in May 2021, using the half-year convention and accelerated depreciation considering any bonus depreciation taken. c. The first year of depreciation on a computer costing $2,800 purchased in May 2021, using the half-year convention and straight-line depreciation with no bonus depreciation. d. The third year of depreciation on business furniture costing $10,000 purchased in March 2019, using the half-year convention and accelerated depreciation but no bonus depreciation..

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started