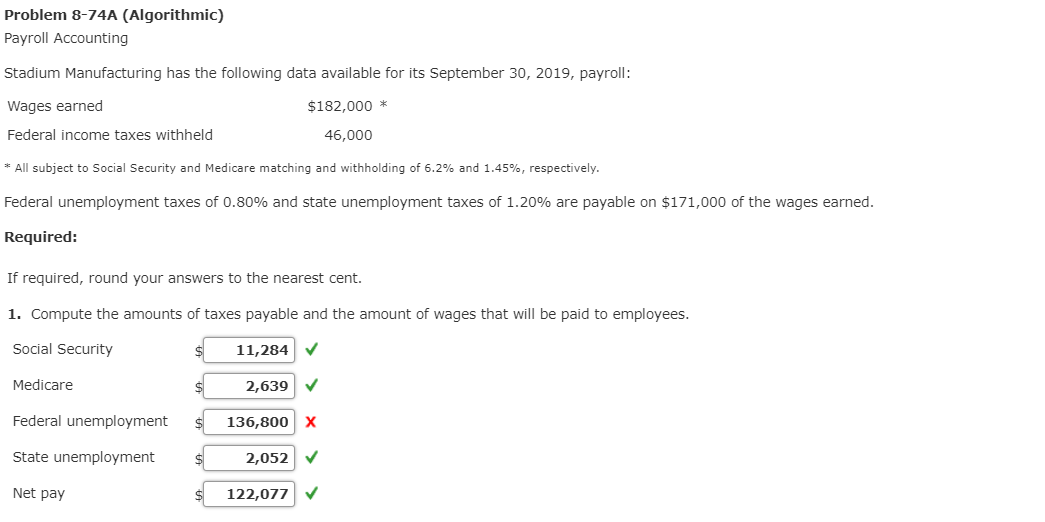

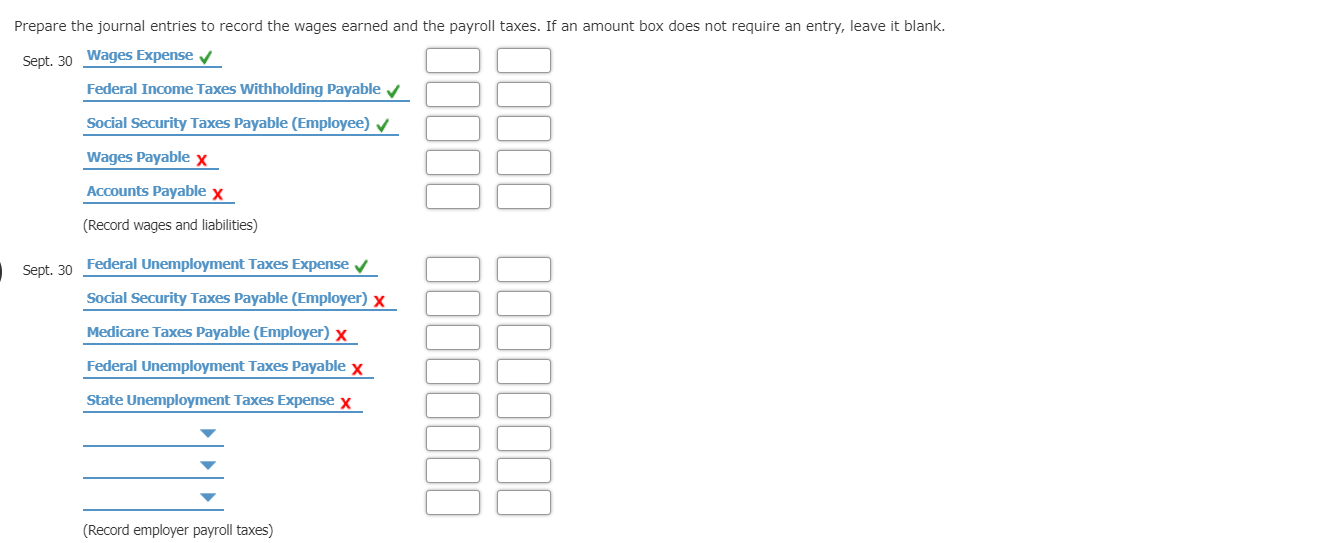

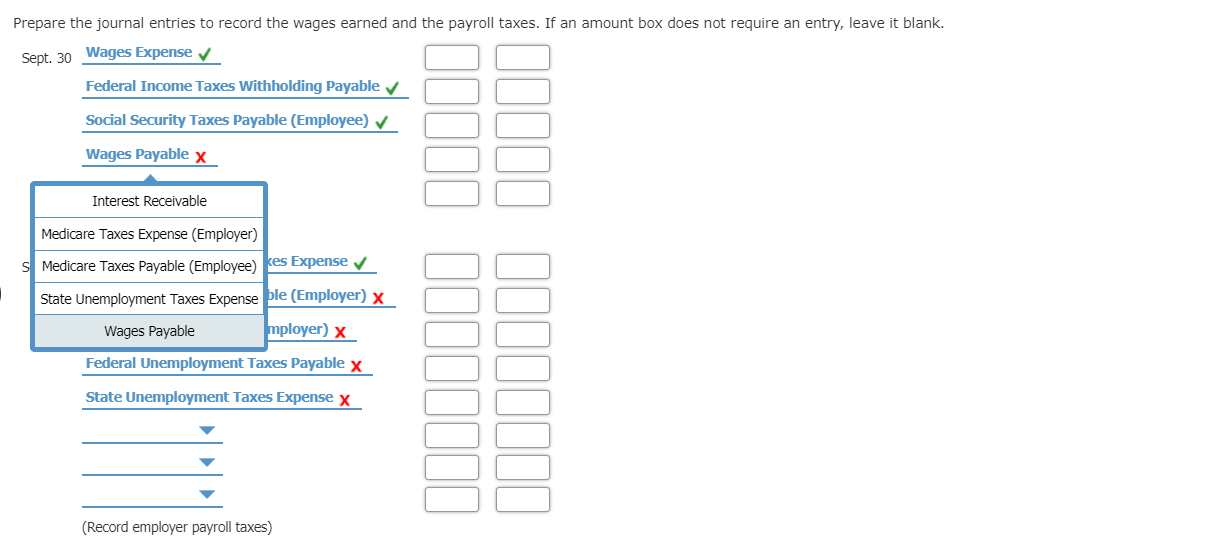

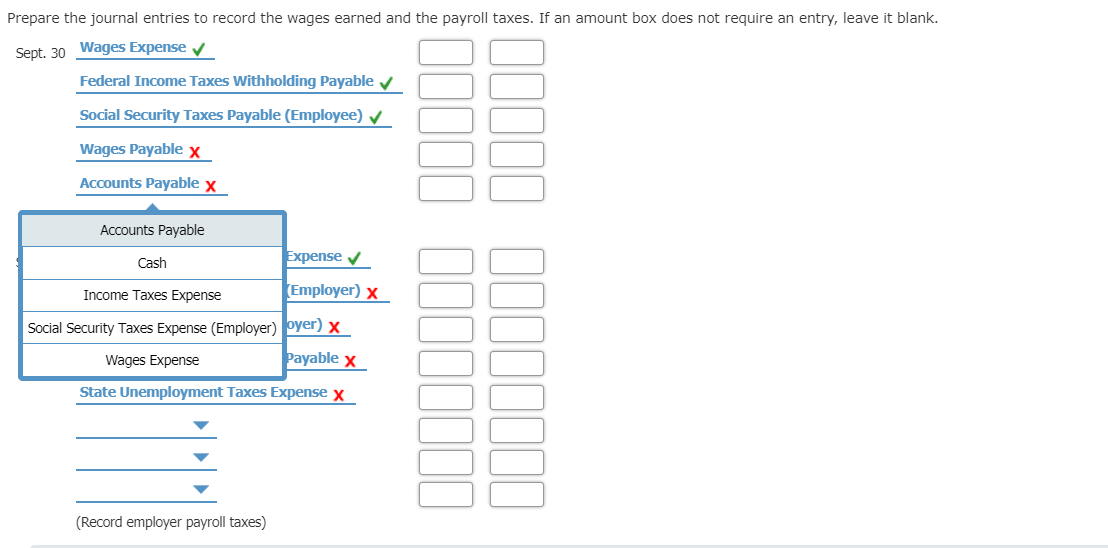

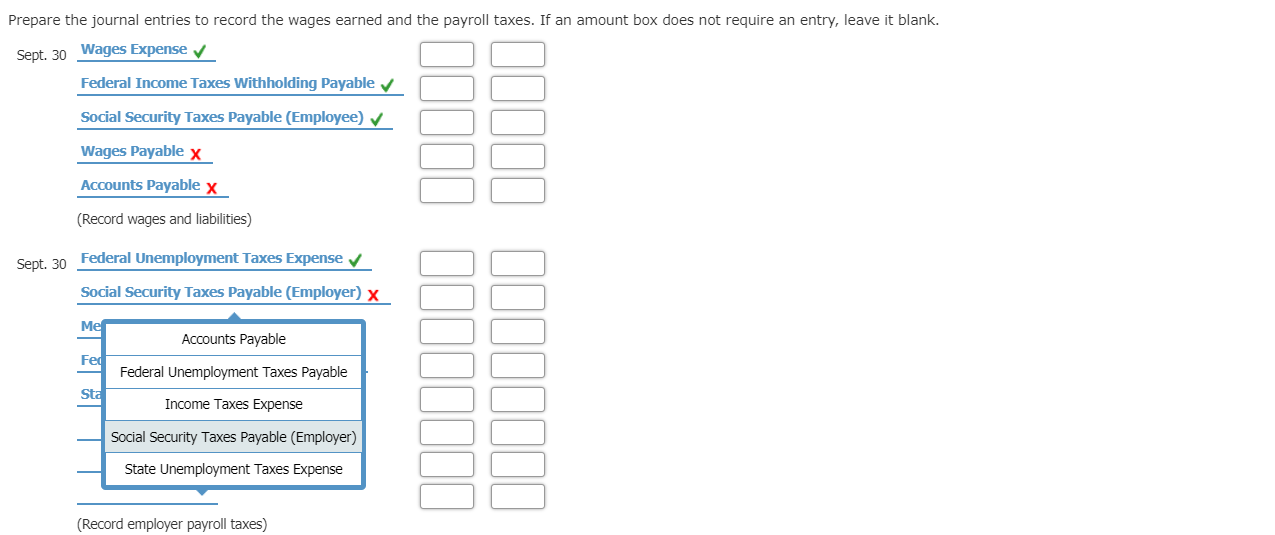

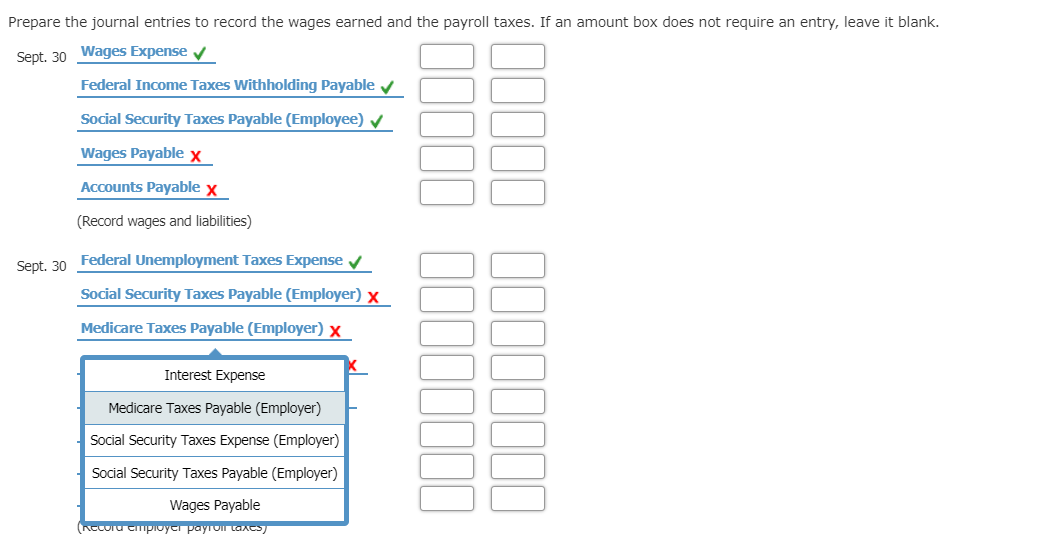

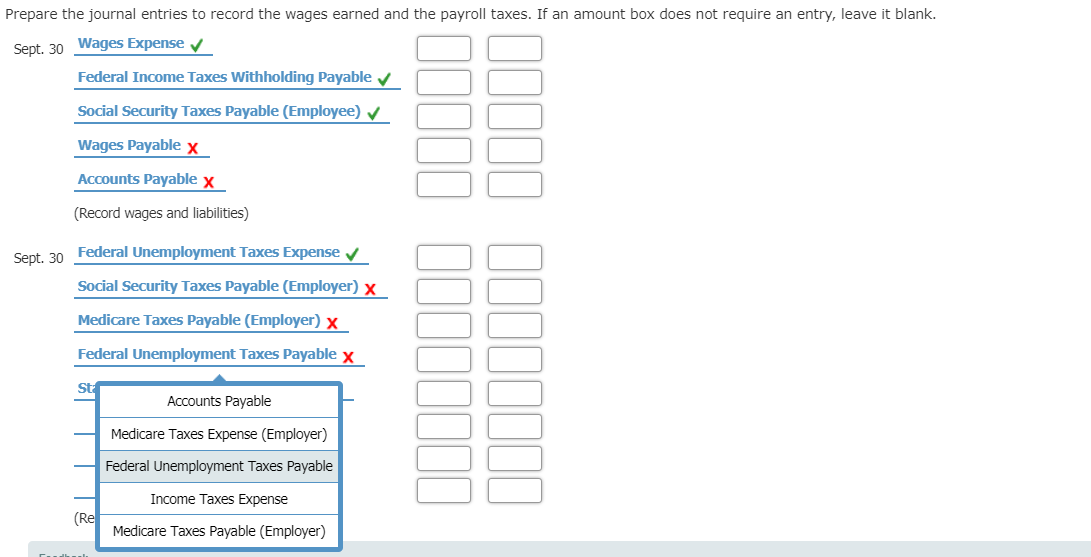

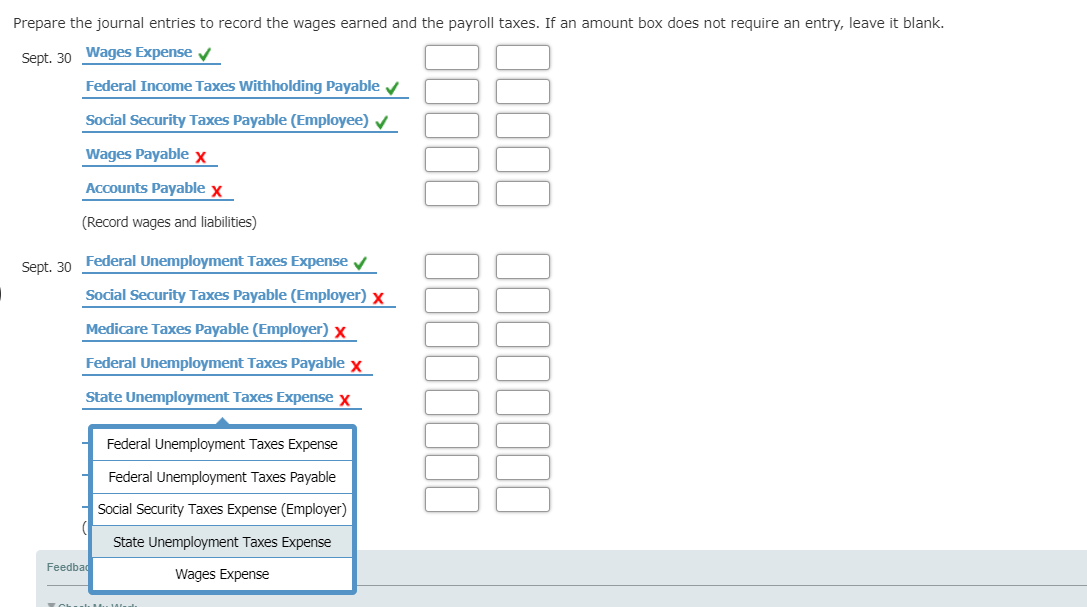

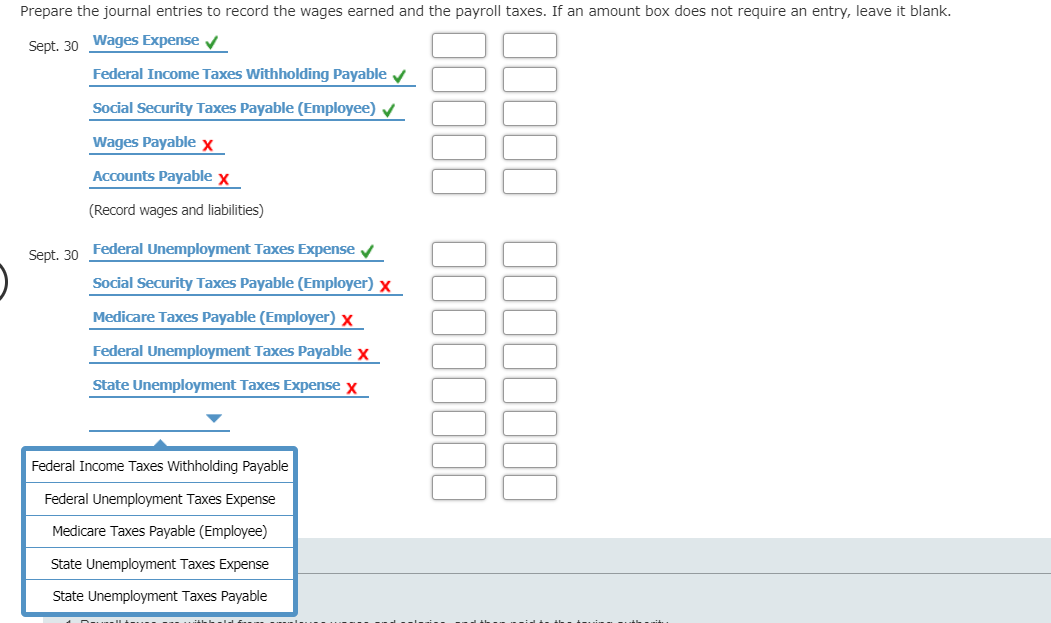

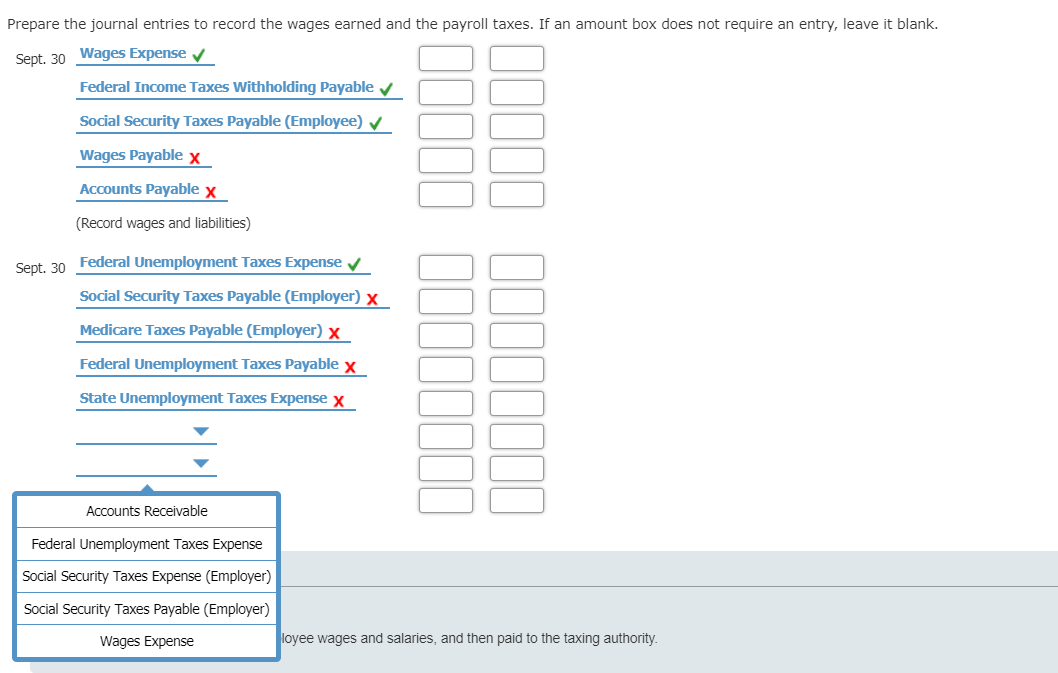

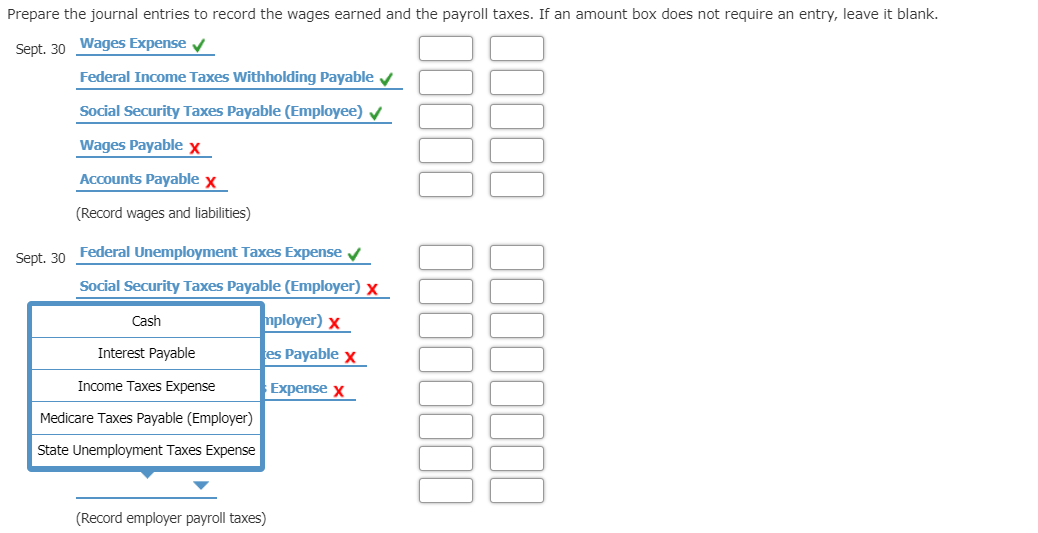

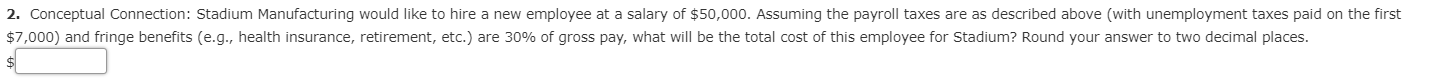

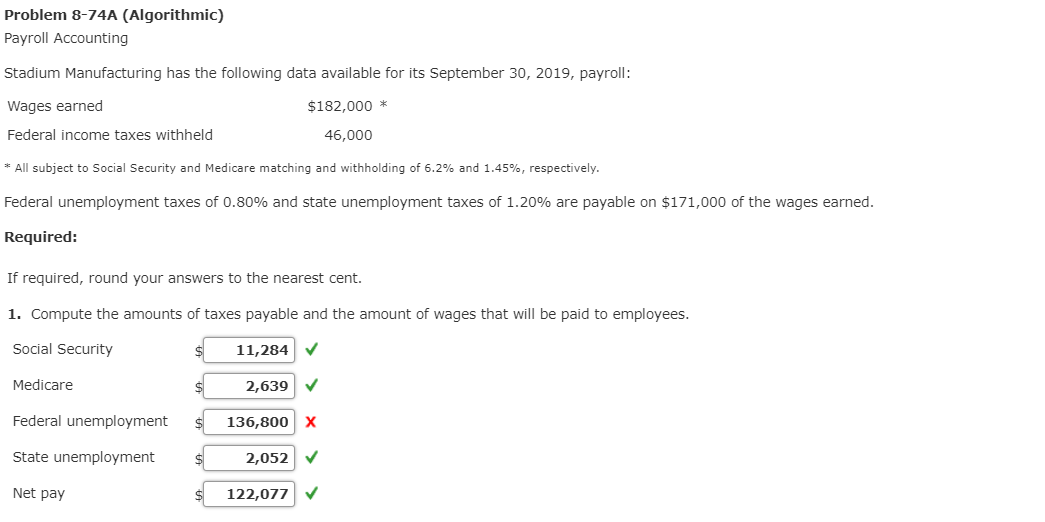

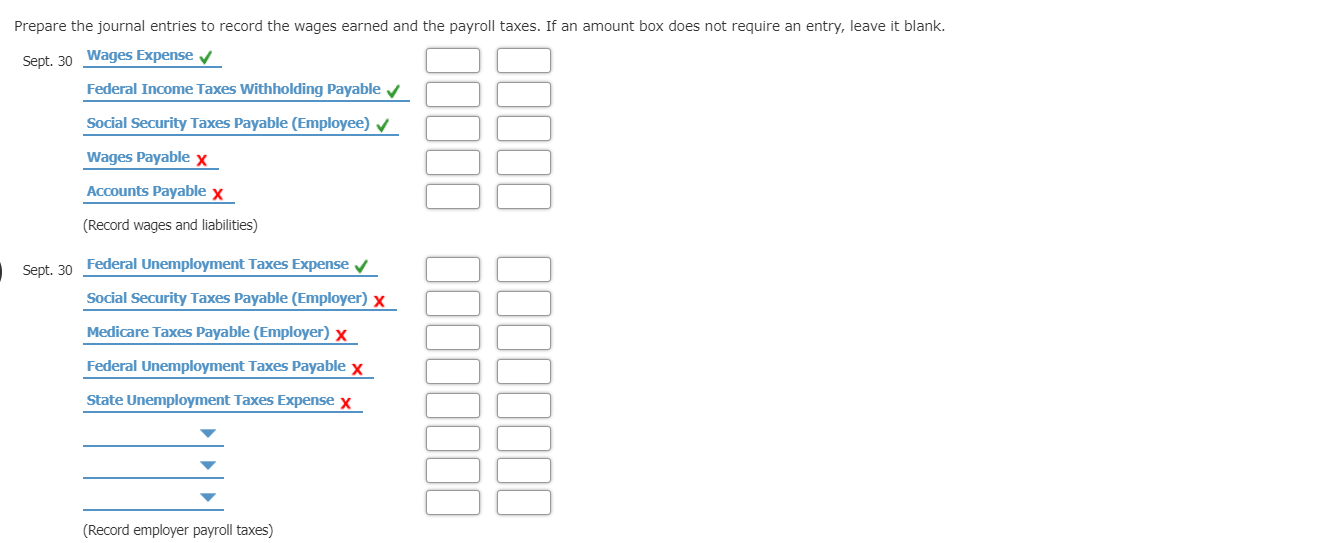

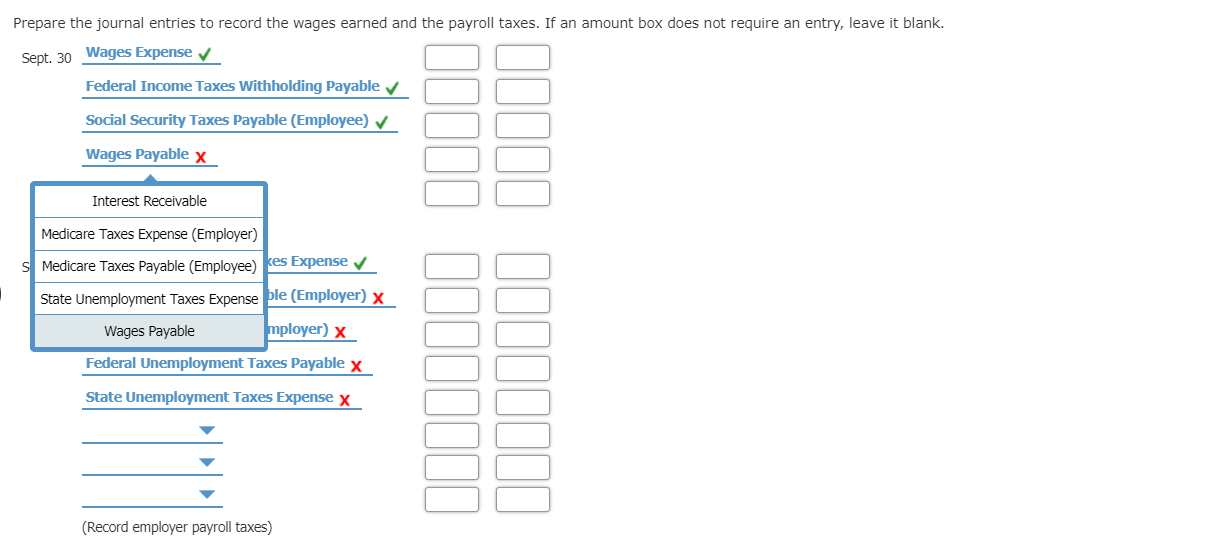

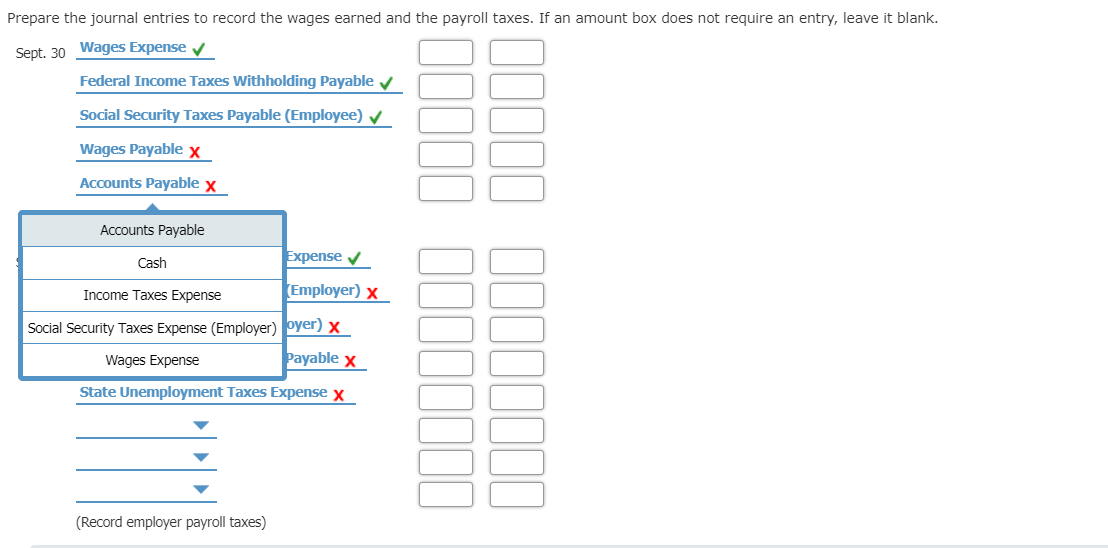

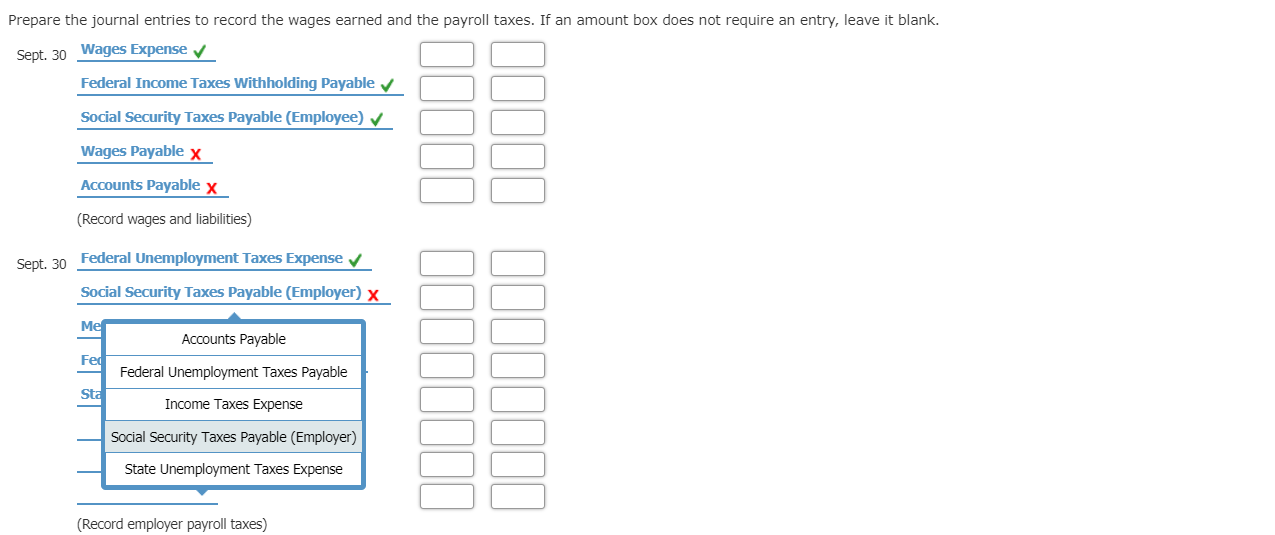

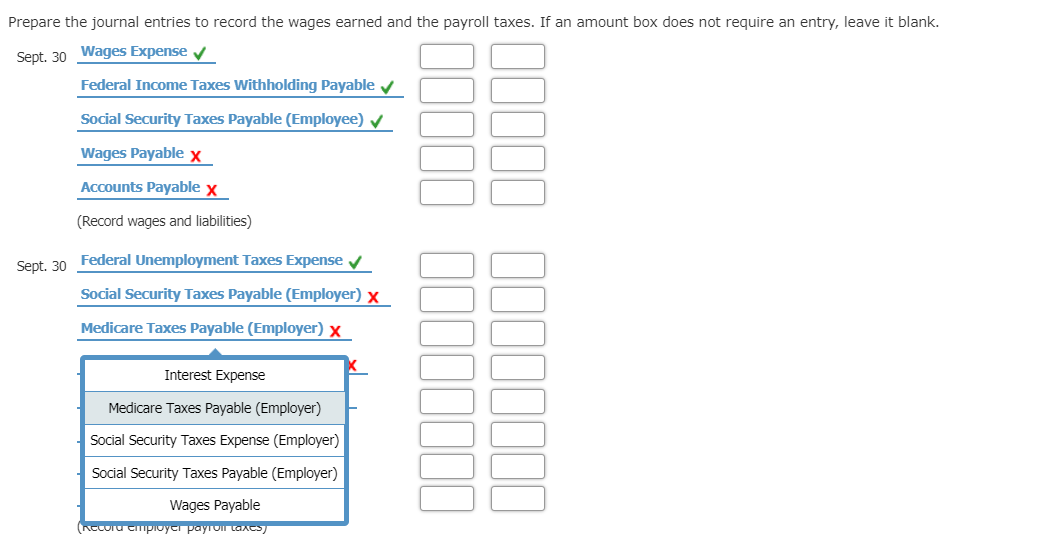

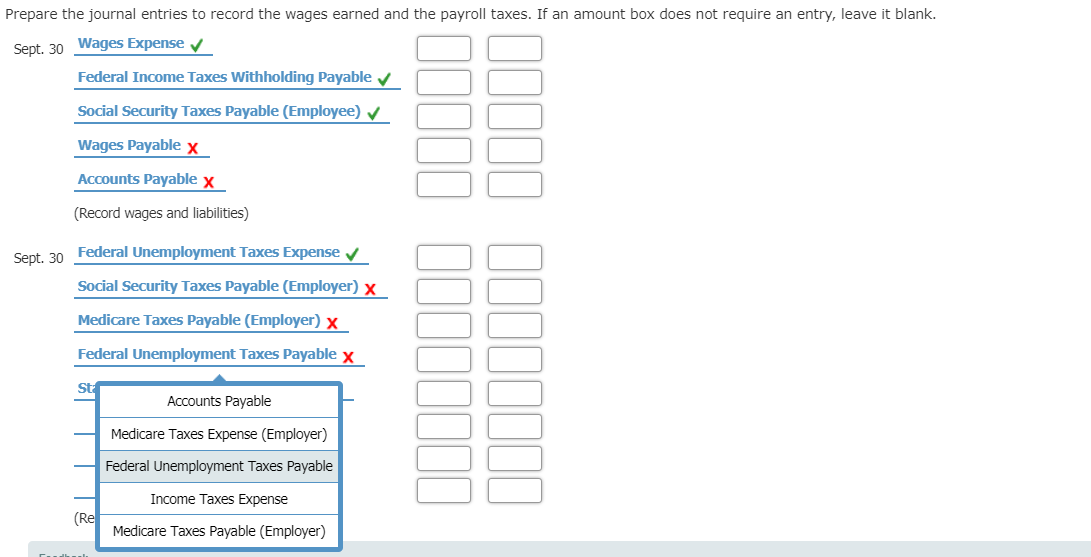

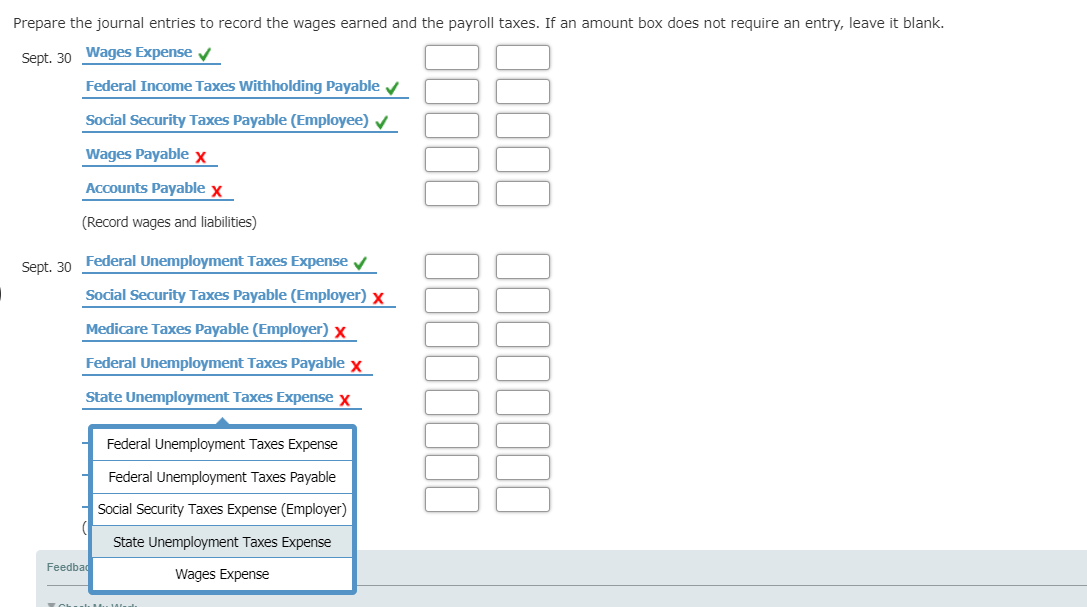

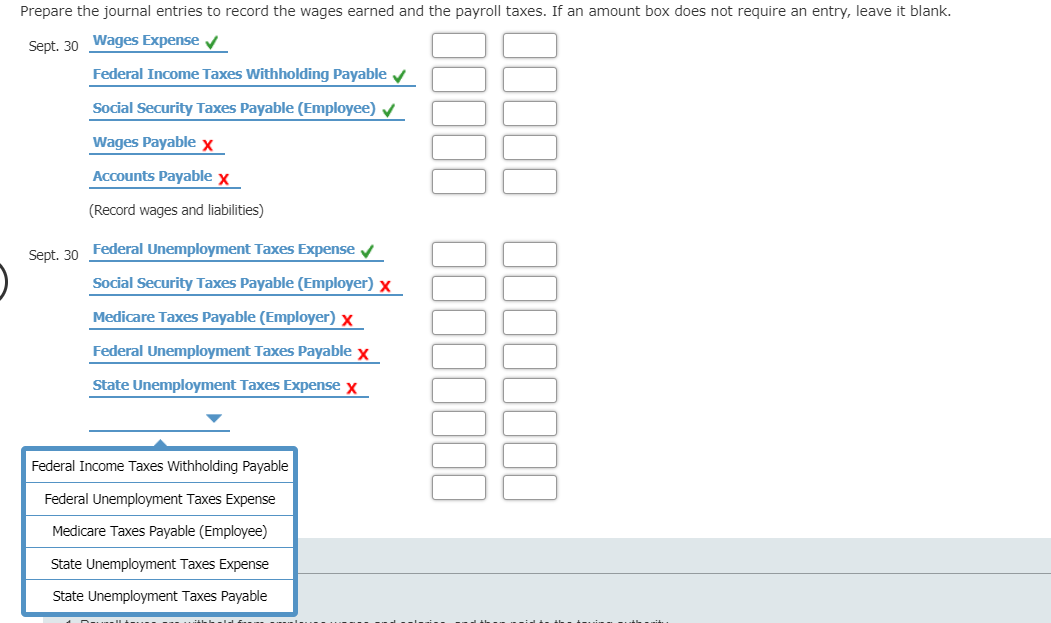

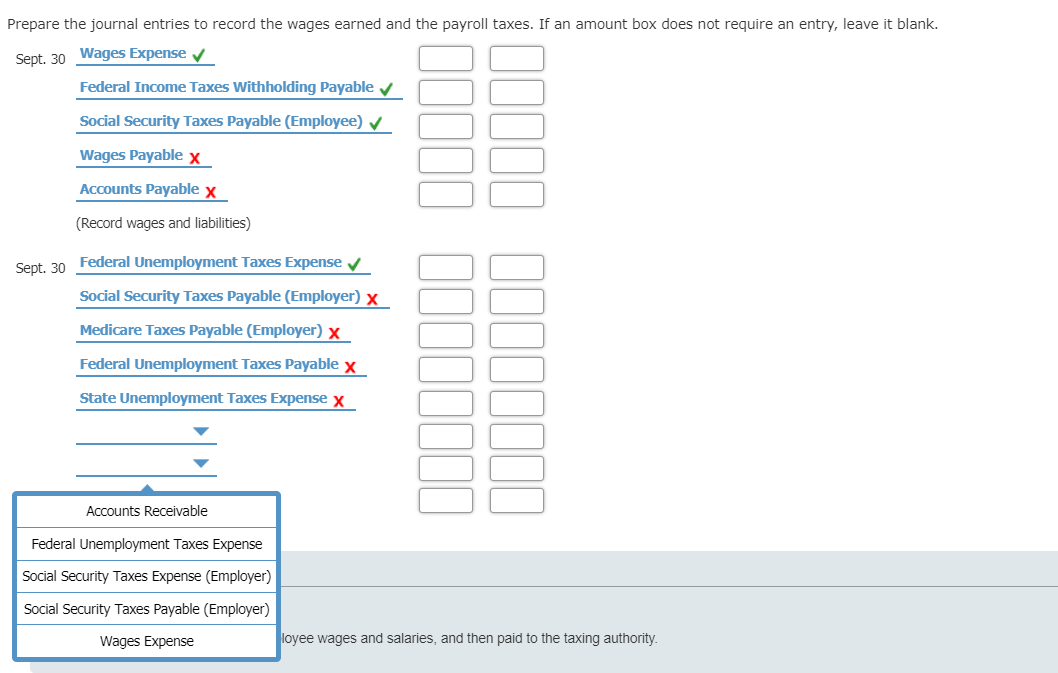

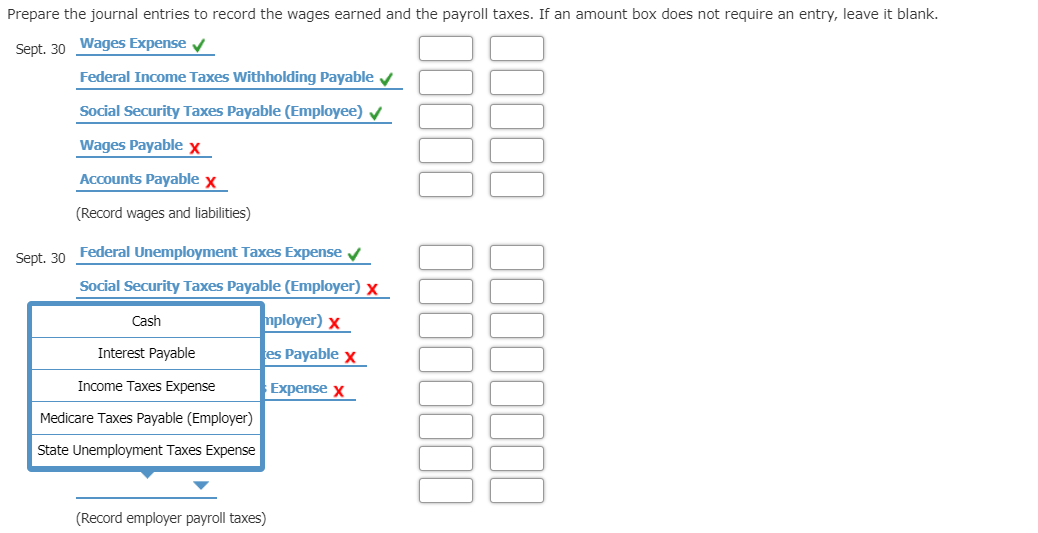

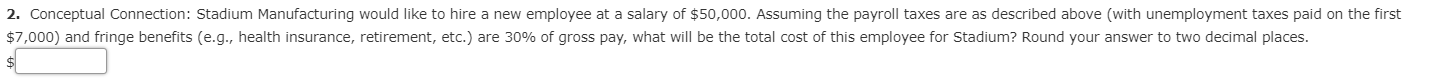

Problem 8-74A (Algorithmic) Payroll Accounting Stadium Manufacturing has the following data available for its September 30, 2019, payroll: $182,000 * Wages earned Federal income taxes withheld 46,000 * All subject to Social Security and Medicare matching and withholding of 6.2% and 1.45%, respectively. Federal unemployment taxes of 0.80% and state unemployment taxes of 1.20% are payable on $171,000 of the wages earned. Required: If required, round your answers to the nearest cent. 1. Compute the amounts of taxes payable and the amount of wages that will be paid to employees. Social Security 11,284 Medicare 2,639 Federal unemployment 136,800 X State unemployment 2,052 Net pay 122,077 Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x (Record wages and liabilities) Sept. 30 Federal Unemployment Taxes Expense Social Security Taxes Payable (Employer) x llll Medicare Taxes Payable (Employer) x Federal Unemployment Taxes Payable x State Unemployment Taxes Expense x (Record employer payroll taxes) Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Interest Receivable Medicare Taxes Expense (Employer) Medicare Taxes Payable (Employee) kes Expense State Unemployment Taxes Expense ble (Employer) x llll Wages Payable mployer) x Federal Unemployment Taxes Payable x State Unemployment Taxes Expensex (Record employer payroll taxes) Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x Accounts Payable Cash Expense Income Taxes Expense Employer) x 111II lllllll. lll Social Security Taxes Expense (Employer) oyer) x Wages Expense payable x State Unemployment Taxes Expensex (Record employer payroll taxes) Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x (Record wages and liabilities) Sept. 30 Federal Unemployment Taxes Expense Social Security Taxes Payable (Employer) x III. llll1111 Me Accounts Payable Fed Federal Unemployment Taxes Payable Sta Income Taxes Expense Social Security Taxes Payable (Employer) State Unemployment Taxes Expense (Record employer payroll taxes) Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x (Record wages and liabilities) Sept. 30 Federal Unemployment Taxes Expense Social Security Taxes Payable (Employer) x Medicare Taxes Payable (Employer) x IIIIII III lll11111 Interest Expense Medicare Taxes Payable (Employer) Social Security Taxes Expense (Employer) Social Security Taxes Payable (Employer) Wages Payable Accor employer payroll ACS Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x (Record wages and liabilities) Sept. 30 Federal Unemployment Taxes Expense Social Security Taxes Payable (Employer) x Medicare Taxes Payable (Employer) x Federal Unemployment Taxes Payable x IlIIIIII IIIIIIII St Accounts Payable Medicare Taxes Expense (Employer) Federal Unemployment Taxes Payable (Re Income Taxes Expense Medicare Taxes Payable (Employer) Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x (Record wages and liabilities) Sept. 30 Federal Unemployment Taxes Expense Social Security Taxes Payable (Employer) x Medicare Taxes Payable (Employer) x Federal Unemployment Taxes Payable x State Unemployment Taxes Expense x Federal Unemployment Taxes Expense Federal Unemployment Taxes Payable Social Security Taxes Expense (Employer) State Unemployment Taxes Expense Feedbad Wages Expense Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x (Record wages and liabilities) Sept. 30 Federal Unemployment Taxes Expense Social Security Taxes Payable (Employer) x Medicare Taxes Payable (Employer) x Federal Unemployment Taxes Payable x State Unemployment Taxes Expensex llllll llllllll Federal Income Taxes Withholding Payable Federal Unemployment Taxes Expense Medicare Taxes Payable (Employee) State Unemployment Taxes Expense State Unemployment Taxes Payable Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x (Record wages and liabilities) llll. lll lll Sept. 30 Federal Unemployment Taxes Expense Social Security Taxes Payable (Employer) x Medicare Taxes Payable (Employer) x Federal Unemployment Taxes Payable x State Unemployment Taxes Expense x Accounts Receivable Federal Unemployment Taxes Expense Social Security Taxes Expense (Employer) Social Security Taxes Payable (Employer) Wages Expense loyee wages and salaries, and then paid to the taxing authority. Prepare the journal entries to record the wages earned and the payroll taxes. If an amount box does not require an entry, leave it blank. Sept. 30 Wages Expense Federal Income Taxes Withholding Payable Social Security Taxes Payable (Employee) Wages Payable x Accounts Payable x (Record wages and liabilities) Sept. 30 Federal Unemployment Taxes Expense Social Security Taxes Payable (Employer) x Cash mployer) x Les Payable x Interest Payable Income Taxes Expense lllll IllIIIII Expense x Medicare Taxes Payable (Employer) State Unemployment Taxes Expense (Record employer payroll taxes) 2. Conceptual Connection: Stadium Manufacturing would like to hire a new employee at a salary of $50,000. Assuming the payroll taxes are as described above (with unemployment taxes paid on the first $7,000) and fringe benefits (e.g., health insurance, retirement, etc.) are 30% of gross pay, what will be the total cost of this employee for Stadium? Round your answer to two decimal places