Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PROBLEM 8P One of the general partners in the law firm with which you are associated has given you the following letter. In your capacity

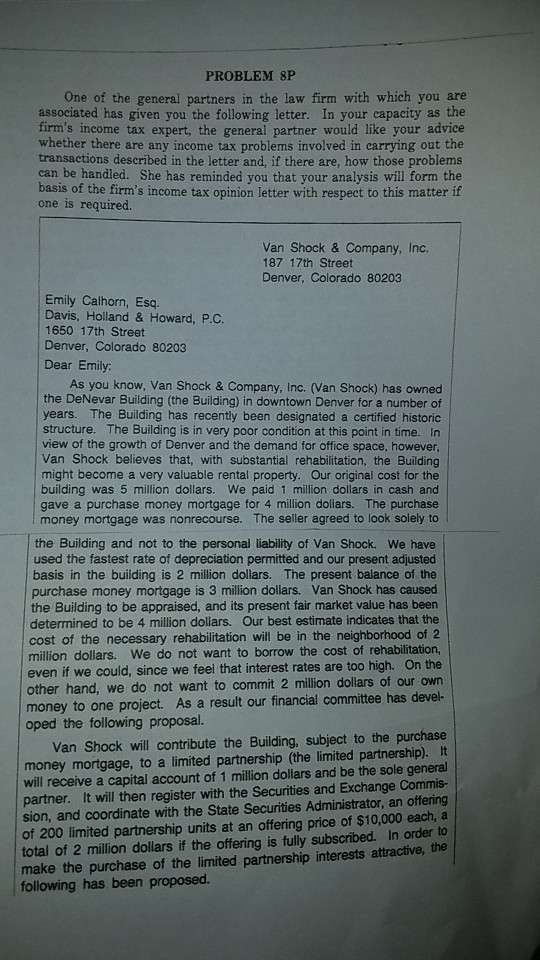

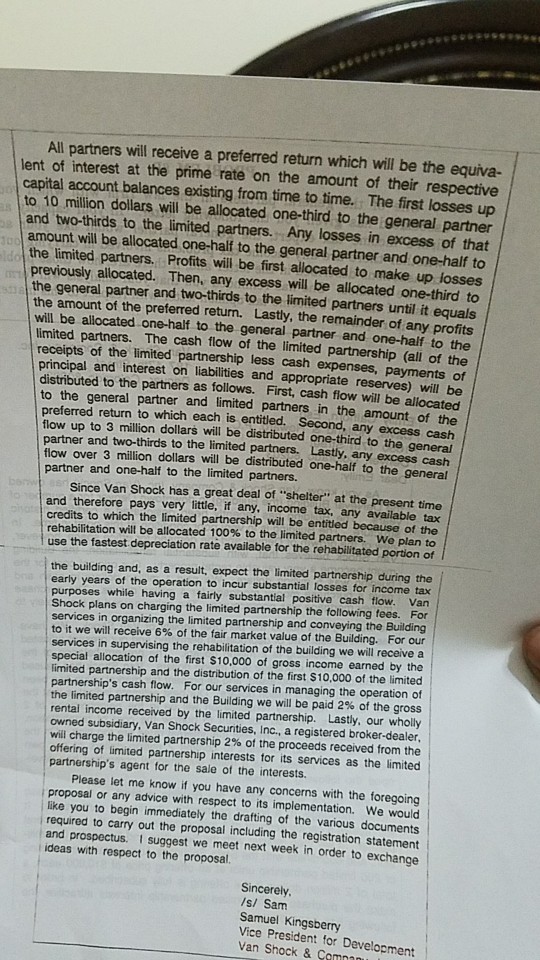

PROBLEM 8P One of the general partners in the law firm with which you are associated has given you the following letter. In your capacity as the firm's income tax expert, the general partner would like your advice whether there are any income tax problems involved in carrying out the transactions described in the letter and, if there are, how those problems can be handled. She has reminded vou that vour analvsis will form the basis of the firm's income tax opinion letter with respect to this matter if one is required. Van Shock & Company, Inc. 187 17th Street Denver, Colorado 80203 Emily Calhorn, Esq. Davis, Holland & Howard, P.C. 1650 17th Street Denver, Colorado 80203 Dear Emily: As you know, Van Shock & Company, Inc. (Van Shock) has owned the DeNevar Building (the Building) in downtown Denver for a number of years. The Building has recently been designated a certified historic structure. The Building is in very poor condition at this point in time. In view of the growth of Denver and the demand for office space, however Van Shock believes that, with substantial rehabilitation, the Building might become a very valuable rental property. Our original cost for the building was 5 million dollars. We paid 1 million dollars in cash and gave a purchase money mortgage for 4 million dollars. The purchase money mortgage was nonrecourse. The seller agreed to look solely to the Building and not to the personal liability of Van Shock. We have used the fastest rate of depreciation permitted and our present adjusted basis in the building is 2 million dollars. The present balance of the purchase money mortgage is 3 million dollars. Van Shock has caused the Building to be appraised, and its present fair market value has been determined to be 4 million dollars. Our best estimate indicates that the cost of the necessary rehabilitation will be in the neighborhood of 2 million dollars. We do not want to borrow the cost of rehabilitation, even if we could, since we feel that interest rates are too high. On the other hand, we do not want to commit 2 million dollars of our own money to one project. As a result our financial committee has devel- oped the following proposal. Van Shock will contribute the Building, subject to the purchase money mortgage, to a limited partnership (the limited partnership). It will receive a capital account of 1 million dollars and be the sole general partner. It will then register with the Securities and Exchange Commis- sion, and coordinate with the State Securities Administrator, an offering of 200 limited partnership units at an offering price of $10,000 each, a total of 2 million dollars if the offering is fully subscribed. In order to make the purchase of the limited partnership interests attractive, the following has been proposed PROBLEM 8P One of the general partners in the law firm with which you are associated has given you the following letter. In your capacity as the firm's income tax expert, the general partner would like your advice whether there are any income tax problems involved in carrying out the transactions described in the letter and, if there are, how those problems can be handled. She has reminded vou that vour analvsis will form the basis of the firm's income tax opinion letter with respect to this matter if one is required. Van Shock & Company, Inc. 187 17th Street Denver, Colorado 80203 Emily Calhorn, Esq. Davis, Holland & Howard, P.C. 1650 17th Street Denver, Colorado 80203 Dear Emily: As you know, Van Shock & Company, Inc. (Van Shock) has owned the DeNevar Building (the Building) in downtown Denver for a number of years. The Building has recently been designated a certified historic structure. The Building is in very poor condition at this point in time. In view of the growth of Denver and the demand for office space, however Van Shock believes that, with substantial rehabilitation, the Building might become a very valuable rental property. Our original cost for the building was 5 million dollars. We paid 1 million dollars in cash and gave a purchase money mortgage for 4 million dollars. The purchase money mortgage was nonrecourse. The seller agreed to look solely to the Building and not to the personal liability of Van Shock. We have used the fastest rate of depreciation permitted and our present adjusted basis in the building is 2 million dollars. The present balance of the purchase money mortgage is 3 million dollars. Van Shock has caused the Building to be appraised, and its present fair market value has been determined to be 4 million dollars. Our best estimate indicates that the cost of the necessary rehabilitation will be in the neighborhood of 2 million dollars. We do not want to borrow the cost of rehabilitation, even if we could, since we feel that interest rates are too high. On the other hand, we do not want to commit 2 million dollars of our own money to one project. As a result our financial committee has devel- oped the following proposal. Van Shock will contribute the Building, subject to the purchase money mortgage, to a limited partnership (the limited partnership). It will receive a capital account of 1 million dollars and be the sole general partner. It will then register with the Securities and Exchange Commis- sion, and coordinate with the State Securities Administrator, an offering of 200 limited partnership units at an offering price of $10,000 each, a total of 2 million dollars if the offering is fully subscribed. In order to make the purchase of the limited partnership interests attractive, the following has been proposed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started