Answered step by step

Verified Expert Solution

Question

1 Approved Answer

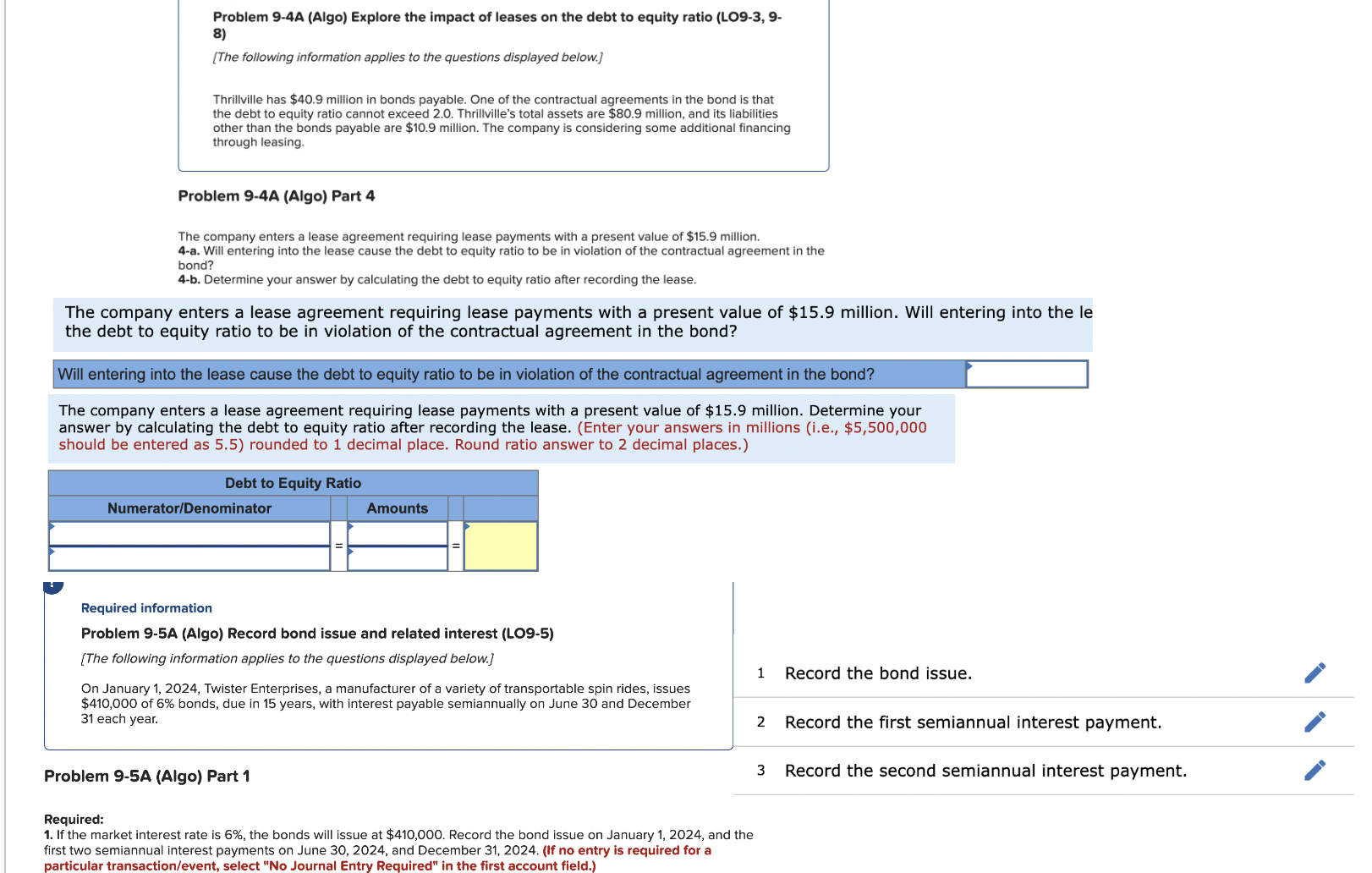

Problem 9 - 4 A ( Algo ) Explore the impact of leases on the debt to equity ratio ( LO 9 - 3 ,

Problem A Algo Explore the impact of leases on the debt to equity ratio LO

The following information applies to the questions displayed below.

Thrillville has $ million in bonds payable. One of the contractual agreements in the bond is that

the debt to equity ratio cannot exceed Thrillville's total assets are $ million, and its liabilities

other than the bonds payable are $ million. The company is considering some additional financing

through leasing.

Problem A Algo Part

The company enters a lease agreement requiring lease payments with a present value of $ million.

a Will entering into the lease cause the debt to equity ratio to be in violation of the contractual agreement in the

bond?

b Determine your answer by calculating the debt to equity ratio after recording the lease.

The company enters a lease agreement requiring lease payments with a present value of $ million. Will entering into the le

the debt to equity ratio to be in violation of the contractual agreement in the bond?

Will entering into the lease cause the debt to equity ratio to be in violation of the contractual agreement in the bond?

The company enters a lease agreement requiring lease payments with a present value of $ million. Determine your

answer by calculating the debt to equity ratio after recording the lease. Enter your answers in millions ie $

should be entered as rounded to decimal place. Round ratio answer to decimal places.

Required information

Problem A Algo Record bond issue and related interest LO

The following information applies to the questions displayed below.

On January Twister Enterprises, a manufacturer of a variety of transportable spin rides, issues

$ of bonds, due in years, with interest payable semiannually on June and December

each year.

Record the bond issue.

Record the first semiannual interest payment.

Problem A Algo Part

Record the second semiannual interest payment.

Required:

If the market interest rate is the bonds will issue at $ Record the bond issue on January and the

first two semiannual interest payments on June and December If no entry is required for a

particular transactionevent select No Journal Entry Required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started