Question

Problem 9-09 Welte Mutual Funds, Inc., is located in New York City. Welte just obtained $100,000 by converting industrial bonds to cash and is now

Problem 9-09

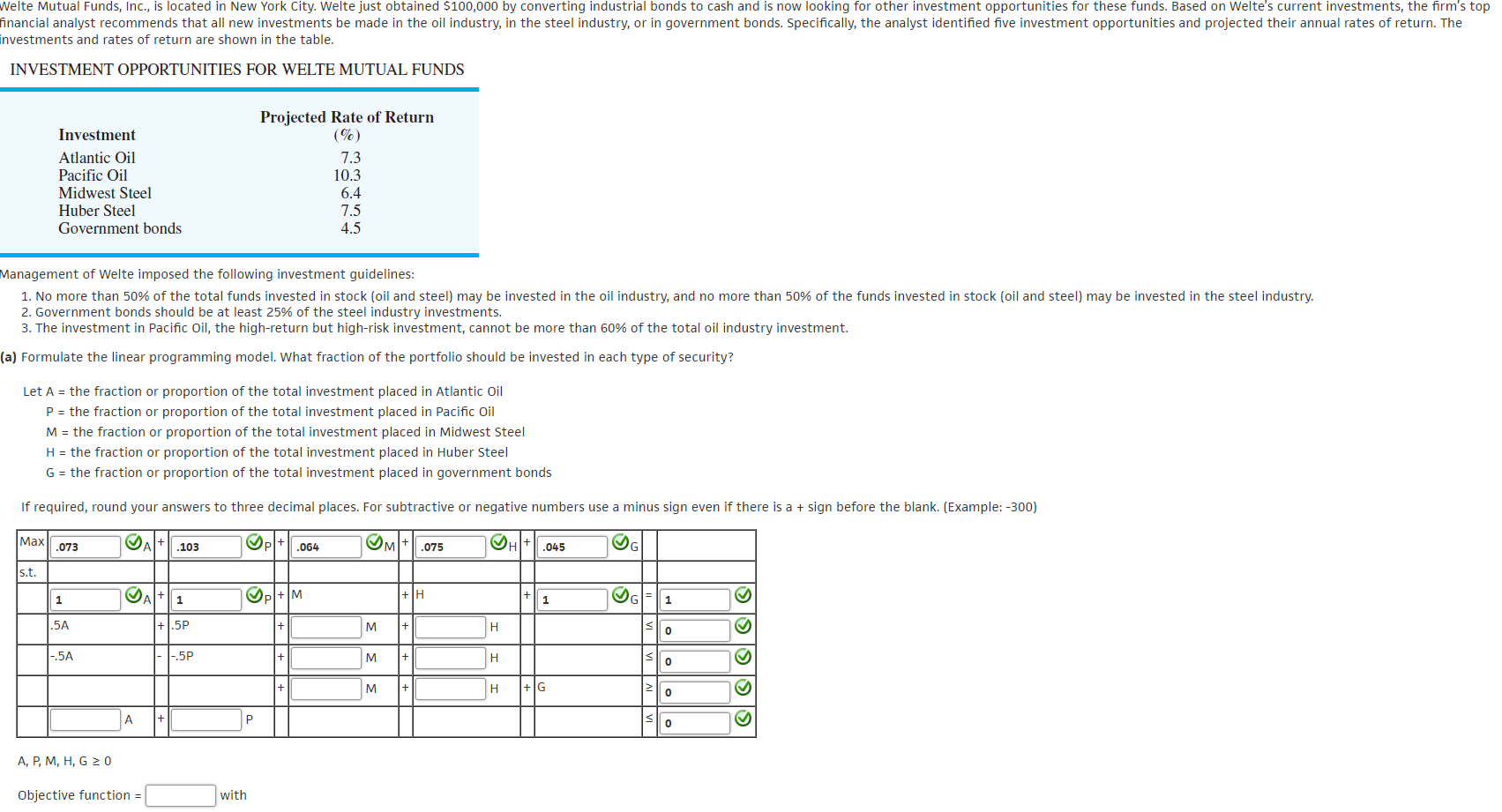

Welte Mutual Funds, Inc., is located in New York City. Welte just obtained $100,000 by converting industrial bonds to cash and is now looking for other investment opportunities for these funds. Based on Welte's current investments, the firm's top financial analyst recommends that all new investments be made in the oil industry, in the steel industry, or in government bonds. Specifically, the analyst identified five investment opportunities and projected their annual rates of return. The investments and rates of return are shown in the table.

Management of Welte imposed the following investment guidelines:

- No more than 50% of the total funds invested in stock (oil and steel) may be invested in the oil industry, and no more than 50% of the funds invested in stock (oil and steel) may be invested in the steel industry.

- Government bonds should be at least 25% of the steel industry investments.

- The investment in Pacific Oil, the high-return but high-risk investment, cannot be more than 60% of the total oil industry investment.

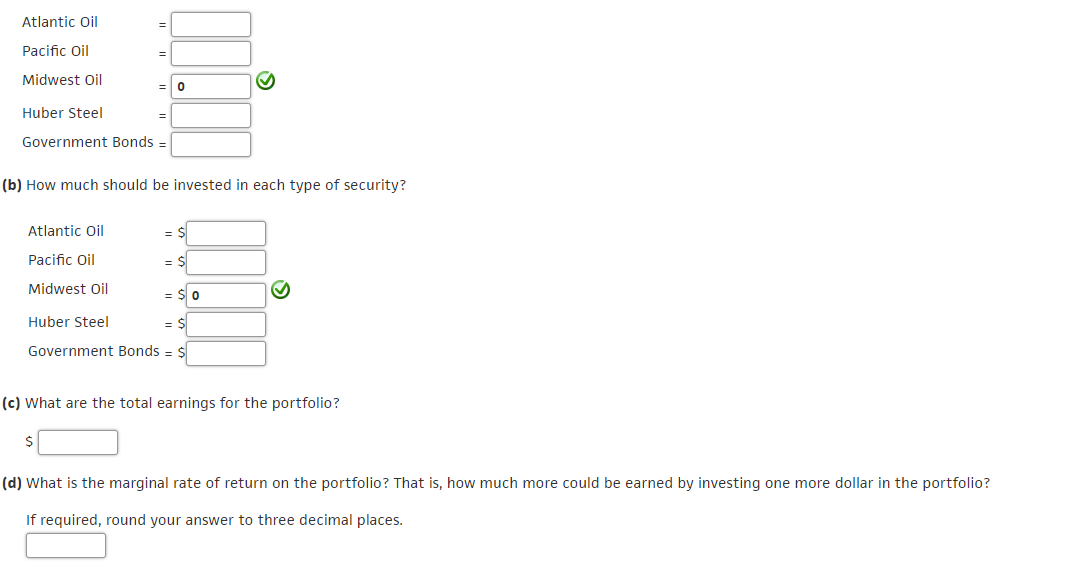

(a)Formulate the linear programming model. What fraction of the portfolio should be invested in each type of security?LetA = the fraction or proportion of the total investment placed in Atlantic OilP = the fraction or proportion of the total investment placed in Pacific OilM = the fraction or proportion of the total investment placed in Midwest SteelH = the fraction or proportion of the total investment placed in Huber SteelG = the fraction or proportion of the total investment placed in government bondsIf required, round your answers to three decimal places. For subtractive or negative numbers use a minus sign even if there is a + sign before the blank. (Example: -300)MaxA+P+M+H+Gs.t.A+P+M+H+G=.5A+.5P+M+H?-.5A--.5P+M+H?+M+H+G?A+P?A, P, M, H, G ? 0Objective function =withAtlantic Oil=Pacific Oil=Midwest Oil=Huber Steel=Government Bonds=(b)How much should be invested in each type of security?Atlantic Oil= $Pacific Oil= $Midwest Oil= $Huber Steel= $Government Bonds= $(c)What are the total earnings for the portfolio?$(d)What is the marginal rate of return on the portfolio? That is, how much more could be earned by investing one more dollar in the portfolio?If required, round your answer to three decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started