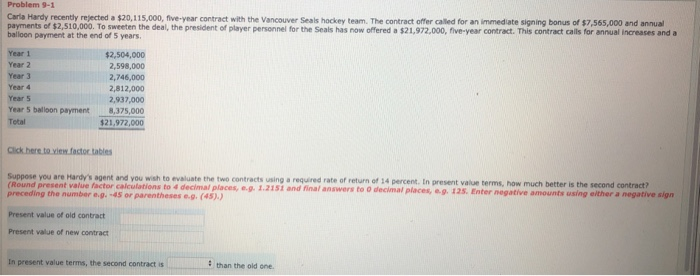

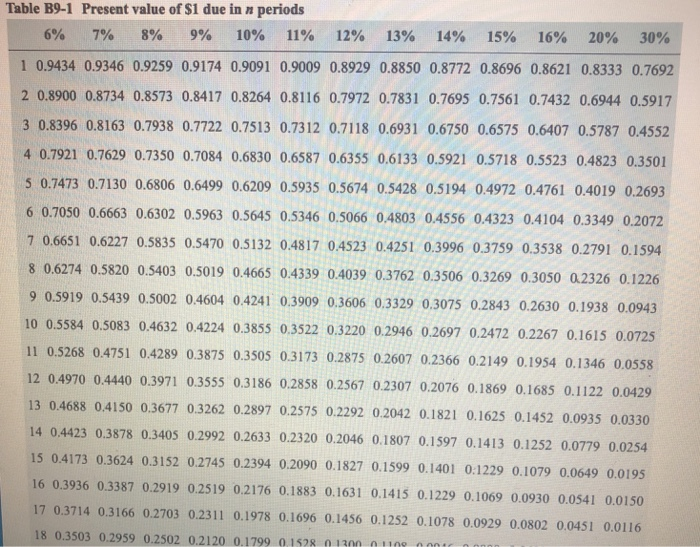

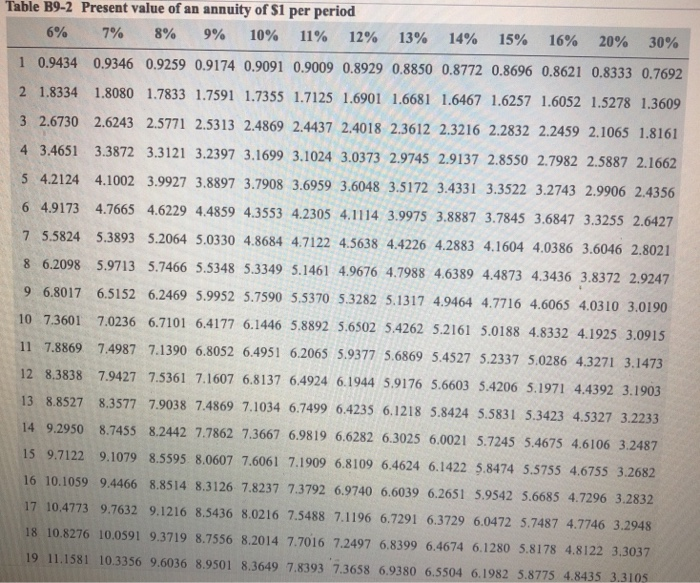

Problem 9-1 Carla Hardy recently rejected a $20,115,000, five-year contract with the Vancouver Seals hockey team. The contract offer called for an immediate signing bonus of $7,565,000 and balloon payment at the end of 5 years ts of $2,510,000. To sweeten the deal, the president of player personnel for the Seals has now offered a $21,972,000, five-year contract. This contract calls for annual increases and a $2,504,000 2,598,000 2,746,000 2,812,000 2,937,000 8,375,000 21,972,000 Year 2 Year 3 Year 4 Year 5 Year 5 balloon payment Tetal Click here to.xiew.factor.table Suppose you are Hardy's agent and you wish to evaluate the twoc (Round present value factor calculations to 4 decimal places, preceding the number e.g. -45 or parentheses e.9. (45).) acts using a required rate of return of 14 percent. In present value terms, how much better is the second contract? e.g. 1.2151 and final answers to o decimal places, e.g. 125. Enter negative amounts using elther a negative sign Present value of old contract Present value of new contract In present value terms, the second contract is than the old one. Present value of $1 due in n periods Table B9-1 30% 20% 15% 16% 13% 14% 12% 1 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8696 0.8621 0.8333 0.7692 2 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.7561 0.7432 0.6944 0.5917 3 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.6575 0.6407 0.5787 0.4552 4 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 0.5718 0.5523 0.4823 0.3501 5 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5194 0.4972 0.4761 0.4019 0.2693 6 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5066 04803 04556 0.4323 0.4104 0.3349 0.2072 7 0.6651 0.6227 0.5835 0.5470 0.5132 04817 04523 0.4251 0.3996 03759 0.3538 0.2791 0.1594 8 0.6274 0.5820 0.5403 0.5019 04665 04339 0.4039 0.3762 0.3506 0.3269 0.3050 0.2326 0.1226 9 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.3075 0.2843 0.2630 0.1938 0.0943 9% 10% 11% 7% 8% 6% 10 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.2946 0.2697 0.2472 0.2267 0.1615 0.0725 11 0.5268 0.4751 0.4289 0.3875 0.3505 03173 0.2875 0.2607 0.2366 0.2149 0.1954 0.1346 0.0558 0.3186 0.2858 0.2567 0.2307 0.2076 0.1869 0.1685 0.1122 0.0429 12 0.4970 0.4440 0.3971 0.3555 3 0.4688 0.4150 0.3677 0.3262 0.2897 0.2575 0.2292 0.2042 0.1821 0.1625 0.1452 0.0935 0.0330 14 0.4423 0.3878 0.3405 0.2992 0.2633 0.2320 0.2046 0.1807 0.1597 0.1413 0.1252 0.0779 0.0254 15 0.4173 0.3624 0.3152 0.2745 0.2394 0.2090 0.1827 0.1599 0.1401 0:1229 0.1079 0.0649 0.0195 16 0.3936 0.3387 0.2919 0.2519 0.2176 0.1883 0.1631 0.1415 0.1229 0.1069 0.0930 0.0541 0.0150 17 0.3714 0.3166 0.2703 0.2311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0929 0.0802 0.0451 0.0116 18 0.3503 0.2959 0.2502 0.2120 0.1799 01528 0 1300 unt Table B9-2 Present value of an annuity of $1 per period 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 20% 30% 10.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8696 0.8621 0.8333 0.7692 2 18334 1.8080 1.7833 1.7591 1.7355 1.7125 1,6901 1.6681 1.6467 1.6257 1.6052 1.5278 1.3609 3 2.6730 2.6243 2.5771 2.5313 2.4869 2.4437 2.4018 2.3612 2.3216 2.2832 2.2459 2.1065 1.8161 4 3.4651 3.3872 33121 3.2397 3.1699 3.1024 3.0373 2.9745 2.9137 2.8550 2.7982 2.5887 2.1662 s 42124 4.1002 3,9927 3.8897 3.7908 3.6959 3,6048 3.5172 3.4331 3.3522 3.2743 2.9906 2.4356 6 49173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 3.9975 3.8887 3.7845 3.6847 3.3 7 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 4.4226 4.2883 4.1604 4.0386 3.6046 2 62098 5.9713 5.7466 5.5348 53349 .1461 49676 4.7988 46389 4.4873 43436 3.8372 2.9247 6.8017 6.5152 6.2469 5.9952 5.7590 5.5370 5.3282 5.1317 4.9464 4.7716 4.6065 4.0310 3.0190 10 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 5.6502 5.4262 5.2161 5.0188 4.8332 4.1925 3.0915 11 7.8869 74987 7.1390 6.8052 6.4951 6.2065 5.9377 5.6869 5.4527 5.2337 5.0286 4.3271 3.1473 12 8.3838 7.9427 7.5361 7.1607 6.8137 6.4924 6.1944 5.9176 5.6603 5.4206 5.1971 4.4392 3.1903 13 8.8527 8.3577 7.9038 7.4869 7.1034 6.7499 6.4235 6.1218 5.8424 5.5831 5.3423 4.5327 3.2233 14 9.2950 8.7455 8.2442 7.7862 7.3667 69819 6.6282 6.3025 6.0021 5.7245 5.4675 4.6106 3.2487 15 9.7122 9.1079 8.5595 8.0607 7.6061 7.1909 6.8109 6.4624 6.1422 5.8474 5.5755 4.6755 3.2682 16 10.1059 9.4466 8.8514 8.3126 7.8237 7.3792 6.9740 6.6039 6.2651 5.9542 5.6685 4.7296 3.2832 17 10.4773 9.7632 9.1216 8.5436 8.0216 7.5488 7.1196 6.7291 6.3729 6.0472 5.7487 4.7746 3.2948 18 10.8276 10.0591 9.3719 8.7556 8.2014 7.7016 7.2497 6.8399 6.4674 6.1280 5.8178 4.8122 3.3037 19 11.1581 10.3356 9.6036 8.9501 8.3649 7.8393 7.3658 6.9380 6.5504 6.1982 5.8775 4.8435 3.3105