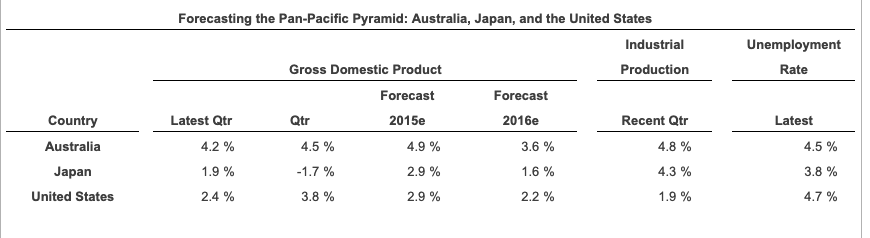

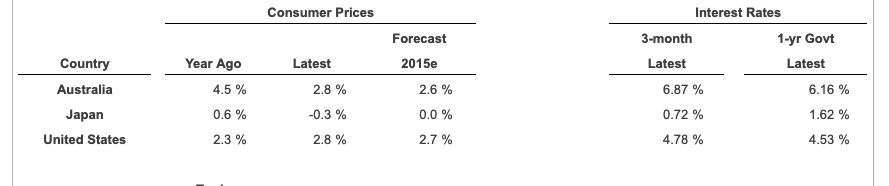

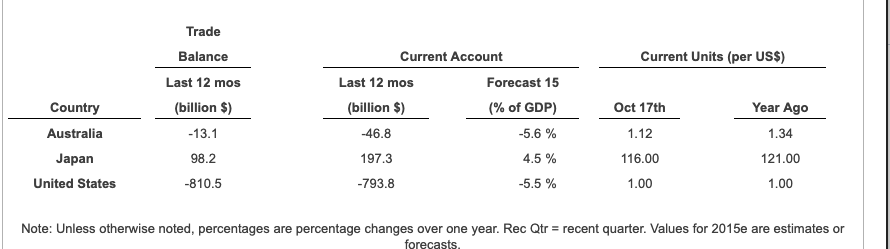

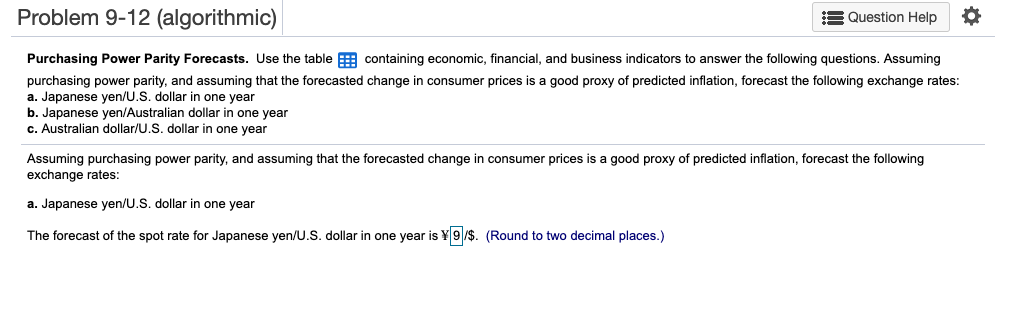

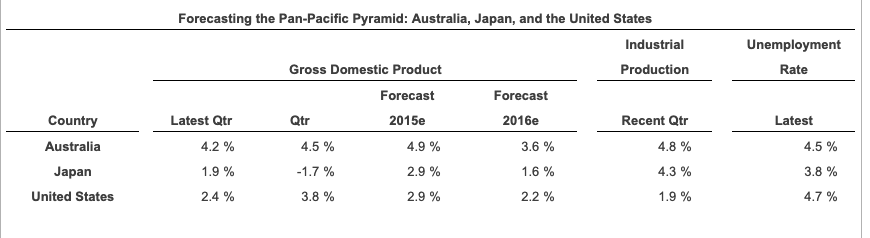

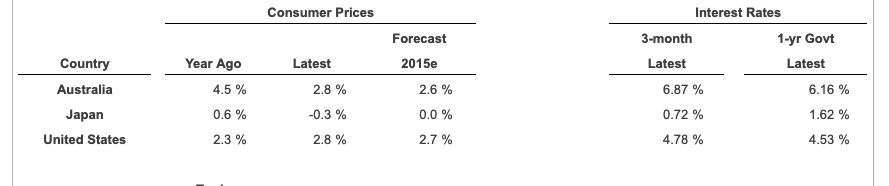

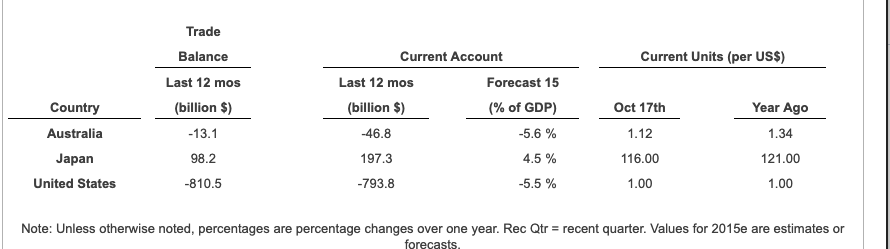

Problem 9-12 (algorithmic) Question Help Purchasing Power Parity Forecasts. Use the tablecontaining economic, financial, and business indicators to answer the following questions. Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following exchange rates a. Japanese yen/U.S. dollar in one year b. Japanese yen/Australian dollar in one year c. Australian dollar/U.S. dollar in one year Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following exchange rates a. Japanese yen/U.S. dollar in one year The forecast of the spot rate for Japanese yen/U.S. dollar in one year is Y 9/s. (Round to two decimal places.) Forecasting the Pan-Pacific Pyramid: Australia, Japan, and the United States Industrial Unemployment Production Rate Gross Domestic Product Forecast Forecast Latest Recent Qtr 4.8 % 4.3 % 1.9 % Qtr 2015e 2016e Country Australia Japan United States Latest Qtr 4.2% 1.9 % 2.4 % 4.9% 2.9% 2.9% 3,6% 1.6% 2.2% 45% 3.8 % 47 % 45% 3.8 % Interest Rates Consumer Prices 3-month 1-yr Govt Forecast Latest Latest Year Ago Latest 2015e Country Australia Japan United States 45% 0.6 % 2.3% 2.8 % -0.3 % 2.8 % 2.6% 0.0 % 27 % 687 % 072% 4.78 % 6.16 % 1.62 % 4.53 % Trade Balance Last 12 mos (billion $) -13.1 98.2 -810.5 Current Account Current Units (per US$) Country Australia Japan United States Last 12 mos (billion $) 46.8 197.3 -793.8 Forecast 15 (% of GDP) 5.6% 45% 55% Oct 17th 1.12 116.00 1.00 Year Ago 1.34 121.00 1.00 Note: Unless otherwise noted, percentages are percentage changes over one year. Rec Qtr-recent quarter. Values for 2015e are estimates or forecasts Problem 9-12 (algorithmic) Question Help Purchasing Power Parity Forecasts. Use the tablecontaining economic, financial, and business indicators to answer the following questions. Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following exchange rates a. Japanese yen/U.S. dollar in one year b. Japanese yen/Australian dollar in one year c. Australian dollar/U.S. dollar in one year Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following exchange rates a. Japanese yen/U.S. dollar in one year The forecast of the spot rate for Japanese yen/U.S. dollar in one year is Y 9/s. (Round to two decimal places.) Forecasting the Pan-Pacific Pyramid: Australia, Japan, and the United States Industrial Unemployment Production Rate Gross Domestic Product Forecast Forecast Latest Recent Qtr 4.8 % 4.3 % 1.9 % Qtr 2015e 2016e Country Australia Japan United States Latest Qtr 4.2% 1.9 % 2.4 % 4.9% 2.9% 2.9% 3,6% 1.6% 2.2% 45% 3.8 % 47 % 45% 3.8 % Interest Rates Consumer Prices 3-month 1-yr Govt Forecast Latest Latest Year Ago Latest 2015e Country Australia Japan United States 45% 0.6 % 2.3% 2.8 % -0.3 % 2.8 % 2.6% 0.0 % 27 % 687 % 072% 4.78 % 6.16 % 1.62 % 4.53 % Trade Balance Last 12 mos (billion $) -13.1 98.2 -810.5 Current Account Current Units (per US$) Country Australia Japan United States Last 12 mos (billion $) 46.8 197.3 -793.8 Forecast 15 (% of GDP) 5.6% 45% 55% Oct 17th 1.12 116.00 1.00 Year Ago 1.34 121.00 1.00 Note: Unless otherwise noted, percentages are percentage changes over one year. Rec Qtr-recent quarter. Values for 2015e are estimates or forecasts