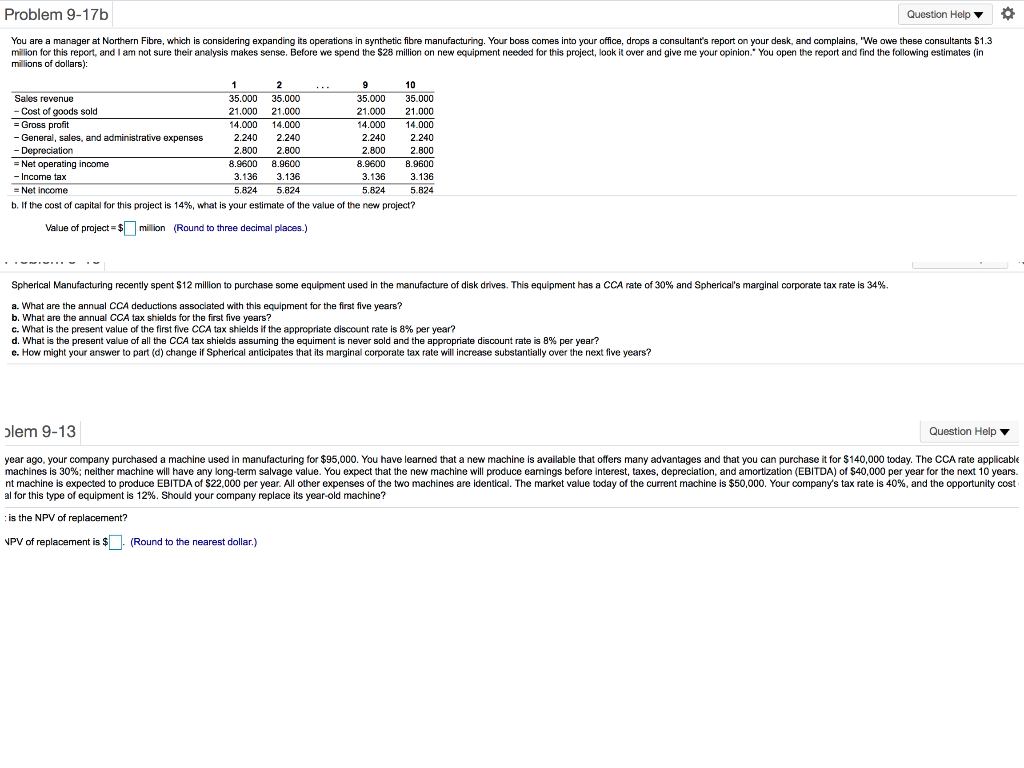

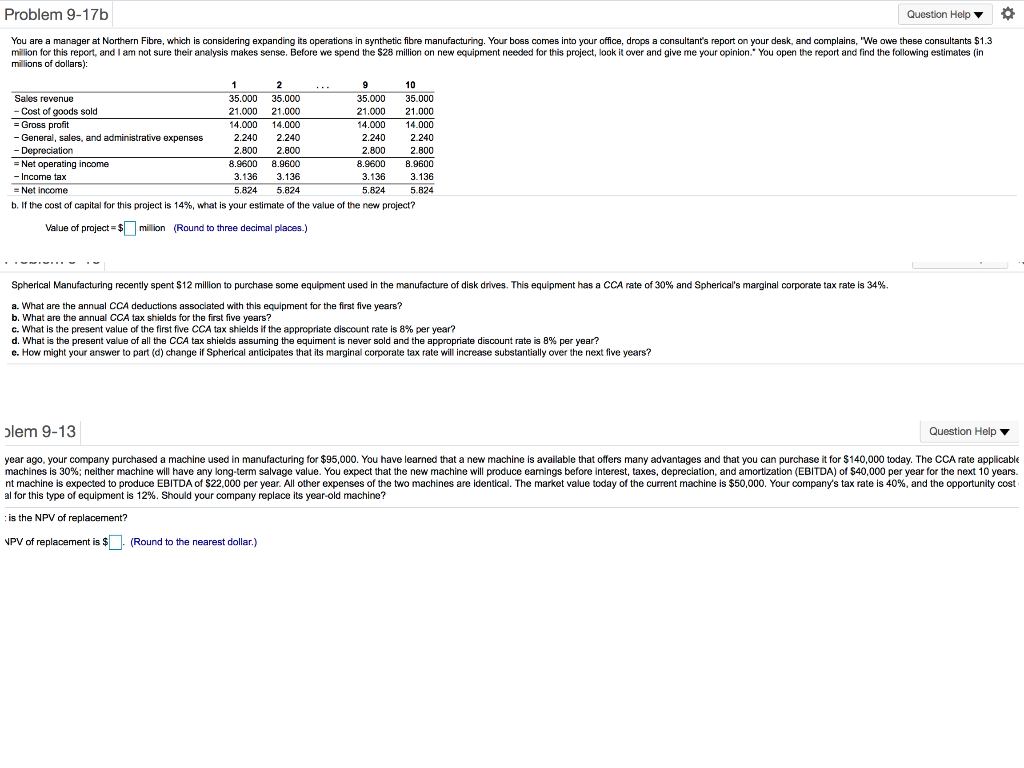

Problem 9-17b Question Help You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.3 million for this report, and I am not sure their analysis makes sense. Before we spend the $28 million on new equipment needed for this project, look it over and give me your opinion. You open the report and find the following estimates (in millions of dollars): 1 2 9 10 35.000 35.000 35.000 21.000 14.000 35.000 21.000 21.000 21.000 14.000 14.000 14.000 Salos revenue - Cost of goods sold = Gross profit - General, sales, and administrative expenses - Depreciation = Net operating income - Income tax 2.240 2.240 2.240 2.240 2.800 2.800 2.800 2.800 8.9600 8.9600 8.9600 8.9600 3.136 3.136 3.136 3.136 = Net income 5.824 5.824 5.824 5.824 b. If the cost of capital for this project is 14%, what is your estimate of the value of the new project? Value of project = $million (Round to three decimal places.) Spherical Manufacturing recently spent $12 million to purchase some equipment used in the manufacture of disk drives. This equipment has a CCA rate of 30% and Spherical's marginal corporate tax rate is 34%. a. What are the annual CCA deductions associated with this equipment for the first five years? b. What are the annual CCA tax shields for the first five years? c. What is the present value of the first five CCA tax shields if the appropriate discount rate is 8% per year? d. What is the present value of all the CCA tax shields assuming the equiment is never sold and the appropriate discount rate is 8% per year? e. How might your answer to part (d) change if Spherical anticipates that its marginal corporate tax rate will increase substantially over the next five years? blem 9-13 Question Help year ago your company purchased a machine used in manufacturing for $95,000. You have learned that a new machine is available that offers many advantages and that you can purchase it for $140,000 today. The CCA rate applicable machines is 30%; neither machine will have any long-term salvage value. You expect that the new machine will produce earnings before interest, taxes, depreciation, and amortization (EBITDA) of $40,000 per year for the next 10 years. nt machine is expected to produce EBITDA of $22,000 per year. All other expenses of the two machines are identical. The market value today of the current machine is $50,000. Your company's tax rate is 40%, and the opportunity cost al for this type of equipment is 12%. Should your company replace its year-old machine? is the NPV of replacement? NPV of replacement is $- (Round to the nearest dollar.) )