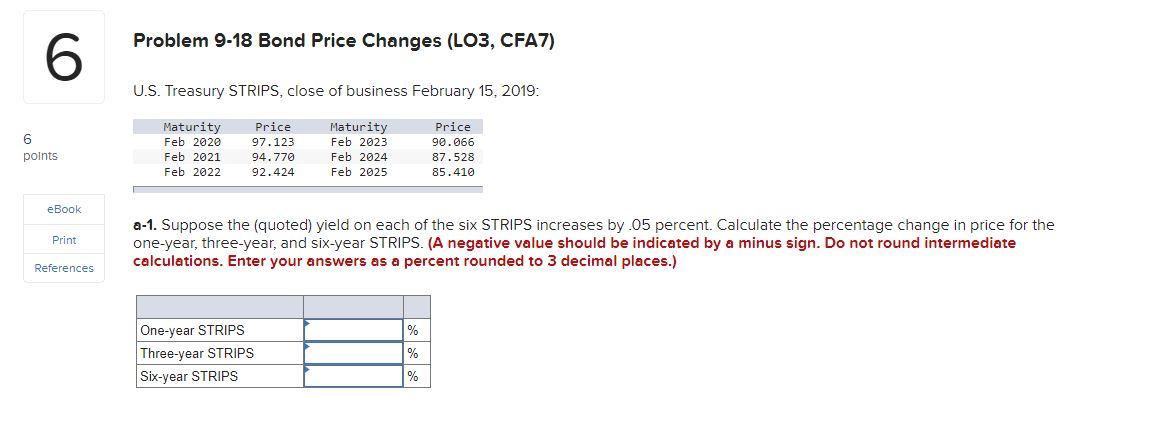

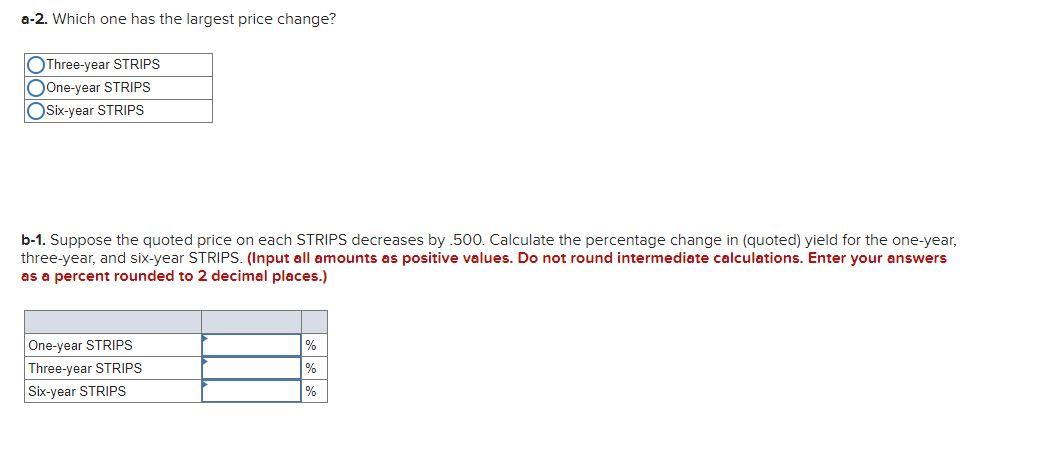

Problem 9-18 Bond Price Changes (LO3, CFA7) 6 U.S. Treasury STRIPS, close of business February 15, 2019: 6 points Maturity Feb 2020 Feb 2021 Feb 2022 Price 97.123 94.770 92.424 Maturity Feb 2023 Feb 2024 Feb 2025 Price 90.066 87.528 85.410 eBook Print a-1. Suppose the (quoted) yield on each of the six STRIPS increases by.05 percent. Calculate the percentage change in price for the one-year, three-year, and six-year STRIPS. (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 3 decimal places.) References % One-year STRIPS Three-year STRIPS Six-year STRIPS % % a-2. Which one has the largest price change? Three-year STRIPS One-year STRIPS Six-year STRIPS b-1. Suppose the quoted price on each STRIPS decreases by .500. Calculate the percentage change in (quoted) yield for the one-year, three-year, and six-year STRIPS. (Input all amounts as positive values. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) One-year STRIPS Three-year STRIPS Six-year STRIPS % % % b-2. Which one has the largest yield change? Three-year STRIPS One-year STRIPS Six-year STRIPS Problem 9-18 Bond Price Changes (LO3, CFA7) 6 U.S. Treasury STRIPS, close of business February 15, 2019: 6 points Maturity Feb 2020 Feb 2021 Feb 2022 Price 97.123 94.770 92.424 Maturity Feb 2023 Feb 2024 Feb 2025 Price 90.066 87.528 85.410 eBook Print a-1. Suppose the (quoted) yield on each of the six STRIPS increases by.05 percent. Calculate the percentage change in price for the one-year, three-year, and six-year STRIPS. (A negative value should be indicated by a minus sign. Do not round intermediate calculations. Enter your answers as a percent rounded to 3 decimal places.) References % One-year STRIPS Three-year STRIPS Six-year STRIPS % % a-2. Which one has the largest price change? Three-year STRIPS One-year STRIPS Six-year STRIPS b-1. Suppose the quoted price on each STRIPS decreases by .500. Calculate the percentage change in (quoted) yield for the one-year, three-year, and six-year STRIPS. (Input all amounts as positive values. Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) One-year STRIPS Three-year STRIPS Six-year STRIPS % % % b-2. Which one has the largest yield change? Three-year STRIPS One-year STRIPS Six-year STRIPS