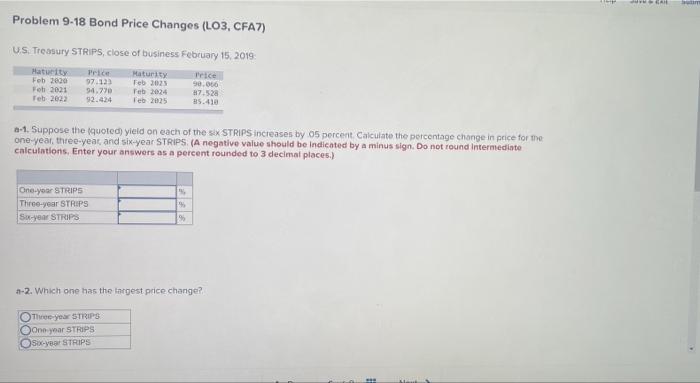

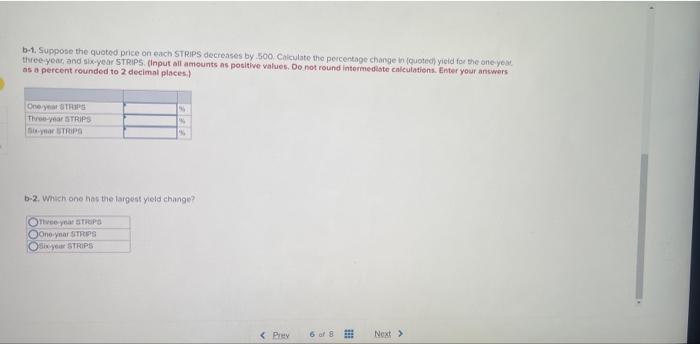

Problem 9-18 Bond Price Changes (LO3, CFA7) U.S. Treasury STRIPS close of business February 15, 2019 Haturity w Maturity ce Feb 2000 97.123 Teb 2025 90.066 Foh 2001 94.70 Feb 2024 37.528 Teb 2022 92.424 Feb 2025 25.410 0-1. Suppose the quoted yield on each of the six STRIPS increases by 05 percent Calculate the percentage change in price for the one year, three-year and six-year STRIPS (A negative value should be indicated by a minus sign. Do not found intermediate calculations, Enter your answers as a percent rounded to 3 decimal places.) One-year STRIPS Three-year STRIPS Se-year STRIPS 90 1-2. Which one has the largest price change? Three-year STRIPS One year STRIPS S-ar STRIPS b-1. Suppose the quoted price on each STRIPS decreases by 500 Calculate the percentage change in (quoted yield for the one year three year, and six-year STRIPS Input all amounts as positive values. Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places) One TPS Three-year STRIPS b 2. Which one has the largest yield change? The year UPS Onoyar STRIPS year STRIPS Problem 9-18 Bond Price Changes (LO3, CFA7) U.S. Treasury STRIPS close of business February 15, 2019 Haturity w Maturity ce Feb 2000 97.123 Teb 2025 90.066 Foh 2001 94.70 Feb 2024 37.528 Teb 2022 92.424 Feb 2025 25.410 0-1. Suppose the quoted yield on each of the six STRIPS increases by 05 percent Calculate the percentage change in price for the one year, three-year and six-year STRIPS (A negative value should be indicated by a minus sign. Do not found intermediate calculations, Enter your answers as a percent rounded to 3 decimal places.) One-year STRIPS Three-year STRIPS Se-year STRIPS 90 1-2. Which one has the largest price change? Three-year STRIPS One year STRIPS S-ar STRIPS b-1. Suppose the quoted price on each STRIPS decreases by 500 Calculate the percentage change in (quoted yield for the one year three year, and six-year STRIPS Input all amounts as positive values. Do not round Intermediate calculations. Enter your answers as a percent rounded to 2 decimal places) One TPS Three-year STRIPS b 2. Which one has the largest yield change? The year UPS Onoyar STRIPS year STRIPS