Answered step by step

Verified Expert Solution

Question

1 Approved Answer

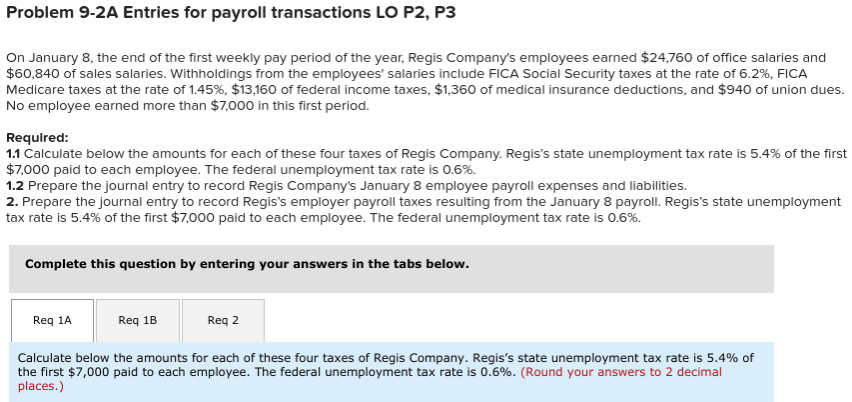

Problem 9-2A Entries for payroll transactions LO P2, P3 General Journal Inputs: Accounts payable Bonus payable Cost of goods sold Deferred income tax liability Earned

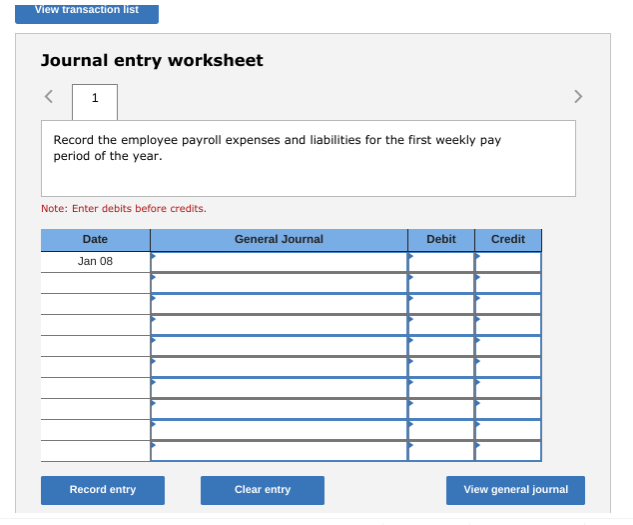

Problem 9-2A Entries for payroll transactions LO P2, P3 General Journal Inputs:

- Accounts payable

- Bonus payable

- Cost of goods sold

- Deferred income tax liability

- Earned services revenue

- Earned ticket revenue

- Employee benefits plan payable

- Employee bonus expense

- Employee fed. inc. taxes payable

- Employee life insurance payable

- Employee medical insurance payable

- Employee union dues payable

- Estimated warranty liability

- Federal unemployment taxes payable

- FICAMedicare taxes payable

- FICASocial sec. taxes payable

- Income taxes expense

- Income taxes payable

- Interest expense

- Interest payable

- Merchandise inventory

- Notes payable

- Office salaries expense

- Payroll taxes expense

- Repair parts inventory

- Salaries payable

- Sales

- Sales salaries expense

- Sales taxes payable

- State unemployment taxes payable

- Unearned services revenue

- Unearned ticket revenue

- Vacation benefits expense

- Vacation benefits payable

- Wages expense

- Warranty expense

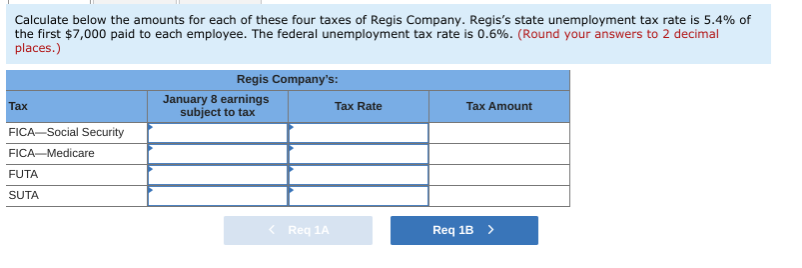

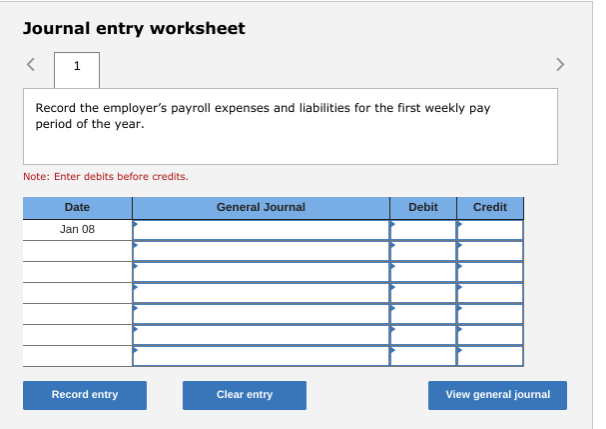

Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities. (Round your answers to 2 decimal places.)

Prepare the journal entry to record Regis Company's January 8 employee payroll expenses and liabilities. (Round your answers to 2 decimal places.)  Prepare the journal entry to record Regiss employer payroll taxes resulting from the January 8 payroll. Regiss state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%. (Round your answers to 2 decimal places.)

Prepare the journal entry to record Regiss employer payroll taxes resulting from the January 8 payroll. Regiss state unemployment tax rate is 5.4% of the first $7,000 paid to each employee. The federal unemployment tax rate is 0.6%. (Round your answers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started