Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 9-40 (LO. 3, 4, 5) You are the head tax accountant for Venture Company, a U.S. corporation. The board of directors is considering expansion

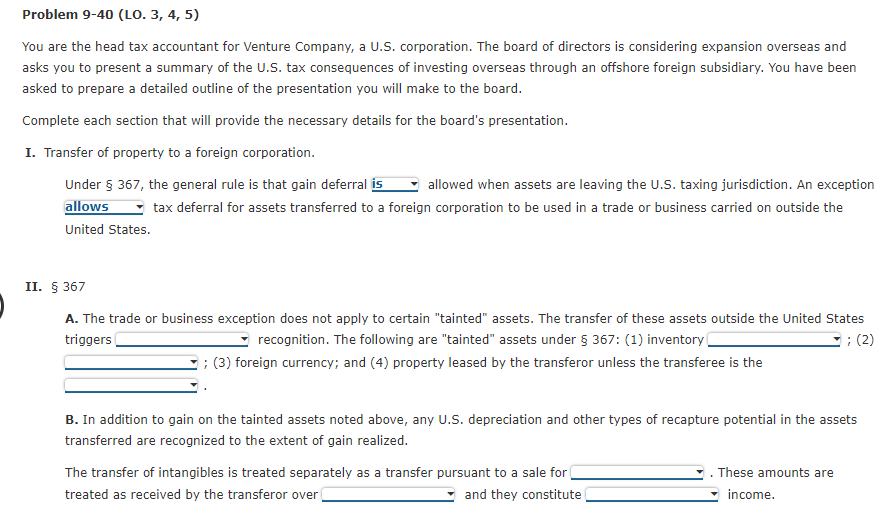

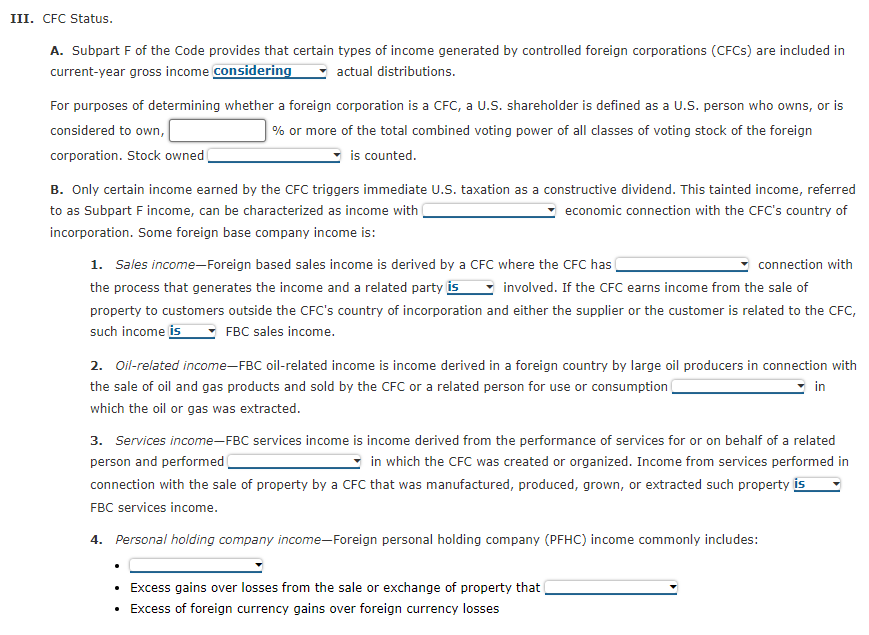

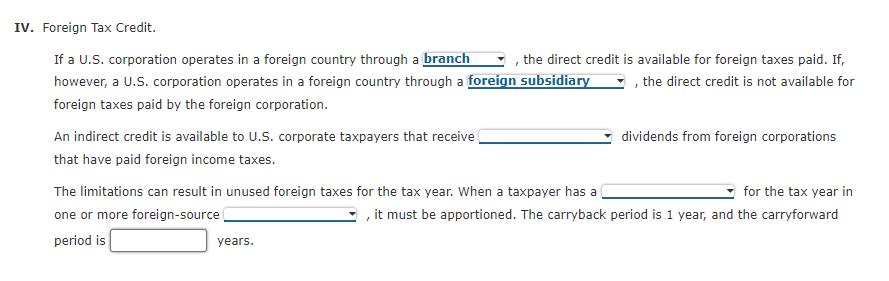

Problem 9-40 (LO. 3, 4, 5) You are the head tax accountant for Venture Company, a U.S. corporation. The board of directors is considering expansion overseas and asks you to present a summary of the U.S. tax consequences of investing overseas through an offshore foreign subsidiary. You have been asked to prepare a detailed outline of the presentation you will make to the board. Complete each section that will provide the necessary details for the board's presentation. I. Transfer of property to a foreign corporation. Under $ 367, the general rule is that gain deferral is allowed when assets are leaving the U.S. taxing jurisdiction. An exception allows tax deferral for assets transferred to a foreign corporation to be used in a trade or business carried on outside the United States. II. $ 367 A. The trade or business exception does not apply to certain "tainted" assets. The transfer of these assets outside the United States triggers recognition. The following are "tainted" assets under $ 367: (1) inventory ; (2) ; (3) foreign currency; and (4) property leased by the transferor unless the transferee is the B. In addition to gain on the tainted assets noted above, any U.S. depreciation and other types of recapture potential in the assets transferred are recognized to the extent of gain realized. The transfer of intangibles is treated separately as a transfer pursuant to a sale for . These amounts are treated as received by the transferor over and they constitute income. III. CFC Status. A. Subpart F of the Code provides that certain types of income generated by controlled foreign corporations (CFCs) are included in current-year gross income considering actual distributions. For purposes of determining whether a foreign corporation is a CFC, a U.S. shareholder is defined as a U.S. person who owns, or is considered to own, % or more of the total combined voting power of all classes of voting stock of the foreign corporation. Stock owned is counted. B. Only certain income earned by the CFC triggers immediate U.S. taxation as a constructive dividend. This tainted income, referred to as Subpart Fincome, can be characterized as income with economic connection with the CFC's country of incorporation. Some foreign base company income is: 1. Sales income-Foreign based sales income is derived by a CFC where the CFC has connection with the process that generates the income and a related party is involved. If the CFC earns income from the sale of property to customers outside the CFC's country of incorporation and either the supplier or the customer is related to the CFC, such income is FBC sales income. 2. Oil-related income-FBC oil-related income is income derived in a foreign country by large oil producers in connection with the sale of oil and gas products and sold by the CFC or a related person for use or consumption in which the oil or gas was extracted. 3. Services income-FBC services income is income derived from the performance of services for or on behalf of a related person and performed in which the CFC was created or organized. Income from services performed in connection with the sale of property by a CFC that was manufactured, produced, grown, or extracted such property is FBC services income. 4. Personal holding company income-Foreign personal holding company (PFHC) income commonly includes: Excess gains over losses from the sale or exchange of property that Excess of foreign currency gains over foreign currency losses . IV. Foreign Tax Credit. If a U.S. corporation operates in a foreign country through a branch the direct credit is available for foreign taxes paid. If, however, a U.S. corporation operates in a foreign country through a foreign subsidiary , the direct credit is not available for foreign taxes paid by the foreign corporation. An indirect credit is available to U.S. corporate taxpayers that receive dividends from foreign corporations that have paid foreign income taxes. The limitations can result in unused foreign taxes for the tax year. When a taxpayer has a for the tax year in one or more foreign-source , it must be apportioned. The carryback period is 1 year, and the carryforward period is years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started