Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem 9.4A (Static) Preparing a bank reconciliation statement and journalizing entries to adjust the cash balance. LO 9-5, 9-6 On August 31, 20X1, the balance

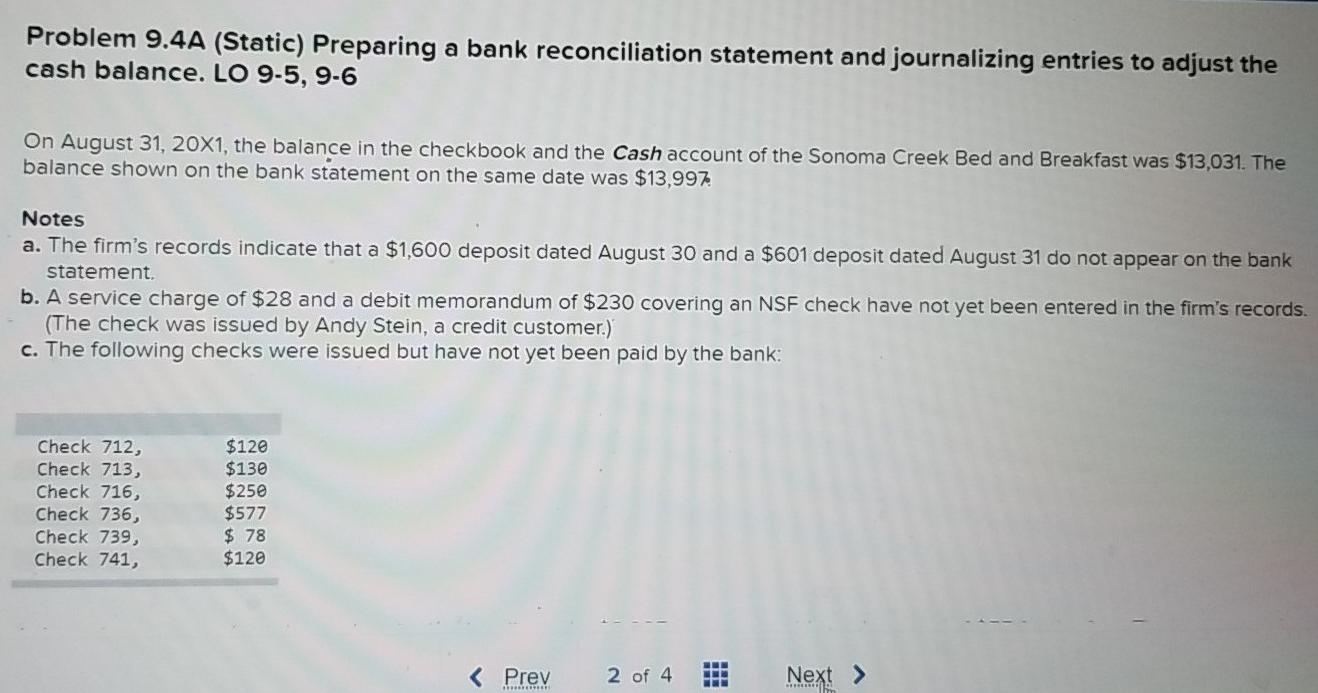

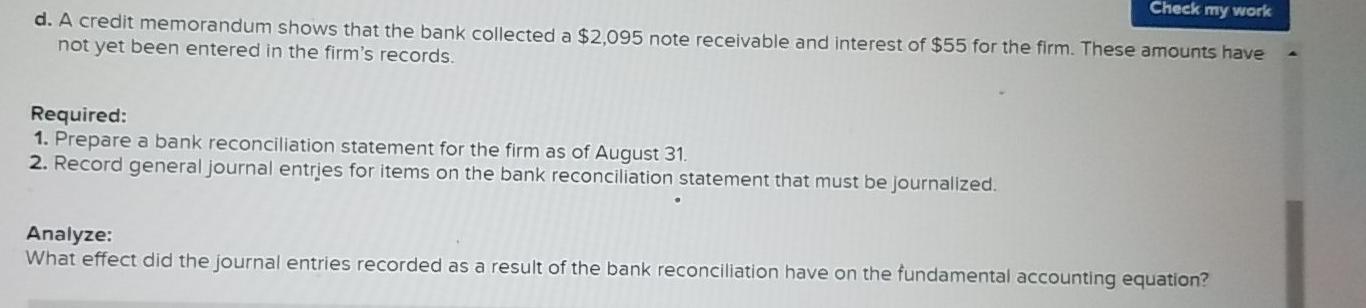

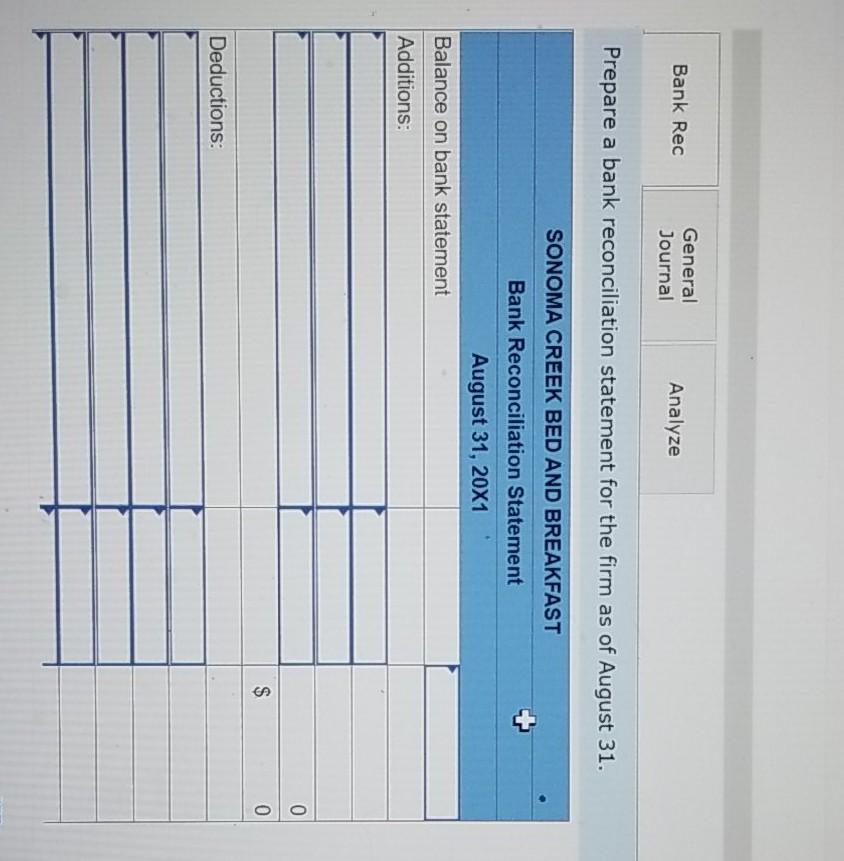

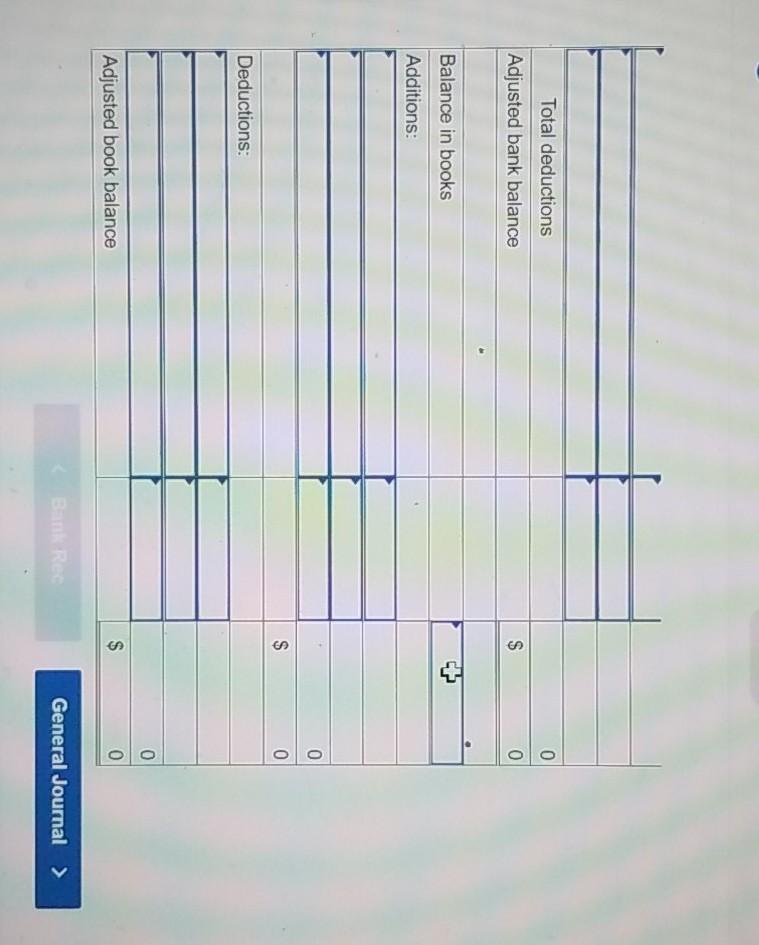

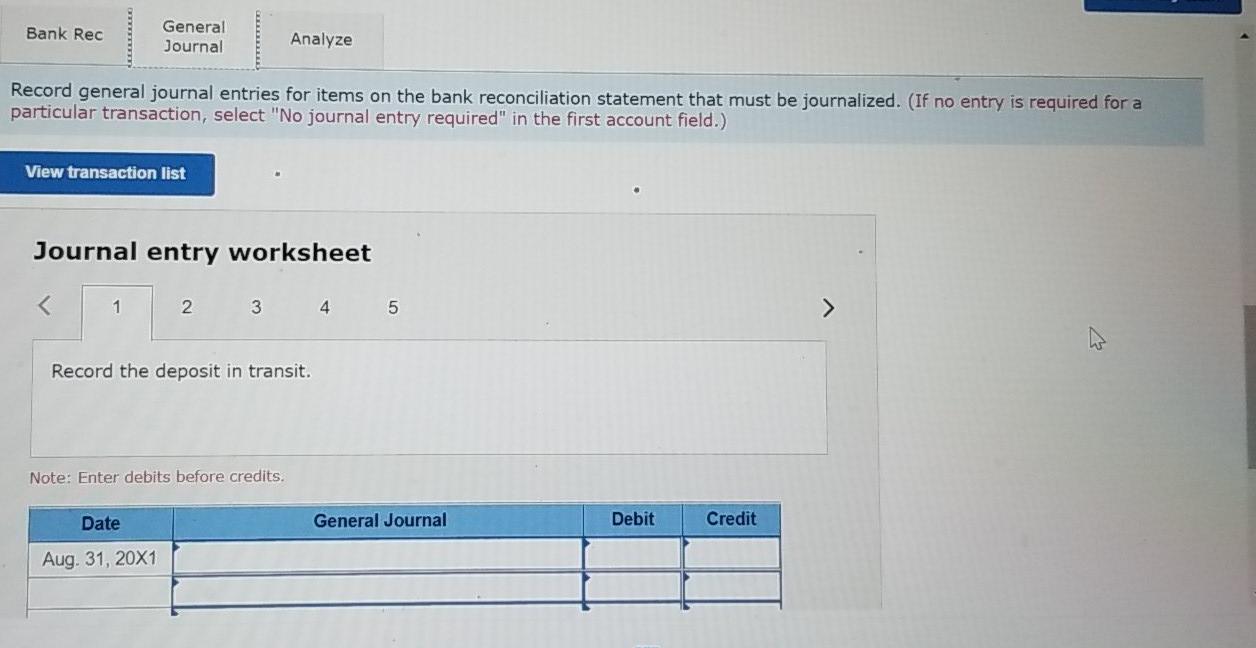

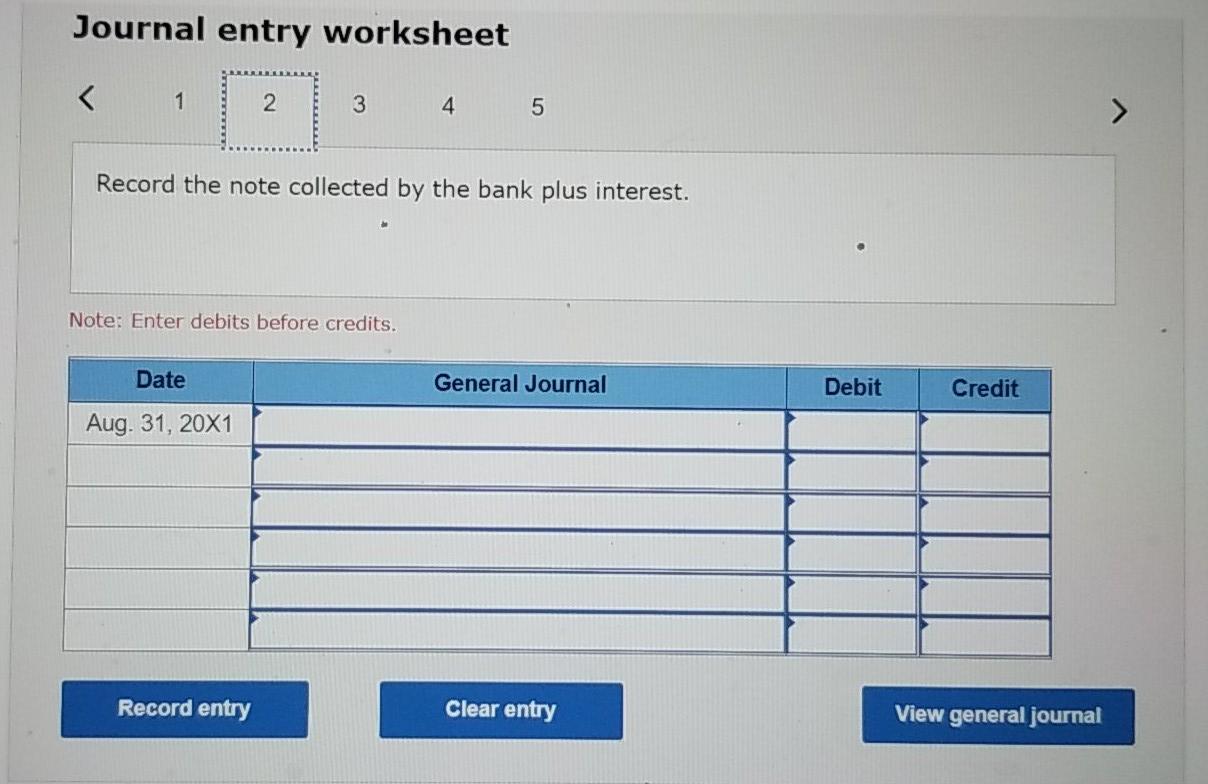

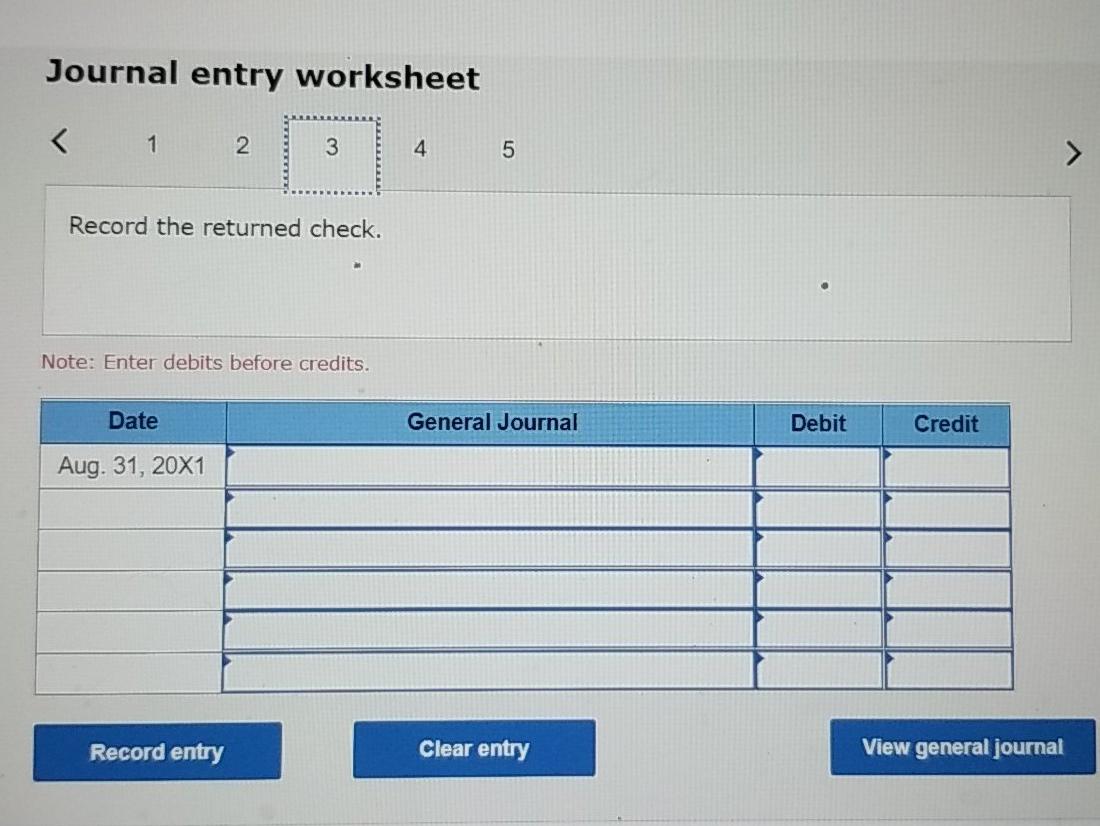

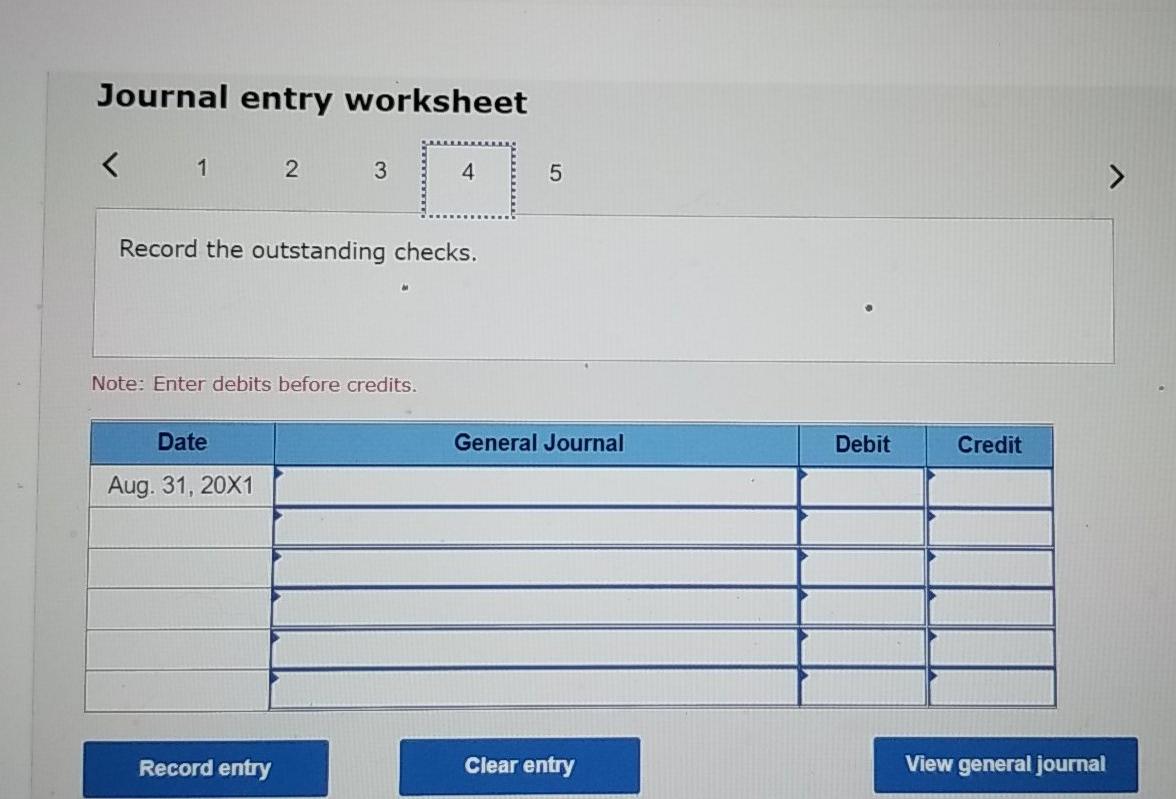

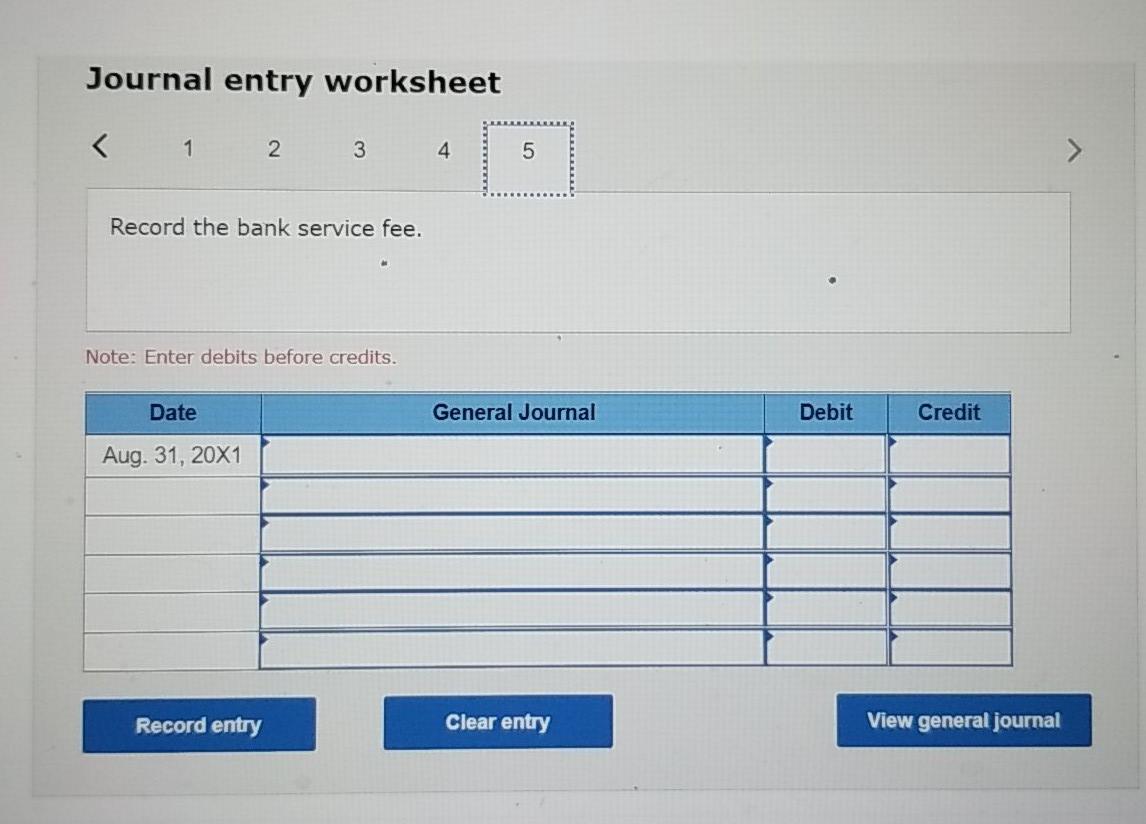

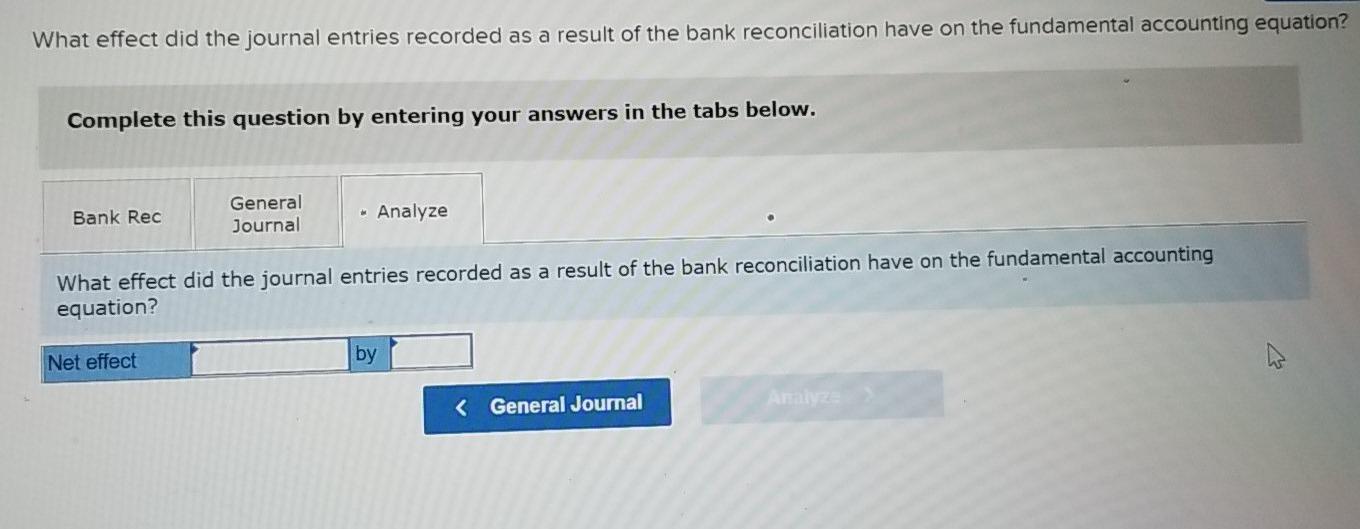

Problem 9.4A (Static) Preparing a bank reconciliation statement and journalizing entries to adjust the cash balance. LO 9-5, 9-6 On August 31, 20X1, the balance in the checkbook and the Cash account of the Sonoma Creek Bed and Breakfast was $13,031. The balance shown on the bank statement on the same date was $13,997 Notes a. The firm's records indicate that a $1,600 deposit dated August 30 and a $601 deposit dated August 31 do not appear on the bank statement b. A service charge of $28 and a debit memorandum of $230 covering an NSF check have not yet been entered in the firm's records. (The check was issued by Andy Stein, a credit customer.) c. The following checks were issued but have not yet been paid by the bank: Check 712, Check 713, Check 716, Check 736, Check 739, Check 741, $12e $130 $250 $577 $ 78 $120 Check my work d. A credit memorandum shows that the bank collected a $2,095 note receivable and interest of $55 for the firm. These amounts have not yet been entered in the firm's records. Required: 1. Prepare a bank reconciliation statement for the firm as of August 31. 2. Record general journal entries for items on the bank reconciliation statement that must be journalized. Analyze: What effect did the journal entries recorded as a result of the bank reconciliation have on the fundamental accounting equation? Bank Rec General Journal Analyze Prepare a bank reconciliation statement for the firm as of August 31. SONOMA CREEK BED AND BREAKFAST Bank Reconciliation Statement August 31, 20X1 Balance on bank statement Additions: 0 $ 0 Deductions: 0 Total deductions Adjusted bank balance $ $ 0 Balance in books Additions: 0 $ 0 Deductions: 0 $ Adjusted book balance 0 ER General Journal > Bank Rec General Journal Analyze Record general journal entries for items on the bank reconciliation statement that must be journalized. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 5 > Record the deposit in transit. Note: Enter debits before credits. Date General Journal Debit Credit Aug. 31, 20X1 Journal entry worksheet 1 2 3 4 5 > Record the note collected by the bank plus interest. Note: Enter debits before credits. Date General Journal Debit Credit Aug. 31, 20X1 Record entry Clear entry View general journal Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started