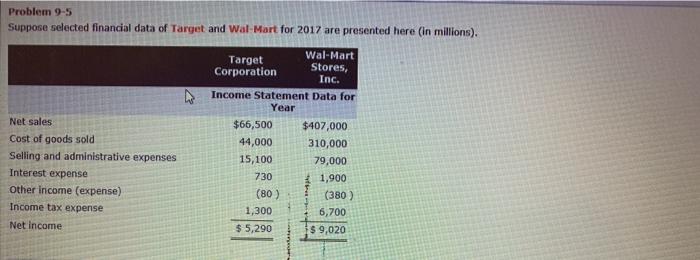

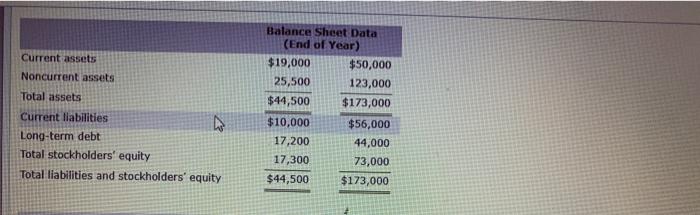

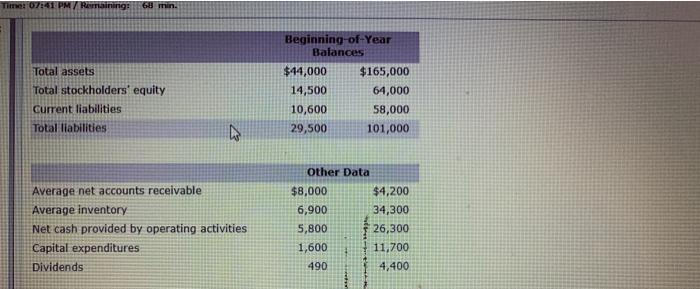

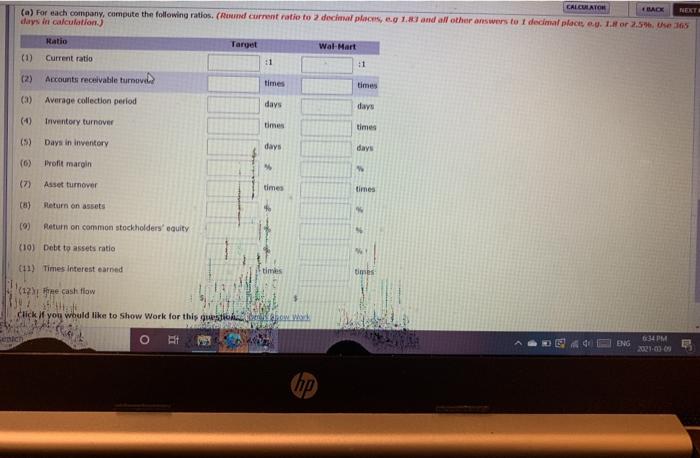

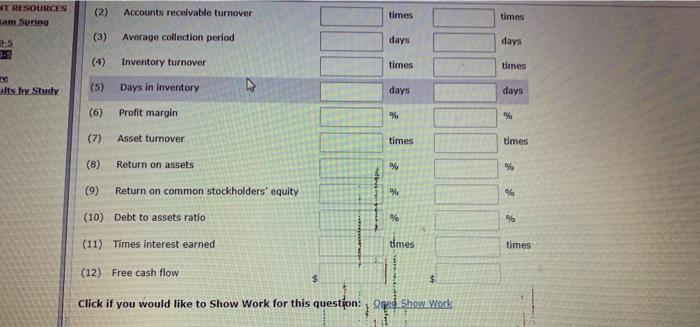

Problem 9-5 Suppose selected financial data of Target and Wal-Mart for 2017 are presented here (in millions). Net sales Cost of goods sold Selling and administrative expenses Interest expense Other Income (expense) Income tax expense Net Income Target Wal-Mart Corporation Stores, Inc. Income Statement Data for Year $66,500 $407,000 44,000 310,000 15,100 79,000 730 + 1,900 (80) (380) 1,300 6,700 $5,290 $ 9,020 Current assets Noncurrent assets Total assets Current liabilities Long-term debt Total stockholders' equity Total liabilities and stockholders' equity Balance Sheet Data (End of Year) $19,000 $50,000 25,500 123,000 $44,500 $173,000 $10,000 $56,000 17,200 44,000 17,300 73,000 $44,500 $173,000 Time: 07:41 PM / Remaining: 60 min Total assets Total stockholders' equity Current liabilities Total liabilities Beginning-of-Year Balances $14,000 $165,000 14,500 64,000 10,600 58,000 29,500 101,000 Average net accounts receivable Average inventory Net cash provided by operating activities Capital expenditures Dividends Other Data $8,000 $4,200 6,900 34,300 5,800 26,300 1,600 11,700 4,400 490 CALCULATOR BACK (a) For each company, compute the following ratios. (Red current ratio to 2 decimal places, e. 1. and all other answers to I decimal places.. 1.1 or 2.5%, the 165 days in calculation) NEXT Ratio Target (1) Current ratio Wal-Mart 11 :1 (2) Accounts receivabile turnove times times (3) Average collection period days days (0) Inventory turnover times (5) Days in inventory days days Profit margin Asset turnover times times (8) Return on assets (9) Return on common stockholders' equity (10) Debt to assets ratio (11) Times Interest earned times 12 The cash flow Clickf you would like to show Work for this question Senin st ENG 634 PM 2012-03-08 (hp T RESOURCES sam Spring (2) Accounts receivable turnover times times (3) Average collection period days days 13 (4) Inventory turnover times times alts by Study (5) Days in Inventory days days (6) Profit margin % % (7) Asset turnover times times (8) Return on assets % % (9) Return on common stockholders' equity % % (10) Debt to assets ratio % 96 (11) Times interest earned times times (12) Free cash flow $ $ Click if you would like to Show Work for this question: Show Work