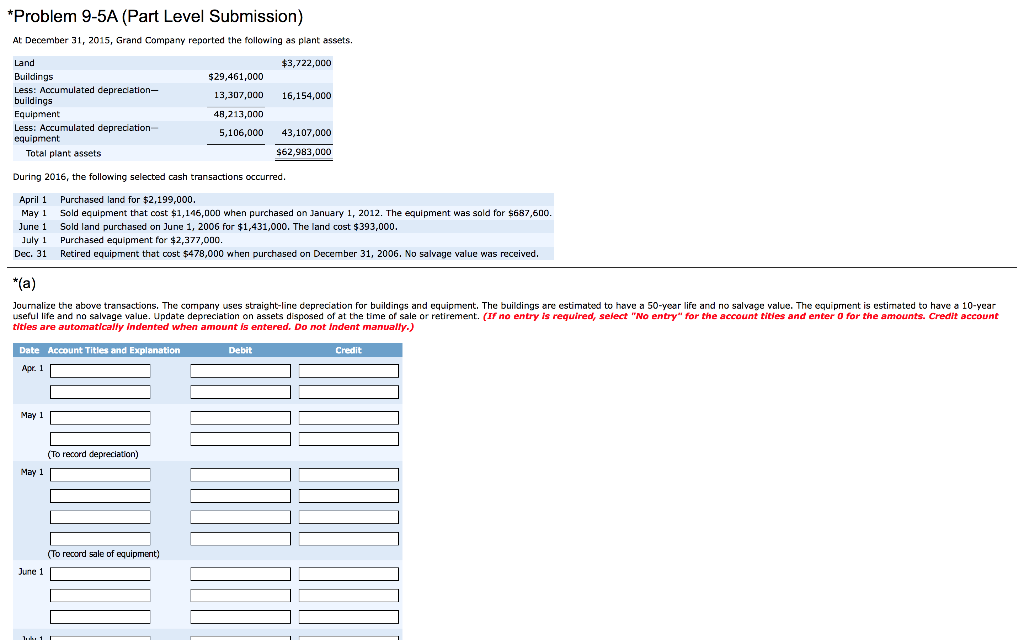

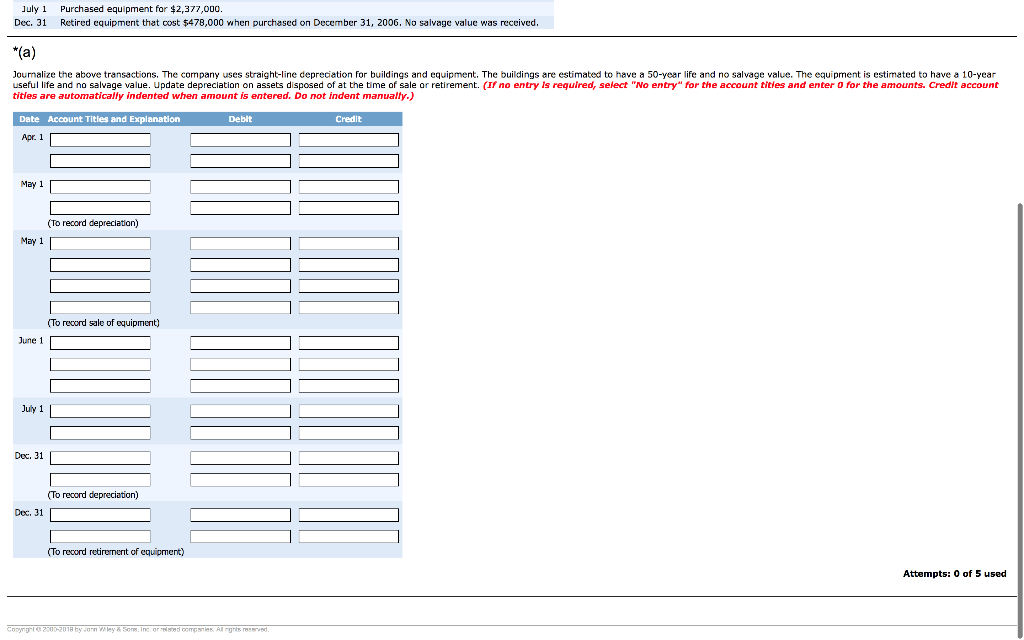

Problem 9-5A (Part Level Submission) At Decemher 31, 2015, Grand Company reported the following as plant assets. Land Buildings Less: Accumulated depredation- buildings Equipment 3,722,00o $29,461,000 13,307,D00 16,154,000 4B,213,000 5,106,000 43,107,000 equipment S62,983,000 Total plant assets During 2016, the following selected cash transactions occurred April 1 Purchased land for $2,199,000 May 1 Sold equipment that cost $1,146,000 when purchased on January 1, 2012. The equipment was sold for $687,600 June 1 Sold land purchased on June 1, 2006 for $1,431,000. The land cost $393,000 July1 Purchased equipment for $2,377,000 Dec. 31 Retired equipment that cost $478,000 when purchased on December 31, 2006. No salvage value was received. ou malize he above transactions. The company uses straight-line deprecation or buildings and equipment. The buildings are estimated to have a 50 year life and no salvage value. The equipment is estimated to have 10-year useful life and no salvage value. update depreciation on assets disposed of at the time of sale or retirement. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically Indented when amount is entered. Do not Indent manually.) Date Account Titles and Explanation Debit Credit Apr. 1 May 1 (To record depreciation) May 1 To record sale of equipment) June 1 July 1 Dec. 31 Purchased equipment for $2,377,000 Retired cquipment that cost $478,000 when purchased on December 31, 2006. No salvage value was received Jour alize the above transactions. The company uses straight line depreciation for buildings and equip ent. The buildings are estimated to have a 50 year life and no salvage value. The equipment is estimated to have10-year useful life and no salvage value. update depreciation on assets disposed of at the time of sale or retirement. (If no entry ls required, select "No entry for the account tities and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Apr. 1 May 1 (To record depreciation) May 1 To record sale of equipment) une 1 July 1 Dec. 31 To record depreciation) Doc. 31 To record retirement of equipment) Attempts: 0 of 5 used