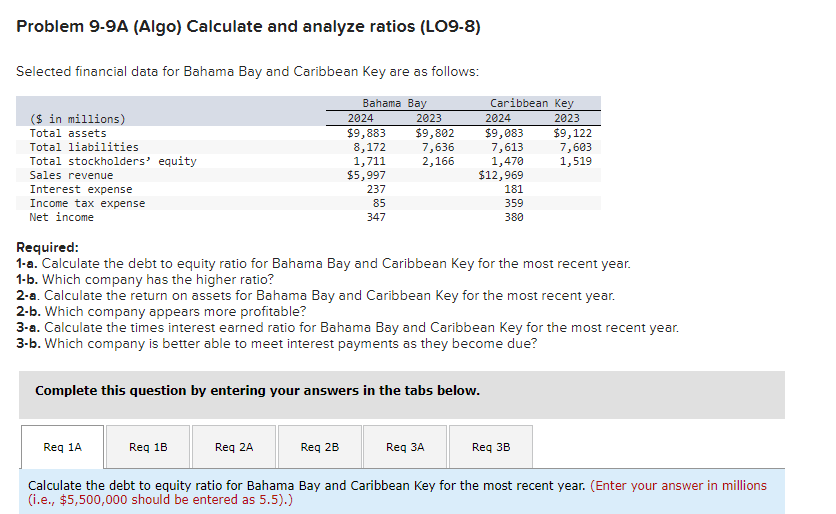

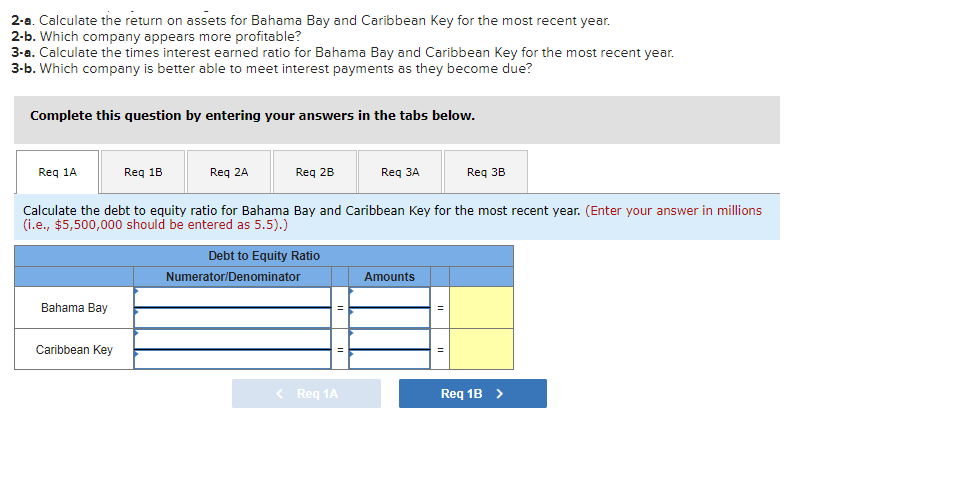

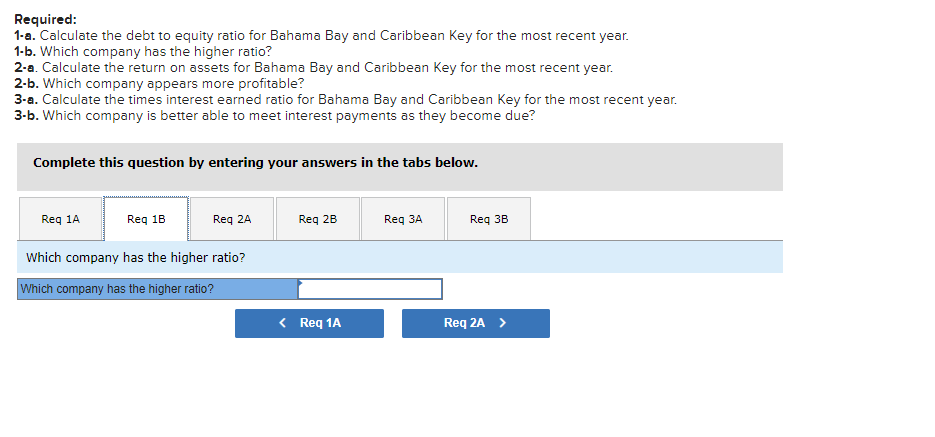

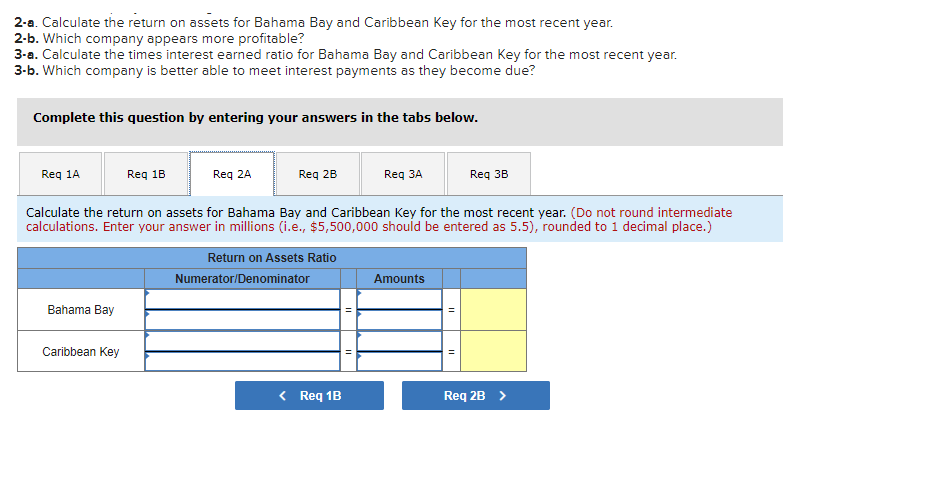

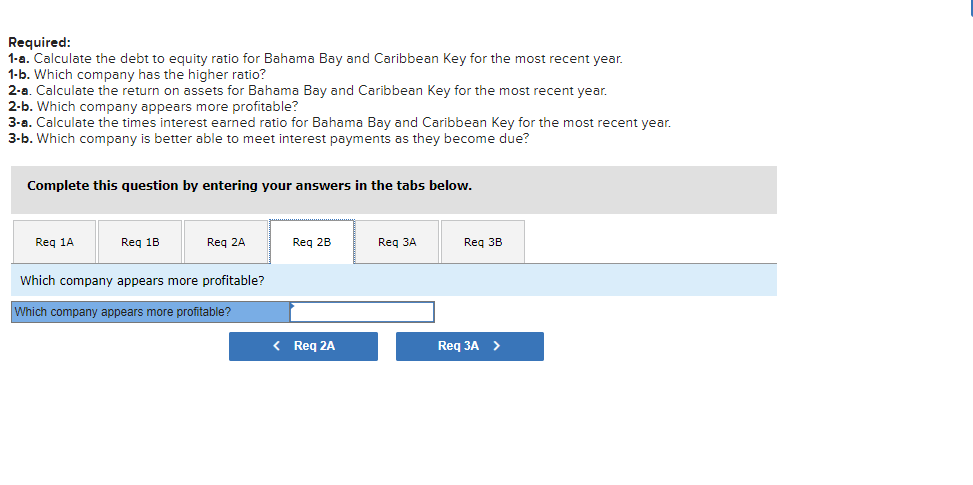

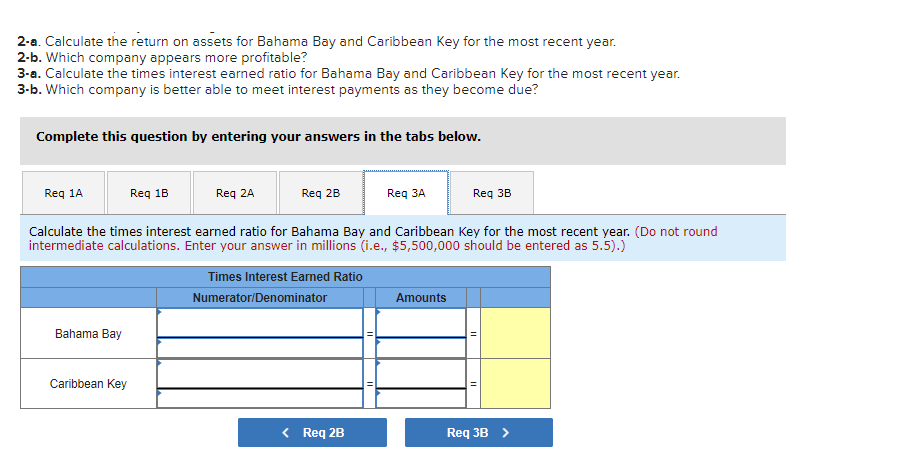

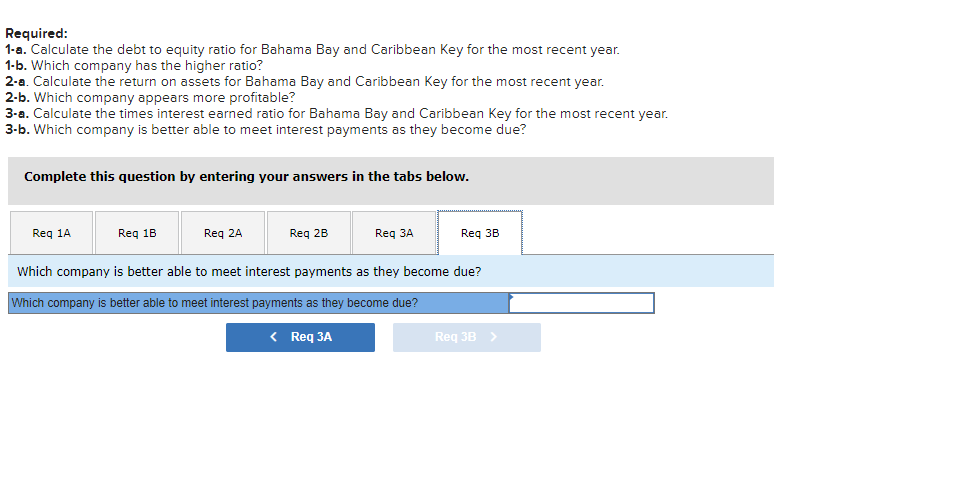

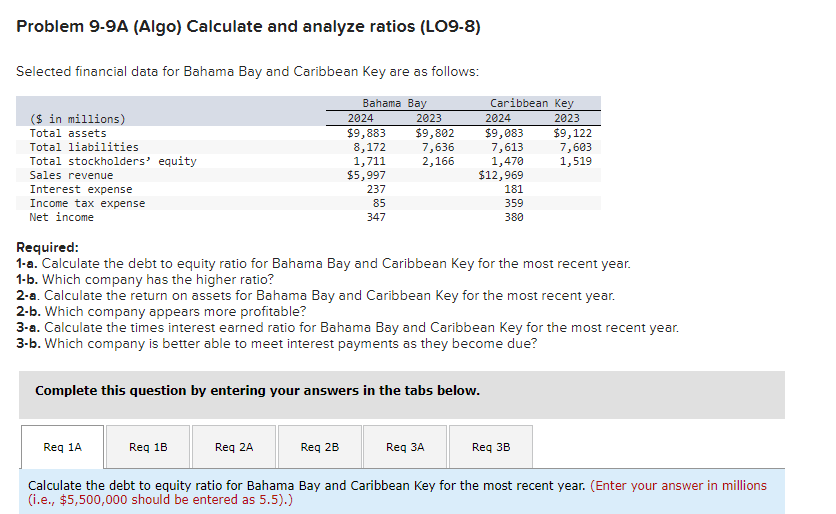

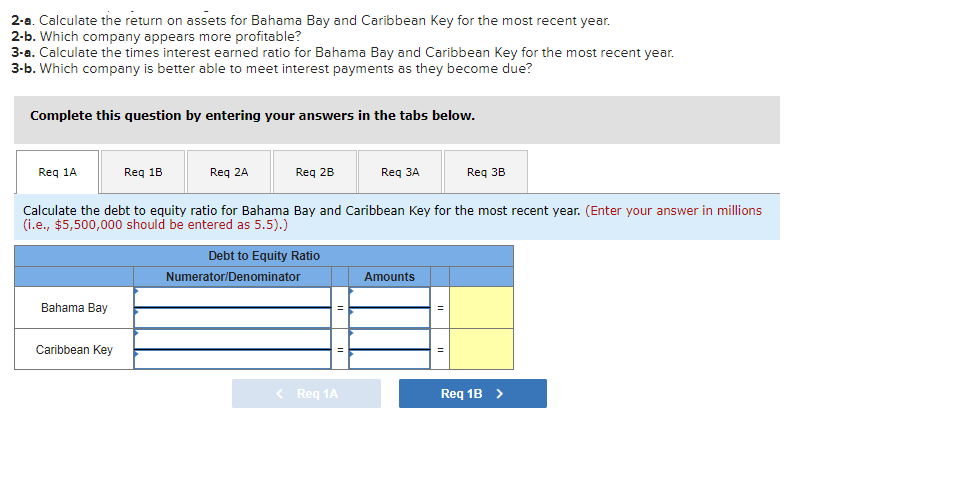

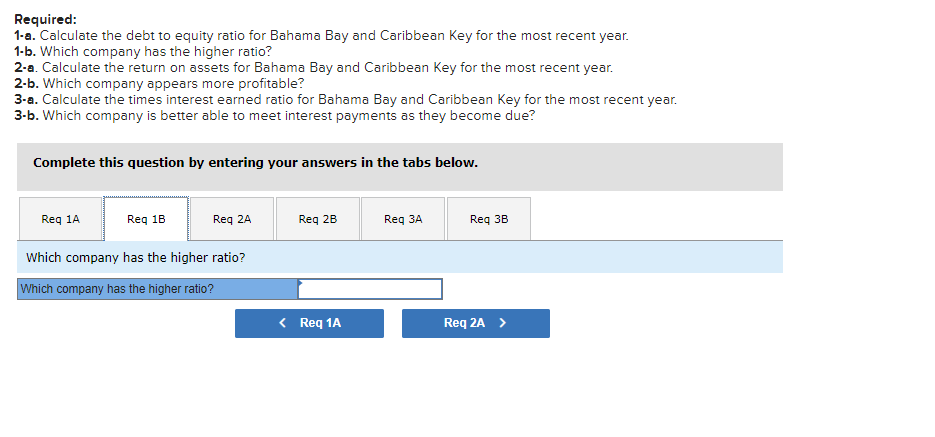

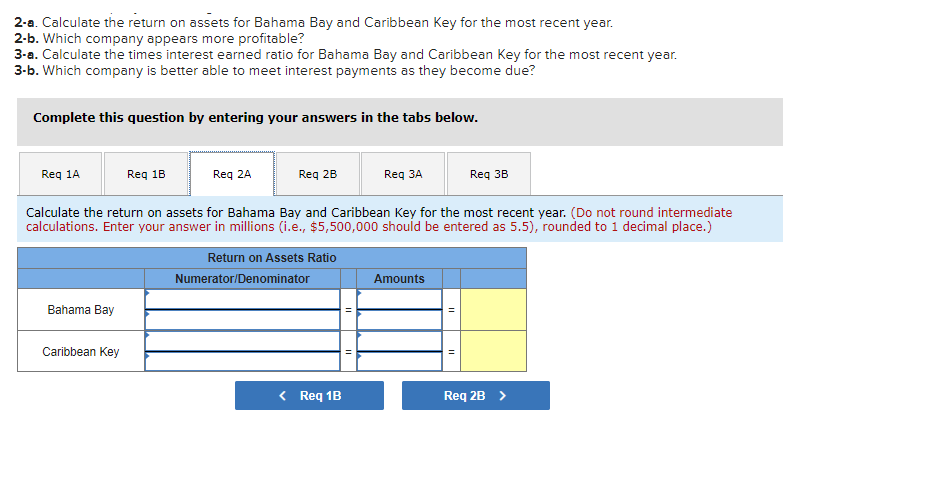

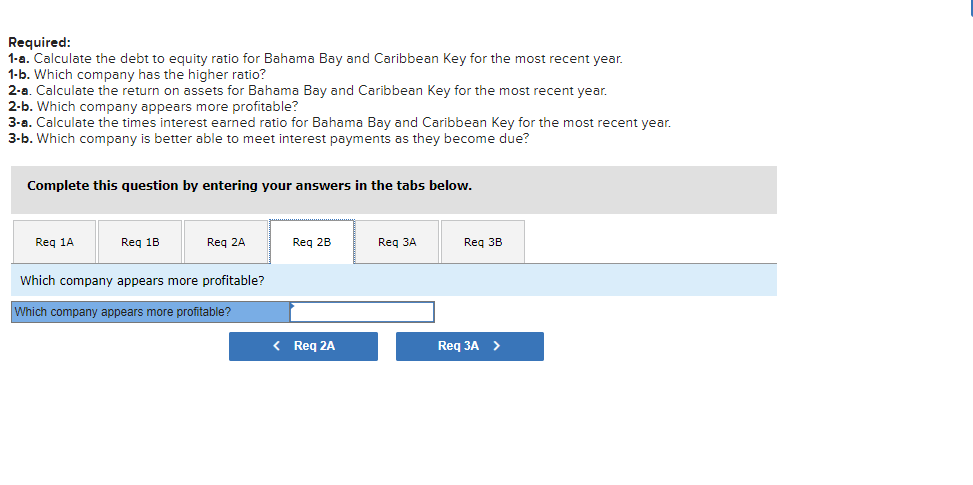

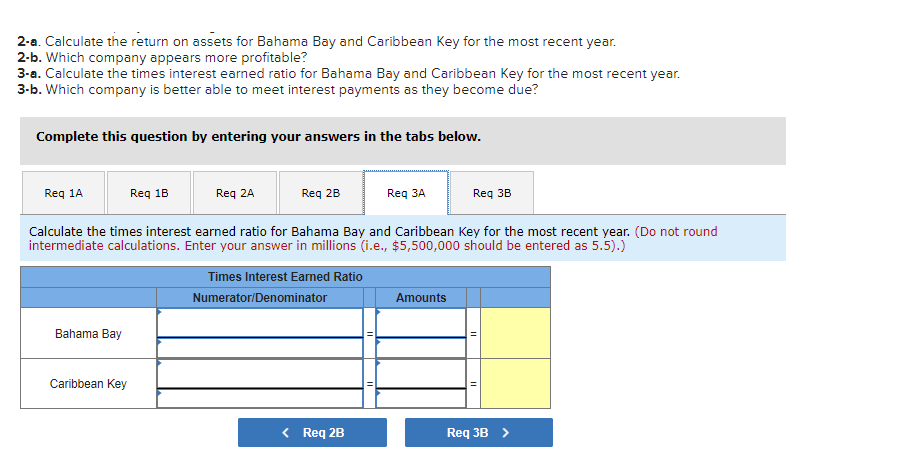

Problem 9-9A (Algo) Calculate and analyze ratios (LO9-8) Selected financial data for Bahama Bay and Caribbean Key are as follows: Required: 1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. 1-b. Which company has the higher ratio? 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Complete this question by entering your answers in the tabs below. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. (Enter your answer in millions (i.e., $5,500,000 should be entered as 5.5).) 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Complete this question by entering your answers in the tabs below. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. (Enter your answer in million (i.e., $5,500,000 should be entered as 5.5).) Required: 1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. 1-b. Which company has the higher ratio? 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Complete this question by entering your answers in the tabs below. Which company has the higher ratio? 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Complete this question by entering your answers in the tabs below. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. (Do not round intermediate calculations. Enter your answer in millions (i.e., $5,500,000 should be entered as 5.5), rounded to 1 decimal place.) Required: 1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. 1-b. Which company has the higher ratio? 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Complete this question by entering your answers in the tabs below. Which company appears more profitable? 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Complete this question by entering your answers in the tabs below. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. (Do not round intermediate calculations. Enter your answer in millions (i.e., $5,500,000 should be entered as 5.5).) Required: 1-a. Calculate the debt to equity ratio for Bahama Bay and Caribbean Key for the most recent year. 1-b. Which company has the higher ratio? 2-a. Calculate the return on assets for Bahama Bay and Caribbean Key for the most recent year. 2-b. Which company appears more profitable? 3-a. Calculate the times interest earned ratio for Bahama Bay and Caribbean Key for the most recent year. 3-b. Which company is better able to meet interest payments as they become due? Complete this question by entering your answers in the tabs below. Which company is better able to meet interest payments as they become due? Which company is better able to meet interest payments as they become due