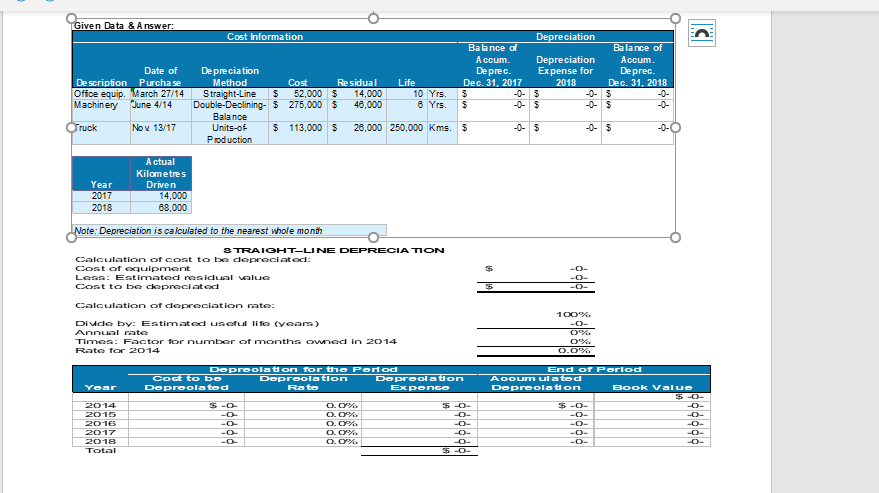

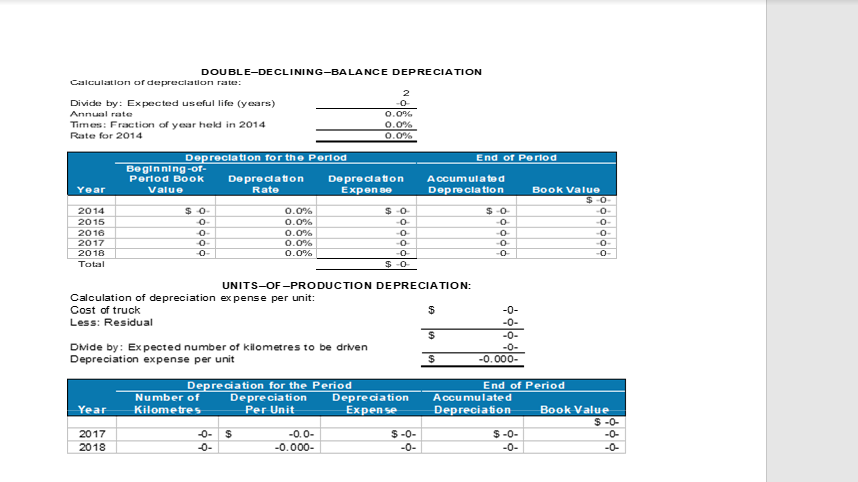

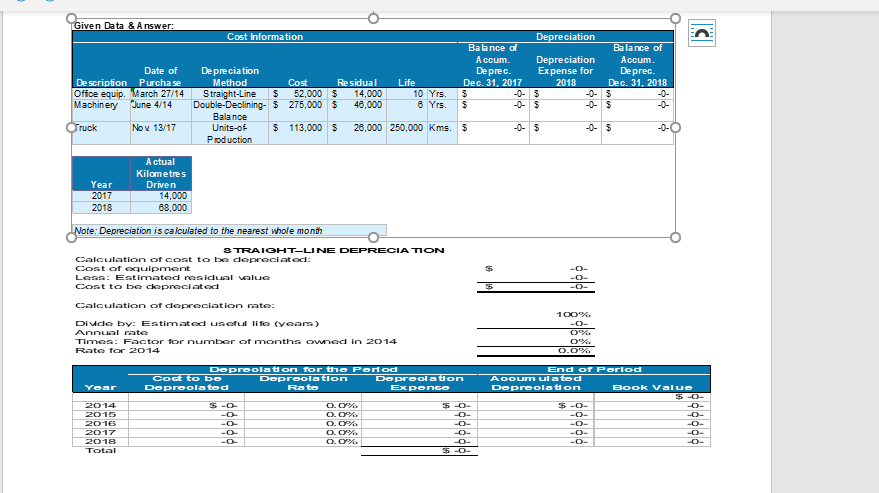

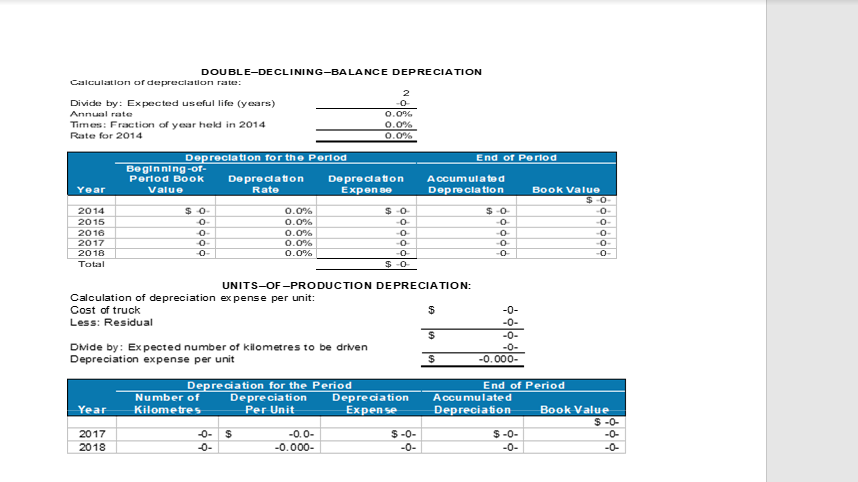

Problem 9-9A Calculating depreciation; partial years depreciation

CHECK FIGURES: Deprec. Expense 2018: Office equip. = $3,800; Machinery = $19,638; Truck = $23,664 At December 31, 2017,

Halifax Servicings balance sheet showed capital asset information as detailed in the schedule below. Halifax calculates depreciation to the nearest whole month.

iven Data & A nswer: Cost Information Date of Purcha se De preciation Method De prec. Dec. 31, 2017 A ccum. Depreciation Accum Expense for 2018 De prec. Dec. 31., 2018 Residual Life De scription Offce equip. March 27/14 Straight-Line 52,000 Machinery June 4/14 Cost 10 Yrs. 14,000 $ 275,000 $ 48,000 Balance Units-of$ 113,000 ruck Nov 13/17 28,000 250,000 Kms. $ Production A ctual Kilometre s Driven Year 2017 2018 4,000 88,000 Depreciation is ca lculated to the nearest whole mont NE DEPRECIATI Calaulation of cost to be cleprociatad Cost of aquipment Less:E Cost to be clopreciatad rasidual olue Calculation of clepreciation rate DiMcle by: Estimatdd uscful lite (Yeas) Annual rate Times: Fac oned in Doproolation Dopreolaion 5-O Total DOUBLE-DECLINING-BALANCE DEPRE CIATION Calculation of depreclation rate Divide by: Expected useful lfe (years) Annual rate Times: Fraction of year hekd in 2014 Rate for 2014 0 0.0% 0.0 Depreclation for the Perlod End of Perlod Beginning-of Perlod BookDepreclaton DepreclatonAccum ul a ted Dep re clation Year Value Rate Expen se Book Value 2014 2015 2016 2017 2018 Total 0.0% 0.0% 0.0% 0.0% 0.0% $-0 1 UNITS-OF-PRODUCTION DEPRECIATION: Calculation of depreciation expense per unit: Cost of truck Less: Residual DMide by: Ex pected number of kilometres to be drven Depreciation expense per unit -0.000- Depre ciation for the Period Depreciation Per Unit End of Period Number of Kilometres Depreciation Accumulated Depreciation Year Expense Book Value S-0- 2017 2018 0.0- 0.000- iven Data & A nswer: Cost Information Date of Purcha se De preciation Method De prec. Dec. 31, 2017 A ccum. Depreciation Accum Expense for 2018 De prec. Dec. 31., 2018 Residual Life De scription Offce equip. March 27/14 Straight-Line 52,000 Machinery June 4/14 Cost 10 Yrs. 14,000 $ 275,000 $ 48,000 Balance Units-of$ 113,000 ruck Nov 13/17 28,000 250,000 Kms. $ Production A ctual Kilometre s Driven Year 2017 2018 4,000 88,000 Depreciation is ca lculated to the nearest whole mont NE DEPRECIATI Calaulation of cost to be cleprociatad Cost of aquipment Less:E Cost to be clopreciatad rasidual olue Calculation of clepreciation rate DiMcle by: Estimatdd uscful lite (Yeas) Annual rate Times: Fac oned in Doproolation Dopreolaion 5-O Total DOUBLE-DECLINING-BALANCE DEPRE CIATION Calculation of depreclation rate Divide by: Expected useful lfe (years) Annual rate Times: Fraction of year hekd in 2014 Rate for 2014 0 0.0% 0.0 Depreclation for the Perlod End of Perlod Beginning-of Perlod BookDepreclaton DepreclatonAccum ul a ted Dep re clation Year Value Rate Expen se Book Value 2014 2015 2016 2017 2018 Total 0.0% 0.0% 0.0% 0.0% 0.0% $-0 1 UNITS-OF-PRODUCTION DEPRECIATION: Calculation of depreciation expense per unit: Cost of truck Less: Residual DMide by: Ex pected number of kilometres to be drven Depreciation expense per unit -0.000- Depre ciation for the Period Depreciation Per Unit End of Period Number of Kilometres Depreciation Accumulated Depreciation Year Expense Book Value S-0- 2017 2018 0.0- 0.000