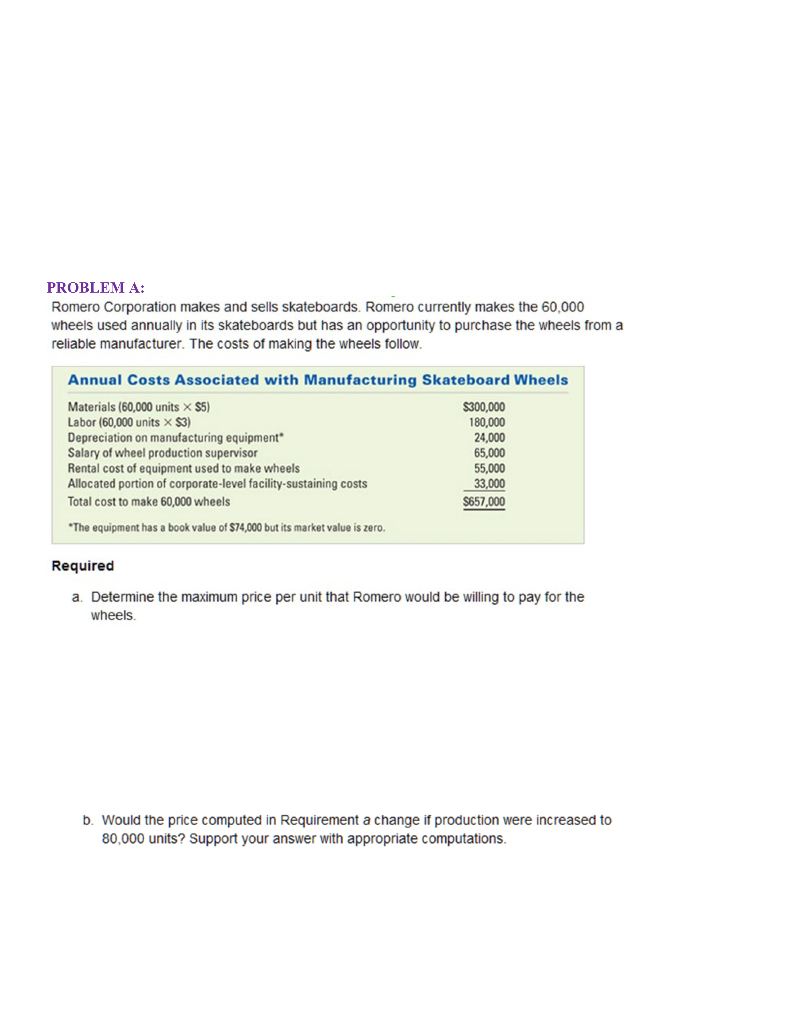

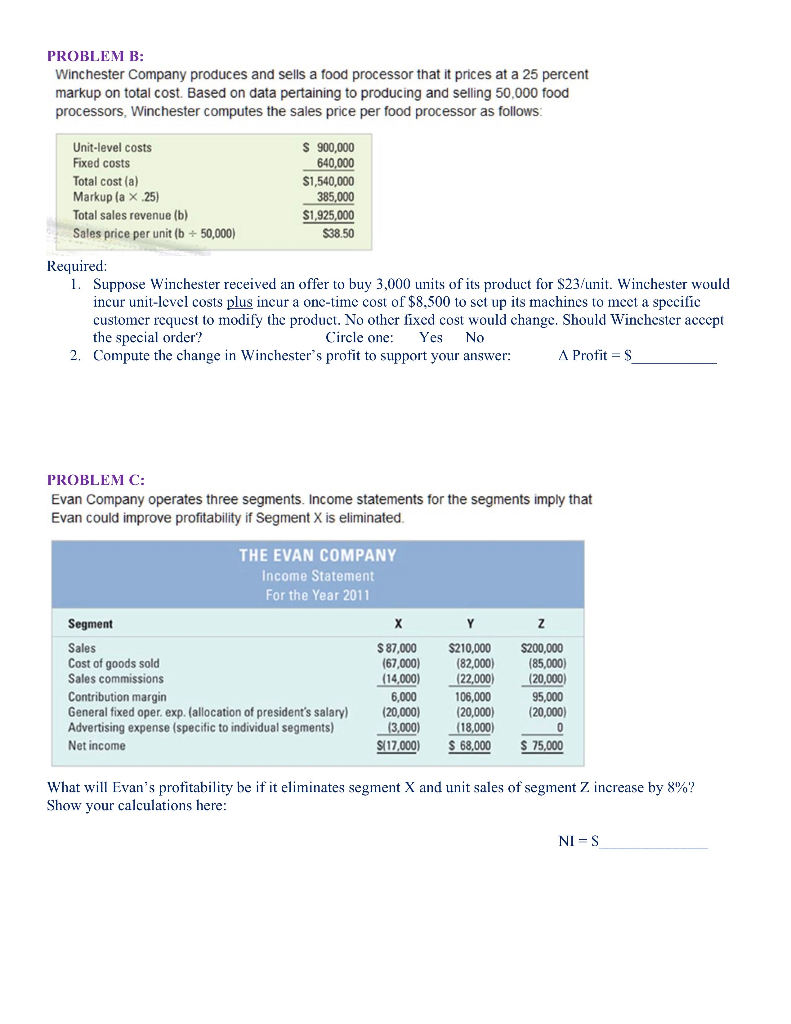

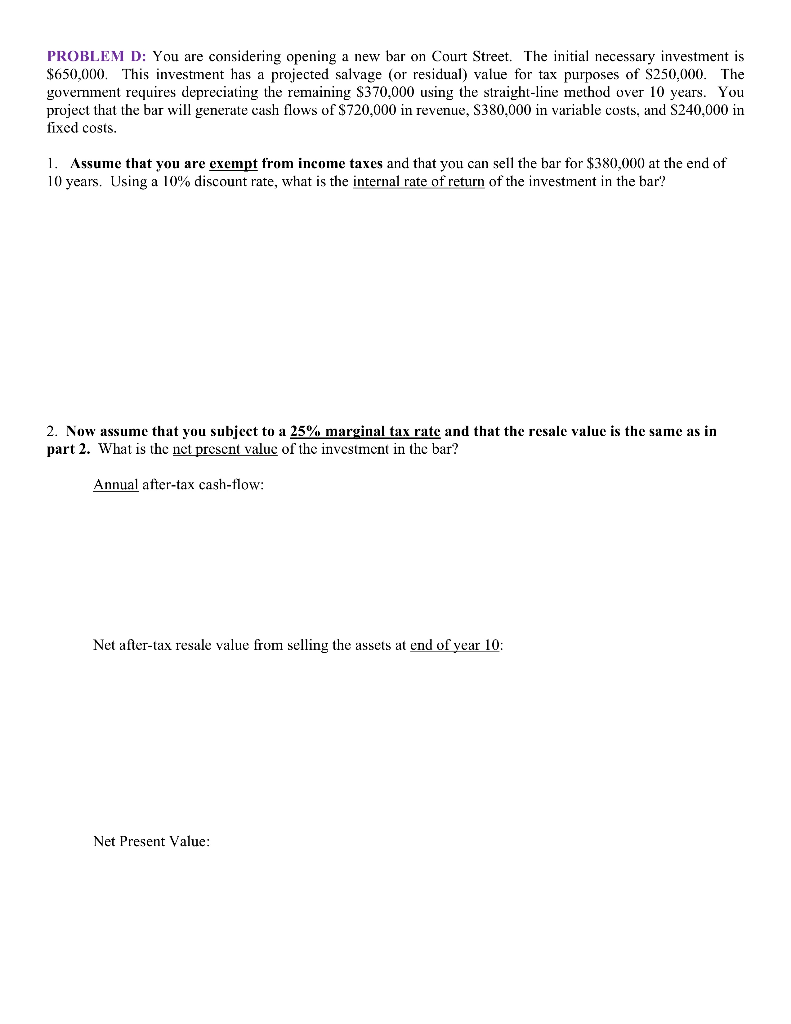

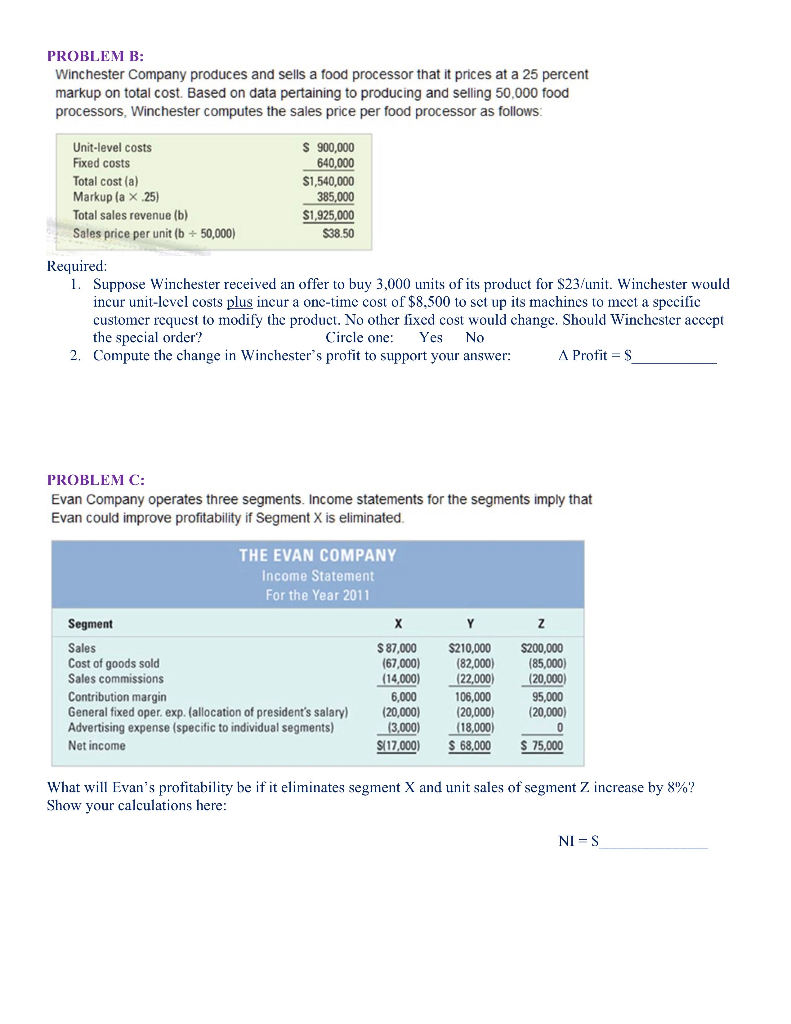

PROBLEM A: Romero Corporation makes and sells skateboards. Romero currently makes the 60,000 wheels used annually in its skateboards but has an opportunity to purchase the wheels from a reliable manufacturer. The costs of making the wheels follow. Annual Costs Associated with Manufacturing Skateboard Wheels Materials (60,000 units X $5) $300,000 Labor (60,000 units X $3) 180,000 Depreciation on manufacturing equipment 24,000 Salary of wheel production supervisor 65,000 Rental cost of equipment used to make wheels 55,000 Allocated portion of corporate-level facility-sustaining costs 33,000 Total cost to make 60,000 wheels $657,000 "The equipment has a book value of $74,000 but its market value is zero. Required a. Determine the maximum price per unit that Romero would be willing to pay for the wheels b. Would the price computed in Requirement a change if production were increased to 80,000 units? Support your answer with appropriate computations. PROBLEM B: Winchester Company produces and sells a food processor that it prices at a 25 percent markup on total cost. Based on data pertaining to producing and selling 50,000 food processors, Winchester computes the sales price per food processor as follows: Unit-level costs Fixed costs Total cost (a) Markup (a X.25) Total sales revenue (b) Sales price per unit (b + 50,000) $ 900,000 640,000 $1,540,000 385,000 $1,925.000 $38.50 Required: 1. Suppose Winchester received an offer to buy 3,000 units of its product for $23/unit. Winchester would incur unit-level costs plus incur a one-time cost of $8.500 to set up its machines to meet a specific customer request to modify the product. No other fixed cost would change. Should Winchester accept the special order? Circle one: Yes No 2. Compute the change in Winchester's profit to support your answer: A Profit = $ PROBLEM C: Evan Company operates three segments. Income statements for the segments imply that Evan could improve profitability if Segment X is eliminated. THE EVAN COMPANY Income Statement For the Year 2011 X Y Z Segment Sales Cost of goods sold Sales commissions Contribution margin General fixed oper. exp. (allocation of president's salary) Advertising expense (specific to individual segments) Net income $ 87,000 (67,000) (14,000) 6,000 (20,000) (3,000) S[17,000) $210,000 (82,000) (22,000) 106,000 (20,000) (18,000) $ 68,000 $200,000 (85,000) (20,000) 95,000 (20,000) 0 $ 75,000 What will Evan's profitability be if it eliminates segment X and unit sales of segment Z increase by 8%? Show your calculations here: NIS PROBLEM D: You are considering opening a new bar on Court Street. The initial necessary investment is $650,000. This investment has a projected salvage (or residual) value for tax purposes of $250,000. The government requires depreciating the remaining $370,000 using the straight-line method over 10 years. You project that the bar will generate cash flows of $720,000 in revenue, S380.000 in variable costs, and S240.000 in fixed costs. 1. Assume that you are exempt from income taxes and that you can sell the bar for $380,000 at the end of 10 years. Using a 10% discount rate, what is the internal rate of return of the investment in the bar? 2. Now assume that you subject to a 25% marginal tax rate and that the resale value is the same as in part 2. What is the net present value of the investment in the bar? Annual after-tax cash-flow: Net after-tax resale value from selling the assets at end of year 10: Net Present Value