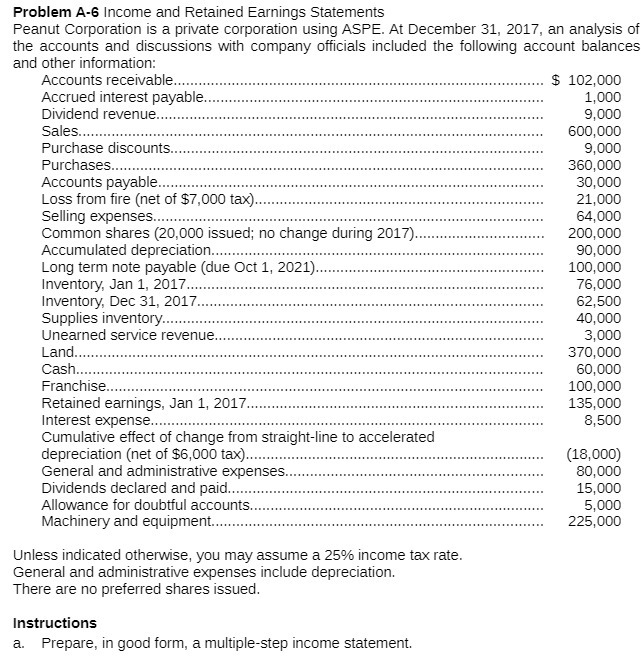

Problem A-6 Income and Retained Earnings Statements Peanut Corporation is a private corporation using ASPE. At December 31, 2017, an analysis of the accounts

Problem A-6 Income and Retained Earnings Statements Peanut Corporation is a private corporation using ASPE. At December 31, 2017, an analysis of the accounts and discussions with company officials included the following account balances and other information: Accounts receivable.... Accrued interest payable.. Dividend revenue.. Sales......... $ 102,000 1,000 9,000 600,000 Purchase discounts.. 9,000 Purchases........... 360,000 Accounts payable...... 30,000 Loss from fire (net of $7,000 tax). 21,000 Selling expenses........ 64,000 Common shares (20,000 issued; no change during 2017). 200,000 Accumulated depreciation....... 90,000 Long term note payable (due Oct 1, 2021). 100,000 Inventory, Jan 1, 2017...... 76,000 Inventory, Dec 31, 2017.. Supplies inventory........ 62,500 40,000 Unearned service revenue. 3,000 Land..... 370,000 Cash..... Franchise... Retained earnings, Jan 1, 2017. Interest expense......... 60,000 100,000 135,000 8,500 Cumulative effect of change from straight-line to accelerated depreciation (net of $6,000 tax)......... General and administrative expenses.. Dividends declared and paid.... Allowance for doubtful accounts.. (18,000) 80,000 15,000 5,000 225,000 Machinery and equipment....... Unless indicated otherwise, you may assume a 25% income tax rate. General and administrative expenses include depreciation. There are no preferred shares issued. Instructions a. Prepare, in good form, a multiple-step income statement.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Multiple step comprehensive income statement Particulars Amount ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started