Answered step by step

Verified Expert Solution

Question

1 Approved Answer

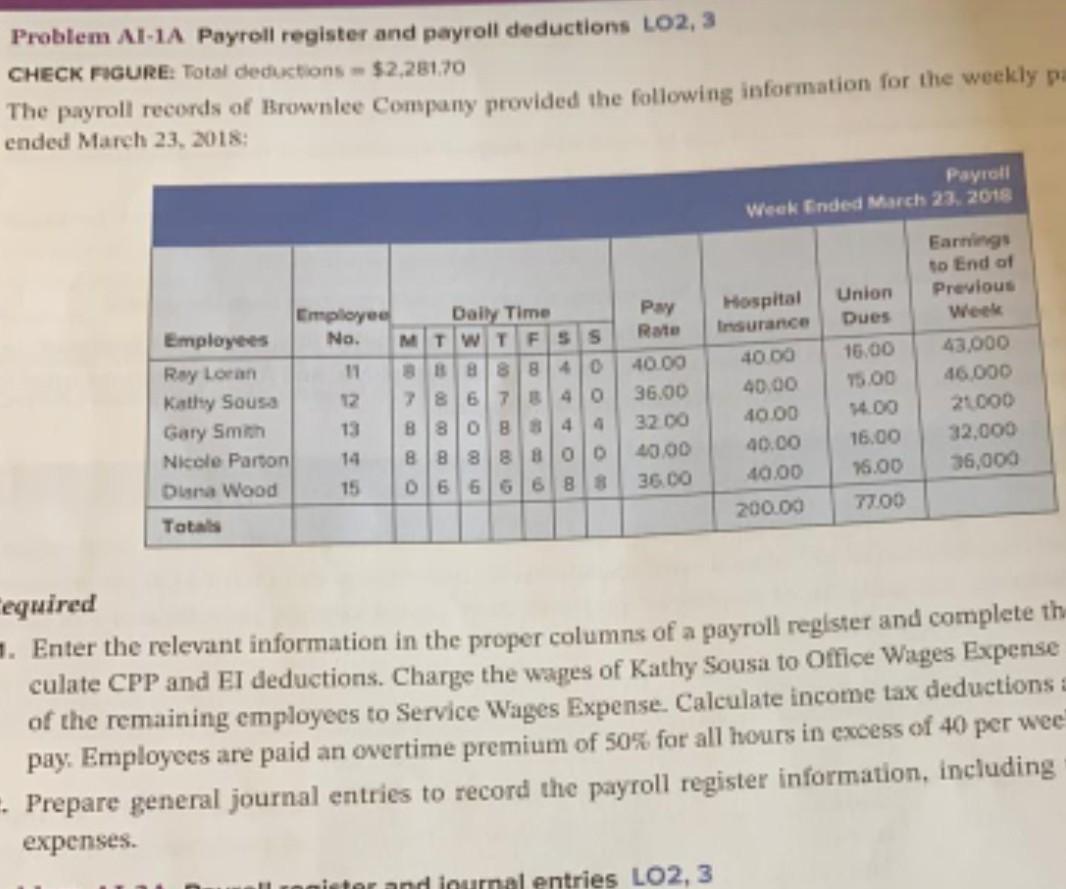

Problem Al-IA Payroll register and payroll deductions LO 2, 3 CHECK FIGURE: Total deductions - $2,281.70 The payroll records of Brownlee Company provided the following

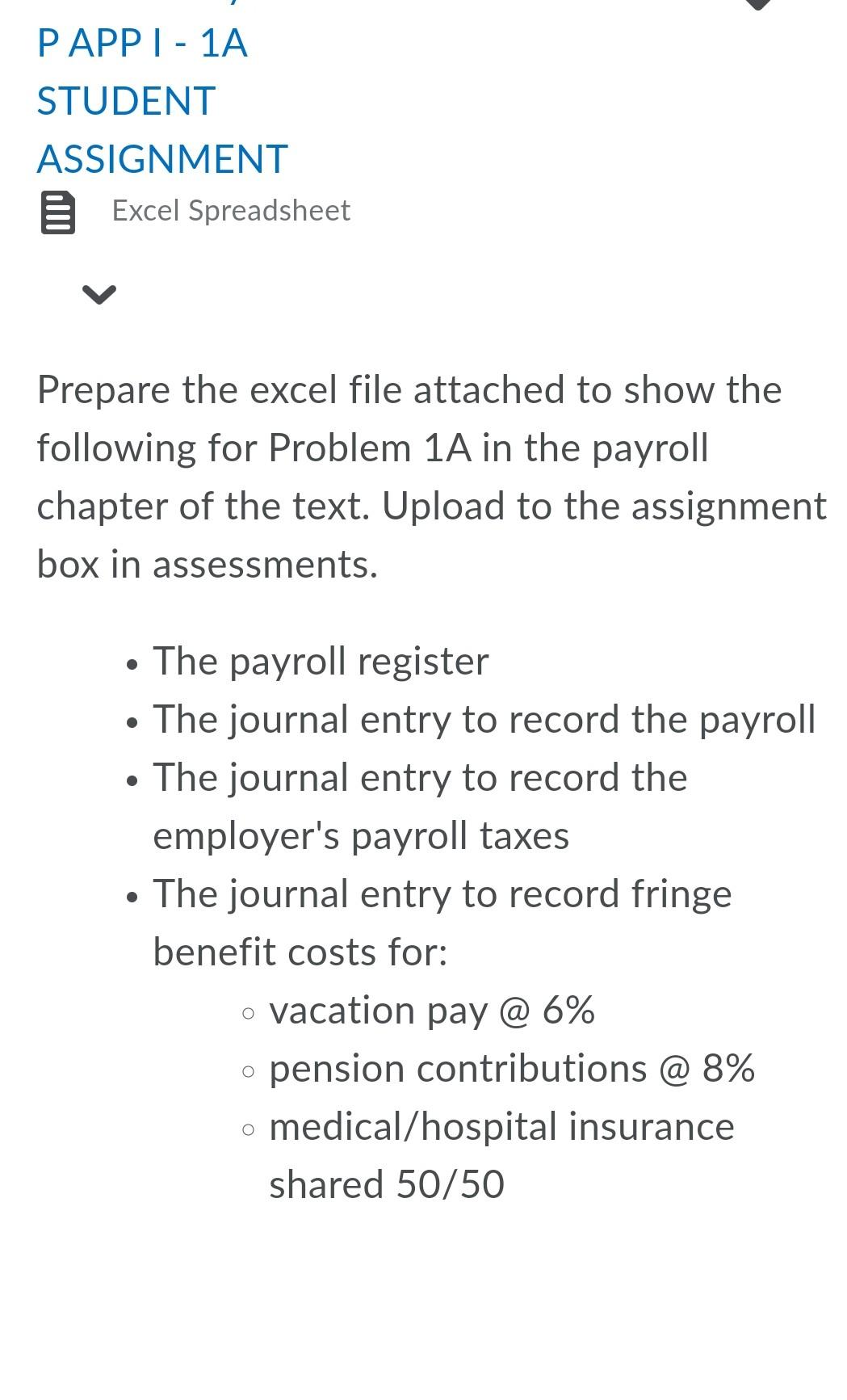

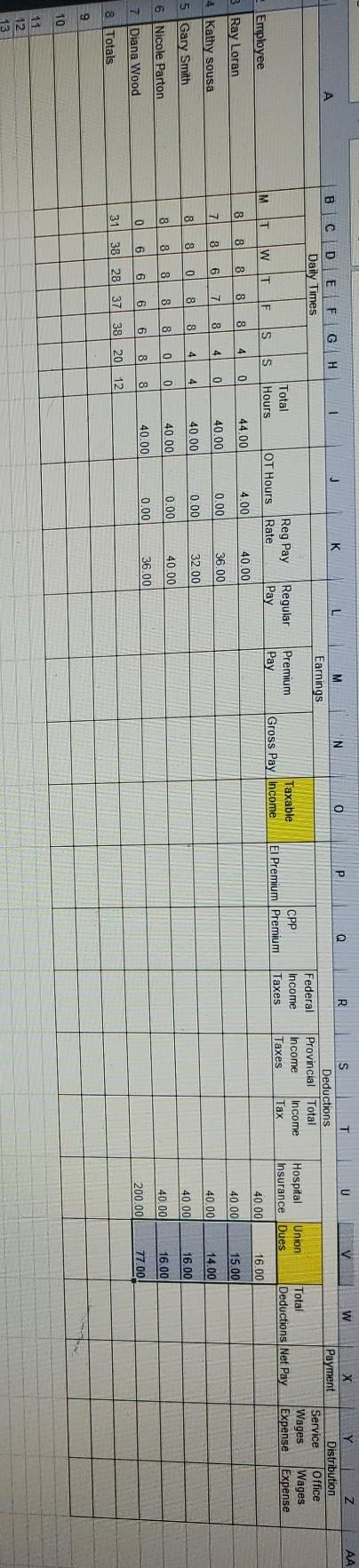

Problem Al-IA Payroll register and payroll deductions LO 2, 3 CHECK FIGURE: Total deductions - $2,281.70 The payroll records of Brownlee Company provided the following information for the weekly pa ended March 23, 2018: Payroll Week Ended March 23, 2018 Pay Rate Union Dues Employee Daily Time Employees No. M T W T F S S Ray Loan 11 BB 888 40 Kathy Sousa 12 Gary Smith 13 Nicole Parton 14 BB 800 Duna Wood 15 6 Hospital Insurance 40 00 40.00 40.00 40.00 40.00 40.00 36.00 32 00 40.00 36.CO Earnings to End of Previous Week 43,000 46.000 21 000 32,000 36,000 16.00 15.00 14.00 16.00 75.00 200.00 77.00 Tatas Fequired m. Enter the relevant information in the proper columns of a payroll register and complete the culate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense of the remaining employees to Service Wages Expense. Calculate income tax deductions a pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per wee 5. Prepare general journal entries to record the payroll register information, including expenses. nister and inurnal entries LO2, 3 PAPP | - 1A STUDENT ASSIGNMENT Excel Spreadsheet Prepare the excel file attached to show the following for Problem 1A in the payroll chapter of the text. Upload to the assignment box in assessments. The payroll register The journal entry to record the payroll The journal entry to record the employer's payroll taxes The journal entry to record fringe benefit costs for: o vacation pay @ 6% pension contributions @ 8% o medical/hospital insurance shared 50/50 O V W AA 0 R K Q 1 N G H 1 J A Payment D EF Daily Times Earnings Y Z Distribution Service Office Wages Wages Expense Expense S T Deductions Provincial Total Income Income Taxes Total Federal Income Taxes Premium Pay Regular Pay Reg Pay Rate Taxable Gross Pay Income CPP El Premium Premium Hospital Union Insurance Dues Total Deductions Net Pay IM T IF W IT IS IS Employee Hours OT Hours 40.00 16.00 8 8 8 8 A 8 0 40.00 44.00 4.00 40.00 15.00 8 8 0 4 7 7 36.00 40.00 0.00 Ray Loran 4 Kathy sousa 5 Gary Smith o colo 14.00 40.00 That 8 8 8 4 40.00 0.00 32.00 40.00 16.00 coco 8 8 8 8 0 40.00 40.00 0.00 6 Nicole Parton . 40.00 16.00 0 6 6 36.00 6 8 8 40.00 0.00 77.00 7 200.00 Diana Wood - colo N 31 38 28 37 12 8 Totals 9 10 12 13 Problem Al-IA Payroll register and payroll deductions LO 2, 3 CHECK FIGURE: Total deductions - $2,281.70 The payroll records of Brownlee Company provided the following information for the weekly pa ended March 23, 2018: Payroll Week Ended March 23, 2018 Pay Rate Union Dues Employee Daily Time Employees No. M T W T F S S Ray Loan 11 BB 888 40 Kathy Sousa 12 Gary Smith 13 Nicole Parton 14 BB 800 Duna Wood 15 6 Hospital Insurance 40 00 40.00 40.00 40.00 40.00 40.00 36.00 32 00 40.00 36.CO Earnings to End of Previous Week 43,000 46.000 21 000 32,000 36,000 16.00 15.00 14.00 16.00 75.00 200.00 77.00 Tatas Fequired m. Enter the relevant information in the proper columns of a payroll register and complete the culate CPP and El deductions. Charge the wages of Kathy Sousa to Office Wages Expense of the remaining employees to Service Wages Expense. Calculate income tax deductions a pay. Employees are paid an overtime premium of 50% for all hours in excess of 40 per wee 5. Prepare general journal entries to record the payroll register information, including expenses. nister and inurnal entries LO2, 3 PAPP | - 1A STUDENT ASSIGNMENT Excel Spreadsheet Prepare the excel file attached to show the following for Problem 1A in the payroll chapter of the text. Upload to the assignment box in assessments. The payroll register The journal entry to record the payroll The journal entry to record the employer's payroll taxes The journal entry to record fringe benefit costs for: o vacation pay @ 6% pension contributions @ 8% o medical/hospital insurance shared 50/50 O V W AA 0 R K Q 1 N G H 1 J A Payment D EF Daily Times Earnings Y Z Distribution Service Office Wages Wages Expense Expense S T Deductions Provincial Total Income Income Taxes Total Federal Income Taxes Premium Pay Regular Pay Reg Pay Rate Taxable Gross Pay Income CPP El Premium Premium Hospital Union Insurance Dues Total Deductions Net Pay IM T IF W IT IS IS Employee Hours OT Hours 40.00 16.00 8 8 8 8 A 8 0 40.00 44.00 4.00 40.00 15.00 8 8 0 4 7 7 36.00 40.00 0.00 Ray Loran 4 Kathy sousa 5 Gary Smith o colo 14.00 40.00 That 8 8 8 4 40.00 0.00 32.00 40.00 16.00 coco 8 8 8 8 0 40.00 40.00 0.00 6 Nicole Parton . 40.00 16.00 0 6 6 36.00 6 8 8 40.00 0.00 77.00 7 200.00 Diana Wood - colo N 31 38 28 37 12 8 Totals 9 10 12 13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started