Answered step by step

Verified Expert Solution

Question

1 Approved Answer

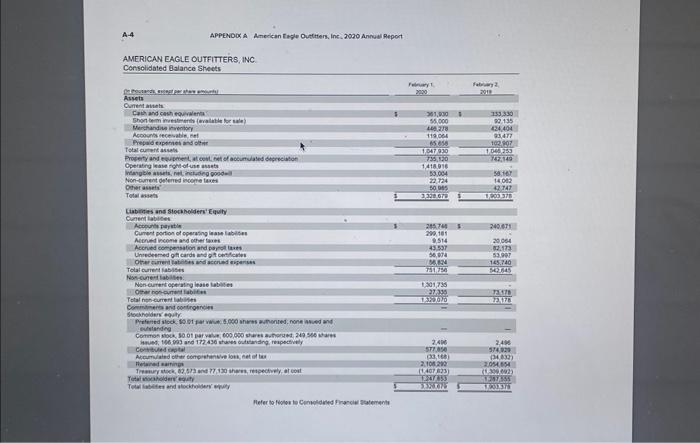

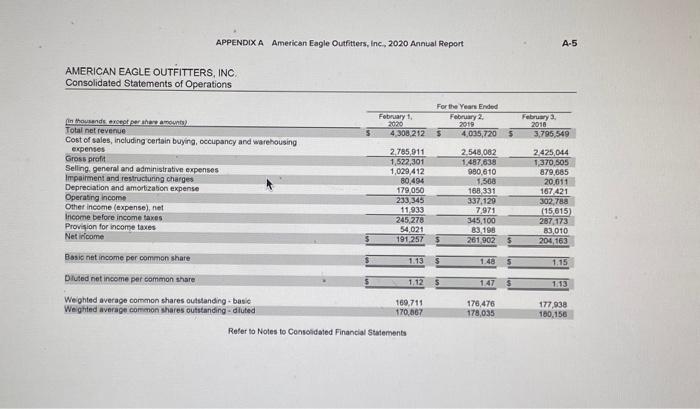

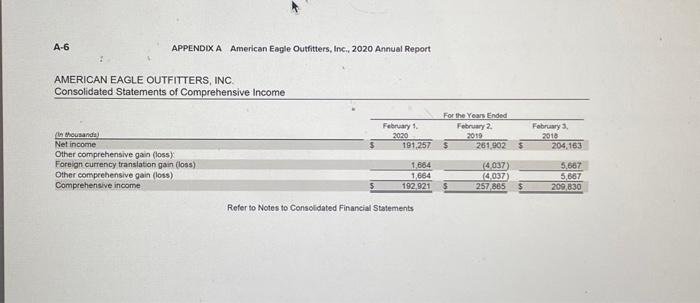

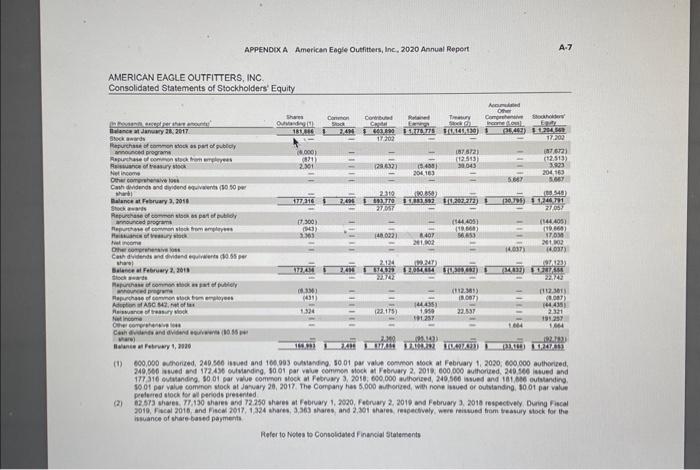

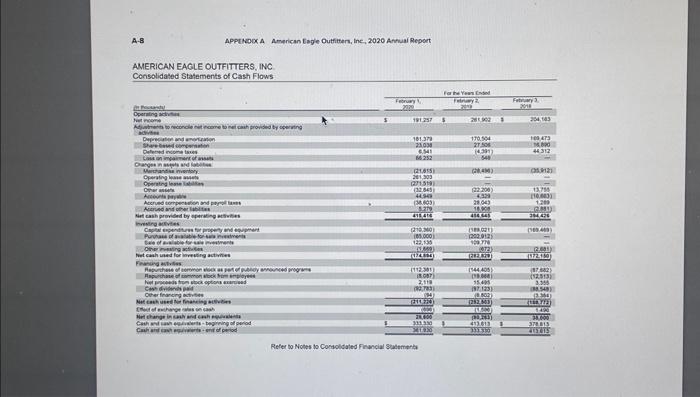

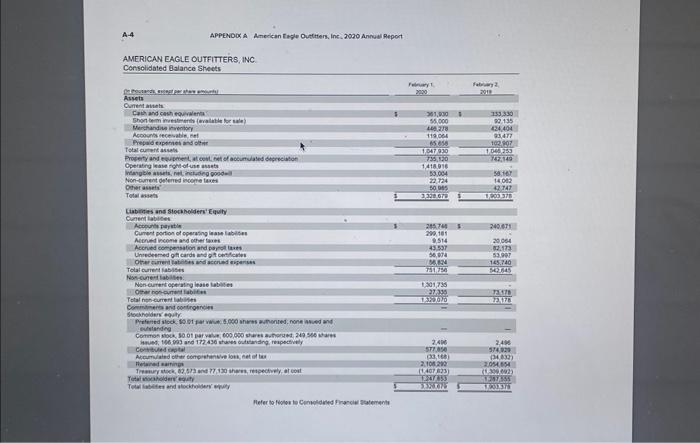

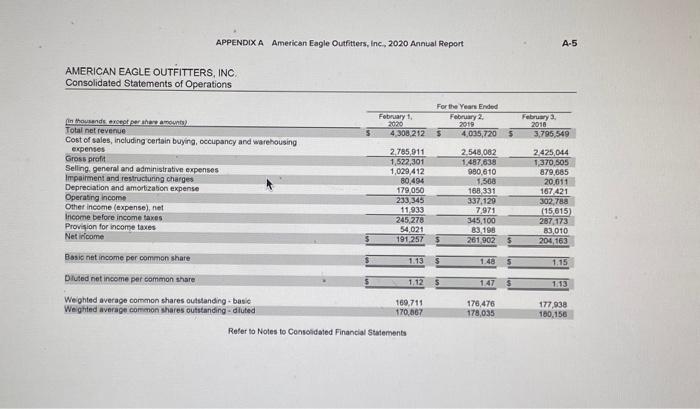

problem- APPENOox A Ameckan taple Outtiers. Ine. 2090 AnNual Report FITTERS INC. APPENDIX A American Eagle Outfitters, inc, 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC

problem-

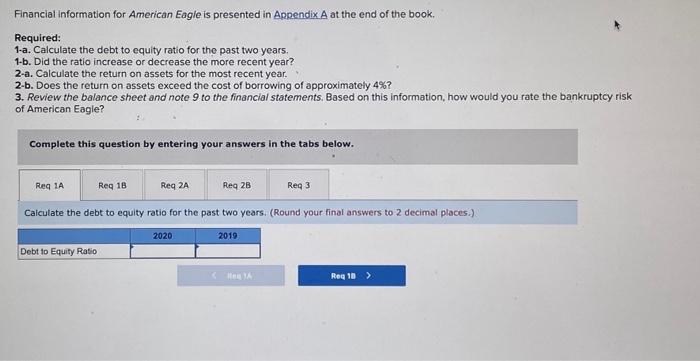

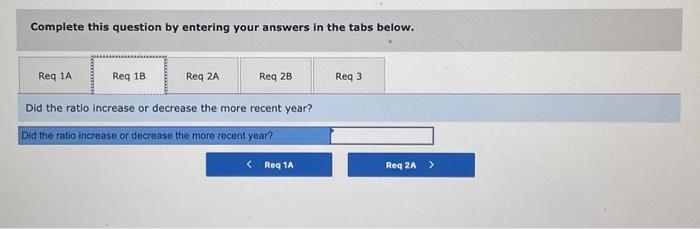

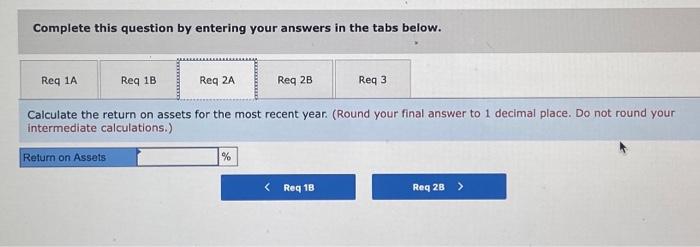

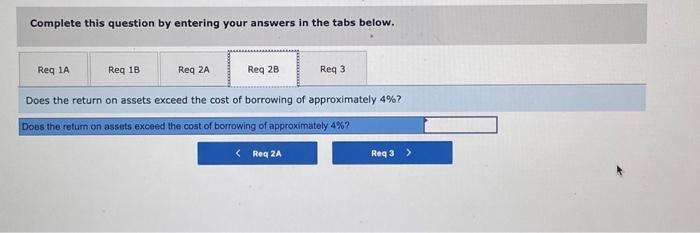

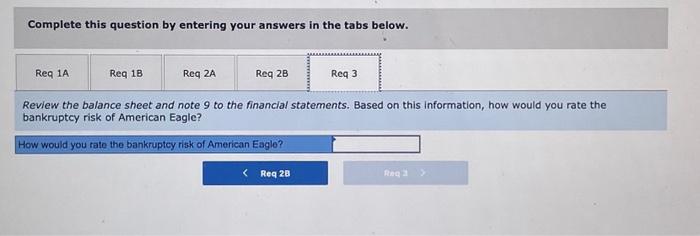

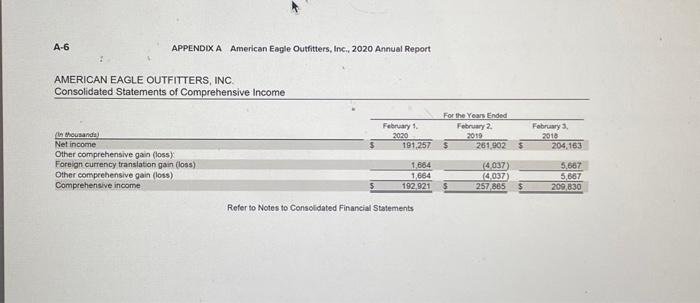

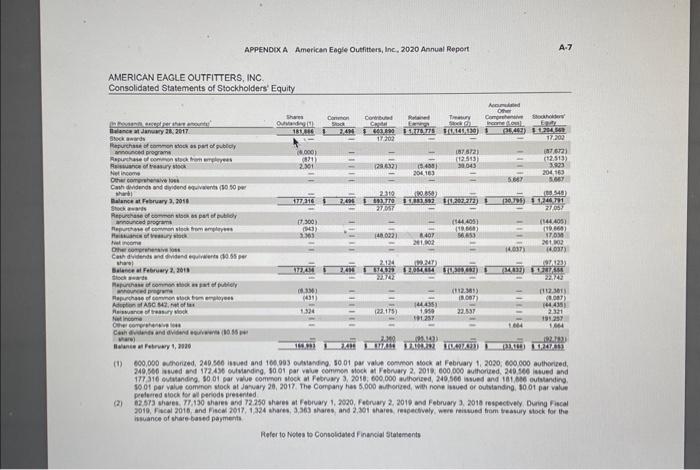

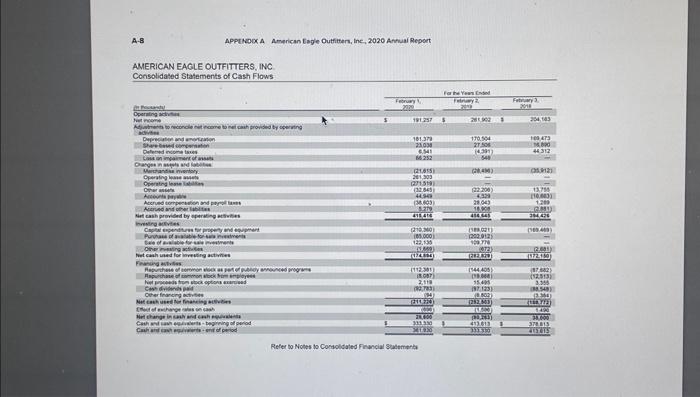

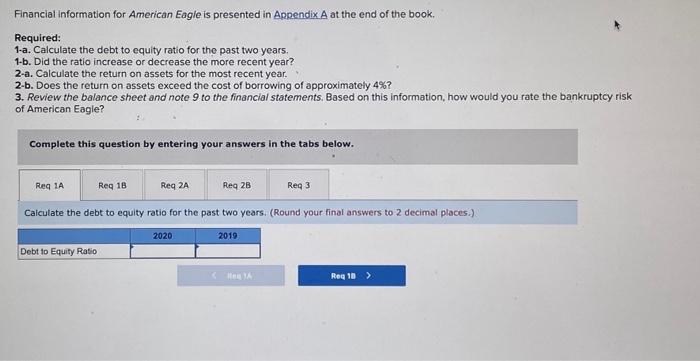

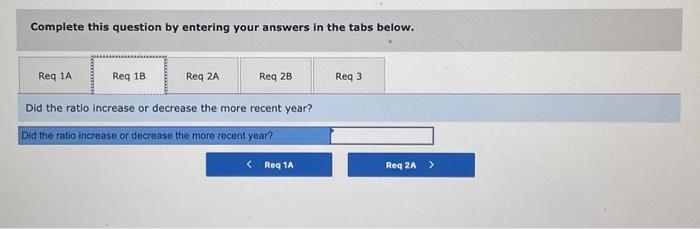

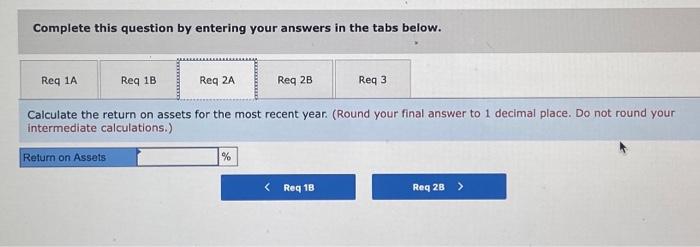

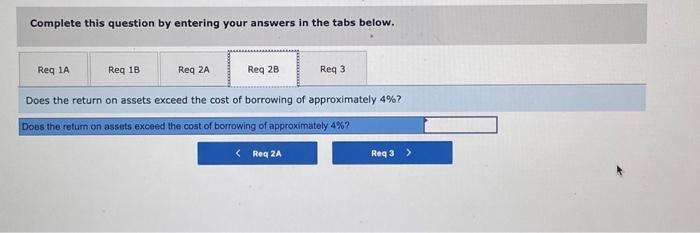

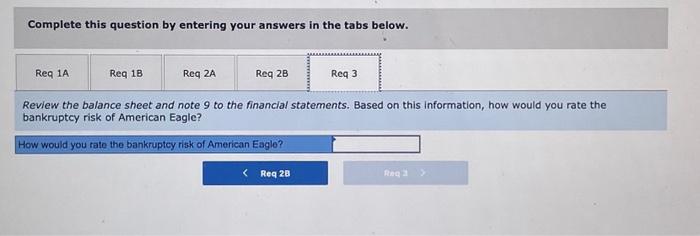

APPENOox A Ameckan taple Outtiers. Ine. 2090 AnNual Report FITTERS INC. APPENDIX A American Eagle Outfitters, inc, 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations Reter to Notes to Consolidated Financial Statements Refer to Notes to Consoldated Financial Stafements APPENOOXA American Eagle Outhitters, Inc, 2020 Annual Report A. 7 AMERICAN EAGLE OUTFITTERS, INC. 10 of par value comren stock at Jarvary 20, 2017. The Company hat 6,000 moterend, wiel none isued or ovtitanding, 10 or par value pectered stock far al perieds preteried (2) 2010, facal 2016 ind fiacd 2017,1,224 thares, 3.363 thares and 2,361 thares, feapectuely, were feisued fom treasury stock for the savance of shave based paymerts Fefer to Notes to Consoldened f in moial Stalements Refer bo Nobes to Comoldaled Finmeial Eealemerta Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1-a. Calculate the debt to equity ratio for the past two years. 1-b. Did the ratio increase or decrease the more recent year? 2-a. Calculate the return on assets for the most recent year. 2-b. Does the return on assets exceed the cost of borrowing of approximately 4% ? 3. Review the balance sheet and note 9 to the financial statements. Based on this information, how would you rate the bankruptcy risk of American Eagle? Complete this question by entering your answers in the tabs below. Caiculate the debt to equity ratio for the past two years. (Round your final answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. Did the ratio increase or decrease the more recent year? Did the ratio increase or decrease the more recent year? Complete this question by entering your answers in the tabs below. Calculate the return on assets for the most recent year. (Round your final answer to 1 decimal place. Do not round your intermediate calculations.) Complete this question by entering your answers in the tabs below. Does the return on assets exceed the cost of borrowing of approximately 4% ? Does the retum on assets exceed the cost of borrowing of approximately 4% ? Complete this question by entering your answers in the tabs below. Review the balance sheet and note 9 to the financial statements. Based on this information, how would you rate the bankruptcy risk of American Eagle? How would you tate the bankruptcy risk of American Eagle? APPENOox A Ameckan taple Outtiers. Ine. 2090 AnNual Report FITTERS INC. APPENDIX A American Eagle Outfitters, inc, 2020 Annual Report AMERICAN EAGLE OUTFITTERS, INC Consolidated Statements of Operations Reter to Notes to Consolidated Financial Statements Refer to Notes to Consoldated Financial Stafements APPENOOXA American Eagle Outhitters, Inc, 2020 Annual Report A. 7 AMERICAN EAGLE OUTFITTERS, INC. 10 of par value comren stock at Jarvary 20, 2017. The Company hat 6,000 moterend, wiel none isued or ovtitanding, 10 or par value pectered stock far al perieds preteried (2) 2010, facal 2016 ind fiacd 2017,1,224 thares, 3.363 thares and 2,361 thares, feapectuely, were feisued fom treasury stock for the savance of shave based paymerts Fefer to Notes to Consoldened f in moial Stalements Refer bo Nobes to Comoldaled Finmeial Eealemerta Financial information for American Eagle is presented in Appendix A at the end of the book. Required: 1-a. Calculate the debt to equity ratio for the past two years. 1-b. Did the ratio increase or decrease the more recent year? 2-a. Calculate the return on assets for the most recent year. 2-b. Does the return on assets exceed the cost of borrowing of approximately 4% ? 3. Review the balance sheet and note 9 to the financial statements. Based on this information, how would you rate the bankruptcy risk of American Eagle? Complete this question by entering your answers in the tabs below. Caiculate the debt to equity ratio for the past two years. (Round your final answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. Did the ratio increase or decrease the more recent year? Did the ratio increase or decrease the more recent year? Complete this question by entering your answers in the tabs below. Calculate the return on assets for the most recent year. (Round your final answer to 1 decimal place. Do not round your intermediate calculations.) Complete this question by entering your answers in the tabs below. Does the return on assets exceed the cost of borrowing of approximately 4% ? Does the retum on assets exceed the cost of borrowing of approximately 4% ? Complete this question by entering your answers in the tabs below. Review the balance sheet and note 9 to the financial statements. Based on this information, how would you rate the bankruptcy risk of American Eagle? How would you tate the bankruptcy risk of American Eagle

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started