Answered step by step

Verified Expert Solution

Question

1 Approved Answer

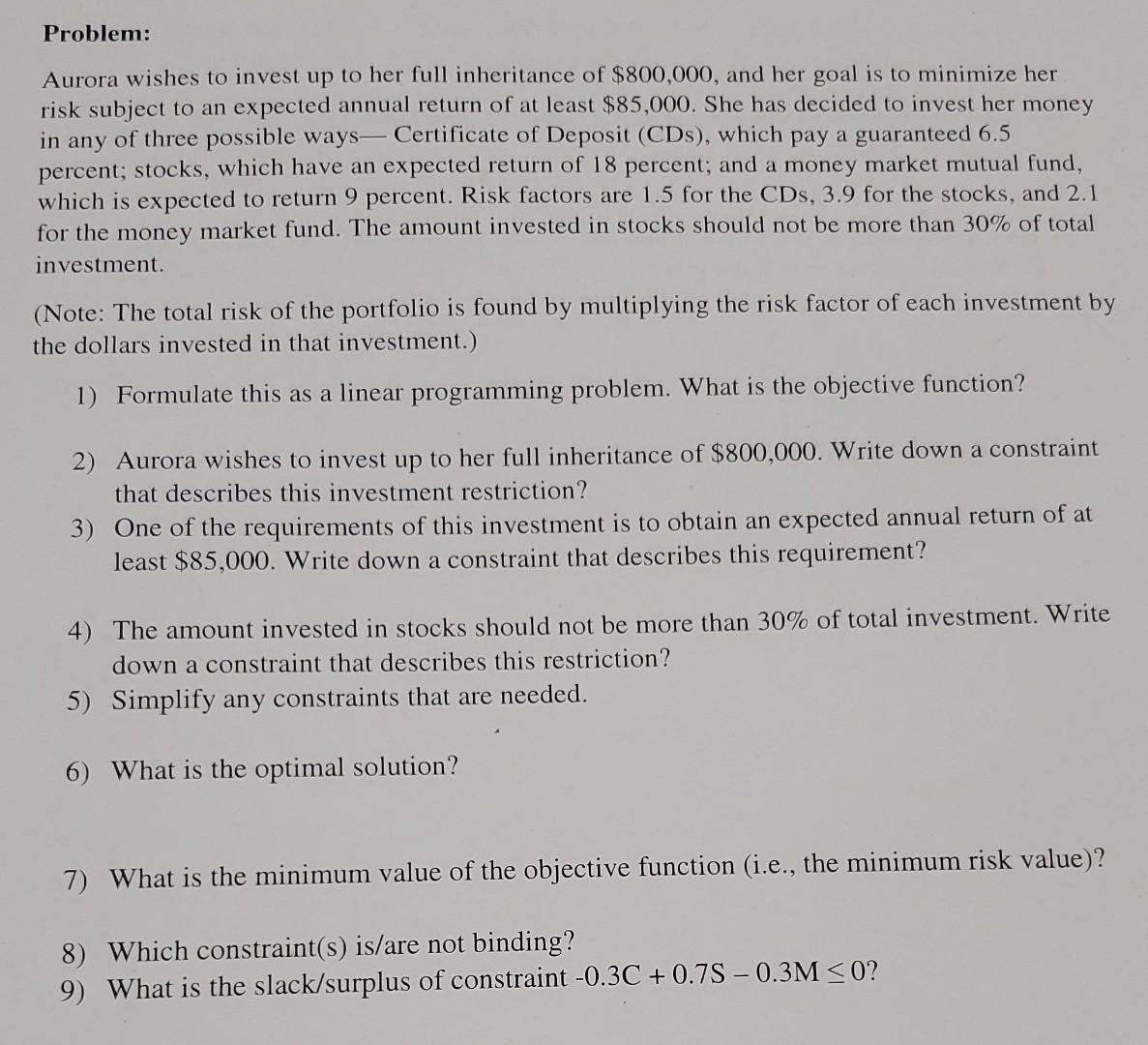

Problem: Aurora wishes to invest up to her full inheritance of $800,000, and her goal is to minimize her risk subject to an expected annual

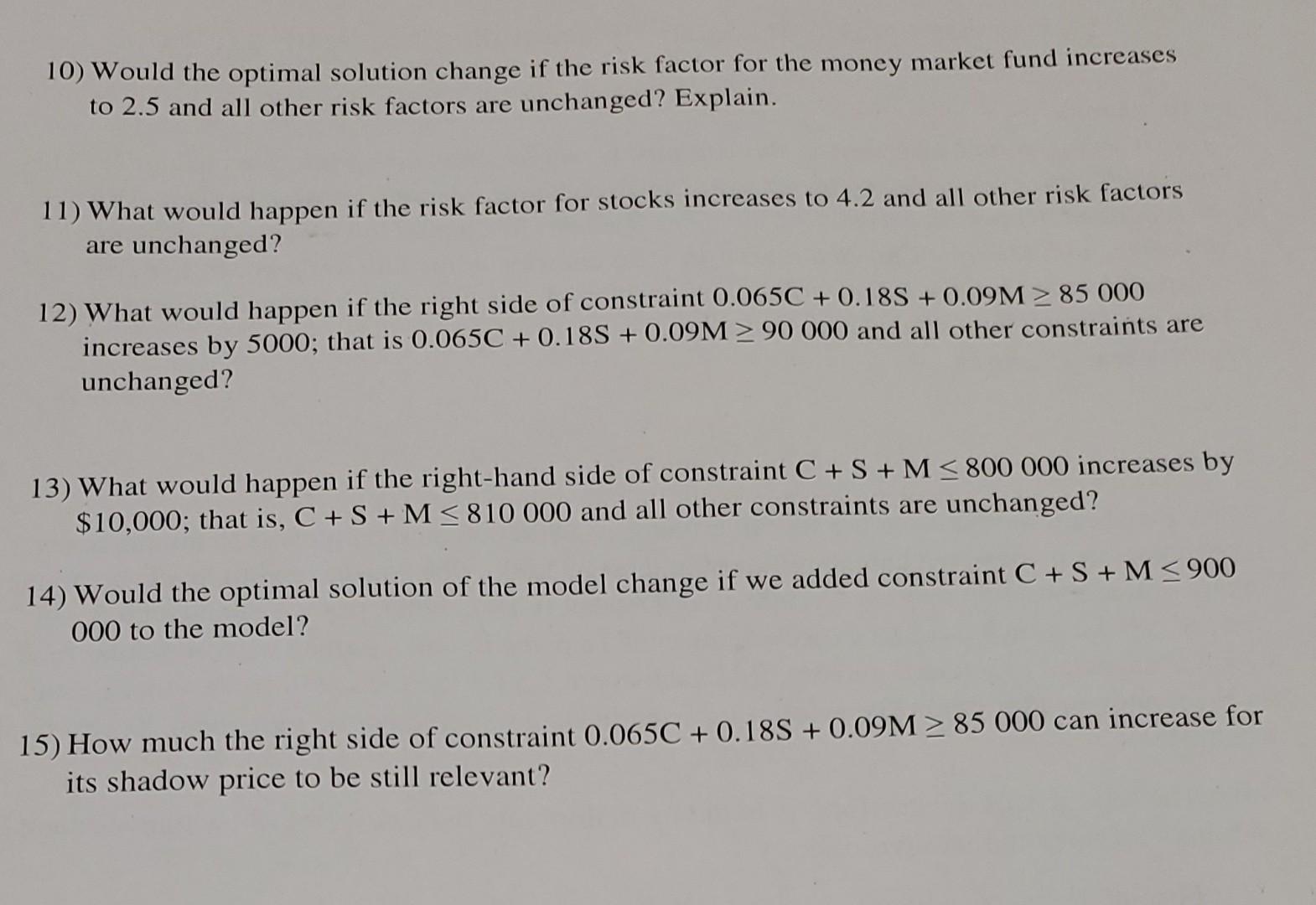

Problem: Aurora wishes to invest up to her full inheritance of $800,000, and her goal is to minimize her risk subject to an expected annual return of at least $85,000. She has decided to invest her money in any of three possible ways- Certificate of Deposit (CDs), which pay a guaranteed 6.5 percent; stocks, which have an expected return of 18 percent; and a money market mutual fund, which is expected to return 9 percent. Risk factors are 1.5 for the CDs, 3.9 for the stocks, and 2.1 for the money market fund. The amount invested in stocks should not be more than 30% of total investment. (Note: The total risk of the portfolio is found by multiplying the risk factor of each investment by the dollars invested in that investment.) 1) Formulate this as a linear programming problem. What is the objective function? 2) Aurora wishes to invest up to her full inheritance of $800,000. Write down a constraint that describes this investment restriction? 3) One of the requirements of this investment is to obtain an expected annual return of at least $85,000. Write down a constraint that describes this requirement? 4) The amount invested in stocks should not be more than 30% of total investment. Write down a constraint that describes this restriction? 5) Simplify any constraints that are needed. 6) What is the optimal solution? 7) What is the minimum value of the objective function (i.e., the minimum risk value)? 8) Which constraint(s) is/are not binding? 9) What is the slack/surplus of constraint 0.3C+0.7S0.3M0 ? 10) Would the optimal solution change if the risk factor for the money market fund increases to 2.5 and all other risk factors are unchanged? Explain. 11) What would happen if the risk factor for stocks increases to 4.2 and all other risk factors are unchanged? 12) What would happen if the right side of constraint 0.065C+0.18S+0.09M85000 increases by 5000 ; that is 0.065C+0.18S+0.09M90000 and all other constraints are unchanged? 13) What would happen if the right-hand side of constraint C+S+M800000 increases by $10,000; that is, C+S+M810000 and all other constraints are unchanged? 14) Would the optimal solution of the model change if we added constraint C+S+M900 000 to the model? 5) How much the right side of constraint 0.065C+0.18S+0.09M85000 can increase for its shadow price to be still relevant

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started