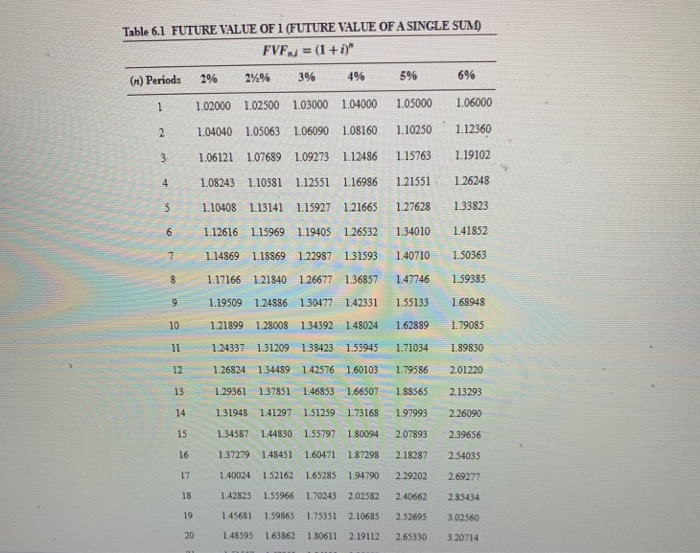

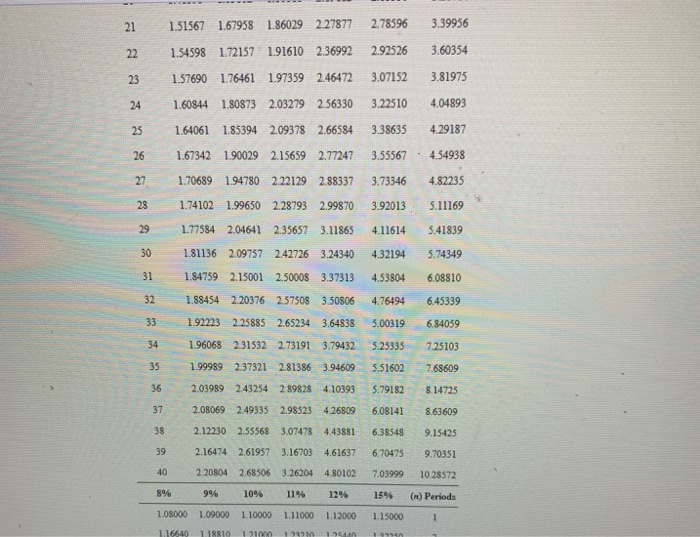

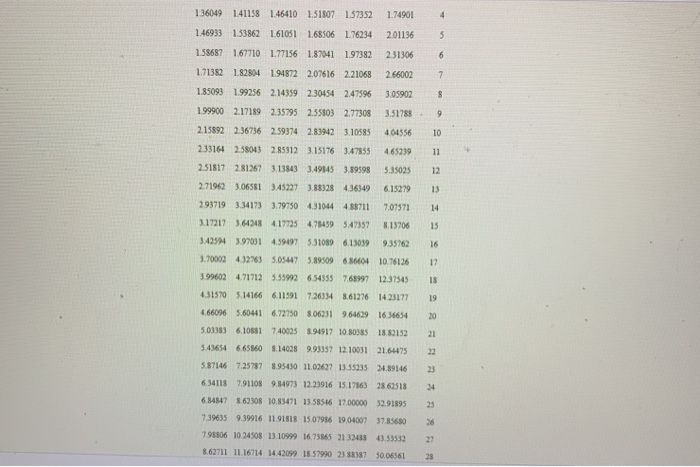

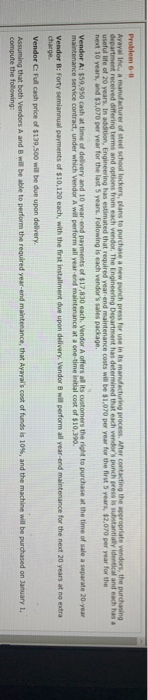

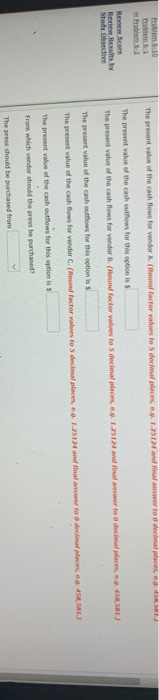

Problem - Ayeyalina manufacturer we wchool lockers to purchase a new unchpress for mange them the propriate and the changed offering terms and who the Engineering Department has determined that each vender's christianach has 12.00 per year for the years, and $3.00 per year for the last years. Following schender's wespe of 20 years in these year and Vendor A 33,50 Cash time of delivery and 10 year end me of $17.00. Vendor Antelor the right to post the time 35-varmacoch der Ausland maintenance ane-mental cost of $10.30 Vendor Bi Forty mal payments of $1,120 each, with the first installment de pon delivery, Vendor will performs alerende for the rest years at the Vendor cash price of $129.500 eue pon delivery keturing that both Vendor A und will be able to perform the recured year and maintenance, that hava/scout of funds 10%, and the machine will be purchased on January 1, compute the line Click here to states The present value of the cash flows for vender A. (Round Hector values to 3 decimal pemand folders 458.381) The present value of the cash out for this option is The present value of the cash flows for vendor (Hound facer values te decimal places a 3. 1.25122 and answer to deal places) The present value of the cash outflows for this option is The presentate of the cash flows for vender C. (Round lacher values to 3 decimal places os. 1.23124 and Boulevere decolle 128) The present value of the cash flows for the options From which vendor should the press be purchased! The press should be purchased from Click you would like to Shew Work for this question and Que Attempt of used Table 6.1 FUTURE VALUE OF 1 (FUTURE VALUE OF A SINGLE SUM FVF = (1+1)" 2% 24% 3% (r) Periods 49 5% 6% 1 1.02000 1.02500 1.03000 1.04000 1.05000 1.06000 2 1.04040 1.05063 1.06090 1.08160 1.10250 1.12360 3 1.06121 1.07689 1.09273 1.12486 1.15763 1.19102 4 1.08243 1.10381 1.12551 1.16986 1.21551 1.26248 5 1.10408 1.13141 1.15927 1.21665 1.27628 1.33823 6 1.12616 1.15969 1.19405 1.26532 1.34010 1.41852 7 1.14869 1.18869 1.22987 1.31593 1.40710 1.50363 8 1.17166 1.21840 1.26677 1.36857 1.47746 1.59385 9 1.19509 1.24886 1.30477 1.42331 1.55133 1.68948 10 1.21899 1.28008 1.34392 1.48024 1.62889 1.79085 11 1.24337 1.31209 1.38423 1.53945 1.71034 1.89830 12 1.26824 1.34489 1.42576 1.60103 1.79586 2.01220 13 1.29361 1.37851 1.46853 1.66507 1.88565 2.13293 14 1.31948 1.41297 1.51259 1.73168 1.97993 2.26090 15 1.34587 1.44830 1.55797 1.80094 2.07893 2.39656 16 1.37279 1.48451 1.60471 1.87298 2.18287 2.54035 17 1.40024 1.52162 1.65285 1.94790 2.29202 2.69272 18 1.42825 1.55966 1.70243 2.02582 2.40662 2.85434 19 1.45681 1.59865 1.75351 2.10685 2.52695 3.02560 20 1.48595 1.63862 1.80611 2.19112 2.65330 3.20714 21 1.51567 1.67958 1.86029 2.27877 2.78596 3.39956 22 1.54598 1.72157 1.91610 2.36992 2.92526 3.60354 23 1.57690 1.76461 1.97359 2.46472 3.07152 3.81975 24 1.60844 1.80873 2.03279 2.56330 3.22510 4.04893 25 1.64061 1.85394 2.09378 2.66584 3.38635 4.29187 26 1.67342 1.90029 2.15659 2.77247 3.55567 4.54938 27 1.70689 1.94780 2.22129 2.88337 3.73346 4.82235 28 1.741021.99650 2.28793 2.99870 3.92013 5.11169 29 1.77584 2.04641 2.35657 3.11865 4.11614 5.41839 30 1.81136 2.09757 2.42726 3.24340 4.32194 5.74349 31 1.84759 2.15001 2.50008 3.37313 4.53804 6.08810 32 1.88454 2.20376 2.57508 3.50806 4.76494 6.45339 33 1.92223 2.25885 2.65234 3.64838 5.00319 6.84059 34 1.96068 2.31532 2.73191 3.79432 5.25335 7.25103 35 1.99989 2.37321 2.81386 3.94609 5.51602 7.68609 36 2.03989 2.43254 2.89828 4.10393 5.79182 8.14725 37 2.08069 2.49335 2.98523 4.26809 6.08141 8.63609 38 2.12230 2.55568 3.07478 4.43881 6.38548 9.15425 39 2.16474 2.61957 3.16703 4.61637 6,70475 9.70351 40 2.20804 2.68506 3.26204 4.80102 7.03999 10.28572 8% 9% 10% 11% 1296 15% (n) Periods 1.08000 1.09000 1.10000 1.11000 1.12000 1.15000 1 1.16640 1.18810 1 21 12210 1951 1934 1.36049 1.41158 1.46410 1.51807 1.57352 1.74901 4 1.46933 1.53862 161051 1.68506 1.76234 2.01136 5 158687 167710 1.77156 1.87041 1.97382 2.31306 6 171382 182804 1.94872 2.07616 2.21068 2.66002 7 8 9 10 11 12 13 14 15 16 17 1.85093 1.99256 2.14359 2.30454 2.47596 3.05902 1.99900 2.17189 2.35795 2.55803 2.77308 3.51788 2.15892 2.36736 2.59374 2.839423.10585 404556 2.33164 2.58043 285312 3.151763.47855 4.65239 2.31817 281267 3.13543 3.49345 3.89598 5.35025 2.71962 3.06581 3.45227 3.88328 4.36349 6.15279 293719 3.34173 3.79750 4.31044488711 7.07571 3.17217364248 4.17725 4.75459 547357 8.13706 3425243.970314.59497 3.31089 6.13039 9.35762 3.70002432763 5.05447 5.89509636604 10.76126 3.99602471712 5.55992654355 7.68997 12.37545 4.31570 5.14166 6.11591726334 8.61276 14.23177 4.66096 5.6041 6.72750 8063319.646291634654 5.03383 6.10851740025 8.94917 10.8038518.82152 5.43654 6.65860 8.140289.93357 12.10031 21.64475 5.871467257878.95430 11.02627 13.55235 34.89146 6.34118 791108 9.84973 12.23916 15.17363 28 62518 6.84847 8.62308 10.83471 13.58546 17.0000032.91895 7.396359.39916 11.91818 15.07956 19.0400737.85680 795806 10.24508 13.10999 16.75865 2132433 43.53532 8.62711 11.16714 14.42099 18.57990 23 88387 $0.06561 18 19 20 21 34 25 26 27 28 Problem - Avayal Inca manufacturer of steel school lockers, plans to purchase a new punch press for use in its manufacturing process. After contacting the appropriate vendors, the purchasing department received differing terms and options from each vendor, The Engineering Department has determined that each vendor's punch press is substantially identical and each has a useful life of 20 years. In addition, Engineering has estimated that required year end maintenance costs will be $1,070 per year for the first years, $2,070 per year for the next 10 years, and $3,070 per year for the last 5 years. Following is each vendor's sales package Vendor A: $59.950 cash at time of delivery and 10 year end payments of $17,830 each. Vendor A offers all its customers the right to purchase at the time of sale a separate 20-year maintenance service contract, under which Vendor A will perform all year end maintenance at a one time Initial cost of $10,390. Vendor 8: Forty semiannual payments of $10,120 each, with the first installment due upon delivery. Vendor will perform all year-end maintenance for the next 20 years at no extra charge. Vendor C: Full cash price of $139,500 will be due upon delivery Assuming that both Vendors A and B will be able to perform the required year-end maintenance, that awal's cost of funds is 10%, and the machine will be purchased on January 1, compute the following: The present value of the cash flows for vendor A. (round factor values to decimal places and finalanswer to decals Problem Problem 62 Review Score Review Results Studente The present value of the cash outflows for this option is $ The present value of the cash flows for vendor B. (Hound factor values to decimal places 1.25124 and final answer to decimal places, ...) The present value of the cash outflows for this option is The present value of the cash flows for vendor C. (Round factor values to 5 decimal places, 0.9. 1.25124 and final answer to o decimal loces, . 158.5*1.) The present value of the cash outflows for this option is From which vendor should the press be purchased The press should be purchased from