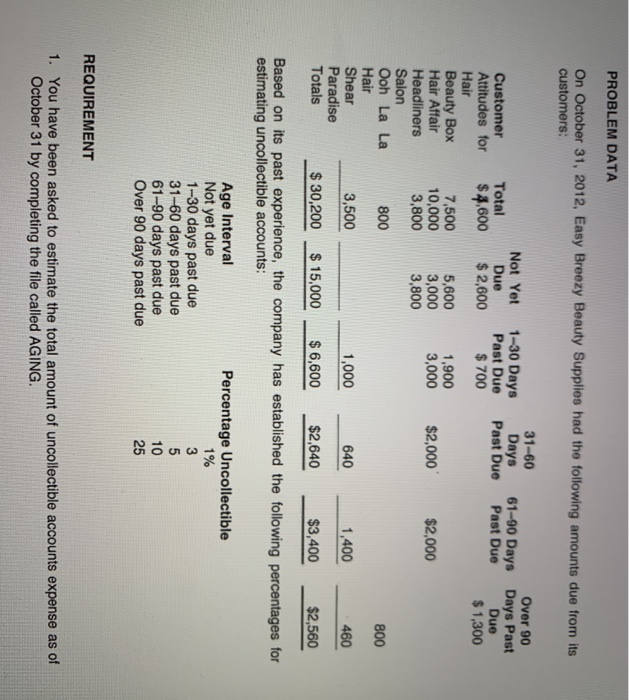

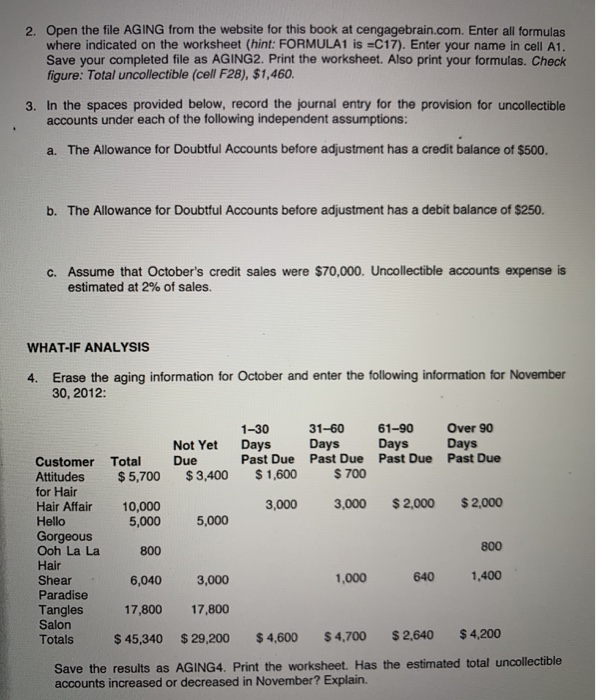

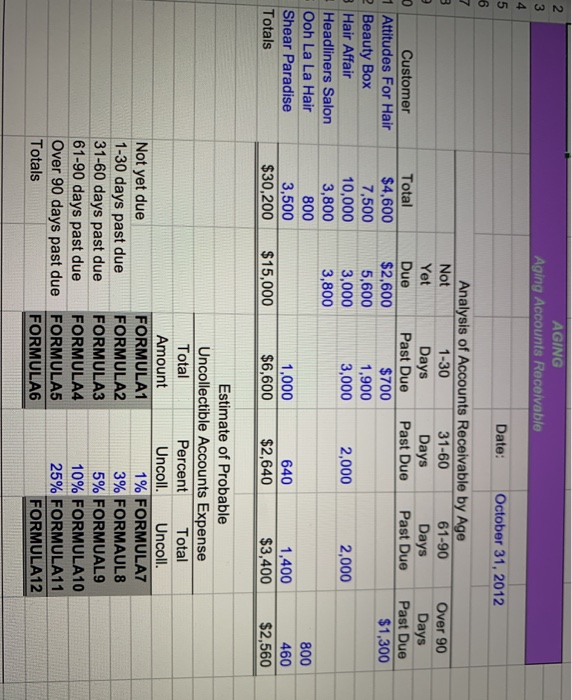

PROBLEM DATA On October 31, 2012, Easy Breezy Beauty Supplies had the following amounts due from its customers: Not Yet Due $ 2,600 Total $4,600 31-60 Days Past Due 1-30 Days Past Due $ 700 Over 90 61-90 Days Days Past Past Due Due $ 1,300 7,500 10,000 3,800 5,600 3,000 3,800 1,900 3,000 $2,000 Customer Attitudes for Hair Beauty Box Hair Affair Headliners Salon Ooh La La Hair Shear Paradise Totals $2,000 800 800 3,500 1,000 640 1,400 460 $ 30,200 $ 15,000 $ 6,600 $2,640 $3,400 $2,560 Based on its past experience, the company has established the following percentages for estimating uncollectible accounts: Age Interval Not yet due 1-30 days past due 31-60 days past due 61-90 days past due Over 90 days past due Percentage Uncollectible 1% 3 5 10 25 REQUIREMENT 1. You have been asked to estimate the total amount of uncollectible accounts expense as of October 31 by completing the file called AGING. 2. Open the file AGING from the website for this book at cengagebrain.com. Enter all formulas where indicated on the worksheet (hint: FORMULA1 is =C17). Enter your name in cell A1. Save your completed file as AGING2. Print the worksheet. Also print your formulas. Check figure: Total uncollectible (cell F28), $1,460. 3. In the spaces provided below, record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. The Allowance for Doubtful Accounts before adjustment has a credit balance of $500. b. The Allowance for Doubtful Accounts before adjustment has a debit balance of $250. C. Assume that October's credit sales were $70,000. Uncollectible accounts expense is estimated at 2% of sales. WHAT-IF ANALYSIS 4. Erase the aging information for October and enter the following information for November 30, 2012: 1-30 31-60 61-90 Over 90 Days Days Days Days Past Due Past Due Past Due Past Due $1,600 $ 700 Not Yet Due $3,400 Total $ 5,700 3,000 3,000 $ 2,000 $ 2,000 10,000 5,000 5,000 Customer Attitudes for Hair Hair Affair Hello Gorgeous Ooh La La Hair Shear Paradise Tangles Salon Totals 800 800 6,040 3,000 1,000 640 1,400 17,800 17,800 $ 45,340 $ 29,200 $ 4,600 $4,700 $ 2,640 $4,200 Save the results as AGING4. Print the worksheet. Has the estimated total uncollectible accounts increased or decreased in November? Explain. AGING Aging Accounts Receivable 3 4 5 6 Date: October 31, 2012 Over 90 Days Past Due $1,300 Customer 1 Attitudes For Hair 2 Beauty Box 3 Hair Affair Headliners Salon Ooh La La Hair Shear Paradise Totals Analysis of Accounts Receivable by Age Not 1-30 31-60 61-90 Yet Days Days Days Due Past Due Past Due Past Due $2,600 $700 5,600 1,900 3,000 3,000 2,000 2,000 3,800 Total $4,600 7,500 10,000 3,800 800 3,500 $30,200 1,000 $6,600 640 $2,640 $15,000 800 460 $2,560 1,400 $3,400 Estimate of Probable Uncollectible Accounts Expense Total Percent Total Amount Uncoll. Uncoll. Not yet due FORMULA1 1% FORMULA7 1-30 days past due FORMULA2 3% FORMAUL8 31-60 days past due FORMULA3 5% FORMUALS 61-90 days past due FORMULA 10% FORMULA10 Over 90 days past due FORMULA5 25% FORMULA11 Totals FORMULA6 FORMULA12