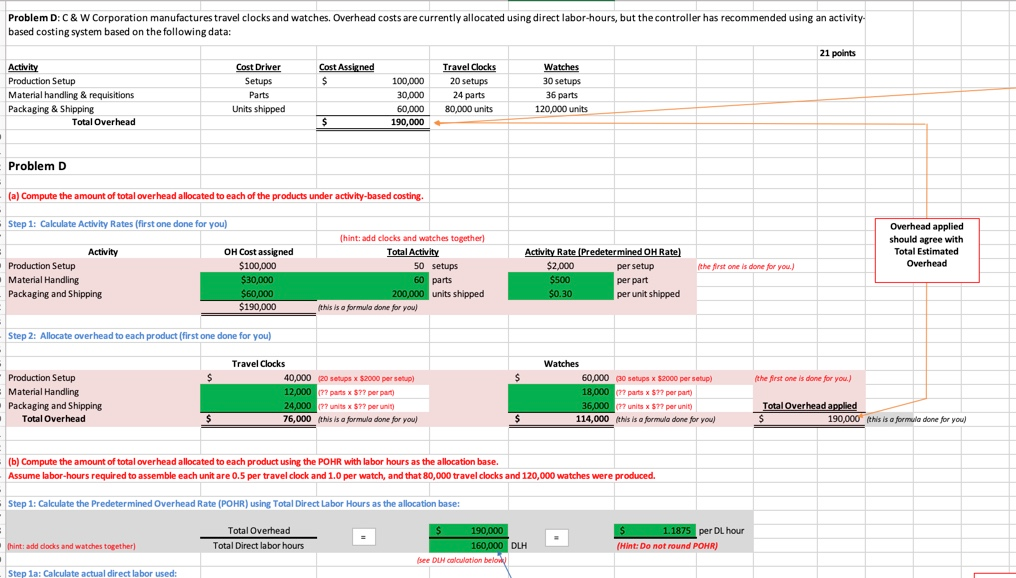

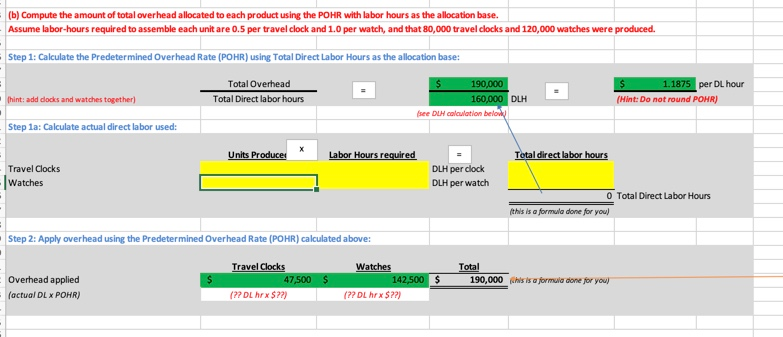

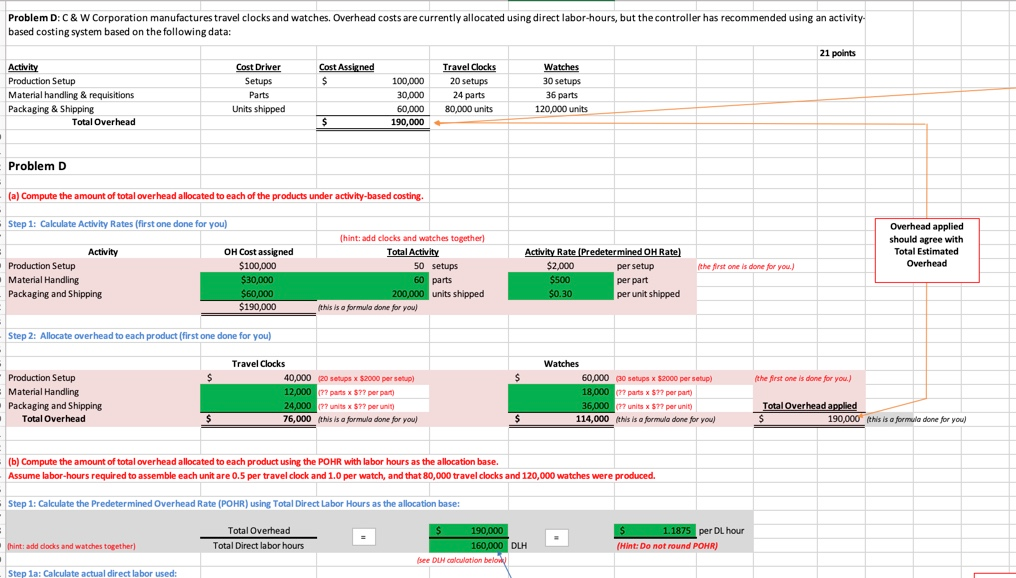

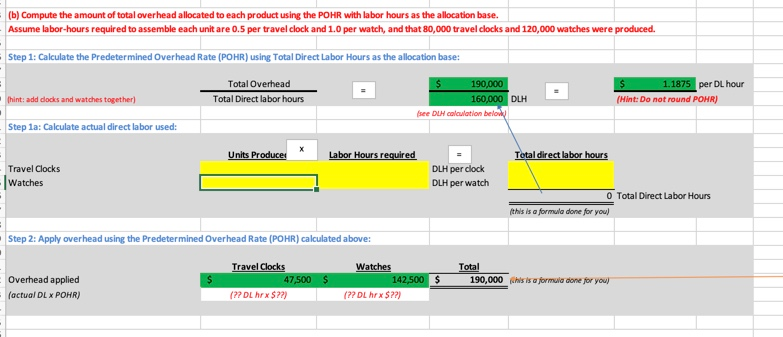

Problem D:C&W Corporation manufactures travel clocks and watches. Overhead costs are currently allocated using direct labor-hours, but the controller has recommended using an activity based costing system based on the following data: 21 points Cost Assigned $ Activity Production Setup Material handling & requisitions Packaging & Shipping Total Overhead Cost Driver Setups Parts Units shipped 100,000 30,000 60,000 190,000 Travel Clocks 20 setups 24 parts 80,000 units Watches 30 setups 36 parts 120,000 units $ Problem D (a) Compute the amount of total overhead allocated to each of the products under activity-based costing. Step 1: Calculate Activity Rates (first one done for you) Overhead applied should agree with Total Estimated Overhead $2.000 Activity Production Setup Material Handling Packaging and Shipping the first one is done for you.) (hint: add clocks and watches together) Total Activity 50 setups 60 parts 200,000 units shipped this is a formula done for you! OH Cost assigned $100,000 $30,000 $60,000 $190,000 Activity Rate (Predetermined OH Rate) per setup $500 per part $0.30 per unit shipped Step 2: Allocate overhead to each product (first one done for you) $ $ the first one is done for you.) Production Setup Material Handling Packaging and Shipping Total Overhead Travel Clocks 40,000 (20 setups x $2000 per setup) 12,000 177 parts x 577 per part 24,000 units x 57 per unit) 76,000 (this is a formula done for you! Watches 60,000 30 setups x $2000 per setup) 18,000 parts x 577 per part) 36,000 units x 577 per unit) 114,000 (this is a formula done for you! Total Overhead applied $ 190,000 (this is a formula dene for you! $ $ (b) Compute the amount of total overhead allocated to each product using the POHR with labor hours as the allocation base. Assume labor-hours required to assemble each unit are 0.5 per travel clock and 1.0 per watch, and that 80,000 travel clocks and 120,000 watches were produced. Step 1: Calculate the Predetermined Overhead Rate (POHR) using Total Direct Labor Hours as the allocation base: Total Overhead Total Direct labor hours $ 190,000 160,000 DLH see I calculation before $ 1.1875 per DL hour (Hint: Do not round POHR) Thint: add docks and watches together) Step 1a: Calculate actual direct labor used: (b) Compute the amount of total overhead allocated to each product using the POHR with labor hours as the allocation base. Assume labor-hours required to assemble each unit are 0.5 per travel clock and 1.0 per watch, and that 80,000 travel clocks and 120,000 watches were produced. Step 1: Calculate the Predetermined Overhead Rate (POHR) using Total Direct Labor Hours as the allocation base: Total Overhead 190,000 1.1875 per DL hour Thint: add cocks and watches together) Total Direct labor hours 160,000 DLH (Hint: Do not round POHR) see DL calculation below Step la: Calculate actual direct labor used: Units Producer Labor Hours required Total direct labor hours Travel Clocks Watches DLH per clock DLH Perwatch Total Direct Labor Hours (this is a formula done for you! Step 2: Apply overhead using the Predetermined Overhead Rate (POHR) calculated above: Travel Clocks 47,500 $ (??DL hrx $?) Overhead applied (actual DL X POHR) Watches 142,500 $ (?? DL hrx $??) Total 190,000 his is a formula done for you