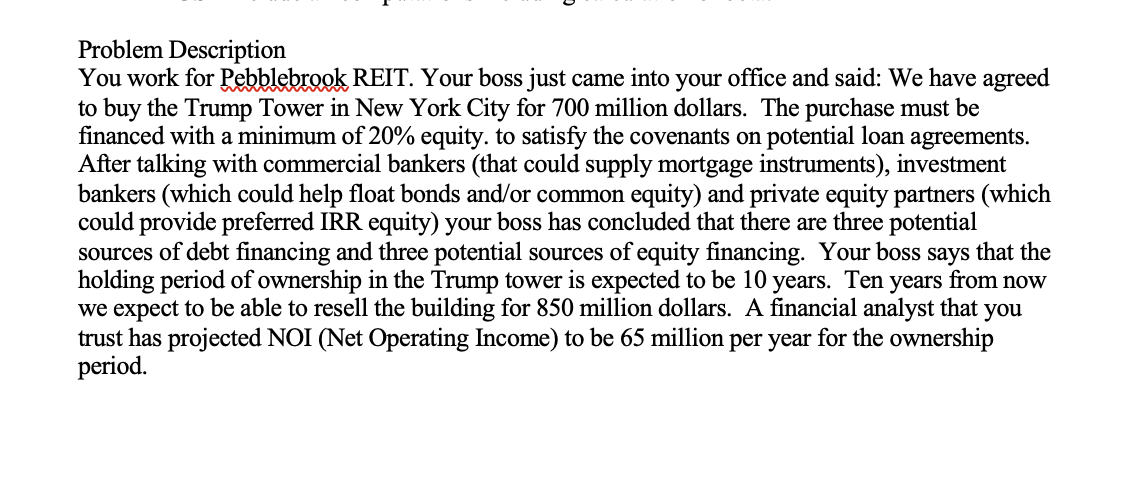

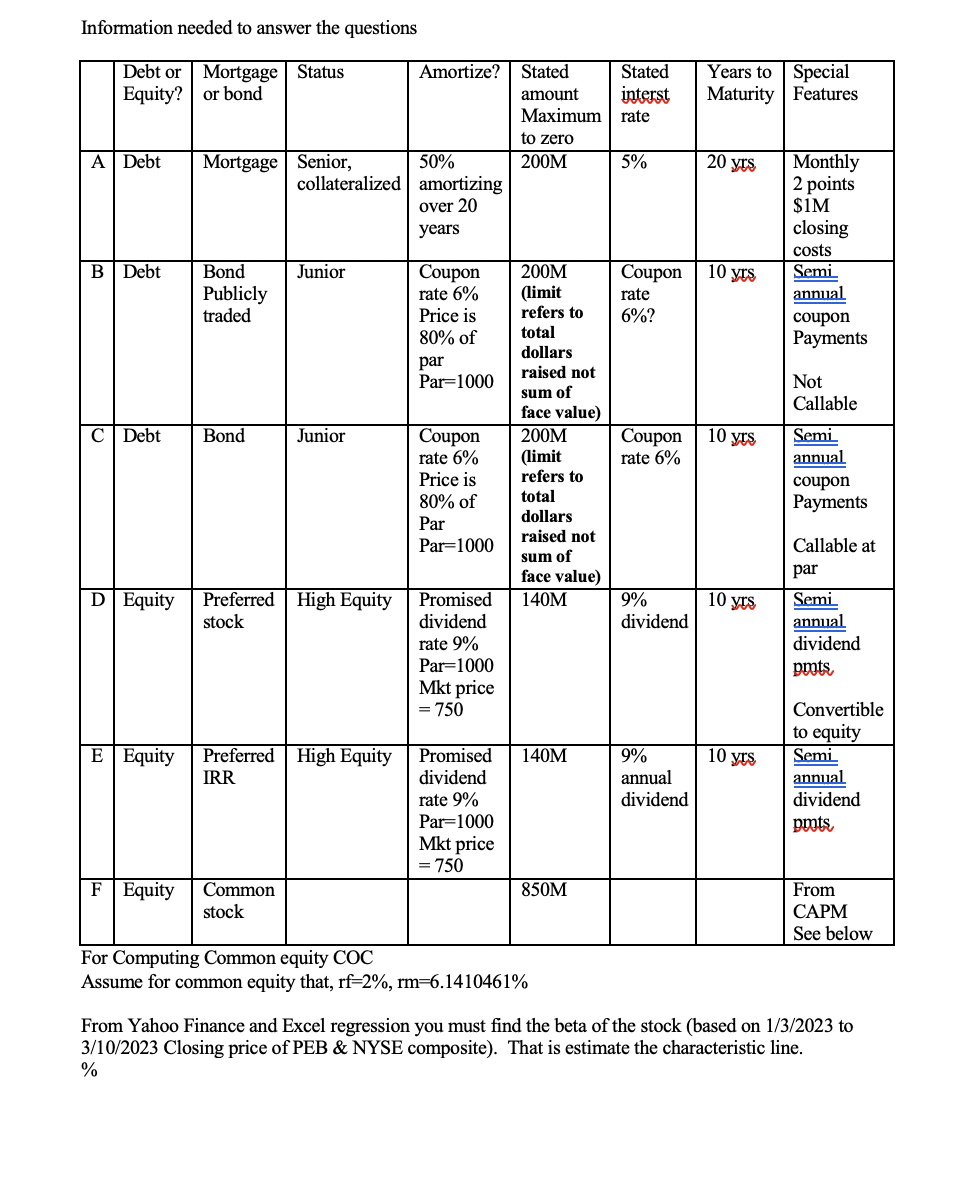

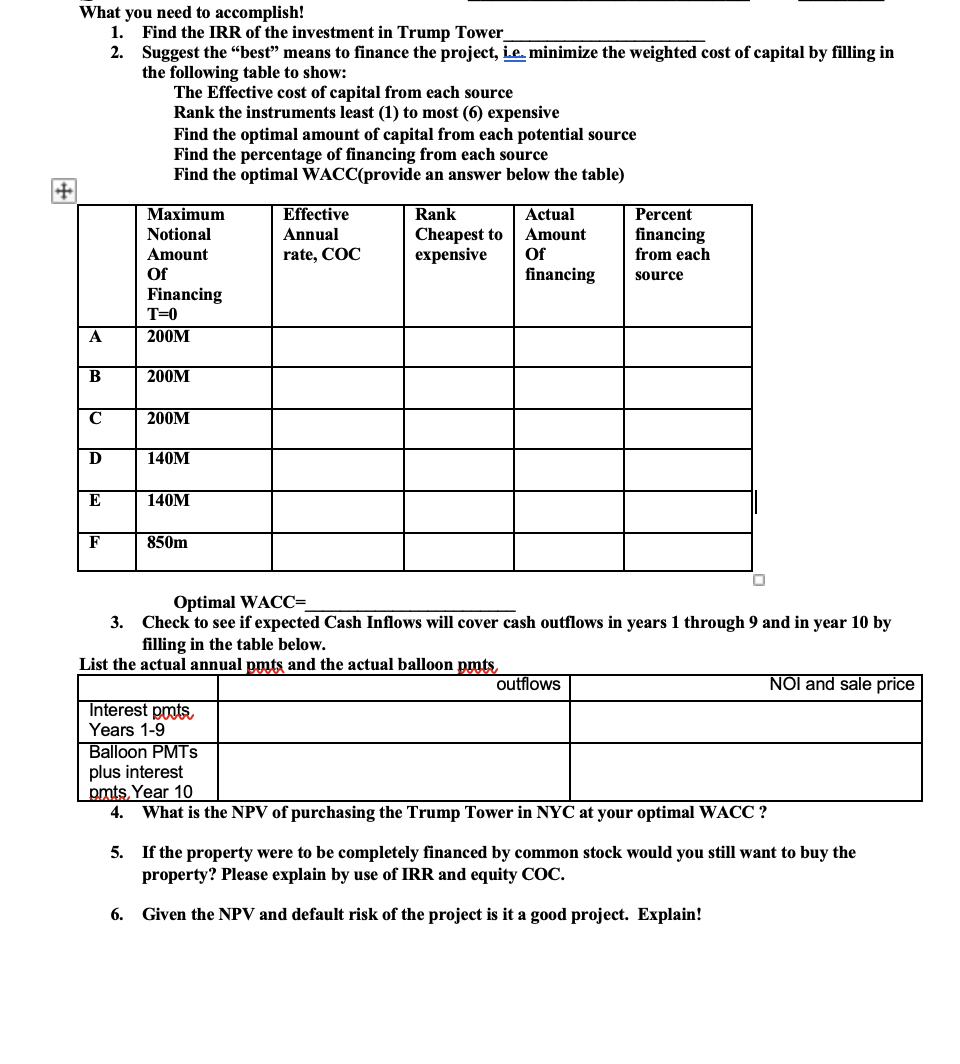

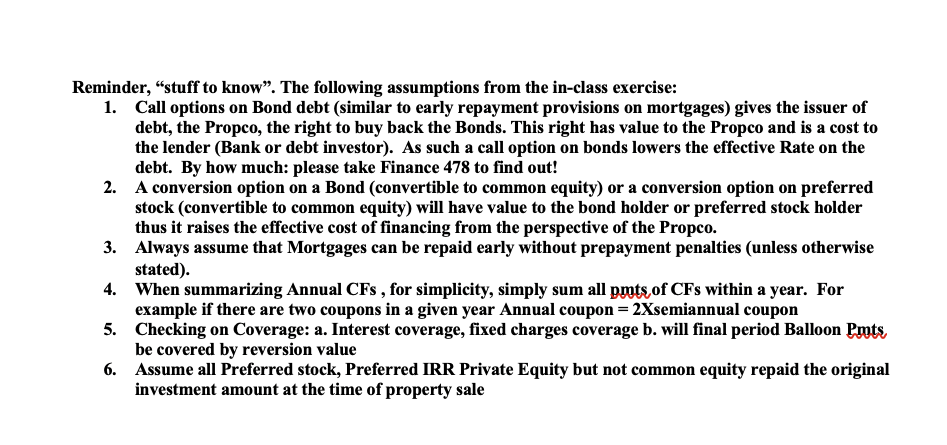

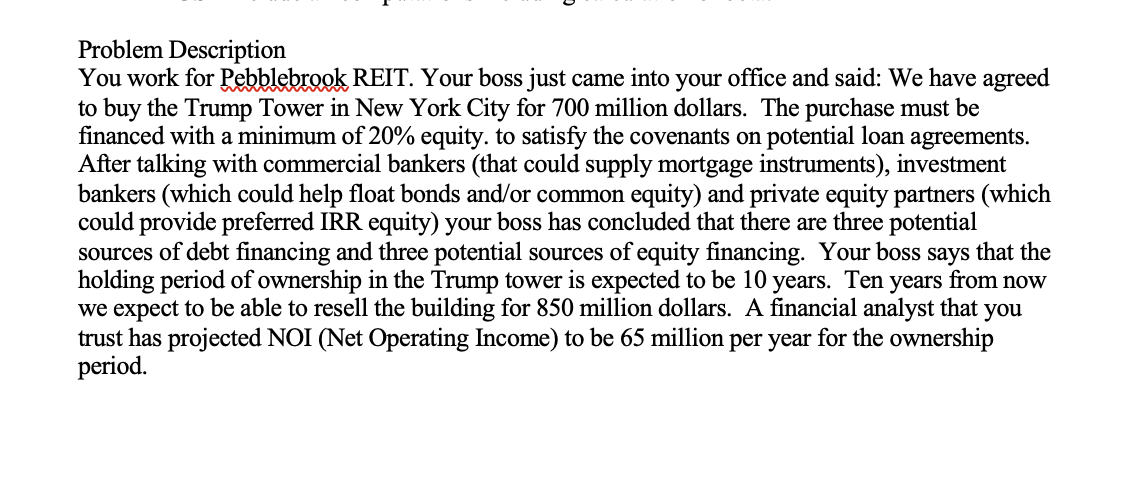

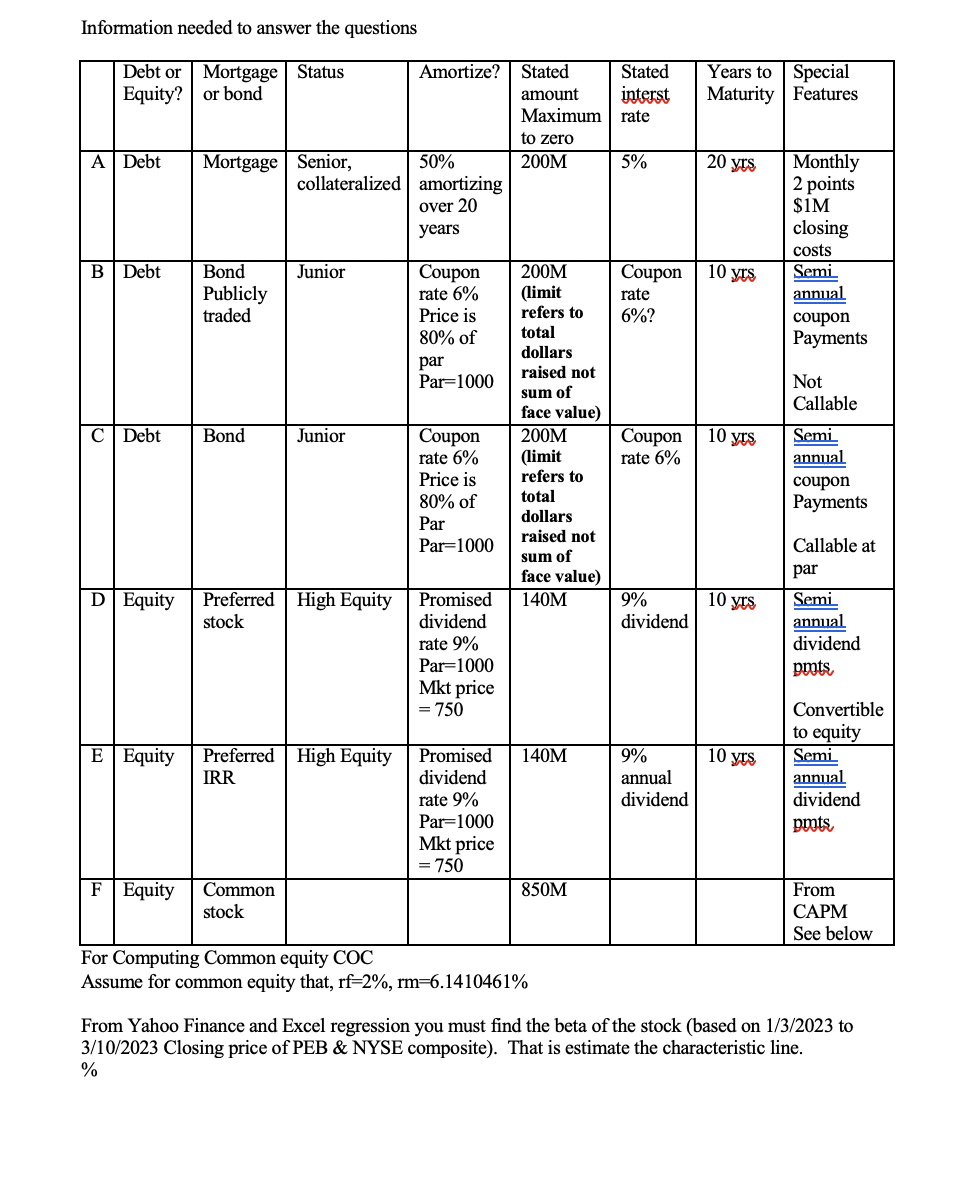

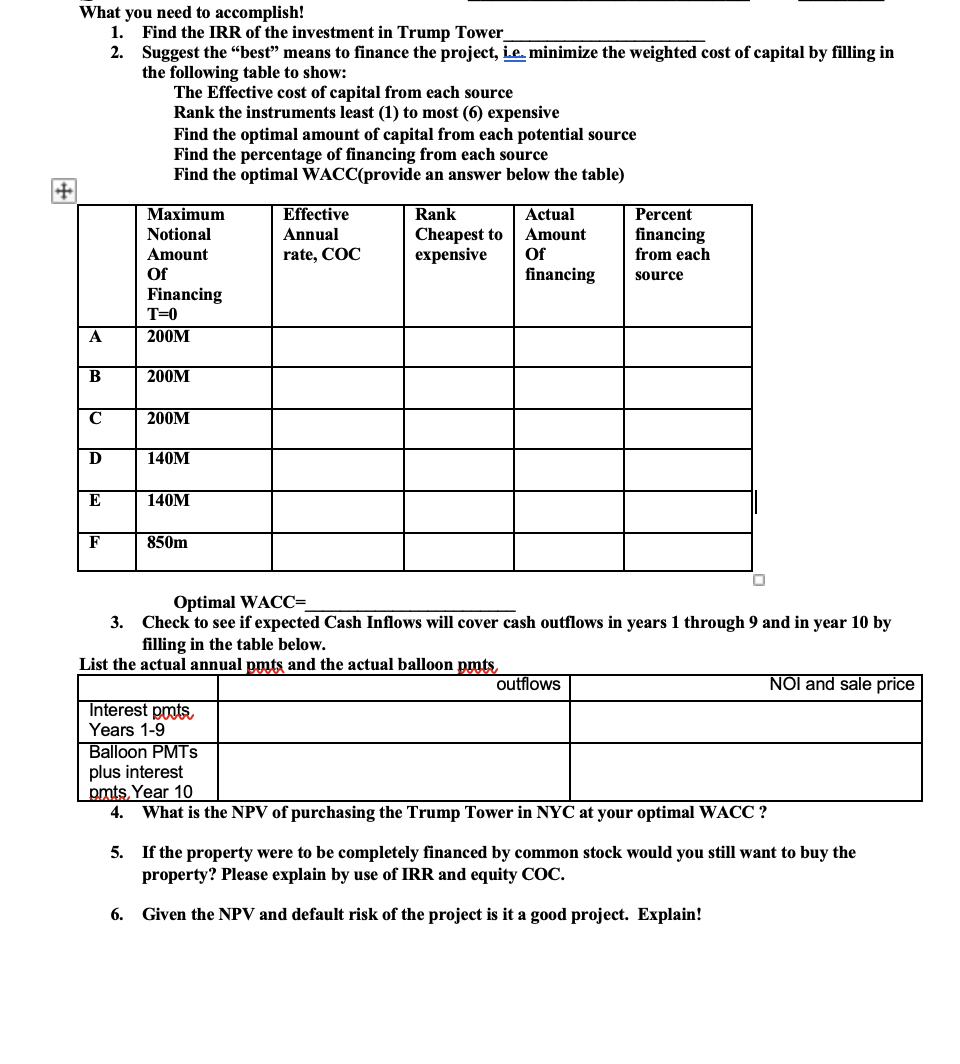

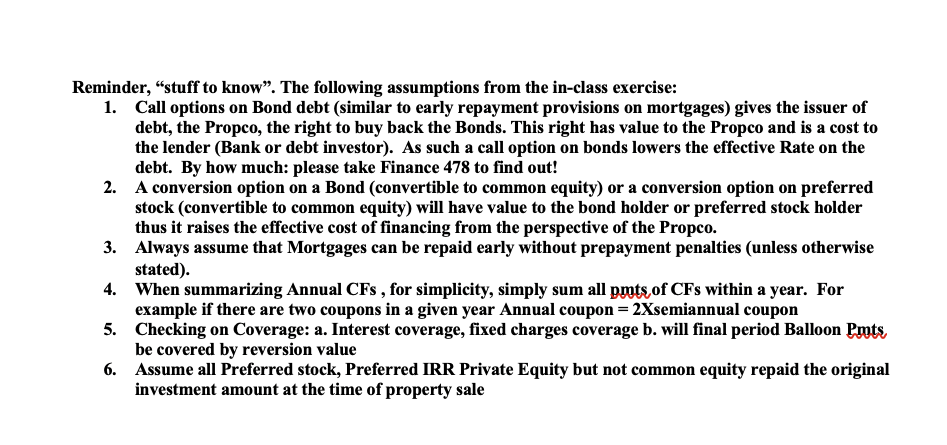

Problem Description You work for Pebblebrook REIT. Your boss just came into your office and said: We have agreed to buy the Trump Tower in New York City for 700 million dollars. The purchase must be financed with a minimum of 20% equity. to satisfy the covenants on potential loan agreements. After talking with commercial bankers (that could supply mortgage instruments), investment bankers (which could help float bonds and/or common equity) and private equity partners (which could provide preferred IRR equity) your boss has concluded that there are three potential sources of debt financing and three potential sources of equity financing. Your boss says that the holding period of ownership in the Trump tower is expected to be 10 years. Ten years from now we expect to be able to resell the building for 850 million dollars. A financial analyst that you trust has projected NOI (Net Operating Income) to be 65 million per year for the ownership period. Information needed to answer the questions Assume tor common equity that, rI=2%,rm=0.1410401% From Yahoo Finance and Excel regression you must find the beta of the stock (based on 1/3/2023 to 3/10/2023 Closing price of PEB \& NYSE composite). That is estimate the characteristic line. % What you need to accomplish! 1. Find the IRR of the investment in Trump Tower 2. Suggest the "best" means to finance the project, i. minimize the weighted cost of capital by filling in the following table to show: The Effective cost of capital from each source Rank the instruments least (1) to most (6) expensive Find the optimal amount of capital from each potential source Find the percentage of financing from each source Find the optimal WACC(provide an answer below the table) Optimal WACC = 3. Check to see if expected Cash Inflows will cover cash outflows in years 1 through 9 and in year 10 by filling in the table below. List the actual annual nmts and the actual balloon nmts. 4. What is the NPV of purchasing the Trump Tower in NYC at your optimal WACC ? 5. If the property were to be completely financed by common stock would you still want to buy the property? Please explain by use of IRR and equity COC. 6. Given the NPV and default risk of the project is it a good project. Explain! Reminder, "stuff to know". The following assumptions from the in-class exercise: 1. Call options on Bond debt (similar to early repayment provisions on mortgages) gives the issuer of debt, the Propco, the right to buy back the Bonds. This right has value to the Propco and is a cost to the lender (Bank or debt investor). As such a call option on bonds lowers the effective Rate on the debt. By how much: please take Finance 478 to find out! 2. A conversion option on a Bond (convertible to common equity) or a conversion option on preferred stock (convertible to common equity) will have value to the bond holder or preferred stock holder thus it raises the effective cost of financing from the perspective of the Propco. 3. Always assume that Mortgages can be repaid early without prepayment penalties (unless otherwise stated). 4. When summarizing Annual CFs, for simplicity, simply sum all pmts of CFs within a year. For example if there are two coupons in a given year Annual coupon =2X semiannual coupon 5. Checking on Coverage: a. Interest coverage, fixed charges coverage b. will final period Balloon Pmts be covered by reversion value 6. Assume all Preferred stock, Preferred IRR Private Equity but not common equity repaid the original investment amount at the time of property sale Problem Description You work for Pebblebrook REIT. Your boss just came into your office and said: We have agreed to buy the Trump Tower in New York City for 700 million dollars. The purchase must be financed with a minimum of 20% equity. to satisfy the covenants on potential loan agreements. After talking with commercial bankers (that could supply mortgage instruments), investment bankers (which could help float bonds and/or common equity) and private equity partners (which could provide preferred IRR equity) your boss has concluded that there are three potential sources of debt financing and three potential sources of equity financing. Your boss says that the holding period of ownership in the Trump tower is expected to be 10 years. Ten years from now we expect to be able to resell the building for 850 million dollars. A financial analyst that you trust has projected NOI (Net Operating Income) to be 65 million per year for the ownership period. Information needed to answer the questions Assume tor common equity that, rI=2%,rm=0.1410401% From Yahoo Finance and Excel regression you must find the beta of the stock (based on 1/3/2023 to 3/10/2023 Closing price of PEB \& NYSE composite). That is estimate the characteristic line. % What you need to accomplish! 1. Find the IRR of the investment in Trump Tower 2. Suggest the "best" means to finance the project, i. minimize the weighted cost of capital by filling in the following table to show: The Effective cost of capital from each source Rank the instruments least (1) to most (6) expensive Find the optimal amount of capital from each potential source Find the percentage of financing from each source Find the optimal WACC(provide an answer below the table) Optimal WACC = 3. Check to see if expected Cash Inflows will cover cash outflows in years 1 through 9 and in year 10 by filling in the table below. List the actual annual nmts and the actual balloon nmts. 4. What is the NPV of purchasing the Trump Tower in NYC at your optimal WACC ? 5. If the property were to be completely financed by common stock would you still want to buy the property? Please explain by use of IRR and equity COC. 6. Given the NPV and default risk of the project is it a good project. Explain! Reminder, "stuff to know". The following assumptions from the in-class exercise: 1. Call options on Bond debt (similar to early repayment provisions on mortgages) gives the issuer of debt, the Propco, the right to buy back the Bonds. This right has value to the Propco and is a cost to the lender (Bank or debt investor). As such a call option on bonds lowers the effective Rate on the debt. By how much: please take Finance 478 to find out! 2. A conversion option on a Bond (convertible to common equity) or a conversion option on preferred stock (convertible to common equity) will have value to the bond holder or preferred stock holder thus it raises the effective cost of financing from the perspective of the Propco. 3. Always assume that Mortgages can be repaid early without prepayment penalties (unless otherwise stated). 4. When summarizing Annual CFs, for simplicity, simply sum all pmts of CFs within a year. For example if there are two coupons in a given year Annual coupon =2X semiannual coupon 5. Checking on Coverage: a. Interest coverage, fixed charges coverage b. will final period Balloon Pmts be covered by reversion value 6. Assume all Preferred stock, Preferred IRR Private Equity but not common equity repaid the original investment amount at the time of property sale