Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Problem Four The following are transactions of Metro Company: 2005 Nov 16 Accepted a $3,700, 90-day, 12% note dated this day in granting Bess

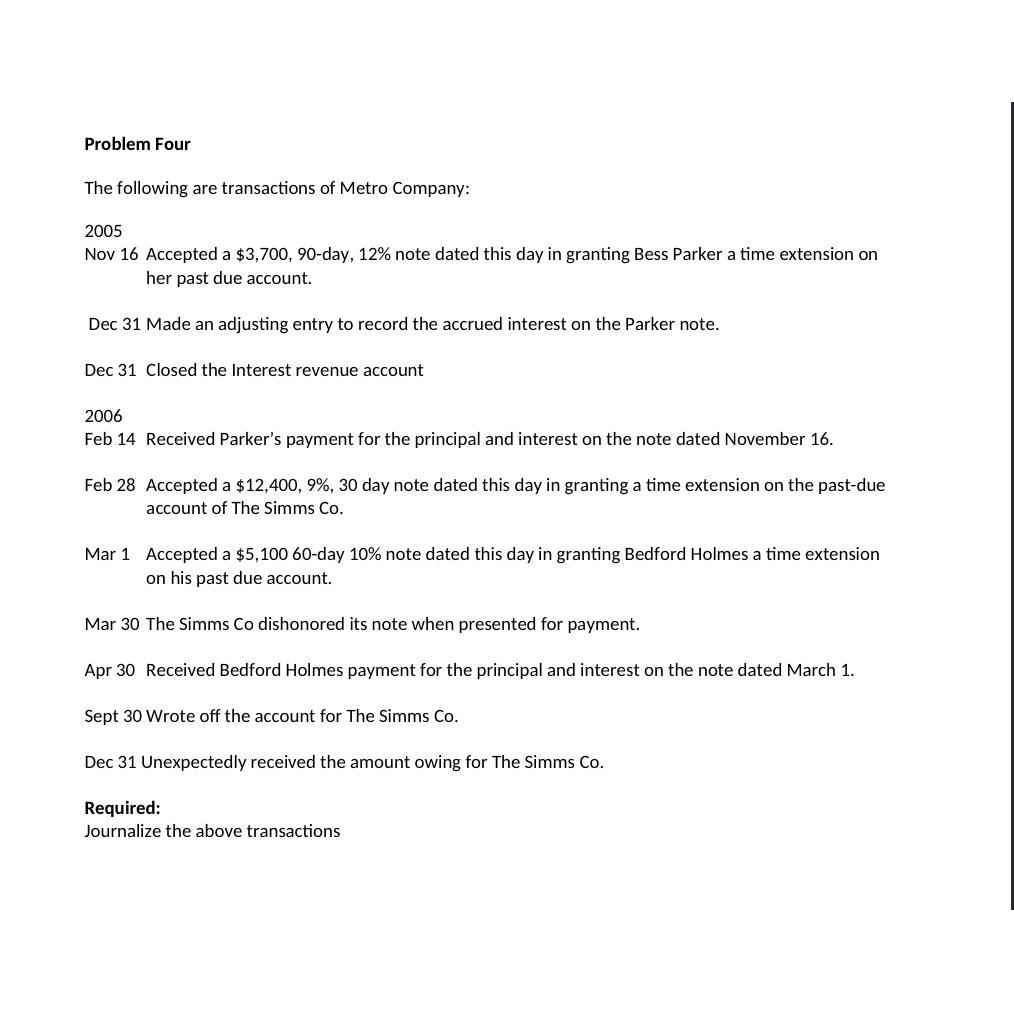

Problem Four The following are transactions of Metro Company: 2005 Nov 16 Accepted a $3,700, 90-day, 12% note dated this day in granting Bess Parker a time extension on her past due account. Dec 31 Made an adjusting entry to record the accrued interest on the Parker note. Dec 31 Closed the Interest revenue account 2006 Feb 14 Received Parker's payment for the principal and interest on the note dated November 16. Feb 28 Accepted a $12,400, 9%, 30 day note dated this day in granting a time extension on the past-due account of The Simms Co. Mar 1 Accepted a $5,100 60-day 10% note dated this day in granting Bedford Holmes a time extension on his past due account. Mar 30 The Simms Co dishonored its note when presented for payment. Apr 30 Received Bedford Holmes payment for the principal and interest on the note dated March 1. Sept 30 Wrote off the account for The Simms Co. Dec 31 Unexpectedly received the amount owing for The Simms Co. Required: Journalize the above transactions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the journal entries for the transactions 2005 Nov 16 Notes Receivable Bess Parker 3700 Acco...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e86e39d017_880305.pdf

180 KBs PDF File

661e86e39d017_880305.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started