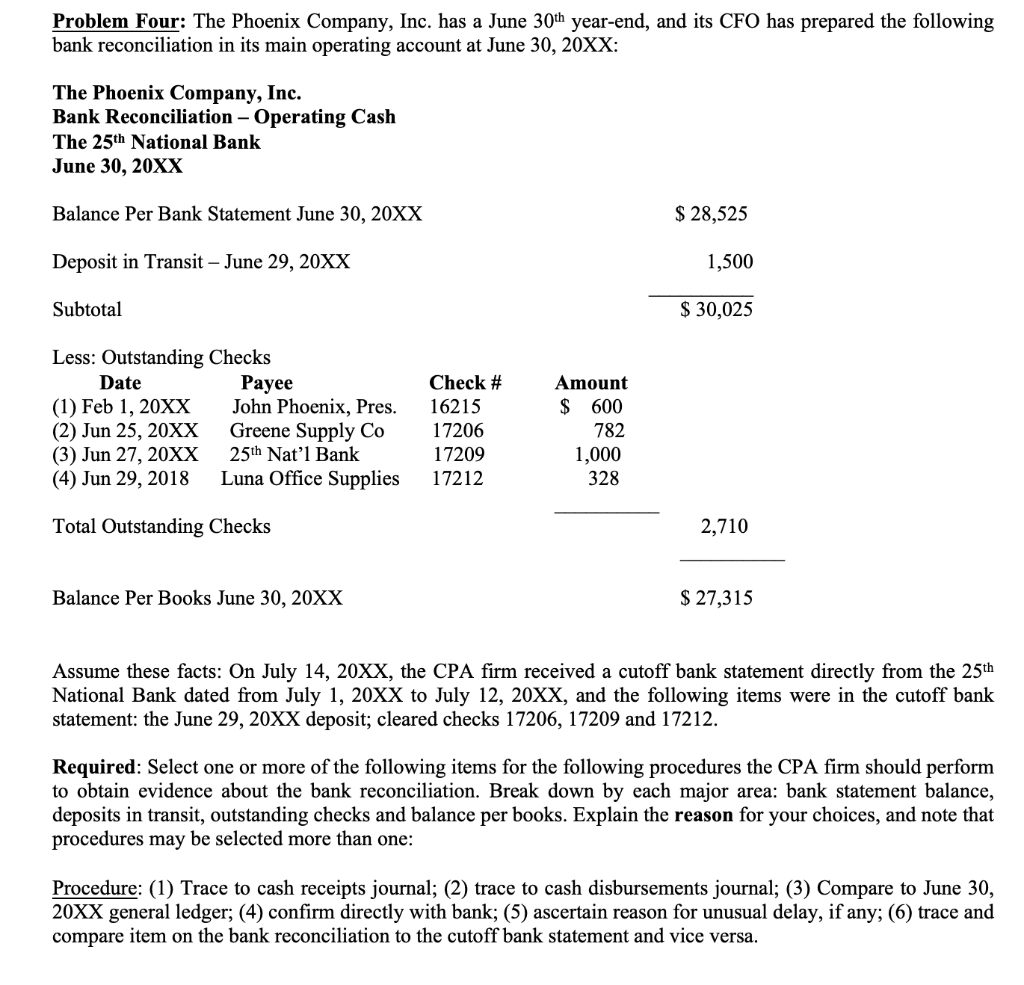

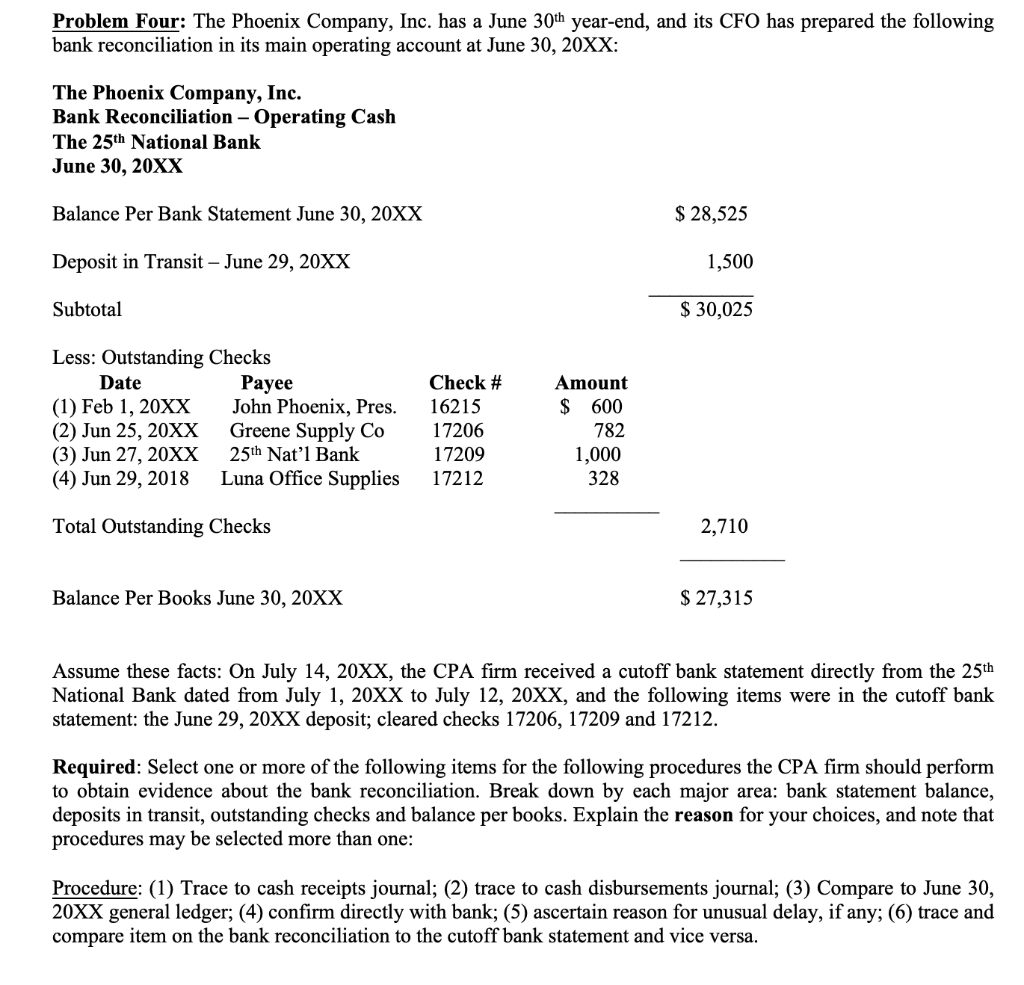

Problem Four: The Phoenix Company, Inc. has a June 30th year-end, and its CFO has prepared the following bank reconciliation in its main operating account at June 30, 20XX: The Phoenix Company, Inc. Bank Reconciliation - Operating Cash The 25th National Bank June 30, 20XX Balance Per Bank Statement June 30, 20XX $ 28,525 Deposit in Transit - June 29, 20XX 1,500 Subtotal $ 30,025 Less: Outstanding Checks Date Payee (1) Feb 1, 20XX John Phoenix, Pres. (2) Jun 25, 20XX Greene Supply Co (3) Jun 27, 20XX 25th Nat'l Bank (4) Jun 29, 2018 Luna Office Supplies Check # 16215 17206 17209 17212 Amount $ 600 782 1,000 328 Total Outstanding Checks 2,710 Balance Per Books June 30, 20XX $ 27,315 Assume these facts: On July 14, 20XX, the CPA firm received a cutoff bank statement directly from the 25th National Bank dated from July 1, 20XX to July 12, 20XX, and the following items were in the cutoff bank statement: the June 29, 20XX deposit; cleared checks 17206, 17209 and 17212. Required: Select one or more of the following items for the following procedures the CPA firm should perform to obtain evidence about the bank reconciliation. Break down by each major area: bank statement balance, deposits in transit, outstanding checks and balance per books. Explain the reason for your choices, and note that procedures may be selected more than one: Procedure: (1) Trace to cash receipts journal; (2) trace to cash disbursements journal; (3) Compare to June 30, 20XX general ledger; (4) confirm directly with bank; (5) ascertain reason for unusual delay, if any; (6) trace and compare item on the bank reconciliation to the cutoff bank statement and vice versa. Problem Four: The Phoenix Company, Inc. has a June 30th year-end, and its CFO has prepared the following bank reconciliation in its main operating account at June 30, 20XX: The Phoenix Company, Inc. Bank Reconciliation - Operating Cash The 25th National Bank June 30, 20XX Balance Per Bank Statement June 30, 20XX $ 28,525 Deposit in Transit - June 29, 20XX 1,500 Subtotal $ 30,025 Less: Outstanding Checks Date Payee (1) Feb 1, 20XX John Phoenix, Pres. (2) Jun 25, 20XX Greene Supply Co (3) Jun 27, 20XX 25th Nat'l Bank (4) Jun 29, 2018 Luna Office Supplies Check # 16215 17206 17209 17212 Amount $ 600 782 1,000 328 Total Outstanding Checks 2,710 Balance Per Books June 30, 20XX $ 27,315 Assume these facts: On July 14, 20XX, the CPA firm received a cutoff bank statement directly from the 25th National Bank dated from July 1, 20XX to July 12, 20XX, and the following items were in the cutoff bank statement: the June 29, 20XX deposit; cleared checks 17206, 17209 and 17212. Required: Select one or more of the following items for the following procedures the CPA firm should perform to obtain evidence about the bank reconciliation. Break down by each major area: bank statement balance, deposits in transit, outstanding checks and balance per books. Explain the reason for your choices, and note that procedures may be selected more than one: Procedure: (1) Trace to cash receipts journal; (2) trace to cash disbursements journal; (3) Compare to June 30, 20XX general ledger; (4) confirm directly with bank; (5) ascertain reason for unusual delay, if any; (6) trace and compare item on the bank reconciliation to the cutoff bank statement and vice versa