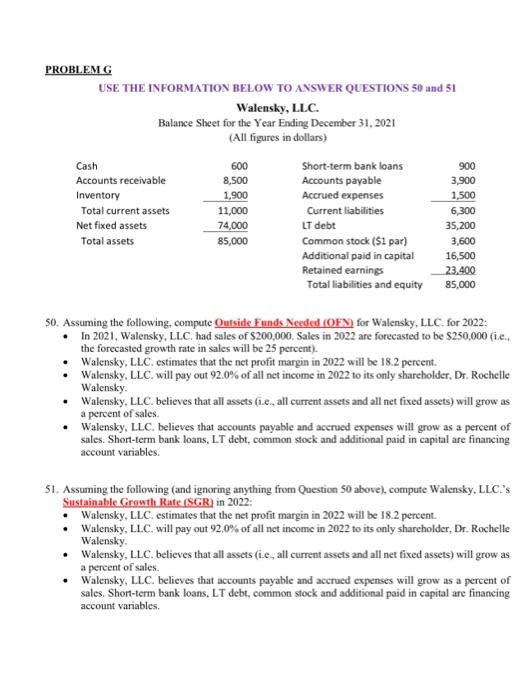

PROBLEM G USE THE INFORMATION BELOW TO ANSWER QUESTIONS 50 and 51 Walensky, L.L. Balance Sheet for the Year Ending December 31, 2021 (All figures in dollars) 50. Assuming the following, compute Oufcide Funds Needed (OF) for Walensky, L.L. for 2022: - In 2021. Walensky, LLC. had sales of $200,000. Sales in 2022 are forecasted to be \$250,000 (i.e., the forecasted growth rate in sales will be 25 percent). - Walensky. LLC. estimates that the net profit margin in 2022 will be 18.2 percent. - Walensky, LLC. will pay out 92.0 of all net income in 2022 to its only shareholder, Dr. Rochelle Walensky. - Walensky, L.LC. believes that all assets (i.e., all current assets and all net fixed assets) will grow as a percent of sales. - Walensky, LLC. believes that accounts payable and accrued expenses will grow as a percent of sales. Short-term bank loans, LT debt, common stock and additional paid in capital are financing account variables. 51. Assuming the following (and ignoring anything from Question 50 above), compute Walensky, LLC.'s Sustainable Cirowth Rate (SGR) in 2022: - Walensky. LLC. estimates that the net profit margin in 2022 will be 18.2 percent. - Walensky, L.LC. will pay out 92.0% of all net income in 2022 to its only shareholder, Dr. Rochelle Walensky. - Walensky, LLC. believes that all assets (i.e, all current assets and all net fixed assets) will grow as a pereent of sales. - Walensky, L.LC. believes that accounts payable and accrued expenser will grow as a percent of sales. Short-term bank loans, LT debt, common stock and additional paid in capital are financing account variables. PROBLEM G USE THE INFORMATION BELOW TO ANSWER QUESTIONS 50 and 51 Walensky, L.L. Balance Sheet for the Year Ending December 31, 2021 (All figures in dollars) 50. Assuming the following, compute Oufcide Funds Needed (OF) for Walensky, L.L. for 2022: - In 2021. Walensky, LLC. had sales of $200,000. Sales in 2022 are forecasted to be \$250,000 (i.e., the forecasted growth rate in sales will be 25 percent). - Walensky. LLC. estimates that the net profit margin in 2022 will be 18.2 percent. - Walensky, LLC. will pay out 92.0 of all net income in 2022 to its only shareholder, Dr. Rochelle Walensky. - Walensky, L.LC. believes that all assets (i.e., all current assets and all net fixed assets) will grow as a percent of sales. - Walensky, LLC. believes that accounts payable and accrued expenses will grow as a percent of sales. Short-term bank loans, LT debt, common stock and additional paid in capital are financing account variables. 51. Assuming the following (and ignoring anything from Question 50 above), compute Walensky, LLC.'s Sustainable Cirowth Rate (SGR) in 2022: - Walensky. LLC. estimates that the net profit margin in 2022 will be 18.2 percent. - Walensky, L.LC. will pay out 92.0% of all net income in 2022 to its only shareholder, Dr. Rochelle Walensky. - Walensky, LLC. believes that all assets (i.e, all current assets and all net fixed assets) will grow as a pereent of sales. - Walensky, L.LC. believes that accounts payable and accrued expenser will grow as a percent of sales. Short-term bank loans, LT debt, common stock and additional paid in capital are financing account variables